$ETSY - 🔥

Announced Phenomenal 2020 FY Results

- 10% big beat on revenue!

- 520% EPS Growth!

There were 50 slides but here are my Top 10/10 Key Takeaways from the Conference Call if you missed it and key expectations going forward into 2021.

10 Quick Thread Insights below👇:

Announced Phenomenal 2020 FY Results

- 10% big beat on revenue!

- 520% EPS Growth!

There were 50 slides but here are my Top 10/10 Key Takeaways from the Conference Call if you missed it and key expectations going forward into 2021.

10 Quick Thread Insights below👇:

1/10: $ETSY Consistent Triple digit Revenue Growth:

Q1: $228M - 35% YoY

Q2: $428M - 137% YoY

Q3: $451M - 128% YoY

Q4: $617M - 129% YoY

2020 Avg: $1.7B -> 111% YoY 🔥

Q1 2021 Guide: - $536M - 135% YoY

Driven by payments, e-commerce & GMS.

Q1: $228M - 35% YoY

Q2: $428M - 137% YoY

Q3: $451M - 128% YoY

Q4: $617M - 129% YoY

2020 Avg: $1.7B -> 111% YoY 🔥

Q1 2021 Guide: - $536M - 135% YoY

Driven by payments, e-commerce & GMS.

2/

$ETSY's brand is improving massively and getting recognition both in North America and Internationally.

41% International growth in sales (111% YoY)

GMS Growth in UK was over 189% and they are becoming a top e-Commerce platform in the UK & Germany.

This is underrated!

$ETSY's brand is improving massively and getting recognition both in North America and Internationally.

41% International growth in sales (111% YoY)

GMS Growth in UK was over 189% and they are becoming a top e-Commerce platform in the UK & Germany.

This is underrated!

3/

$ETSY Active Buyers & Sellers are increasing is key

2020 Growth Figures:

$ETSY Marketplace Growth (Comps against $SHOP?)

Q1 - 24%

Q2 - 147%

Q3 - 142%

Q4 -150%

Active buyers:

Q1 - 0.60

Q2 - 0.77

Q3 - 1.10

Q4 - 1.70

Active Sellers:

Q1 -27%

Q2 -33%

Q3 -42%

Q4 - 63%

$ETSY Active Buyers & Sellers are increasing is key

2020 Growth Figures:

$ETSY Marketplace Growth (Comps against $SHOP?)

Q1 - 24%

Q2 - 147%

Q3 - 142%

Q4 -150%

Active buyers:

Q1 - 0.60

Q2 - 0.77

Q3 - 1.10

Q4 - 1.70

Active Sellers:

Q1 -27%

Q2 -33%

Q3 -42%

Q4 - 63%

4/

$ETSY Take-Rates (% of the value of the transactions $ETSY facilitates that they get to keep as revenue.)

Q1 2020 - 2%

Q2 2020 - (-4%)

Q3 2020 - 4%)

Q4 2020 - 5%

This is tough metric and it was expected to decline, but kept up.

Key for driving the following below 👇

$ETSY Take-Rates (% of the value of the transactions $ETSY facilitates that they get to keep as revenue.)

Q1 2020 - 2%

Q2 2020 - (-4%)

Q3 2020 - 4%)

Q4 2020 - 5%

This is tough metric and it was expected to decline, but kept up.

Key for driving the following below 👇

5/ $ETSY's bottom-line is absolutely top-class considering their immense growth.

Gross Margins have been improving

Q1 - 64%

Q2 - 74%

Q3 - 73%

Q4 - 76%

They are generating more F Cash-flows which is improving for future re-investing into the business.

Gross Margins have been improving

Q1 - 64%

Q2 - 74%

Q3 - 73%

Q4 - 76%

They are generating more F Cash-flows which is improving for future re-investing into the business.

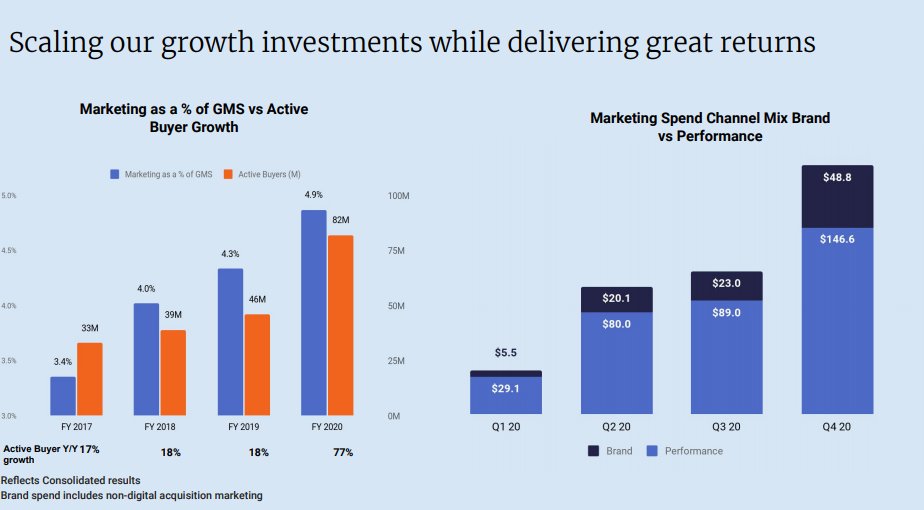

6/ $ETSY Strong ROI

They are getting more efficient with their sales and marketing spend --> generating increasing ROI per $.

They are getting more efficient with their sales and marketing spend --> generating increasing ROI per $.

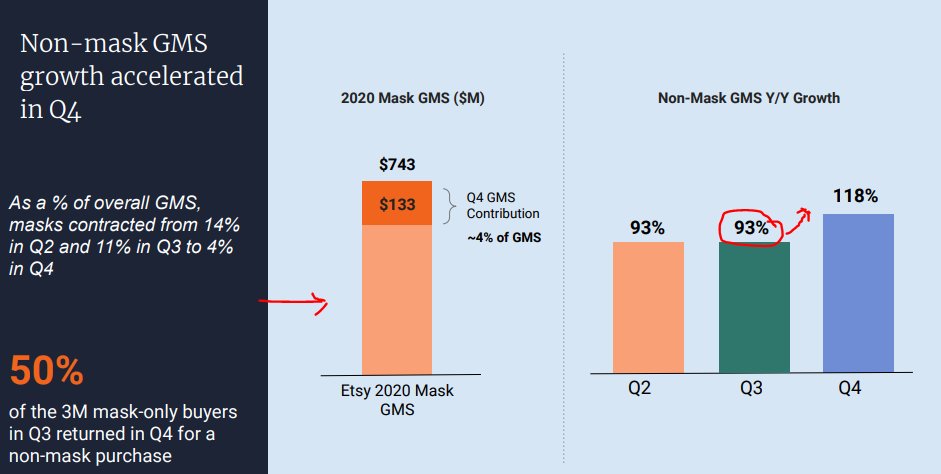

7/ $ETSY Conversion rates

% of Individuals that had two or more purchasers (48%

Many consumers came to $ETSY at first for masks but realized how good it was......They stayed!😀

More shoppers are going beyond just masks on the $ETSY platforms.

% of Individuals that had two or more purchasers (48%

Many consumers came to $ETSY at first for masks but realized how good it was......They stayed!😀

More shoppers are going beyond just masks on the $ETSY platforms.

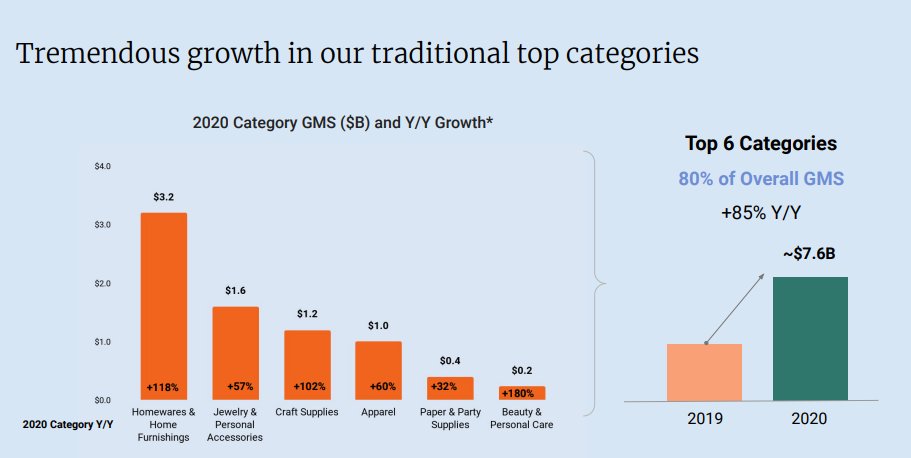

8/

$ETSY is also enjoying the boom from the Housing Trends

226% YoY growth in homes home-furnishing trends and expected to continue to drive future sales.

They expect it to be one of the fastest growing segments.

$ETSY is also enjoying the boom from the Housing Trends

226% YoY growth in homes home-furnishing trends and expected to continue to drive future sales.

They expect it to be one of the fastest growing segments.

9/

In 2021 Expectations:

- Drive more sellers, inventory

- Mgmt emphasize increased spending in hiring within their Analytics teams

- Expect more International growth in Europe

- Investing in more marketing and ambitions growth which may depress bottom-line

Guidance👇

In 2021 Expectations:

- Drive more sellers, inventory

- Mgmt emphasize increased spending in hiring within their Analytics teams

- Expect more International growth in Europe

- Investing in more marketing and ambitions growth which may depress bottom-line

Guidance👇

10/10

Bottom-line:

- Don't expect such numbers in 2021, but expect growth!

- $ETSY is experiencing higher conversation rates, Habitual & repeat buyers which bodes well for the future

- Best 'Video' Conference call yet :)

Great quarter! I may buy more shares! 😀

Bottom-line:

- Don't expect such numbers in 2021, but expect growth!

- $ETSY is experiencing higher conversation rates, Habitual & repeat buyers which bodes well for the future

- Best 'Video' Conference call yet :)

Great quarter! I may buy more shares! 😀

• • •

Missing some Tweet in this thread? You can try to

force a refresh