re: the latest market jitters, here's what is happening in a nutshell:

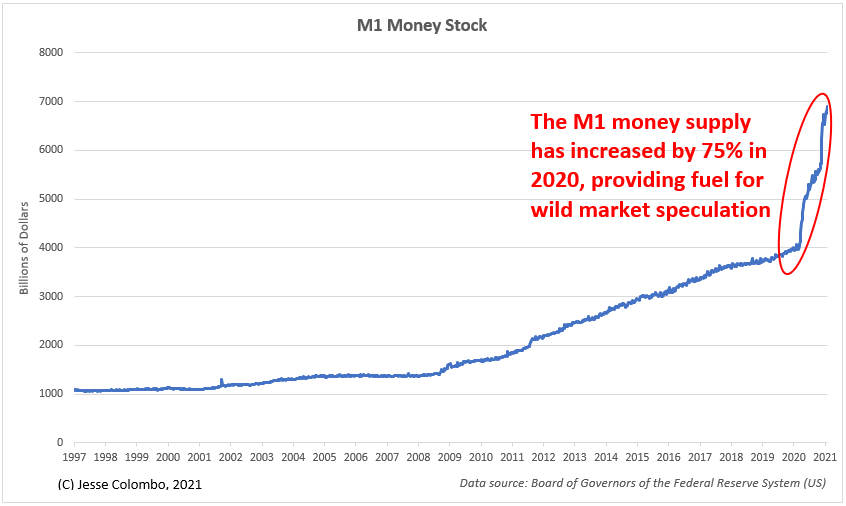

Asset prices & total debt have become far too inflated and require ever-increasing amounts of monetary stimulus to prop it all up.

$SPY $QQQ

Asset prices & total debt have become far too inflated and require ever-increasing amounts of monetary stimulus to prop it all up.

$SPY $QQQ

As with heroin addiction, the economy builds up a tolerance to stimulus and requires more and more to prevent "dope sickness."

Of course, the central banks WILL give in and pump more stimulus.

But, ultimately, it will kill the addict.

Of course, the central banks WILL give in and pump more stimulus.

But, ultimately, it will kill the addict.

https://twitter.com/TheBubbleBubble/status/1365007195058958339?s=20

This massive global debt bubble requires ultra-low interest rates to avoid imploding.

That's why every time rates increase ever-so-slightly, the markets panic.

When will it all blow up? It's impossible to tell because it's so manipulated, which makes it even more maddening.

That's why every time rates increase ever-so-slightly, the markets panic.

When will it all blow up? It's impossible to tell because it's so manipulated, which makes it even more maddening.

Our global bubble economy is like a jack-in-the-box toy from hell:

You keep turning the knob, but it's impossible to predict when the demons will pop out...but it's just a matter of time.

Nothing you do can prevent the shock when it happens.

You keep turning the knob, but it's impossible to predict when the demons will pop out...but it's just a matter of time.

Nothing you do can prevent the shock when it happens.

Is this the top before the bubble bursts? I honestly don't know...nobody knows. It's unknowable because it's so manipulated. It's not even a market.

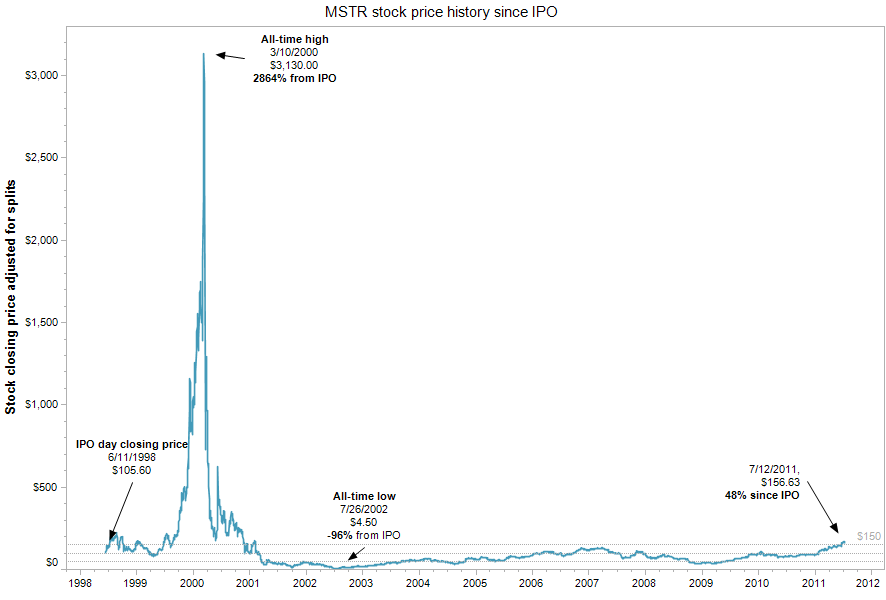

And when it does finally crash, I don't foresee it going straight down like a traditional bear market:

And when it does finally crash, I don't foresee it going straight down like a traditional bear market:

https://twitter.com/TheBubbleBubble/status/1087784349599186946?s=20

I honestly feel very sorry for anyone who has to be a "Market Strategist" in these times.

This so-called "market" gives nothing but false signals & fake-outs.

That's why I'm out of that world & don't dwell much on the day-to-day minutiae.

I hope you all understand.

This so-called "market" gives nothing but false signals & fake-outs.

That's why I'm out of that world & don't dwell much on the day-to-day minutiae.

I hope you all understand.

• • •

Missing some Tweet in this thread? You can try to

force a refresh