THREAD: Is this time different?

Over 10 years ago we had the Global Financial Crisis (GFC), we discussed recovery funds & rebounds at length.

But 10 years later, the context is different. Pre-COVID growth in global CO₂ emissions was slowing…

nature.com/articles/s4155…

Over 10 years ago we had the Global Financial Crisis (GFC), we discussed recovery funds & rebounds at length.

But 10 years later, the context is different. Pre-COVID growth in global CO₂ emissions was slowing…

nature.com/articles/s4155…

2. The GFC came after 10 years of strong growth. There was a 𝐦𝐚𝐬𝐬𝐢𝐯𝐞 5% rebound in 2010…

Then from around 2012 emissions growth started to slow. Could this GFC recovery funds, GFC after effects, climate policy working, ...? (we don't know)

rdcu.be/bOUaB

Then from around 2012 emissions growth started to slow. Could this GFC recovery funds, GFC after effects, climate policy working, ...? (we don't know)

rdcu.be/bOUaB

3. Comparing 2011-2015 with 2016-2019 (global stocktake), CO₂ emissions have

* Declined in 64 countries: -0.16GtCO₂/yr

* Increased in the remainder: 0.37GtCO₂/yr

* Net increase: 0.21GtCO₂/yr

But emission reductions need to ramp up to 1-2GtCO₂/yr 𝐞𝐯𝐞𝐫𝐲 𝐲𝐞𝐚𝐫...

* Declined in 64 countries: -0.16GtCO₂/yr

* Increased in the remainder: 0.37GtCO₂/yr

* Net increase: 0.21GtCO₂/yr

But emission reductions need to ramp up to 1-2GtCO₂/yr 𝐞𝐯𝐞𝐫𝐲 𝐲𝐞𝐚𝐫...

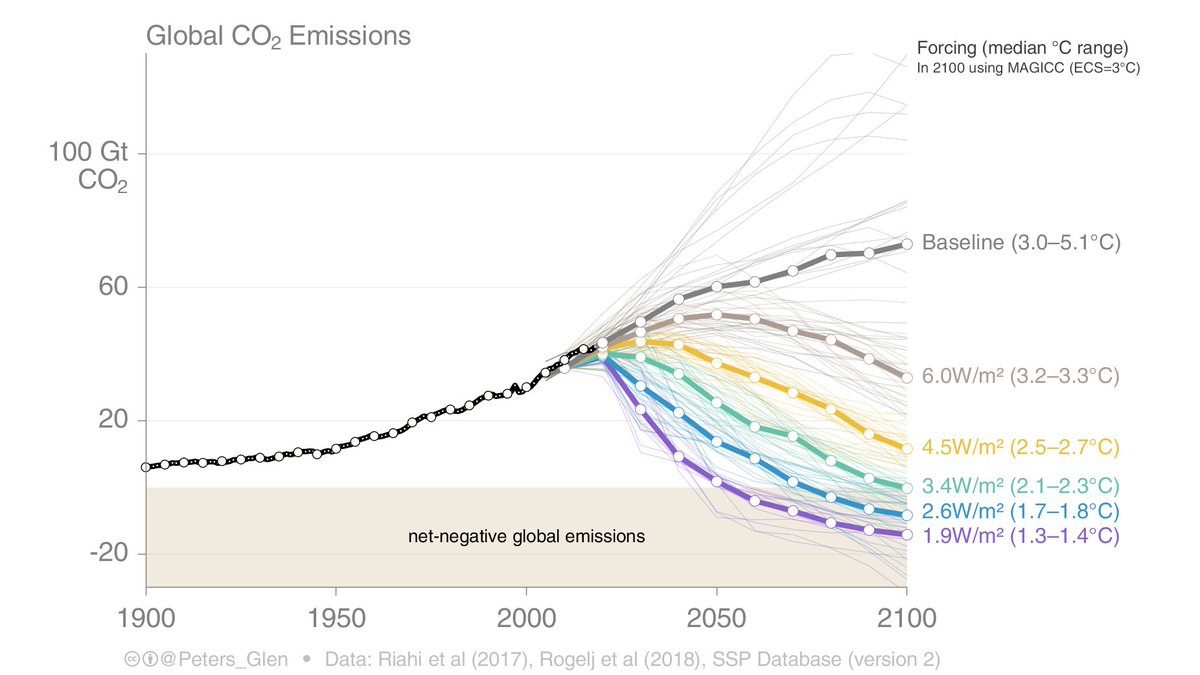

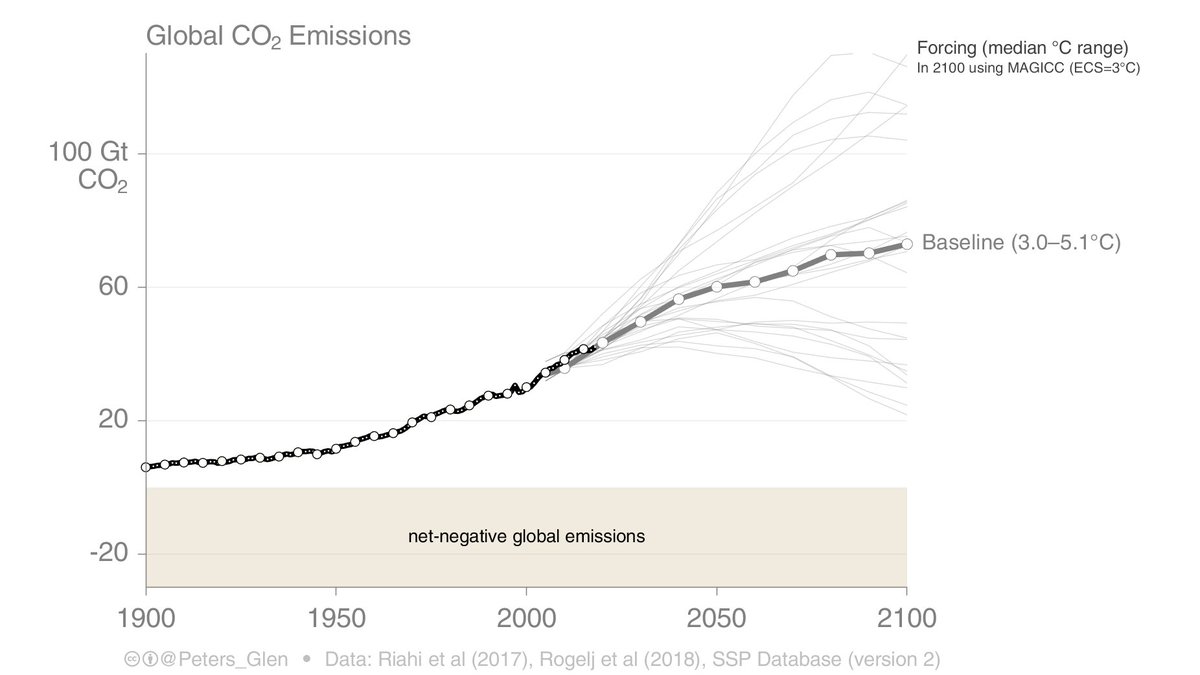

4. The drop in 2020 was unprecedented, but it is a one off.

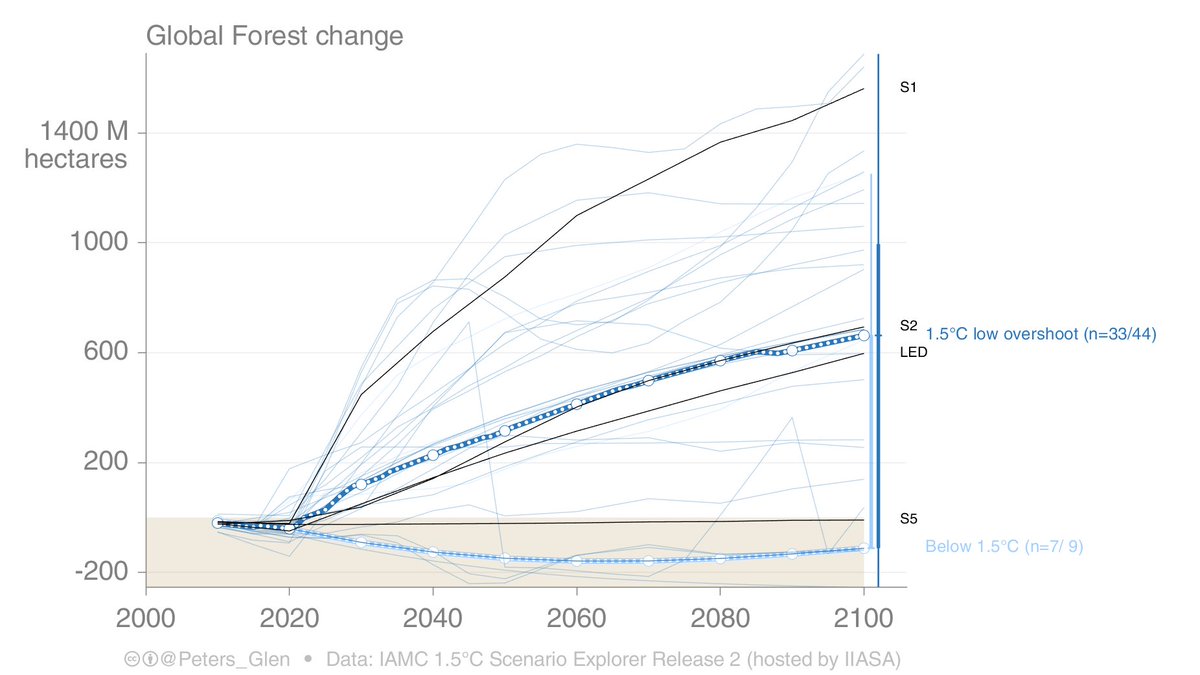

The thing with 1.5-2°C pathways, is that emission reductions of the size seen in 2020 need to happen 𝐞𝐯𝐞𝐫𝐲 𝐲𝐞𝐚𝐫 (& be done via means other than lockdowns).

We need a radical departure from the status quo.

The thing with 1.5-2°C pathways, is that emission reductions of the size seen in 2020 need to happen 𝐞𝐯𝐞𝐫𝐲 𝐲𝐞𝐚𝐫 (& be done via means other than lockdowns).

We need a radical departure from the status quo.

5. Interlude: You can play around with the changes between countries (high, upper-middle, lower income) over five year periods, & see how growth rates are changing.

Growth rates are declining, but they need a 2020 like step change!

enactivescience.com/gcp/

Growth rates are declining, but they need a 2020 like step change!

enactivescience.com/gcp/

6. What happens in 2021?

GDP is forecast to grow at 5.5%.

If CO₂/GDP improves as in the 10 year trend, that would lead to a 3% rebound.

If CO₂/GDP doesn’t improve (aka, GFC in 2010), emissions will growth 5.5%! We could wipe 2020 out in one year!

GDP is forecast to grow at 5.5%.

If CO₂/GDP improves as in the 10 year trend, that would lead to a 3% rebound.

If CO₂/GDP doesn’t improve (aka, GFC in 2010), emissions will growth 5.5%! We could wipe 2020 out in one year!

https://twitter.com/Peters_Glen/status/1366665124233293825

7. We expect some rebound in 2021, it is hard to avoid.

But, governments do have some control over how recovery money is spent & that is critical.

But, governments do have some control over how recovery money is spent & that is critical.

8. Even if all recovery funds went to renewables, active mobility infrastructure (walking, bikes), electric vehicles, service sectors (hit the hardest), etc, we still expect a rebound in 2021, but emissions may level out & decline soon after. There are some upfront "costs".

9. The worst outcome is to just press reset and go back to 2019, as if 2020 never happened. This would be a lost opportunity.

https://twitter.com/Peters_Glen/status/1367024650128134147

10. Fossil industries were hit hard in 2020.

In contrast, solar, wind, & electric vehicles did well & grew. They were resilient.

Do governments support the industries that suffered or accelerate the resilient ones?

In contrast, solar, wind, & electric vehicles did well & grew. They were resilient.

Do governments support the industries that suffered or accelerate the resilient ones?

11. It is not as if we are starting flat footed.

The @IEA had an entire report on a sustainable recovery, we are not short of policy options or ideas.

These ideas don't just appear, they have been around for years. 2020 just gave a new opportunity.

iea.org/reports/sustai…

The @IEA had an entire report on a sustainable recovery, we are not short of policy options or ideas.

These ideas don't just appear, they have been around for years. 2020 just gave a new opportunity.

iea.org/reports/sustai…

12. The article (Brief Communication) is currently free access, so go download your copy & read nature.com/articles/s4155…

/end

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh