🚨 NEW UK IPO THREAD 🚨

Moonpig $MOON is UK's leading online greeting/gifting card maker w/ 60% market share.

They offer 22K+ cards/gifts, personalization features, and next-day delivery.

Growing revs 25%+ w/ 25% EBITDA margins

Yours for 14x '24 FCF👇

macro-ops.com/moonpig-moon-u…

Moonpig $MOON is UK's leading online greeting/gifting card maker w/ 60% market share.

They offer 22K+ cards/gifts, personalization features, and next-day delivery.

Growing revs 25%+ w/ 25% EBITDA margins

Yours for 14x '24 FCF👇

macro-ops.com/moonpig-moon-u…

1/ Why People Buy Cards & Why They Love Receiving Them

Physical cards mean more to people than other forms of communication.

In an age of quick-burst email and massive group texting, a physical card is a piece of antique art.

The more we move online, the more we love cards.

Physical cards mean more to people than other forms of communication.

In an age of quick-burst email and massive group texting, a physical card is a piece of antique art.

The more we move online, the more we love cards.

2/ UK Gifting Cards: A Resilient & Non-Cyclical Industry

Sending/receiving cards is ingrained in UK culture. Per $MOON prospectus, 87% of UK adults that purchase/send a card send ~20 per year.

Gifting cards = annuity-like revs. People buy cards for the same people every year!

Sending/receiving cards is ingrained in UK culture. Per $MOON prospectus, 87% of UK adults that purchase/send a card send ~20 per year.

Gifting cards = annuity-like revs. People buy cards for the same people every year!

3/ $MOON Is The Obvious Online Choice For Cards

The card market is moving online. Online cards grew faster than cosmetics, homewares & clothing!

Despite this growth, online sales represent only 10% of the total card market.

By 2024, online will account for ~20% of card sales.

The card market is moving online. Online cards grew faster than cosmetics, homewares & clothing!

Despite this growth, online sales represent only 10% of the total card market.

By 2024, online will account for ~20% of card sales.

4/ Benefits of Buying Cards Online

The biggest benefit to buying cards online is in the *data*

MOON has 160M in historical transaction data.

Data helps MOON's recommendation/curation algorithm provide the best curated, personalized experiences for customers.

STICKY BIZ

The biggest benefit to buying cards online is in the *data*

MOON has 160M in historical transaction data.

Data helps MOON's recommendation/curation algorithm provide the best curated, personalized experiences for customers.

STICKY BIZ

5/ $MOON & $SFIX ... A Worthy Comparison?

Like Stitch Fix (SFIX), MOON learns about your likes, humor, and other attributes to continually curate the best types of cards for all your occasions.

This type of customer engagement has led to an 86% brand awareness & 74 NPS rating

Like Stitch Fix (SFIX), MOON learns about your likes, humor, and other attributes to continually curate the best types of cards for all your occasions.

This type of customer engagement has led to an 86% brand awareness & 74 NPS rating

6/ An App-First Business

MOON’s app offers augmented reality card selection, personalized handwritten messages, and faster checkout times than a web page.

App customers also purchase more cards. In 2019, customers who used the app bot 15% more cards than webpage customers.

MOON’s app offers augmented reality card selection, personalized handwritten messages, and faster checkout times than a web page.

App customers also purchase more cards. In 2019, customers who used the app bot 15% more cards than webpage customers.

7/ The MOON Experience: From Home Page To Checkout

The website has a beautiful UI/UX. It’s light, pink, and sports great fonts.

MOON built its search engine in-house using its 160M+ purchase history insights.

Before checkout, MOON offers cross-sell products like gifts, etc.

The website has a beautiful UI/UX. It’s light, pink, and sports great fonts.

MOON built its search engine in-house using its 160M+ purchase history insights.

Before checkout, MOON offers cross-sell products like gifts, etc.

8/ The Three Cards You Can Buy

$MOON sells 3 types of cards:

- Personalized photo

- Personalized wording

- Ready-made

$MOON grew designs from 17K to 22K+ in 6 months. Their secret? Rapid design & deployment.

They sell two brands: 'Moonpig' in UK & 'Greetz' in Netherlands

$MOON sells 3 types of cards:

- Personalized photo

- Personalized wording

- Ready-made

$MOON grew designs from 17K to 22K+ in 6 months. Their secret? Rapid design & deployment.

They sell two brands: 'Moonpig' in UK & 'Greetz' in Netherlands

9/ $MOON Customer Data

MOON is a hit with 12.2M active users as of October 31, 2020.

The co’s grown its user base by 122% since 2018 (5.5M customers).

>50% of MOON’s customers use the card maker for at least two years.

Customers purchase ~2 cards per year (room to grow!!)

MOON is a hit with 12.2M active users as of October 31, 2020.

The co’s grown its user base by 122% since 2018 (5.5M customers).

>50% of MOON’s customers use the card maker for at least two years.

Customers purchase ~2 cards per year (room to grow!!)

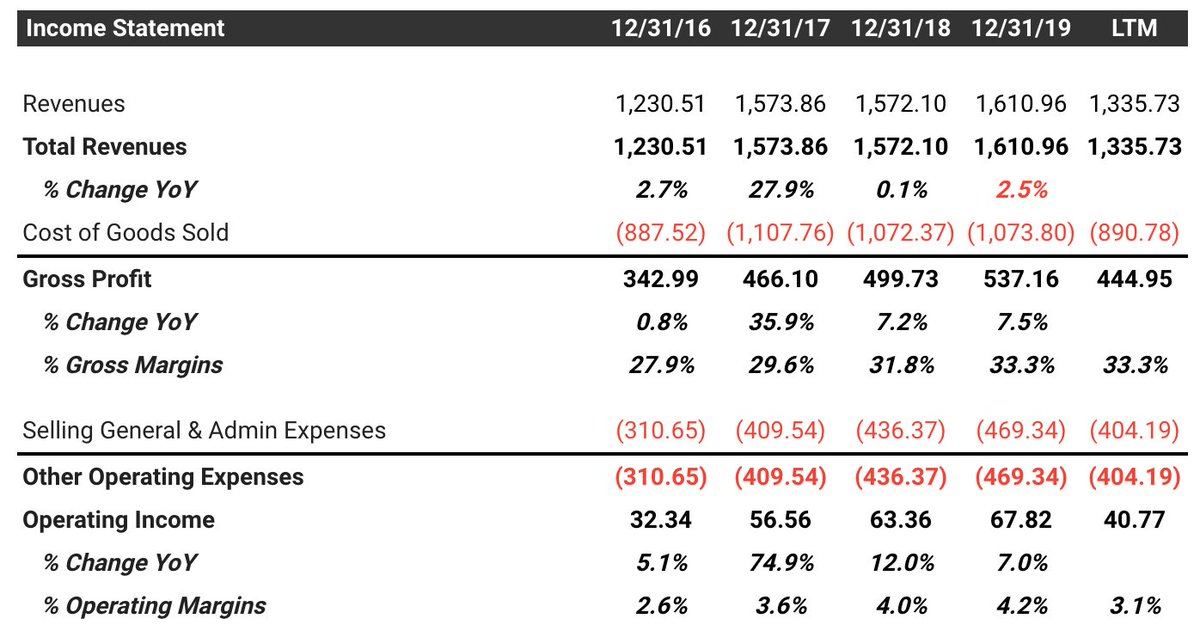

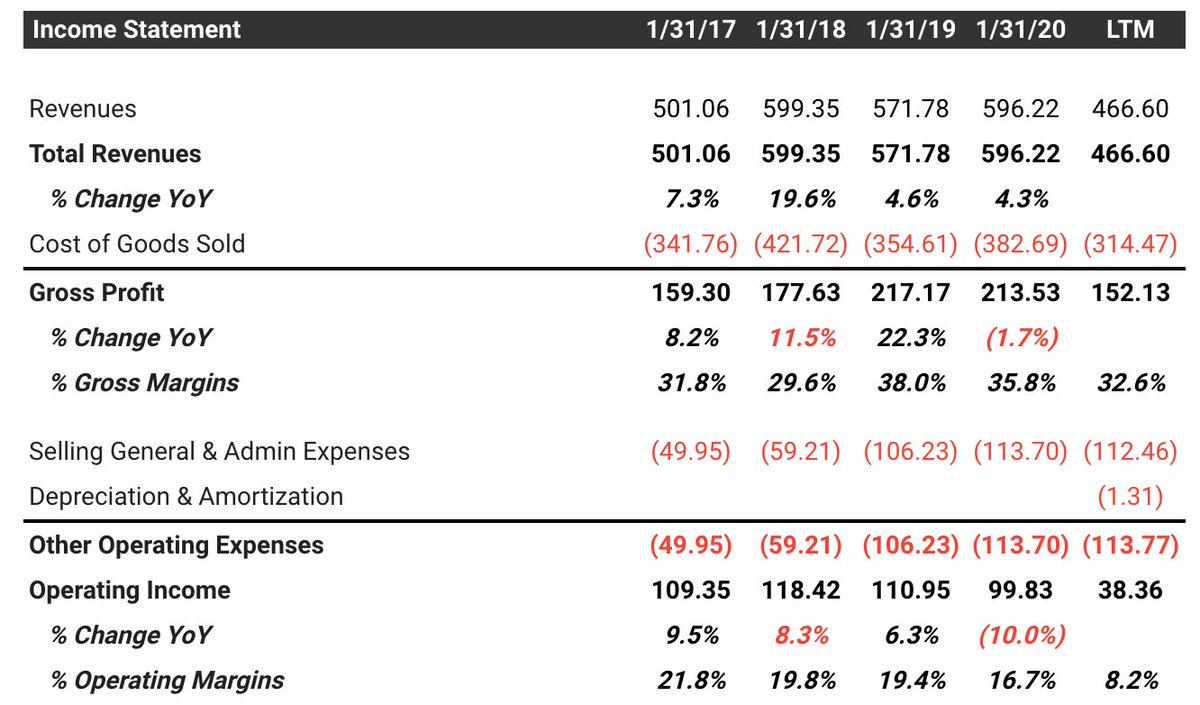

10/ Narrative To Numbers

In 2020 MOON processed 24.3M orders from 12.2M customers with a GBP 7.1 average order value.

Moonpig does 56% gross margins and 32% EBITDA margins.

Greetz does 44% gross margin and 10% EBITDA margin.

172M in rev, 44M in EBITDA & 100%+ FCF conversion

In 2020 MOON processed 24.3M orders from 12.2M customers with a GBP 7.1 average order value.

Moonpig does 56% gross margins and 32% EBITDA margins.

Greetz does 44% gross margin and 10% EBITDA margin.

172M in rev, 44M in EBITDA & 100%+ FCF conversion

11/ Looking Ahead: The Next Five Years

$MOON has three growth levers: customers, orders-per-customer, price-per-order

Below is our assumption of those three drivers.

If we’re correct in our guesses, we end 2024 w/ 144M EBITDA (9% yield), 100M after-tax earnings & 110M FCF

$MOON has three growth levers: customers, orders-per-customer, price-per-order

Below is our assumption of those three drivers.

If we’re correct in our guesses, we end 2024 w/ 144M EBITDA (9% yield), 100M after-tax earnings & 110M FCF

12/ Why The Opportunity Exists

- Newly issued IPO and started trading on the LSE on February 2.

- Recently split from Horizon Group, which was a conglomerate of Moonpig and Photobox.

- Susceptible to the “But what if [Amazon, RedBubble, etc.] enter this space?” question

- Newly issued IPO and started trading on the LSE on February 2.

- Recently split from Horizon Group, which was a conglomerate of Moonpig and Photobox.

- Susceptible to the “But what if [Amazon, RedBubble, etc.] enter this space?” question

13/ Concluding Thoughts

If you liked this write-up and want to receive stuff like this in your inbox (for free!), consider joining us at @MacroOps.

We send out free write-ups, chart packs, and more.

Click the link below to sign-up!

macro-ops.com

If you liked this write-up and want to receive stuff like this in your inbox (for free!), consider joining us at @MacroOps.

We send out free write-ups, chart packs, and more.

Click the link below to sign-up!

macro-ops.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh