Listen up you @michaeljburry fanboys/girls (myself included)!

You made some money on $GME. Congrats.

But do you know what else The "Big Short Squeeze" holds?

Probably not.

Here's a thread on every non-US company Burry holds in Scion AM.

h/t @theTIKR for the data!

You made some money on $GME. Congrats.

But do you know what else The "Big Short Squeeze" holds?

Probably not.

Here's a thread on every non-US company Burry holds in Scion AM.

h/t @theTIKR for the data!

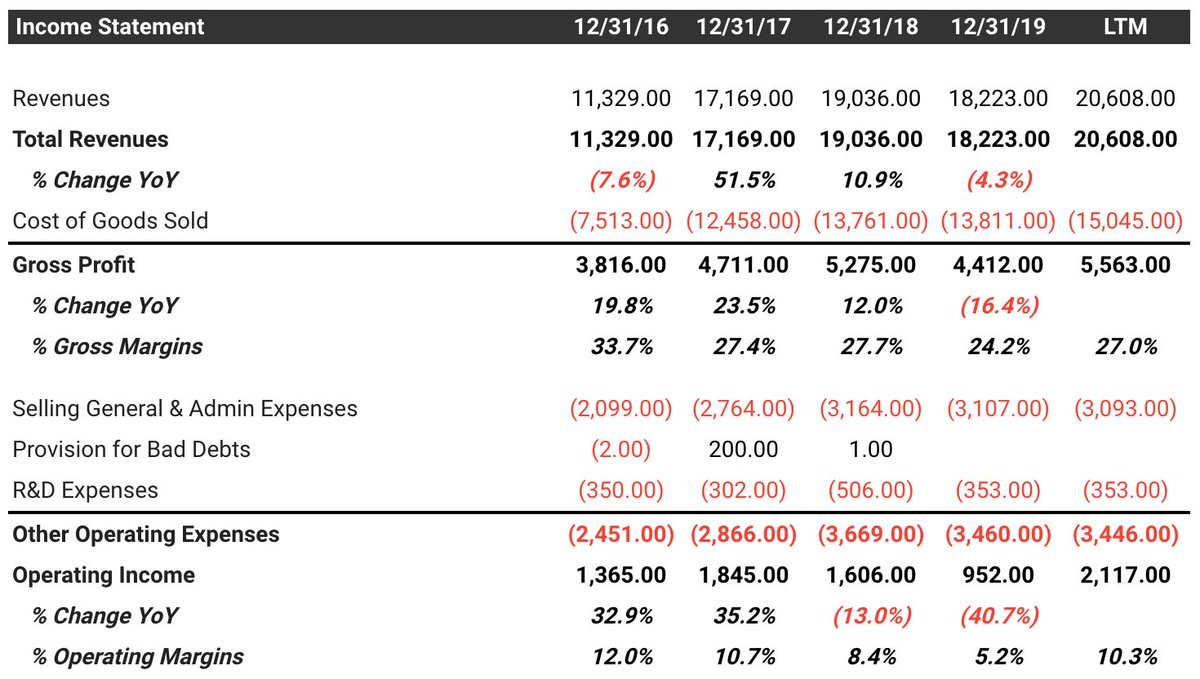

1/ Robert Walters (RWA)

Country: UK

Description: Provides professional recruitment consultancy services worldwide.

Financials/Valuation:

- 1% Revenue 5YR CAGR

- 3.5% EBITDA Margins

- $127M net cash on BS

- 15x EV/EBIT

- 0.32x EV/Sales

Country: UK

Description: Provides professional recruitment consultancy services worldwide.

Financials/Valuation:

- 1% Revenue 5YR CAGR

- 3.5% EBITDA Margins

- $127M net cash on BS

- 15x EV/EBIT

- 0.32x EV/Sales

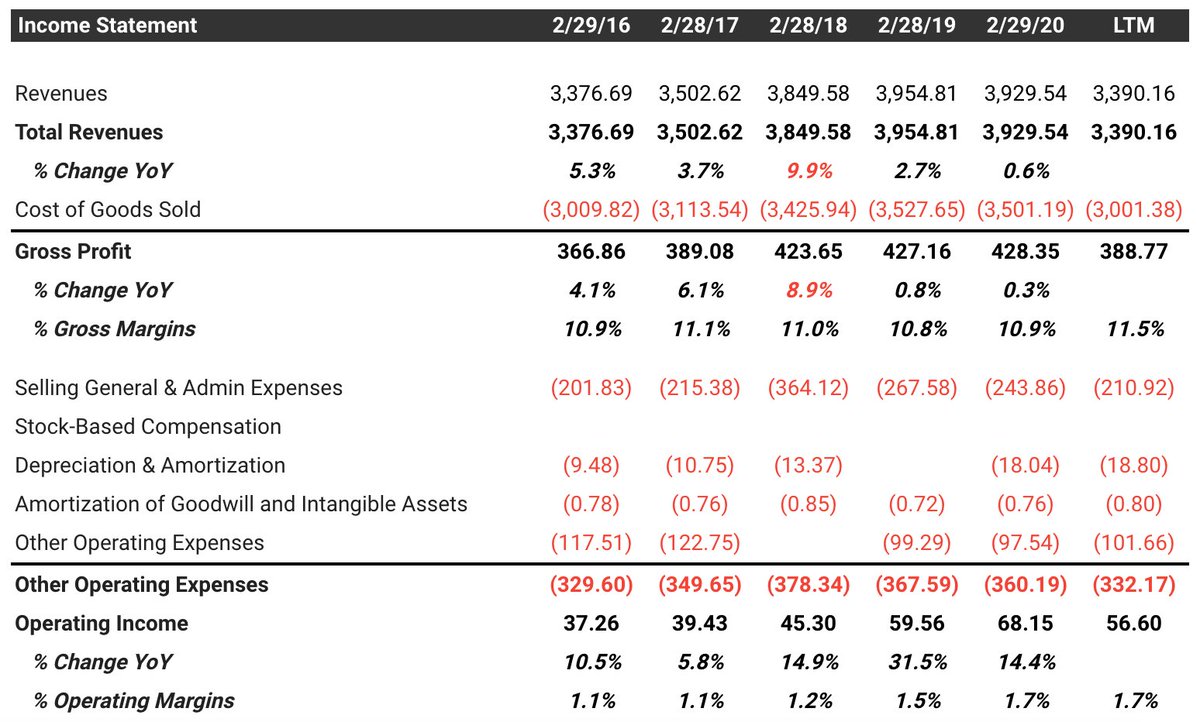

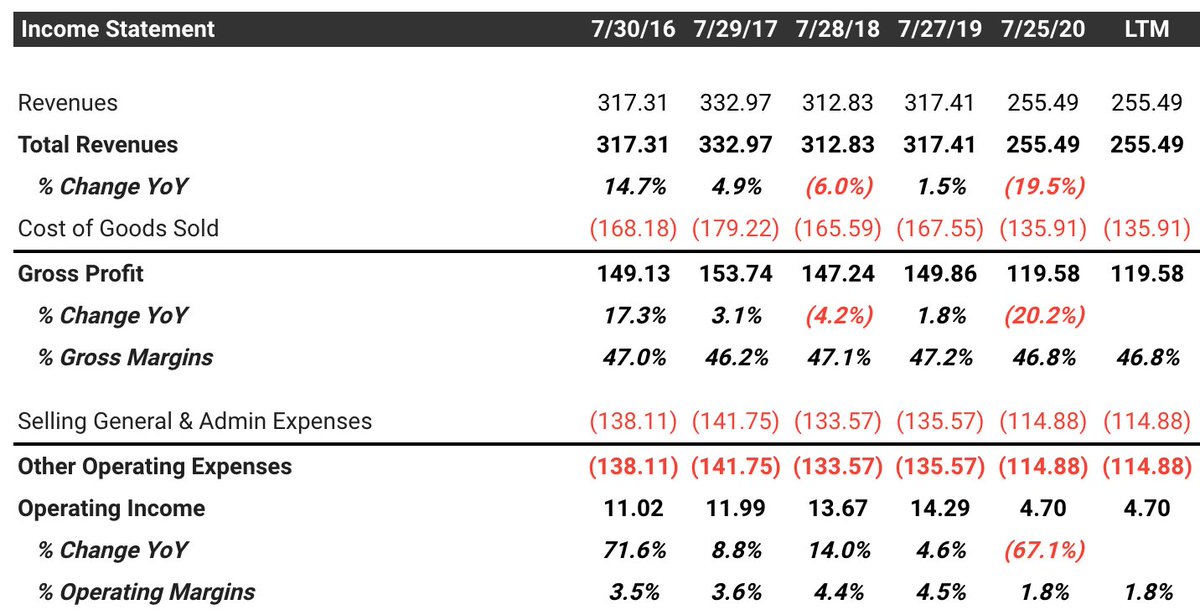

2/ Card Factory PLC (CARD)

Country: UK

Description: The company designs, sources, prints, warehouses, produces, distributes, and sells greeting cards.

Financials/Valuation:

- 4.3% 4YR Rev CAGR

- 27% EBITDA margins

- 12% NI Margin

- 6x EV/EBITDA

- 1.31x EV/Sales

Country: UK

Description: The company designs, sources, prints, warehouses, produces, distributes, and sells greeting cards.

Financials/Valuation:

- 4.3% 4YR Rev CAGR

- 27% EBITDA margins

- 12% NI Margin

- 6x EV/EBITDA

- 1.31x EV/Sales

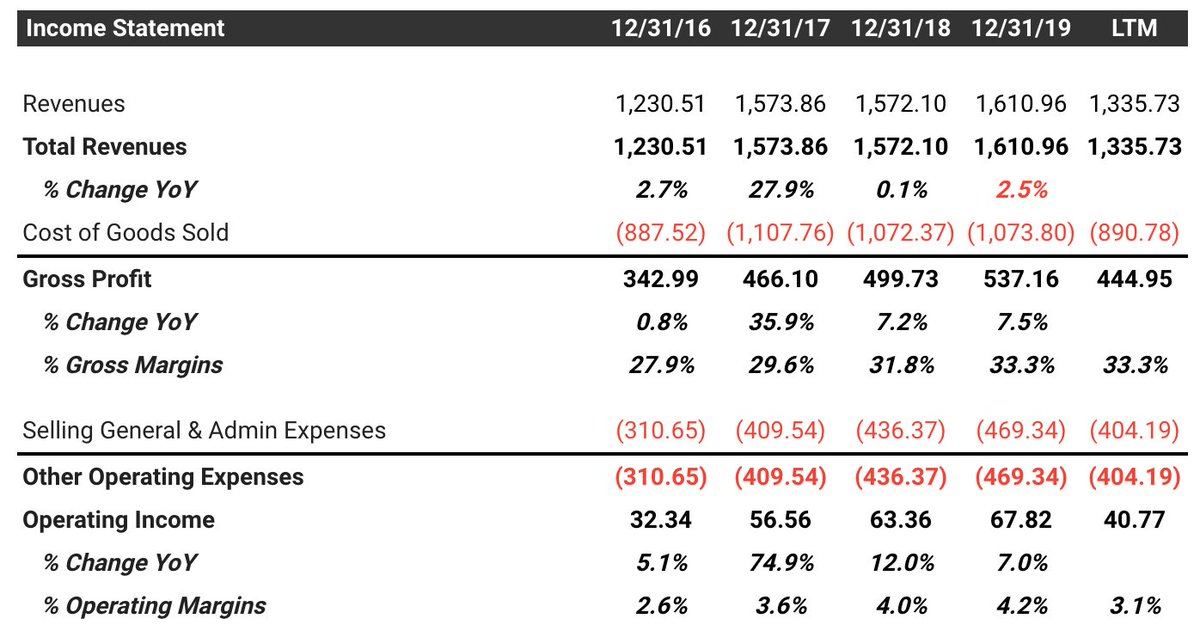

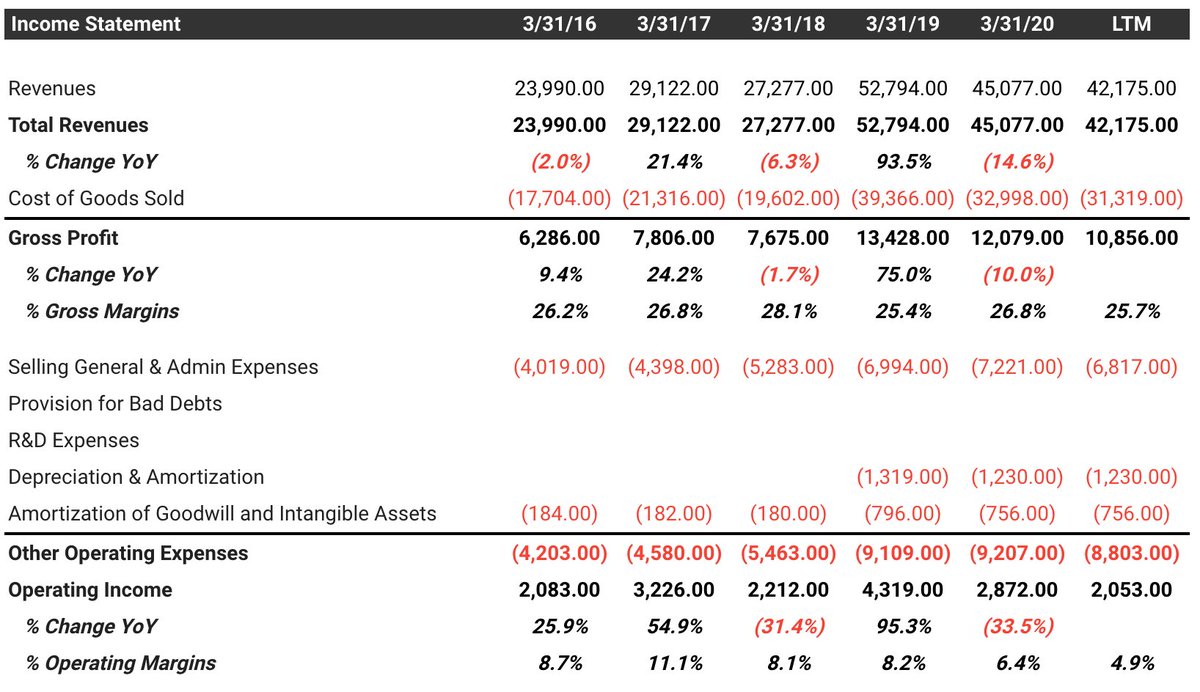

3/ Vertu Motors PLC (VTU)

Country: UK

Description: The company sells new cars, motorcycles, commercial vehicles, and used vehicles, as well as provides related aftersales services.

Financials/Val:

- 6% 5YR Rev CAGR

- 2% EBITDA margin

- 3.13x EV/EBITDA

- 0.06x EV/Sales

Country: UK

Description: The company sells new cars, motorcycles, commercial vehicles, and used vehicles, as well as provides related aftersales services.

Financials/Val:

- 6% 5YR Rev CAGR

- 2% EBITDA margin

- 3.13x EV/EBITDA

- 0.06x EV/Sales

4/ Chosun Welding (A120030)

Country: South Korea

Description: Offers covered arc welding electrodes, stick electrodes, submerged arc materials, and solid wires.

Fin/Val:

- 0% 5YR Rev CAGR

- 25% EBITDA Margin

- 11% ROC

- 2.35x EV/EBITDA

- 0.57x EV/Sales

Country: South Korea

Description: Offers covered arc welding electrodes, stick electrodes, submerged arc materials, and solid wires.

Fin/Val:

- 0% 5YR Rev CAGR

- 25% EBITDA Margin

- 11% ROC

- 2.35x EV/EBITDA

- 0.57x EV/Sales

5/ Autech Corp (A067170)

Country: South Korea

Description: Medical vehicles, including ambulance/EMS and mobile hospital

Fin/Val:

- 98% 3YR Rev CAGR

- 3.3% EBITDA Margin

- 0.36x EV/Sales

- 25x EV/EBITDA

Country: South Korea

Description: Medical vehicles, including ambulance/EMS and mobile hospital

Fin/Val:

- 98% 3YR Rev CAGR

- 3.3% EBITDA Margin

- 0.36x EV/Sales

- 25x EV/EBITDA

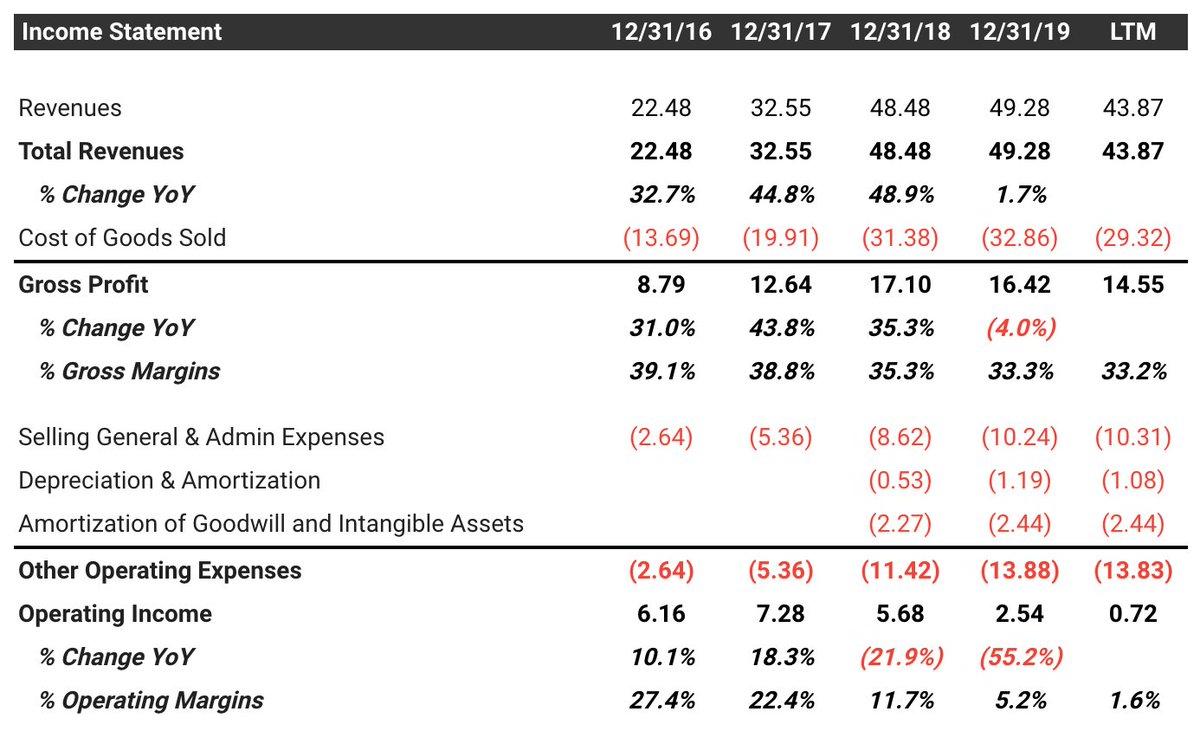

6/ Ezwel Co., Ltd. (A090850)

Country: South Korea

Description: Enables employees to choose welfare items and benefit levels according to their lifestyle and preference

Fin/Val:

- 11% 3YR Rev CAGR

- 15.5% EBITDA Margin

- 2.31x EV/Sales

- 11.43x EV/EBITDA

Country: South Korea

Description: Enables employees to choose welfare items and benefit levels according to their lifestyle and preference

Fin/Val:

- 11% 3YR Rev CAGR

- 15.5% EBITDA Margin

- 2.31x EV/Sales

- 11.43x EV/EBITDA

7/ ScS Group plc (SCS)

Country: UK

Description: Engages in the retail of upholstered furniture, flooring, and related products

Fin/Val:

- (4%) 5YR Rev CAGR

- 2.7% EBITDA Margin

- 0.42x EV/Sales

- 7.59x EV/EBITDA

Country: UK

Description: Engages in the retail of upholstered furniture, flooring, and related products

Fin/Val:

- (4%) 5YR Rev CAGR

- 2.7% EBITDA Margin

- 0.42x EV/Sales

- 7.59x EV/EBITDA

8/ Warpaint London PLC (W7L)

Country: UK

Description: Color cosmetics. The company offers eye, face make-up, lip, and nail products; gift products; accessories and sets; brushes; and others.

Fin/Val:

- 22% 3YR Rev CAGR

- 1.40x EV/Sales

- 9x EV/EBITDA

Country: UK

Description: Color cosmetics. The company offers eye, face make-up, lip, and nail products; gift products; accessories and sets; brushes; and others.

Fin/Val:

- 22% 3YR Rev CAGR

- 1.40x EV/Sales

- 9x EV/EBITDA

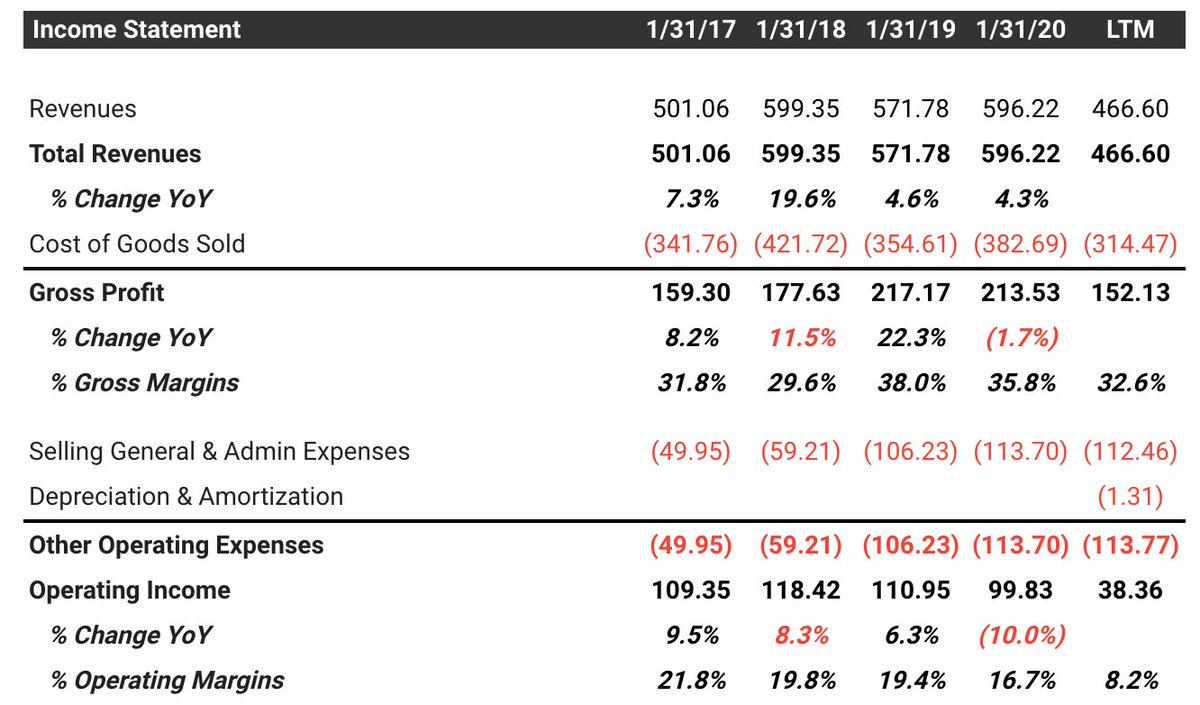

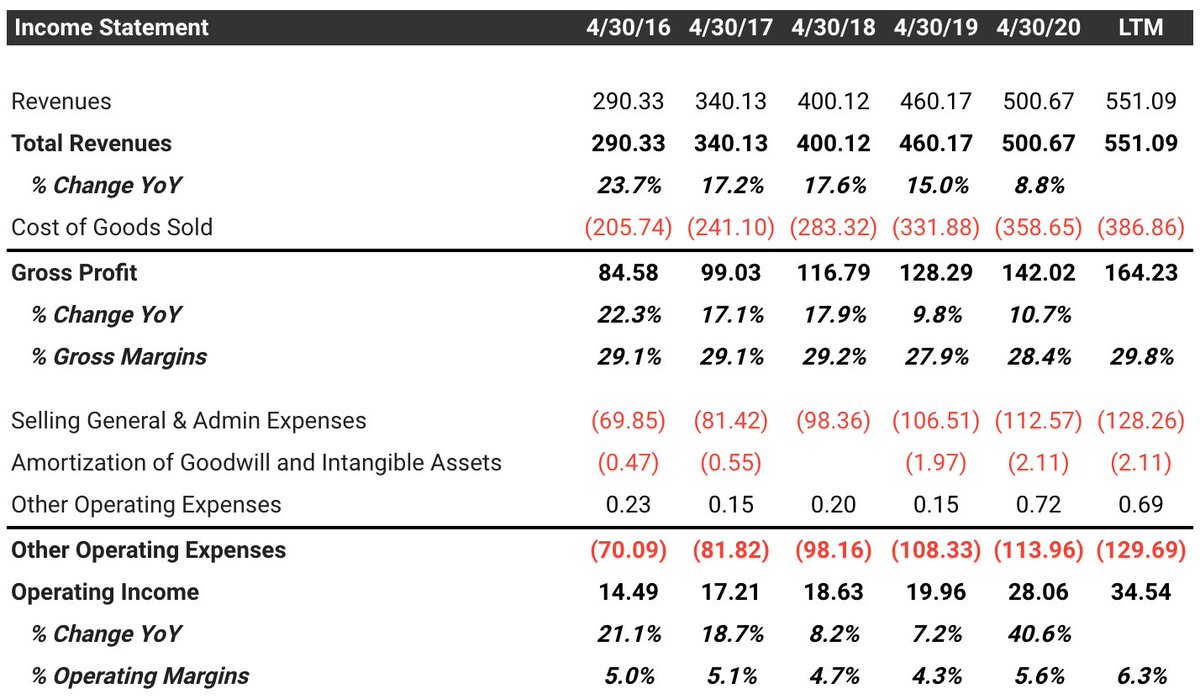

9/ Clipper Logistics plc (CLG)

Country: UK

Description: It offers e-fulfilment, returns management, multichannel, technical services, warehousing, urban and retail consolidation, etc.

Fin/Val:

- 15% 4YR Rev CAGR

- 12% EBITDA Margins

- 1.25x EV/Sales

- 13x EV/EBITDA

Country: UK

Description: It offers e-fulfilment, returns management, multichannel, technical services, warehousing, urban and retail consolidation, etc.

Fin/Val:

- 15% 4YR Rev CAGR

- 12% EBITDA Margins

- 1.25x EV/Sales

- 13x EV/EBITDA

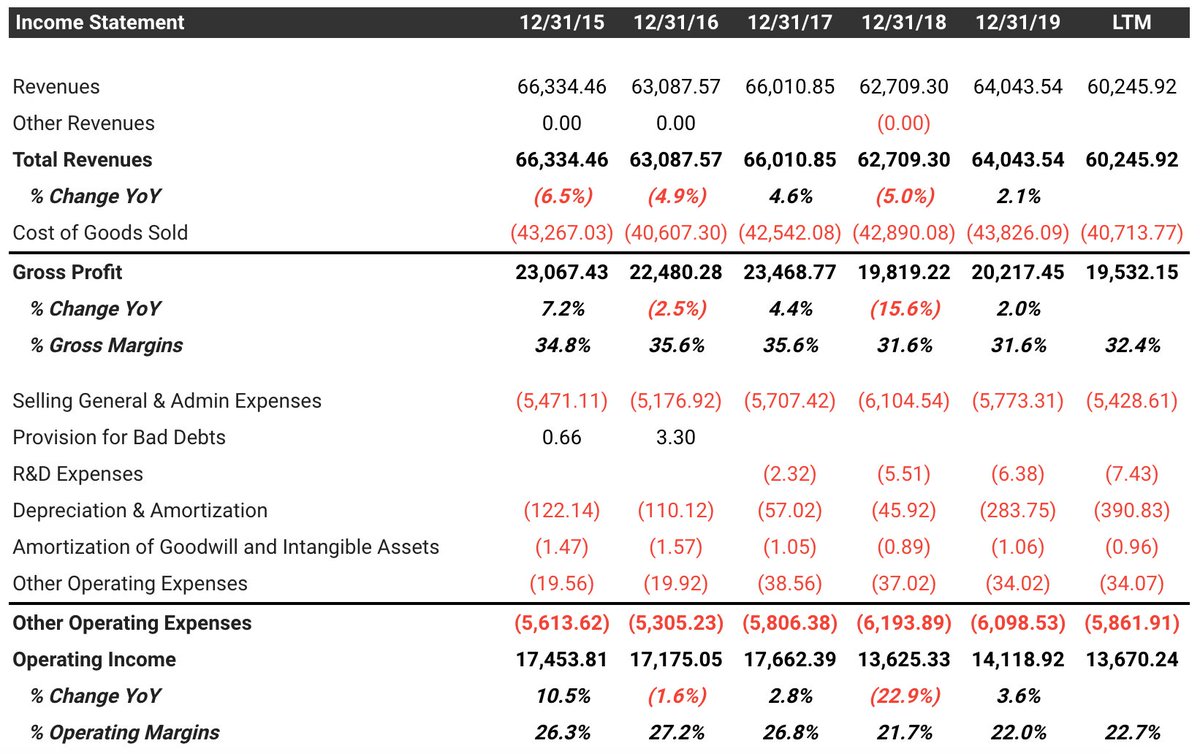

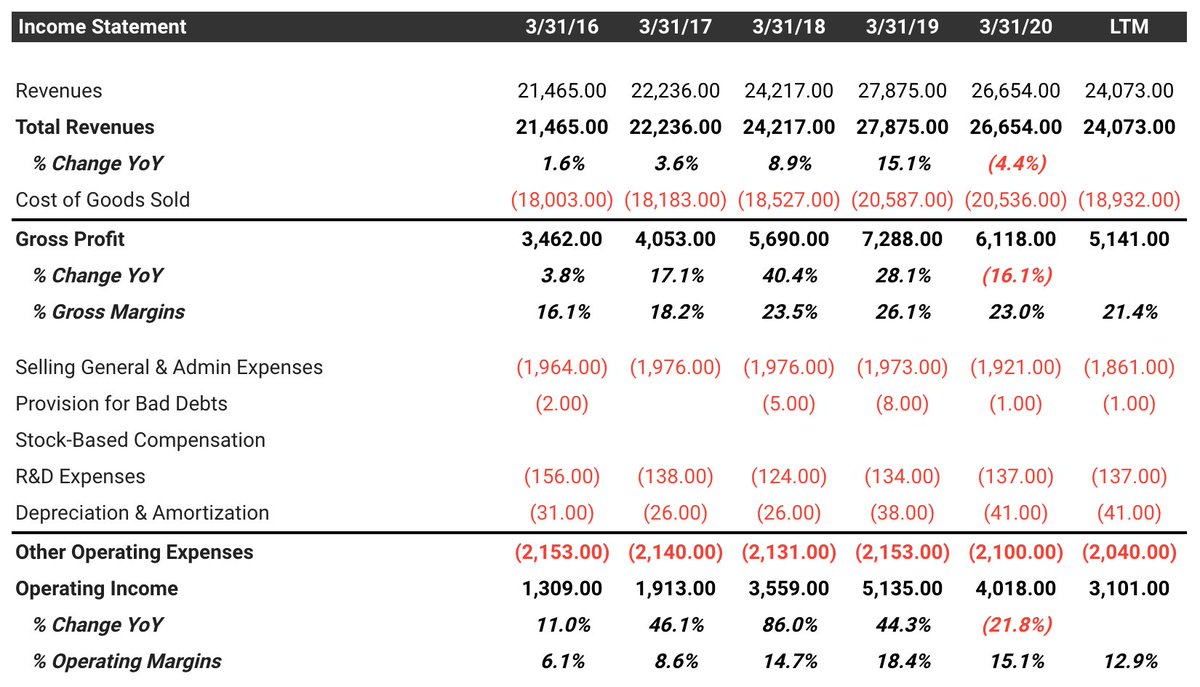

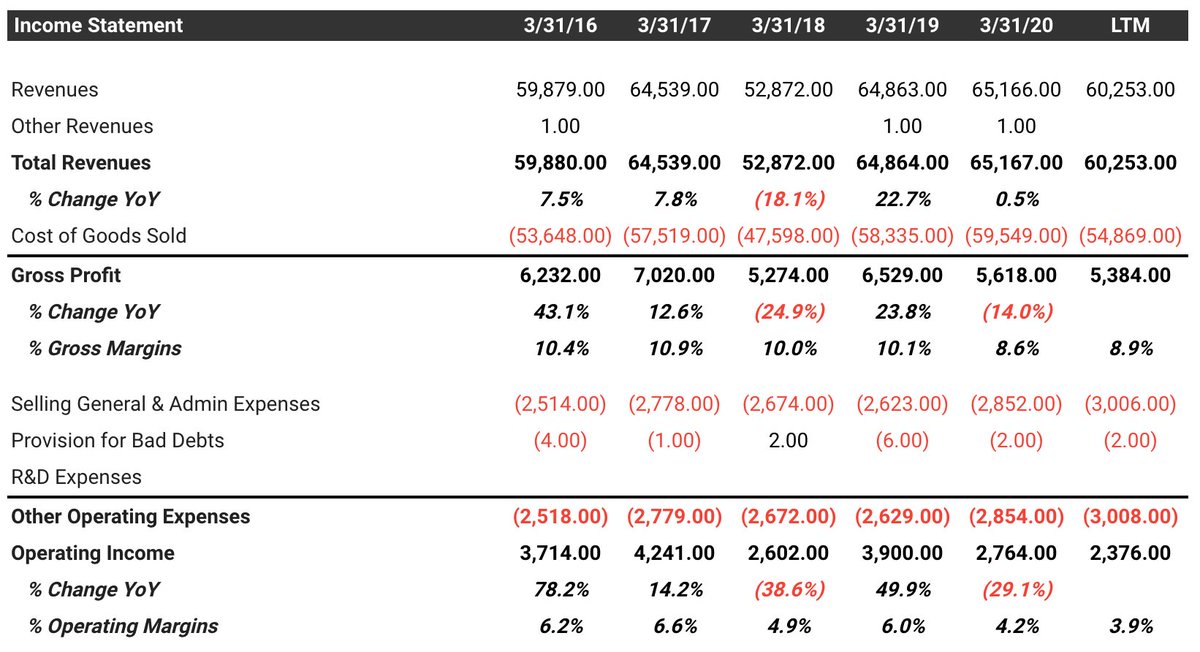

10/ Yotai Refractories (5357)

Country: Japan

Description: manufactures and sells refractories and ceramics in Japan.

Fin/Val:

- 6% 4YR Rev CAGR

- 15% EBIT Margins

- 0.37x EV/Sales

- 2.23x EV/EBITDA

Country: Japan

Description: manufactures and sells refractories and ceramics in Japan.

Fin/Val:

- 6% 4YR Rev CAGR

- 15% EBIT Margins

- 0.37x EV/Sales

- 2.23x EV/EBITDA

11/ Tazmo Co. (6266)

Country: Japan

Description: manufactures and sells semiconductor manufacturing equipment in Japan and internationally

Fin/Val:

- 22% 4YR Rev CAGR

- 10% EBIT Margins

- 9.33x EV/EBIT

- 1x EV/Sales

Country: Japan

Description: manufactures and sells semiconductor manufacturing equipment in Japan and internationally

Fin/Val:

- 22% 4YR Rev CAGR

- 10% EBIT Margins

- 9.33x EV/EBIT

- 1x EV/Sales

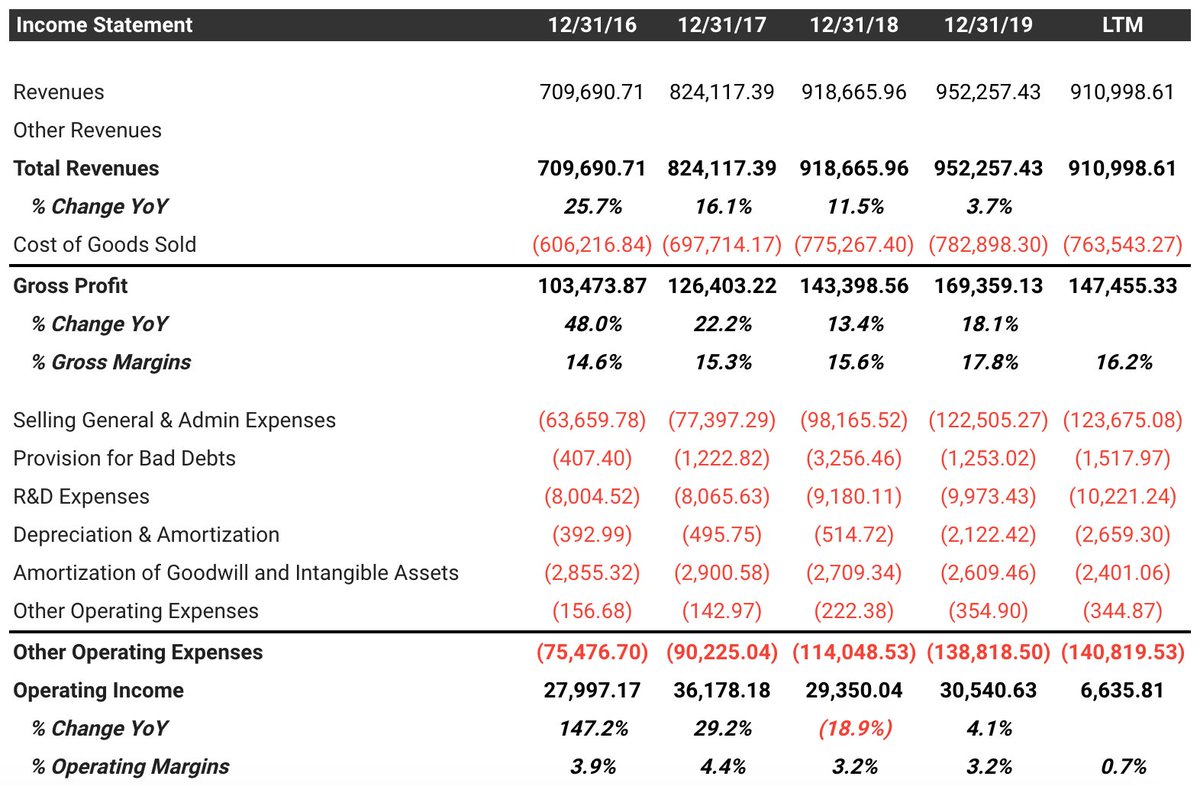

12/ Sansei Technologies (6357)

Country: Japan

Description: plans, designs, manufactures, installs, repairs, and maintains amusement rides, stage equipment, elevators.

Fin/Val:

- 32% 4YR Rev CAGR

- 6% EBIT Margin

- 4.55x EV/EBITDA

- 0.48x EV/Sales

Country: Japan

Description: plans, designs, manufactures, installs, repairs, and maintains amusement rides, stage equipment, elevators.

Fin/Val:

- 32% 4YR Rev CAGR

- 6% EBIT Margin

- 4.55x EV/EBITDA

- 0.48x EV/Sales

13/ Daisue Construction (1814)

Country: Japan

Description: Construction of condominiums; and office, logistics warehouse, factory, medical treatment, ceremonial occasion, etc.

Fin/Val:

- 3% 4YR Rev CAGR

- 4% EBIT Margins

- 0.02x EV/Sales

- 0.50x EV/EBITDA

Country: Japan

Description: Construction of condominiums; and office, logistics warehouse, factory, medical treatment, ceremonial occasion, etc.

Fin/Val:

- 3% 4YR Rev CAGR

- 4% EBIT Margins

- 0.02x EV/Sales

- 0.50x EV/EBITDA

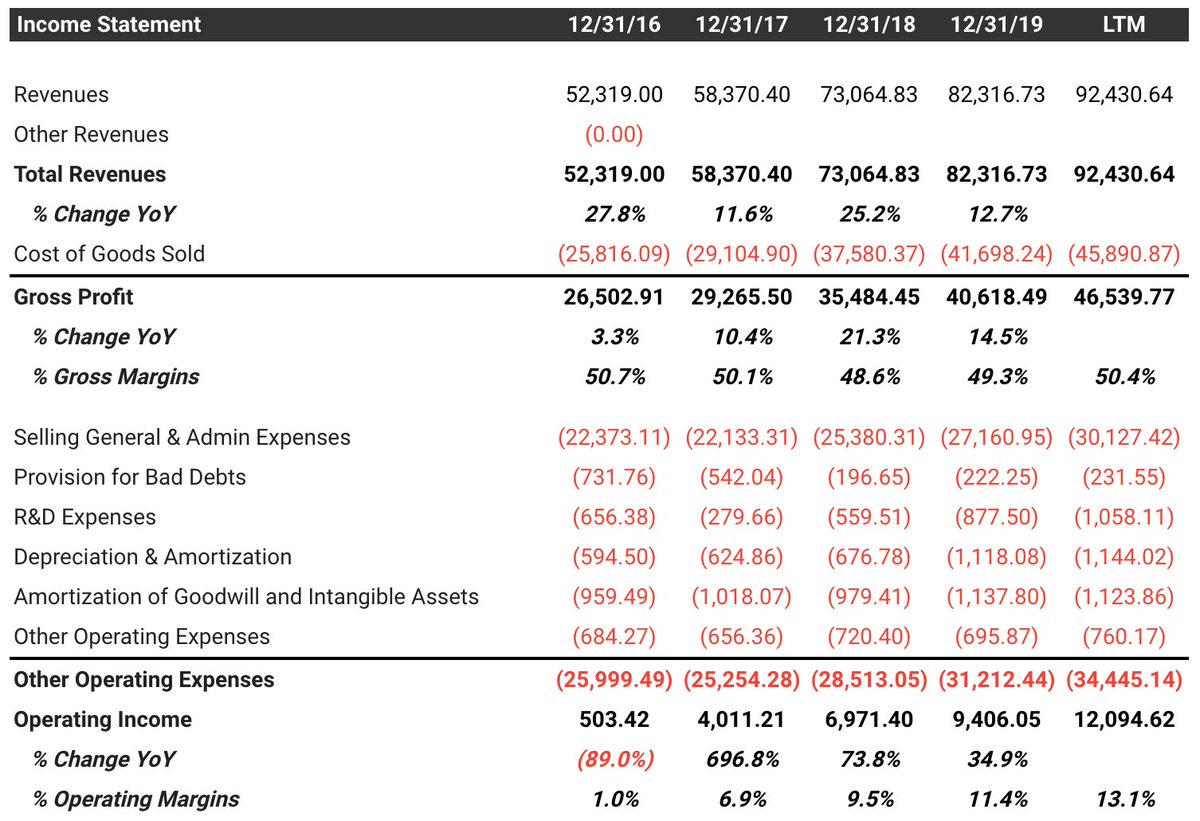

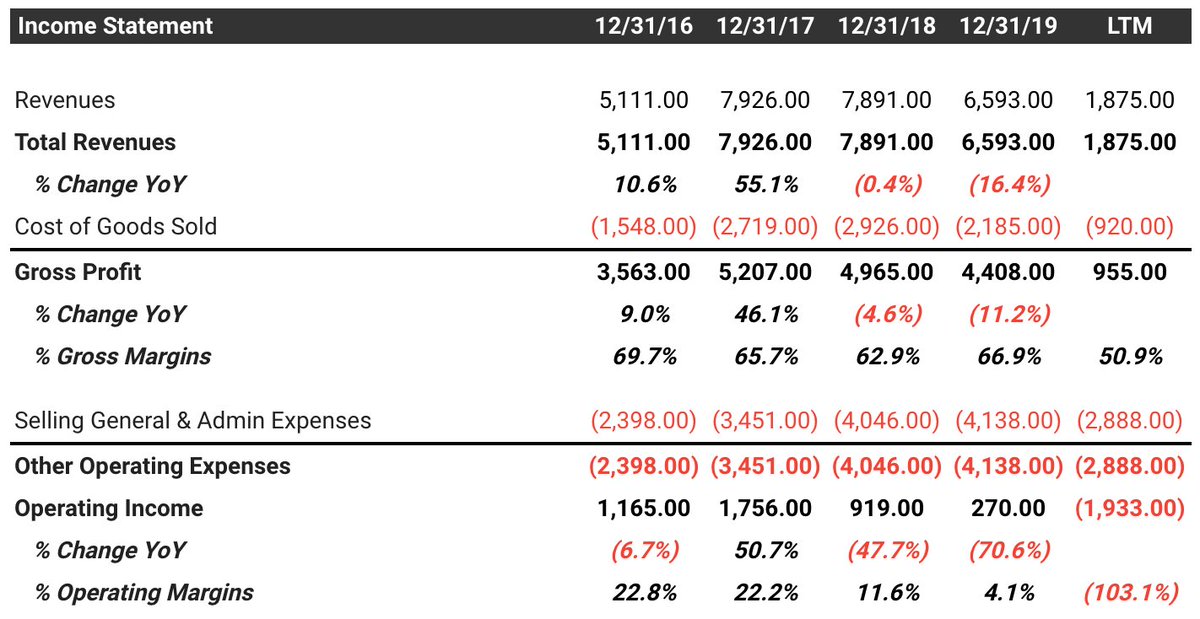

14/ Hanatour Japan (6561)

Country: Japan

Description: arranges inbound travel services from South Korea, China, and South-East Asia, as well as local Japan and option tours

Fin/Val:

- 28% 4YR Rev CAGR

- 20% EBIT Margins

- 6.25x EV/Sales

- 3.15x P/Book

Country: Japan

Description: arranges inbound travel services from South Korea, China, and South-East Asia, as well as local Japan and option tours

Fin/Val:

- 28% 4YR Rev CAGR

- 20% EBIT Margins

- 6.25x EV/Sales

- 3.15x P/Book

15/ Conclusion

Whew! That's a lot to add to your watchlist.

If you like what you read, consider joining our @MacroOps email list. We send out write-ups on off-the-beaten-path companies (like these) every week.

Join here: macro-ops.com

Whew! That's a lot to add to your watchlist.

If you like what you read, consider joining our @MacroOps email list. We send out write-ups on off-the-beaten-path companies (like these) every week.

Join here: macro-ops.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh