"Things I wish I knew when I started Investing" My quick version.

Sharing with few #FinTwit friends. @saxena_puru @BrianFeroldi @TMFJMo @FromValue @adventuresinfi @dhaval_kotecha @Gautam__Baid @SagaPartners @richard_chu97 @7Innovator @investing_city

Sharing with few #FinTwit friends. @saxena_puru @BrianFeroldi @TMFJMo @FromValue @adventuresinfi @dhaval_kotecha @Gautam__Baid @SagaPartners @richard_chu97 @7Innovator @investing_city

Applicable more to Business focused, long-term, individual investors picking their own stocks (but not direct advice of course).

So here we go.⬇️⬇️

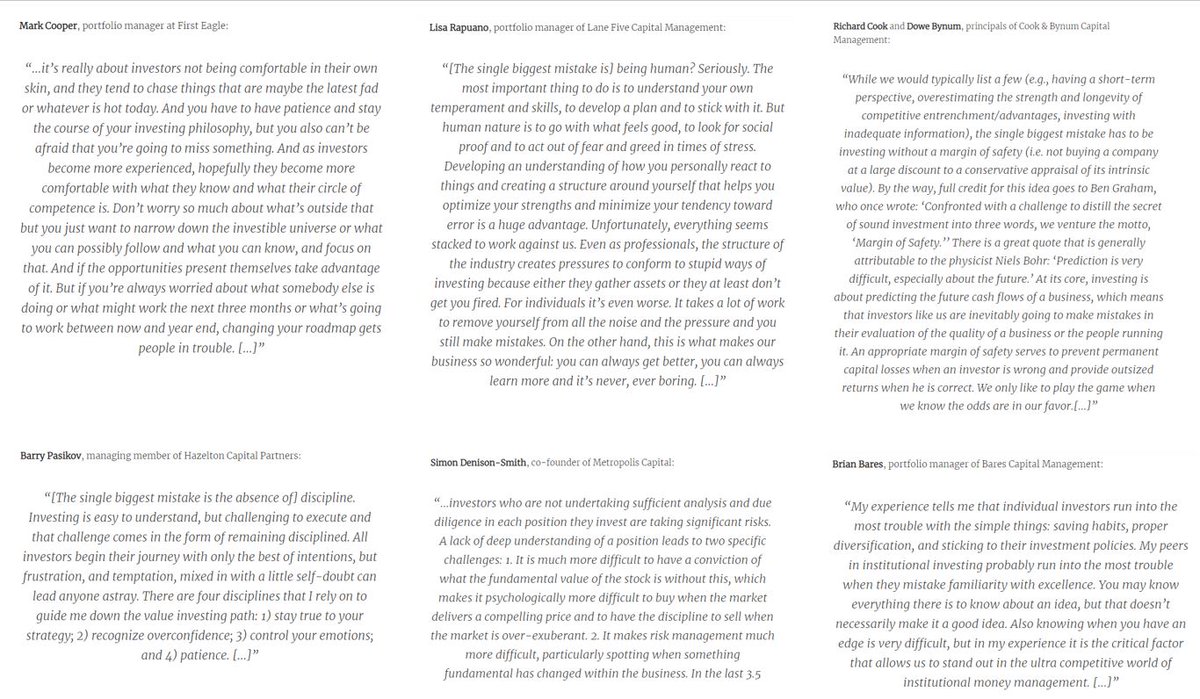

1⃣ Know Yourself. Process/style.

So here we go.⬇️⬇️

1⃣ Know Yourself. Process/style.

Hope this was helpful. Happy Friday!

/END

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh