Senate amendments to the American Rescue Plan Act impose restrictions on the use of the $350 billion in state and local aid.

CAN'T

- Use for tax cuts

- Deposit in pension fund

CAN

- Cover pandemic expenses

- Backfill pandemic-era revenue losses

- Do water/sewer/broadband

1/

CAN'T

- Use for tax cuts

- Deposit in pension fund

CAN

- Cover pandemic expenses

- Backfill pandemic-era revenue losses

- Do water/sewer/broadband

1/

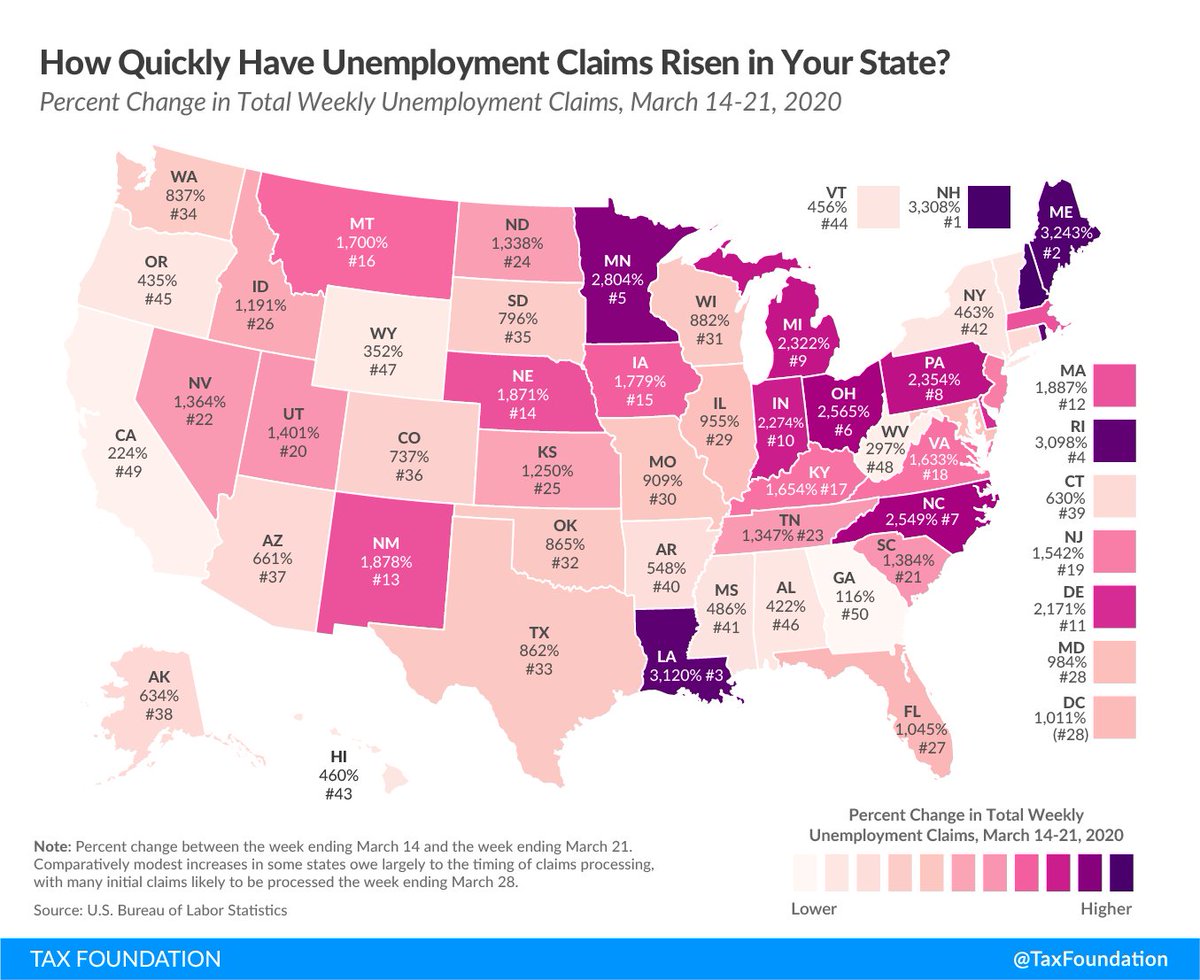

Almost half the states saw revenue increases during the pandemic. Typically not as high as projected, but sometimes exceeding projections. Losses frequently way less than aid. So what do you spend it on if you didn't lose much revenue? Lots and lots of rural broadband? 2/

I understand Congress not wanting states to turn this into tax cuts (though if you give states money they don't need...), but what about states already planning a tax cut? Surely Congress can't ban state tax cuts through 2024. There could be some interesting adjudication. 3/

This wouldn't seem to allow states to deposit the money into their depleted unemployment compensation trust funds, the most urgent need in many states. Congress should have *targeted* the aid this way. Instead they're *prohibiting* that use. 4/

taxfoundation.org/unemployment-c…

taxfoundation.org/unemployment-c…

A reminder in all of this that state revenues are only down 0.2% in 2020, and many states are up. Every state gets more aid under this bill than they posted in losses, and many (most?) get more than they missed projections by. 5/

taxfoundation.org/state-and-loca…

taxfoundation.org/state-and-loca…

It's genuinely unclear to me what states are supposed to do with this money. Even with the CARES $150 billion, states couldn't find enough ways to spend it on COVID-specific responses (and they're getting more $ for actual needs like vaccines and public health in this bill). 6/

If they needed more flexibility to spend that, what's a state with stable revenues supposed to spend this money on? Can't put it in the rainy day fund. Can't replenish the UC fund. Can't cut taxes. Not much to backfill. Couldn't fully spend the last round for COVID responses. 7/

It keeps coming back to this: while there are a few jurisdictions in a genuinely rough spot, this idea of spending hundreds of billions on state and local aid is a solution in search of a problem. It's as if it's still March 2020 and we're still in the dark on revenues. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh