The first company that came to my mind when i saw this was: $U

▫️customer experience > earnings

▫️growing customer base > earnings

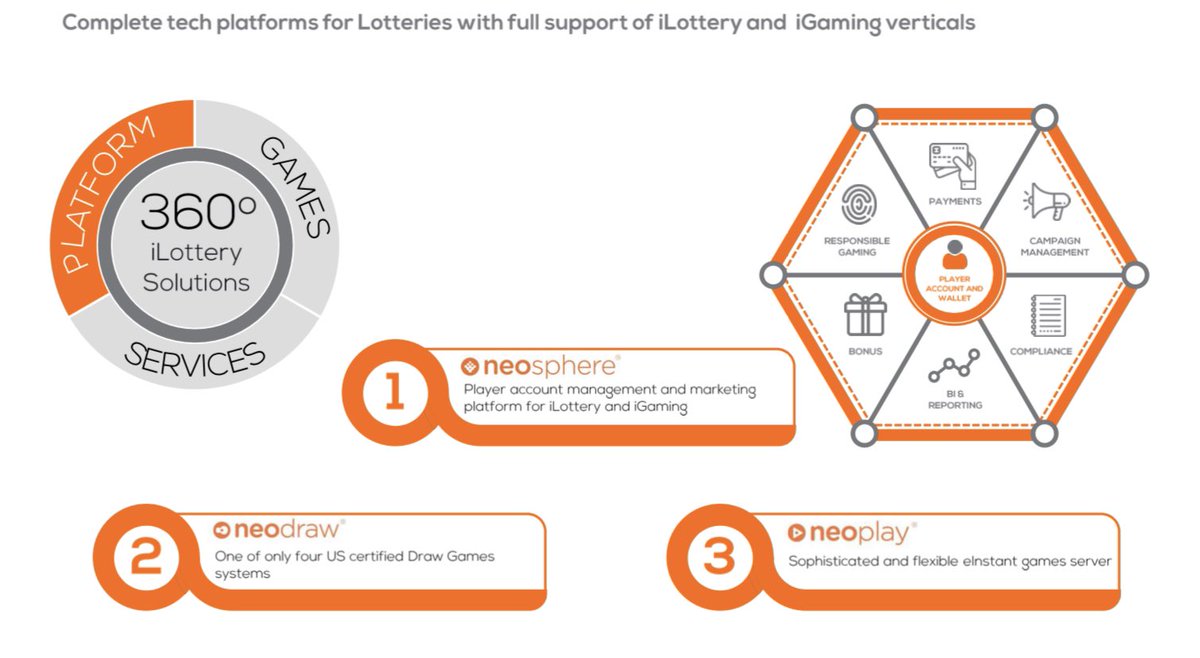

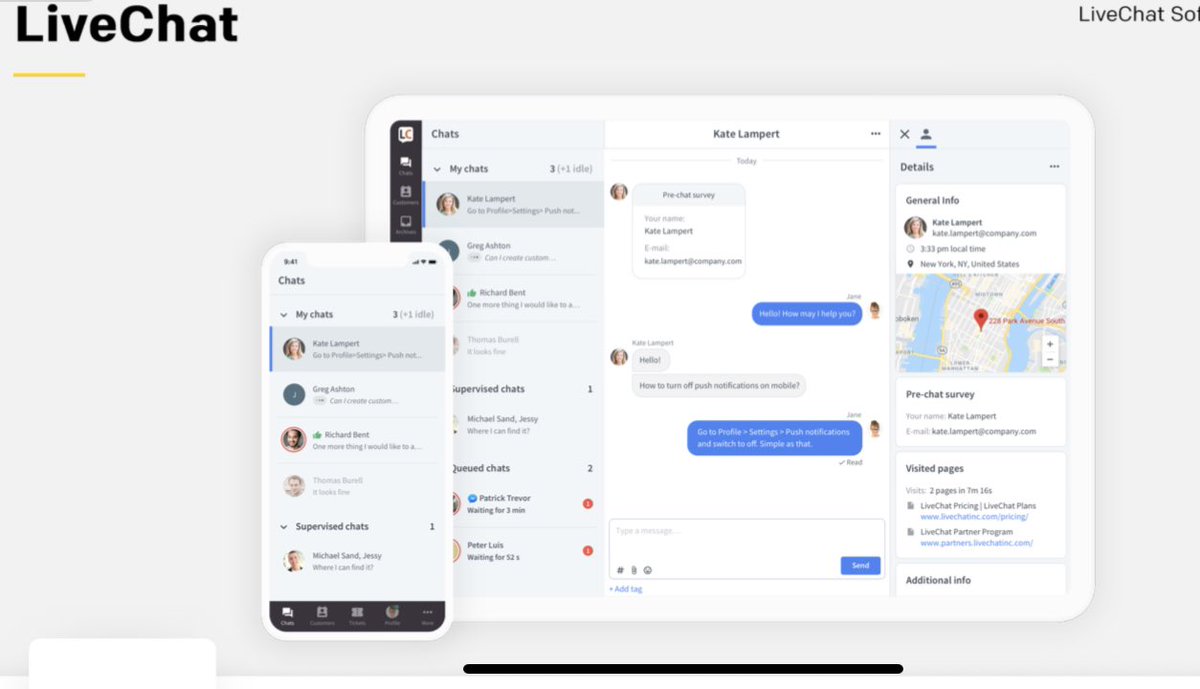

▫️continuous development of the main product to expand in other markets

▫️build an ecosystem around the main product

1/

▫️customer experience > earnings

▫️growing customer base > earnings

▫️continuous development of the main product to expand in other markets

▫️build an ecosystem around the main product

1/

https://twitter.com/BrianFeroldi/status/1367464963024052225

▫️focus on not giving the customer a reason to leave the ecosystem

—> like Amazon Prime the Create Solutions of Unity are just a lure for the cusomter to enter the ecosystem. Once content created with unity it is more likely that the creator will also use another value added 2/

—> like Amazon Prime the Create Solutions of Unity are just a lure for the cusomter to enter the ecosystem. Once content created with unity it is more likely that the creator will also use another value added 2/

service for this content like the operate solutions. That‘s why the entry barrier for content creator must be as low as possible (price/usability). In the first step attracting customers for the lure is expensive, but money will be made in the second step 💸

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh