[THREAD]

"Graham or Growth" by James Anderson is a beautiful look into the world of value/growth investing.

"So I reread Ben Graham’s The Intelligent Investor. Of course it is wonderful. But I don’t believe that it invalidates Growth investing."

Link: magazinebailliegifford.com/Graham-Or-Grow…

"Graham or Growth" by James Anderson is a beautiful look into the world of value/growth investing.

"So I reread Ben Graham’s The Intelligent Investor. Of course it is wonderful. But I don’t believe that it invalidates Growth investing."

Link: magazinebailliegifford.com/Graham-Or-Grow…

1/ Start with Performance

The last decade hasn't been the same as Graham points out in his book.

It hasn't been better to "buy a group of large companies that are relatively unpopular."

In fact, it's been better to buy "glamorous and dangers fields of anticipated growth"

The last decade hasn't been the same as Graham points out in his book.

It hasn't been better to "buy a group of large companies that are relatively unpopular."

In fact, it's been better to buy "glamorous and dangers fields of anticipated growth"

2/ Using Microsoft as An Example

When you stop and think about $MSFT, it'll blow your mind. Anderson notes:

"In its last year as a private company, $MSFT made $24 million net profit. In 2018 it earned $30.27 billion. That’s at a 24& CAGR over 33 years w/ 30% EBIT margins."

When you stop and think about $MSFT, it'll blow your mind. Anderson notes:

"In its last year as a private company, $MSFT made $24 million net profit. In 2018 it earned $30.27 billion. That’s at a 24& CAGR over 33 years w/ 30% EBIT margins."

3/ Its Complexity, My Dear

Our world/markets are giant, complex, and unpredictable systems, whose complexity grows w/ time.

"Value-driven dictums of Graham and the extremes of Microsoft may be the near-random outcome of an almost infinite set of possibilities in each period

Our world/markets are giant, complex, and unpredictable systems, whose complexity grows w/ time.

"Value-driven dictums of Graham and the extremes of Microsoft may be the near-random outcome of an almost infinite set of possibilities in each period

4/ Thinking About Future States

What we saw with newspapers and Blockbuster may be the start of a more dramatic transformation. Anderson notes that:

- Investors are questions terminal value of O&G

- Significance of mean reversion

- Importance of mass creative destruction

What we saw with newspapers and Blockbuster may be the start of a more dramatic transformation. Anderson notes that:

- Investors are questions terminal value of O&G

- Significance of mean reversion

- Importance of mass creative destruction

5/ A Transformed World

We could be on the verge of a change that rivals the Industrial Revolution.

If that's the case, Anderson says that "it's not just that the rules of the game will be unknown, but that the nature of the economy and corporate life will be mysterious."

We could be on the verge of a change that rivals the Industrial Revolution.

If that's the case, Anderson says that "it's not just that the rules of the game will be unknown, but that the nature of the economy and corporate life will be mysterious."

6/ Stocks: From Biology To Cities?

The long-held microeconomic theory of declining returns to scale may not be the right framework going forward.

Future co's might look like cities: organisms that get stronger + more resilient the more they grow.

Ex: macro-ops.com/how-to-spot-in…

The long-held microeconomic theory of declining returns to scale may not be the right framework going forward.

Future co's might look like cities: organisms that get stronger + more resilient the more they grow.

Ex: macro-ops.com/how-to-spot-in…

7/ Coke: The Negative Lollapalooza

When $BRKB bought $KO they saw a business that could be worth $2T by 2034.

But will it get there? The last 20yrs = +12% in aggregate.

KO now faces negative Lollapalooza effects w/ health concerns via obesity, diabetes (I.e., uphill battle).

When $BRKB bought $KO they saw a business that could be worth $2T by 2034.

But will it get there? The last 20yrs = +12% in aggregate.

KO now faces negative Lollapalooza effects w/ health concerns via obesity, diabetes (I.e., uphill battle).

8/ Coke v. Facebook: Graham's Formula

Graham's formula for assessing value is simple: Current earnings x (8.5 + 2x expected growth rate).

What does the formula say about growth? Anderson notes:

KO = ~7.5% over 7-10yrs

FB = <7% over 7-10yrs

Which one's the better bargain now?

Graham's formula for assessing value is simple: Current earnings x (8.5 + 2x expected growth rate).

What does the formula say about growth? Anderson notes:

KO = ~7.5% over 7-10yrs

FB = <7% over 7-10yrs

Which one's the better bargain now?

9/ Margin of UPSIDE Thinking

This part of Anderson's piece *really* got me thinking. My first instinct is to see how much I can lose in an investment.

What about the reverse? What if I started thinking about companies that had the best OPPORTUNITIES for SUCCESS?

Game-changer.

This part of Anderson's piece *really* got me thinking. My first instinct is to see how much I can lose in an investment.

What about the reverse? What if I started thinking about companies that had the best OPPORTUNITIES for SUCCESS?

Game-changer.

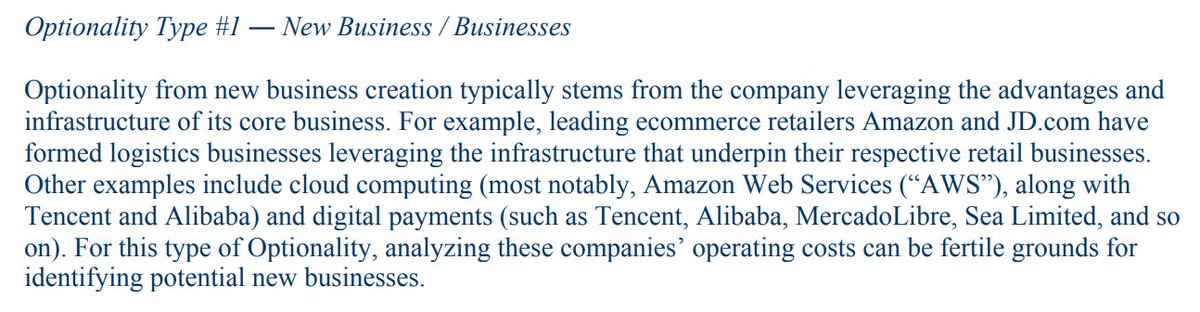

10/ The Venture Model

Concluding, Anderson notes that the VC model helps explain the potential future for investors.

Focus on what can go RIGHT and how much cash a business can generate if it hits that.

Then, position your bet according to the probability of success outcome

Concluding, Anderson notes that the VC model helps explain the potential future for investors.

Focus on what can go RIGHT and how much cash a business can generate if it hits that.

Then, position your bet according to the probability of success outcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh