The defi matrix

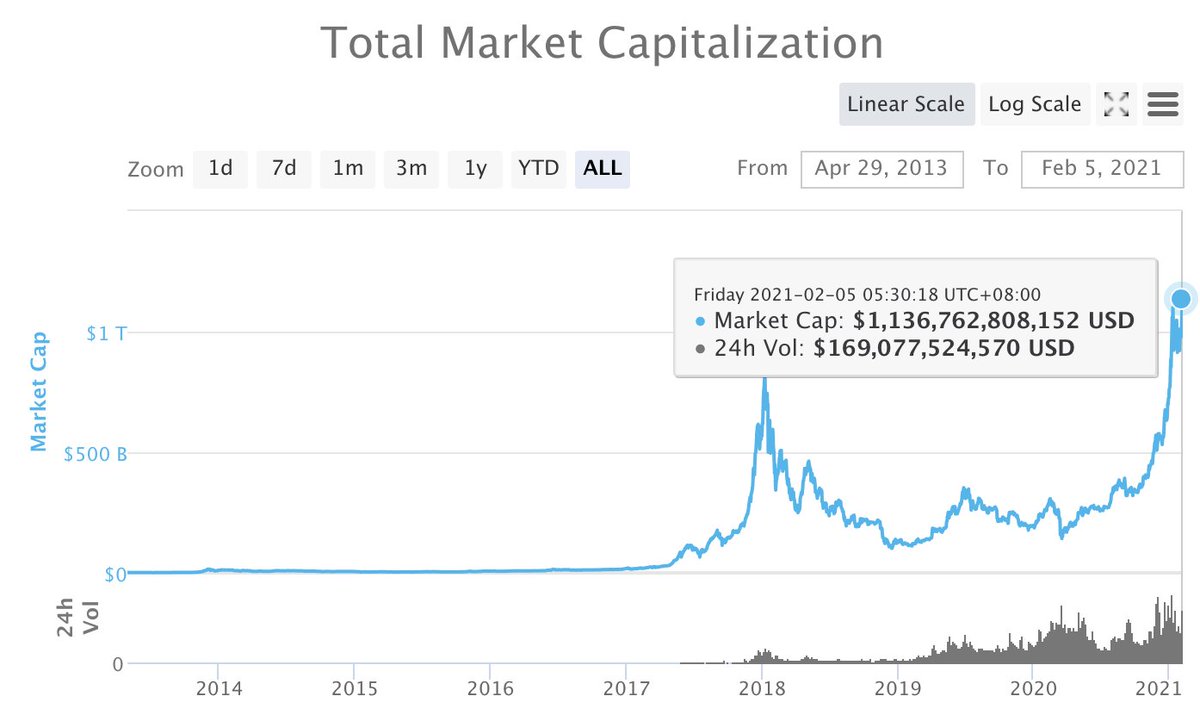

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

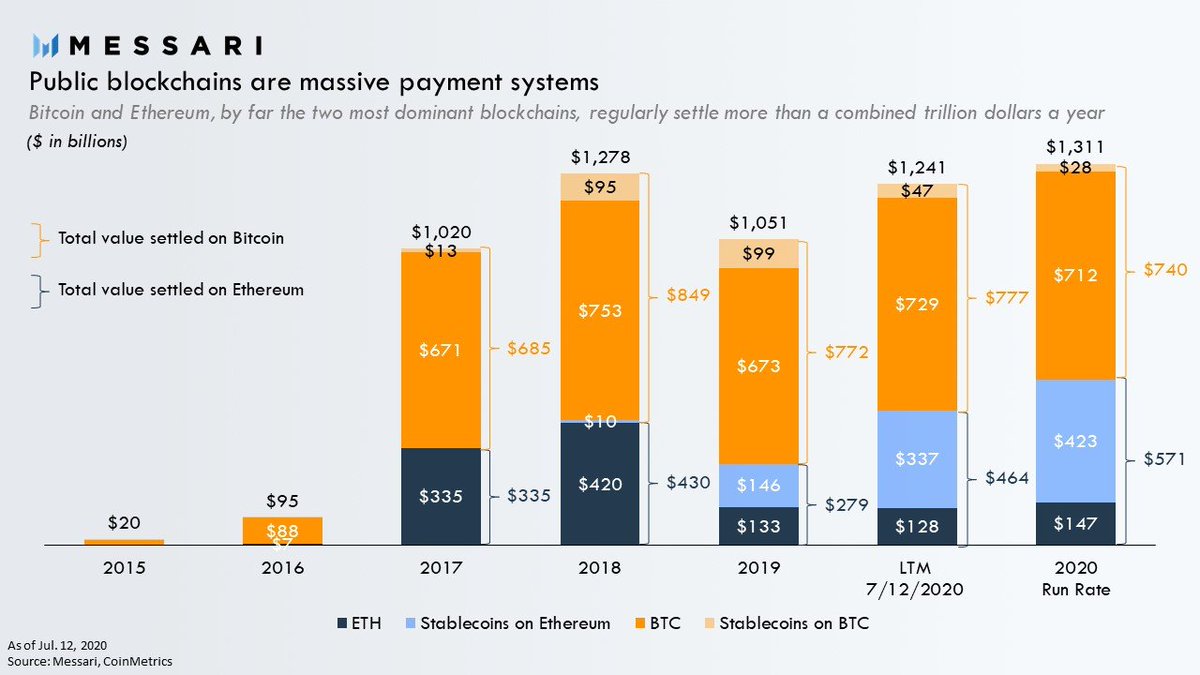

The defi matrix is the table of all pair wise trades. It’s the fiat/stablecoin pairs, the fiat/crypto pairs, the crypto/crypto pairs, and much more besides.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

More liquidity, less currency?

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

https://twitter.com/pierreyvesg7/status/1364628112739356677

AMMs boost BTC. Here's why.

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Basically, automated market makers like @Uniswap boost BTC in the long term, because they allow *everything* to be priced in BTC terms, and *anyone* to switch out of BTC into their asset of choice.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

Minimum necessary currency

Total global liquidity for everything via automated market makers will drive the world to minimize national currency holdings.

Because the scale-up of AMMs & yield farming will allow anyone to instantly get a better return than holding cash!

Total global liquidity for everything via automated market makers will drive the world to minimize national currency holdings.

Because the scale-up of AMMs & yield farming will allow anyone to instantly get a better return than holding cash!

This is how the age of coercion yields to the age of volition. You still keep minimum necessary currency on hand to render unto Caesar, etc.

But no more than that. Every excess unit of fiat beyond the necessary minimum goes into crypto to seek higher returns in the defi matrix.

But no more than that. Every excess unit of fiat beyond the necessary minimum goes into crypto to seek higher returns in the defi matrix.

The defi matrix is what comes after the social graph. AMMs enable global yield farming. Every minute, every user will (automatically) run a search to find the best return for their assets in a totally liquid global financial market, and auto-rebalance.

It all becomes arbitrage.

It all becomes arbitrage.

Yeah, this is hard, but another thing that might get marked-to-market is your job. It's also an asset, one that requires maintenance like a house, except the maintenance is via labor rather than capital.

Maybe you can constantly find a better job too...

Maybe you can constantly find a better job too...

https://twitter.com/manbeachproject/status/1364826708788977669

Algorithmic liquidity reduces the need to hold currency.

Normally people talk about "liquidity events" as the moments when you can convert an illiquid asset into currency. But with AMMs you have a continuous liquidity event...

Normally people talk about "liquidity events" as the moments when you can convert an illiquid asset into currency. But with AMMs you have a continuous liquidity event...

• • •

Missing some Tweet in this thread? You can try to

force a refresh