WHAT SHOULD LUCID BE WORTH ?

Company management have provided their own financial projections for the business through 2026

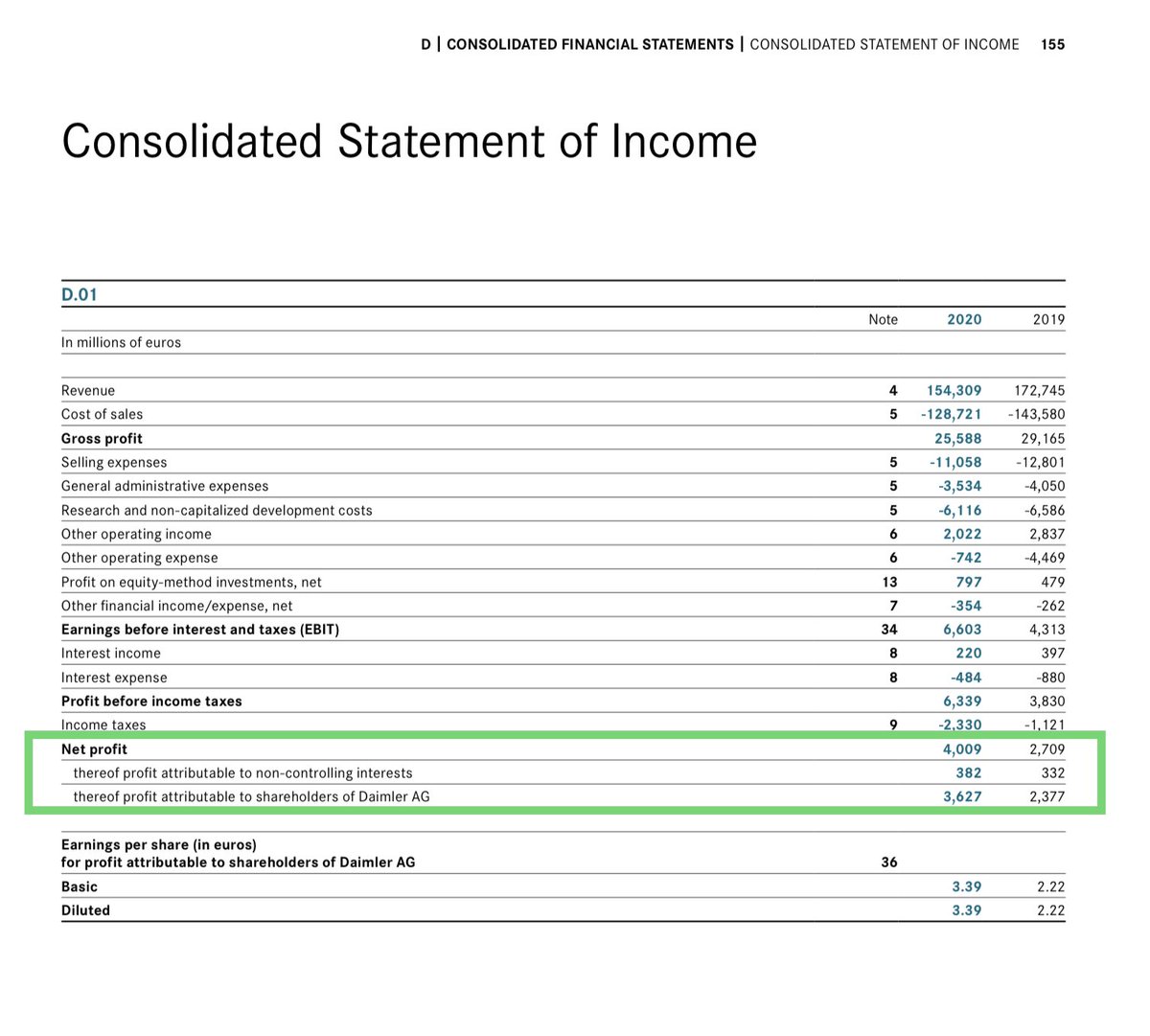

The 2026 Income Statement is shown here

At a "Buyer's Pricing" 10x P/E Multiple the business would be worth $17 billion in 2026

1/4

Company management have provided their own financial projections for the business through 2026

The 2026 Income Statement is shown here

At a "Buyer's Pricing" 10x P/E Multiple the business would be worth $17 billion in 2026

1/4

https://twitter.com/jpr007/status/1364127215839944707

LUCID VALUATION IN 2026

At a "Seller's Pricing" 20x P/E Multiple the business would be worth $34 billion in 2026

2/4

At a "Seller's Pricing" 20x P/E Multiple the business would be worth $34 billion in 2026

2/4

LUCID VALUATION IN 2021

If we use a 15% Equity Discount Rate to convert these 2026 Valuations back to 2021 :

10x P/E Multiple : $17 billion --> $8.44 billion

20x P/E Multiple : $34 billion --> $16.88 billion

Any other proposed valuation can be calculated pro-rata from this

If we use a 15% Equity Discount Rate to convert these 2026 Valuations back to 2021 :

10x P/E Multiple : $17 billion --> $8.44 billion

20x P/E Multiple : $34 billion --> $16.88 billion

Any other proposed valuation can be calculated pro-rata from this

• • •

Missing some Tweet in this thread? You can try to

force a refresh