Bottom.

Rates down, VIX down, stocks down.

This is the opposite of nearly every day the past 2 weeks.

This is the opposite of nearly every day the past 2 weeks.

All of @CathieDWood's @ARKInvest funds putting in monster capitulation volume on huge bottoming candles.

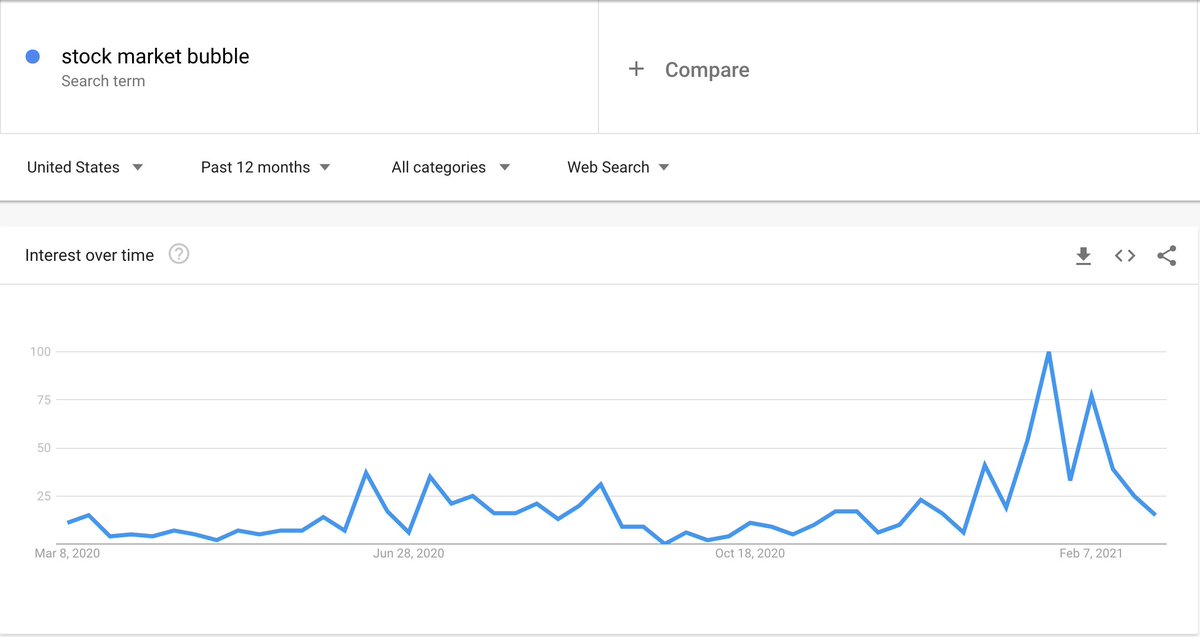

#stockmarketcrash is trending for the second day in a row, meaning, market sentiment is quite bearish.

Solid/positive jobs/unemployment report gets faded (good news is bad news).

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

Political theater in D.C. will end and the COVID relief bill will pass.

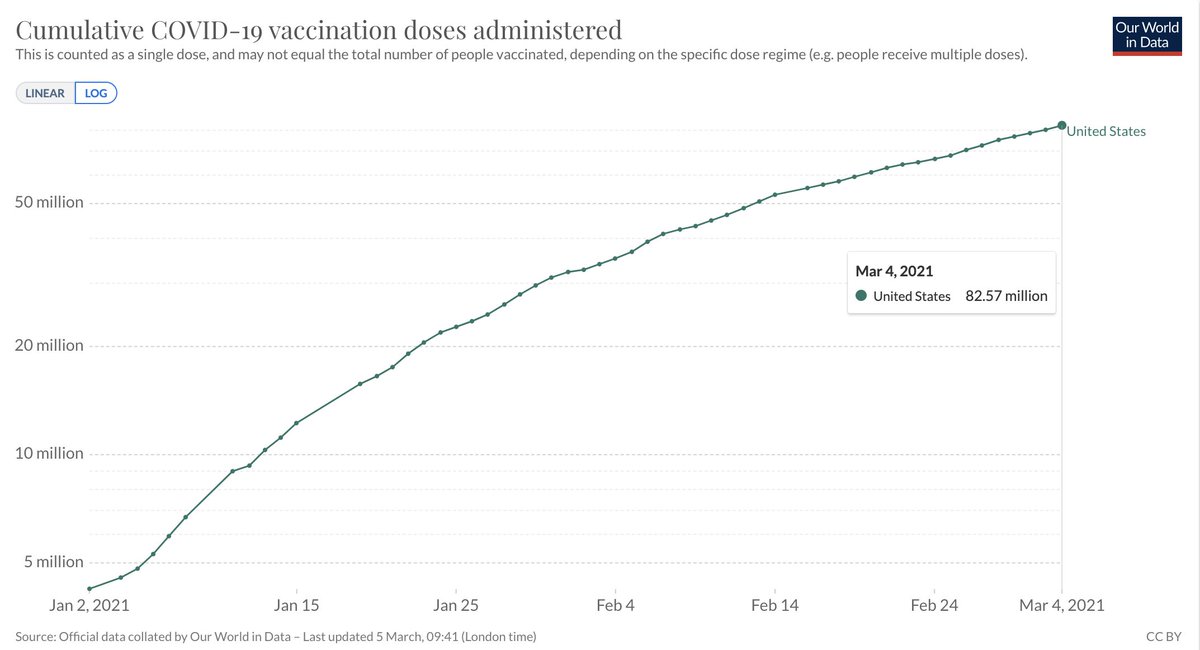

Stimulus checks will flow in the coming weeks.

Stimulus checks will flow in the coming weeks.

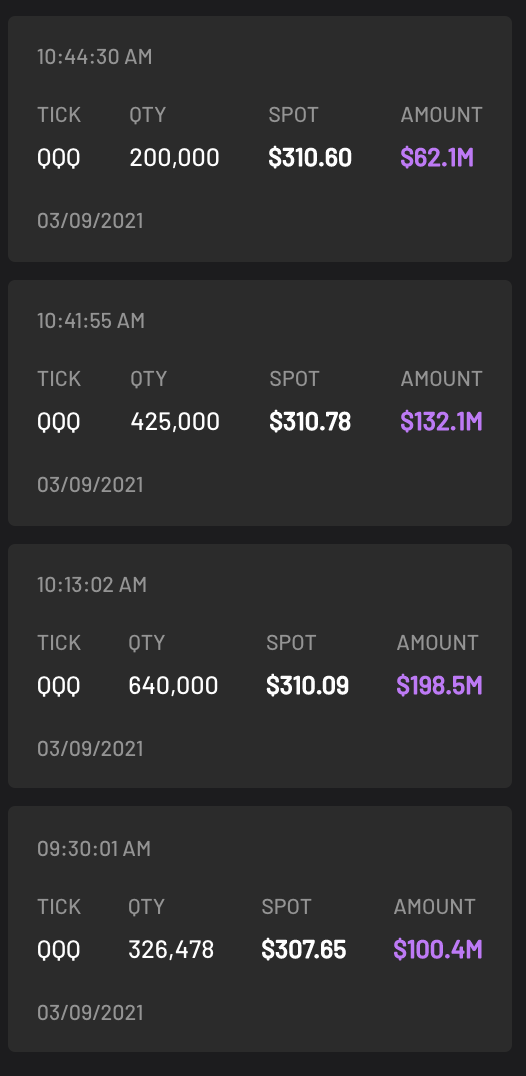

Nasdaq, $QQQ, plunged 3 standard deviations from its 20-day moving average, typically a grossly oversold indicator.

Not financial advice.

Don't Be Dumb™️.

I've been wrong before.

Don't Be Dumb™️.

I've been wrong before.

Send it.

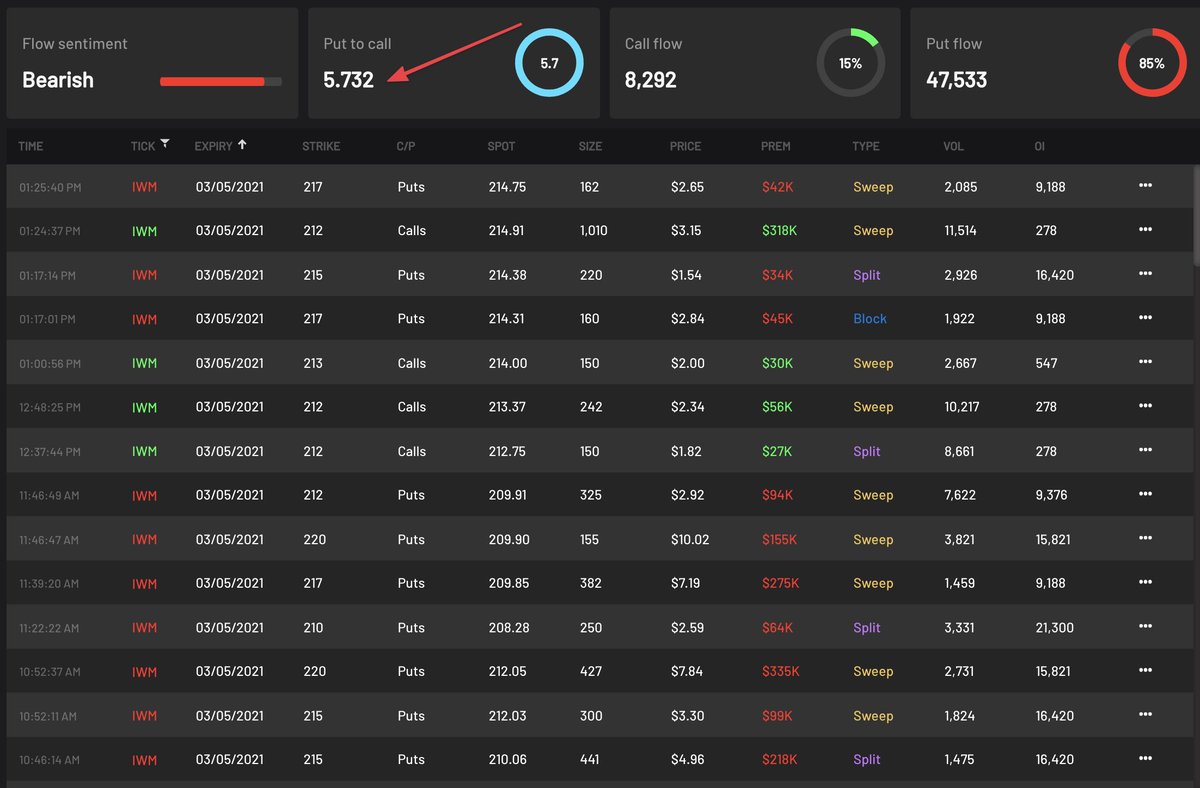

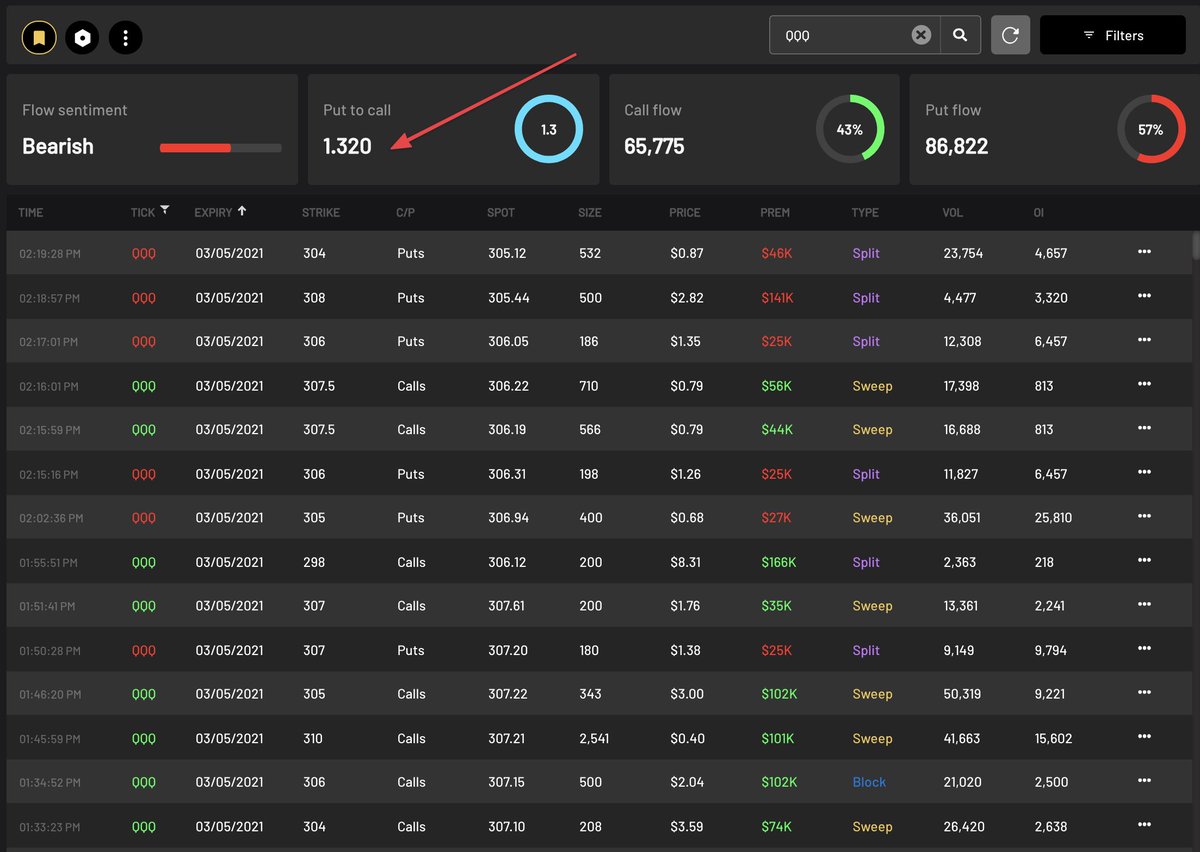

$QQQ put/call ratio vs $IWM put/call ratio is outsized bullish for Growth vs Value reversion, meaning, traders are significantly more bearish Russell 2000 as opposed to the Nasdaq

bit.ly/cheddar-flow

bit.ly/cheddar-flow

• • •

Missing some Tweet in this thread? You can try to

force a refresh