The good side of debt. How using leverage & borrowed money can benefit you [Thread]

Debt is demonized thanks to many people using borrowings to fund consumption expenditure.

Borrowing cash to fund sneakers, savanna & sushi - bad debt. Using a loan to boost your company and increase revenue - good debt.

Debt as a source of investment capital can be powerful

Borrowing cash to fund sneakers, savanna & sushi - bad debt. Using a loan to boost your company and increase revenue - good debt.

Debt as a source of investment capital can be powerful

If you purchased a house, chances you structured a leveraged buyout (LBO). You contribute a small deposit & use the bank's financing to purchase the house. You repay the bank across the next 20 years.

After 20 years, your house is worth more than you paid for it. An example:

After 20 years, your house is worth more than you paid for it. An example:

Using debt as a powerful tool is really common

The corporate bond market (companies borrowing from the market) is massive.

Private equity use clever structuring & leverage to extract returns. Leveraged finance teams within investment banks help structure & fund these deals.

The corporate bond market (companies borrowing from the market) is massive.

Private equity use clever structuring & leverage to extract returns. Leveraged finance teams within investment banks help structure & fund these deals.

Student debt and home loans aren't always good debt. You aren't always guaranteed a salary which can help pay off the student loan.

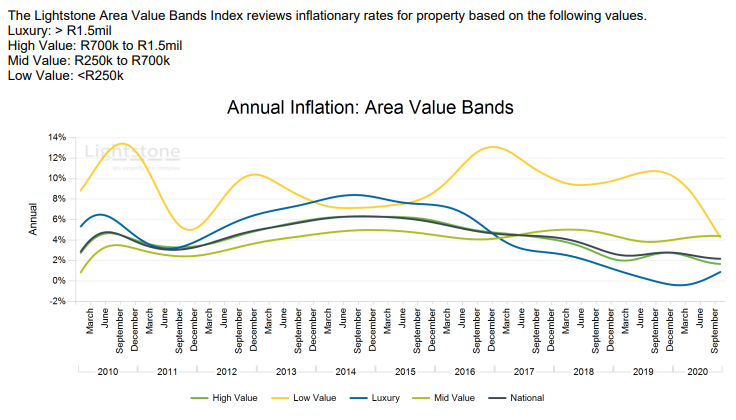

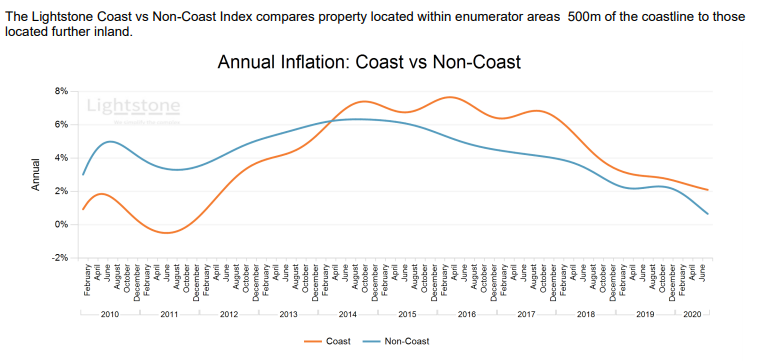

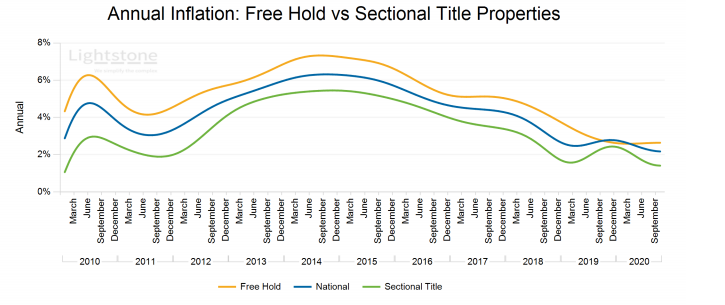

As for houses? Much less attractive when you consider all the costs of home ownership. Running a house involves more than paying off the bond.

As for houses? Much less attractive when you consider all the costs of home ownership. Running a house involves more than paying off the bond.

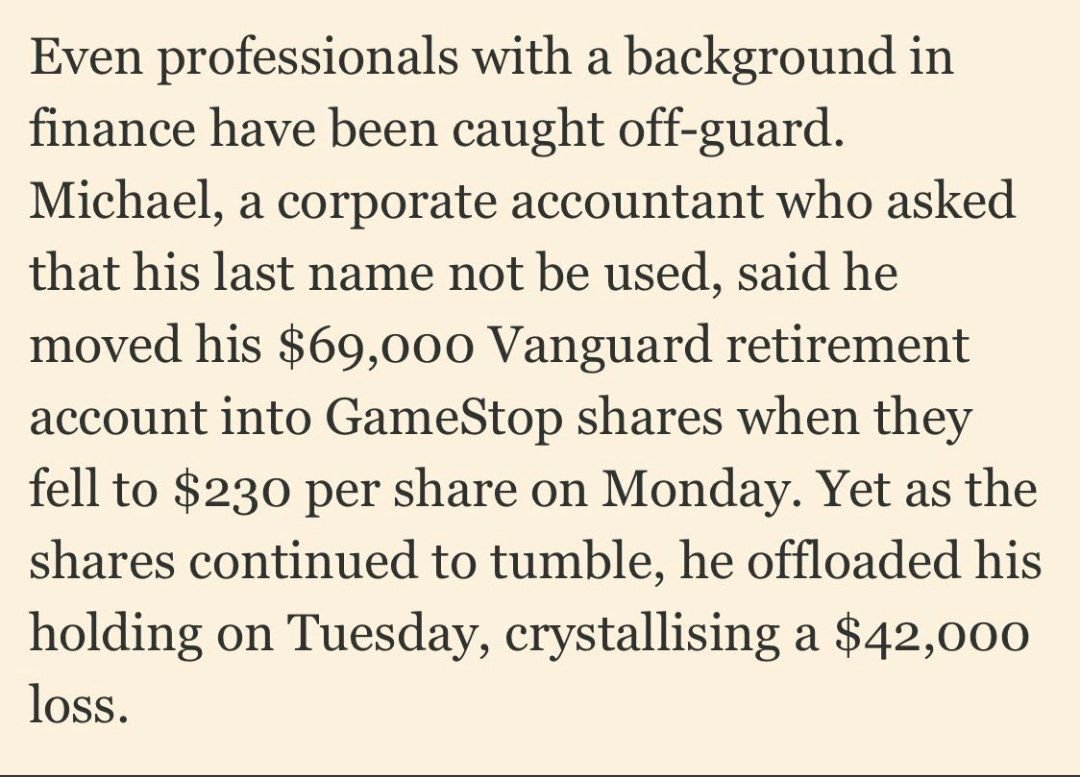

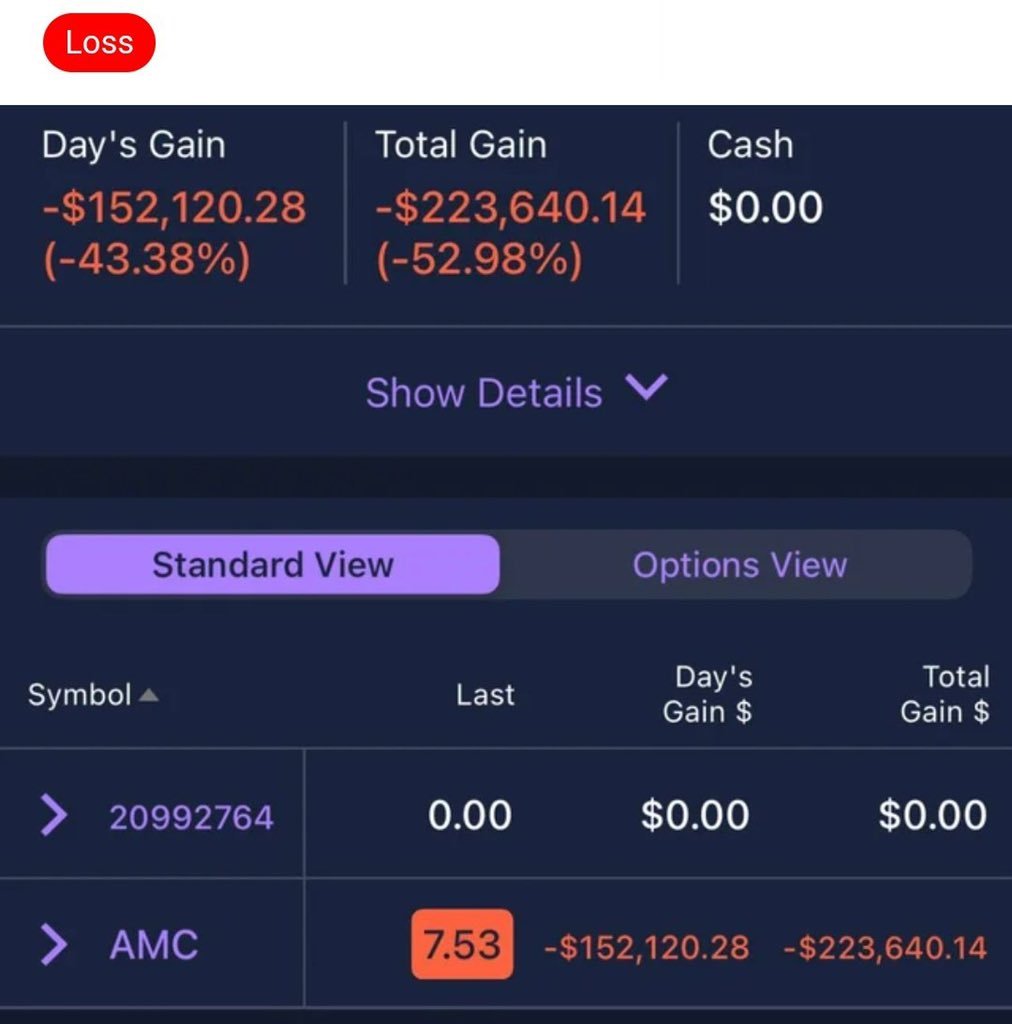

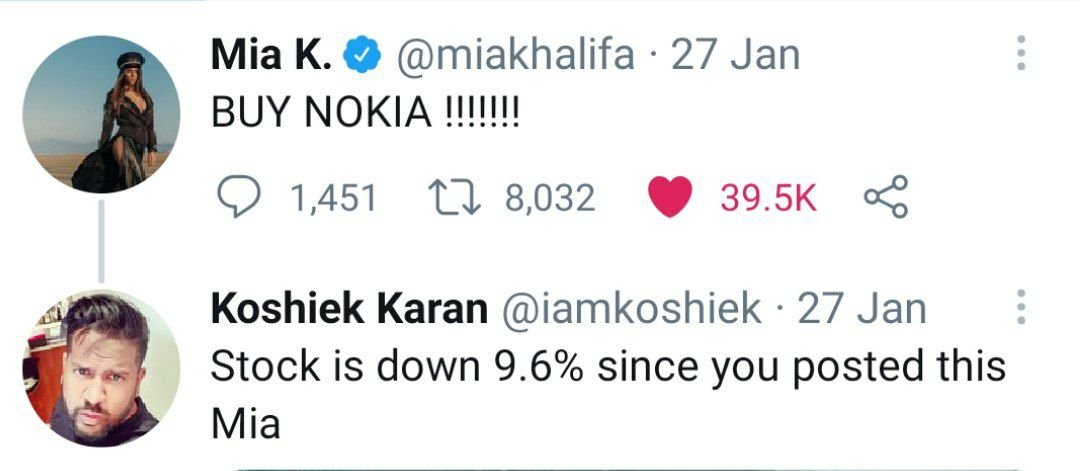

Leverage is an amplifier- amplifies your gains & your losses. Right now you're thinking dot com/ sub-prime crisis/ Bain & Edcon. Exactly!

Low rates, steep valuations, lofty bid premia, higher acquisition leverage, overly optimistic cash flow forecasts.. system always overheats!

Low rates, steep valuations, lofty bid premia, higher acquisition leverage, overly optimistic cash flow forecasts.. system always overheats!

Staying safe with debt

Ideally you want to be able to survive increases in the interest rate, be able to service the debt when business is slow and not be suffocated if you need additional leverage. Refinancing debt is also expensive.

Qualifying doesn't mean affordability.

Ideally you want to be able to survive increases in the interest rate, be able to service the debt when business is slow and not be suffocated if you need additional leverage. Refinancing debt is also expensive.

Qualifying doesn't mean affordability.

Quick checklist on good debt:

- Does the cash flow of my assets match the liabilities?

- Can I convert this to some form of equity if I default?

- Is this tied to my personal assets? (Will the kids starve?)

- Can I withstand shock events and still be able to repay the debt?

- Does the cash flow of my assets match the liabilities?

- Can I convert this to some form of equity if I default?

- Is this tied to my personal assets? (Will the kids starve?)

- Can I withstand shock events and still be able to repay the debt?

One of the reasons millionaires go bankrupt multiple times and bounce back - they never attach business liabilities to personal assets.

As far as possible ringfence the debt you're using in an investment vehicle. No - you can't ringfence the LV bag or the M4.

As far as possible ringfence the debt you're using in an investment vehicle. No - you can't ringfence the LV bag or the M4.

Pro-tip:

Interest & capital holidays might sound really great but they can really hurt you overall. Make sure to find out how the interest is rolled up and the extension on your overall repayment period.

Banks are not charities.

Interest & capital holidays might sound really great but they can really hurt you overall. Make sure to find out how the interest is rolled up and the extension on your overall repayment period.

Banks are not charities.

Here's a useful thread on raising capital

https://twitter.com/iamkoshiek/status/1343517614556016641?s=20

Debt in itself really isn't a villain.

Sure debt used for the wrong reasons (fuel consumption) can ruin your life. Debt as a source of productive capital is an incredibly powerful tool in generating a strong set of returns.

Here's to using it the right way!

Sure debt used for the wrong reasons (fuel consumption) can ruin your life. Debt as a source of productive capital is an incredibly powerful tool in generating a strong set of returns.

Here's to using it the right way!

Shout-out for making it to the end. For more threads, daily stock market updates ++ great memes check out our Telegram: t.me/BankerX

• • •

Missing some Tweet in this thread? You can try to

force a refresh