$SKLZ Earnings call -

First introduced new board members which I spoke about.

First few statements about defending patents and stopping cheating as the core.

Focused on converting users to paid users.

First introduced new board members which I spoke about.

First few statements about defending patents and stopping cheating as the core.

Focused on converting users to paid users.

$SKLZ CEO - We have been continually investing in synchronous gaming categories from RTS, FPS, racing genres. Synchronous content will expand our universe even more.

$SKLZ We have made significant investment in architecture for reliability and fast natured content.

$SKLZ In Q4 grew headcount by 64% (WOW). New investments in payments and software.

$SKLZ In Q4 grew headcount by 64% (WOW). New investments in payments and software.

CEO told a story about someone who left Zynga and created their own studio just for $SKLZ games, receiving VC funding. This game is now the #1 game on the platform (Blackout Bingo)

Four investment focuses:

1) Content - Still not had a true blockbuster game, no #1 hit on either app store. Highlights Big Buck Hunter returning to make a game on $SKLZ. Highlights #NFL partnership developer challenge.

1) Content - Still not had a true blockbuster game, no #1 hit on either app store. Highlights Big Buck Hunter returning to make a game on $SKLZ. Highlights #NFL partnership developer challenge.

NFL Developer challenge based games are NOT in our forecasts.

2) International expansion - We expect to launch in India later this year. India is already 2/3 the size of the US mobile gaming market and growing 4x faster.

2) International expansion - We expect to launch in India later this year. India is already 2/3 the size of the US mobile gaming market and growing 4x faster.

3) Partnered competitions - Nearly all revenue drops to the bottom line.

We are focused on a 100 year journey. This is year 8. We are focused on enabling game makers to compete with large studios.

We are focused on a 100 year journey. This is year 8. We are focused on enabling game makers to compete with large studios.

(I missed one of the numbered four - maybe it was NFL)

CFO Speaking -

Average entry fee is $3 per tournament. We get about 84c per fee. We have millions of tx per day and [results will be based on take rate and transaction velocity].

CFO recites financials.

CFO Speaking -

Average entry fee is $3 per tournament. We get about 84c per fee. We have millions of tx per day and [results will be based on take rate and transaction velocity].

CFO recites financials.

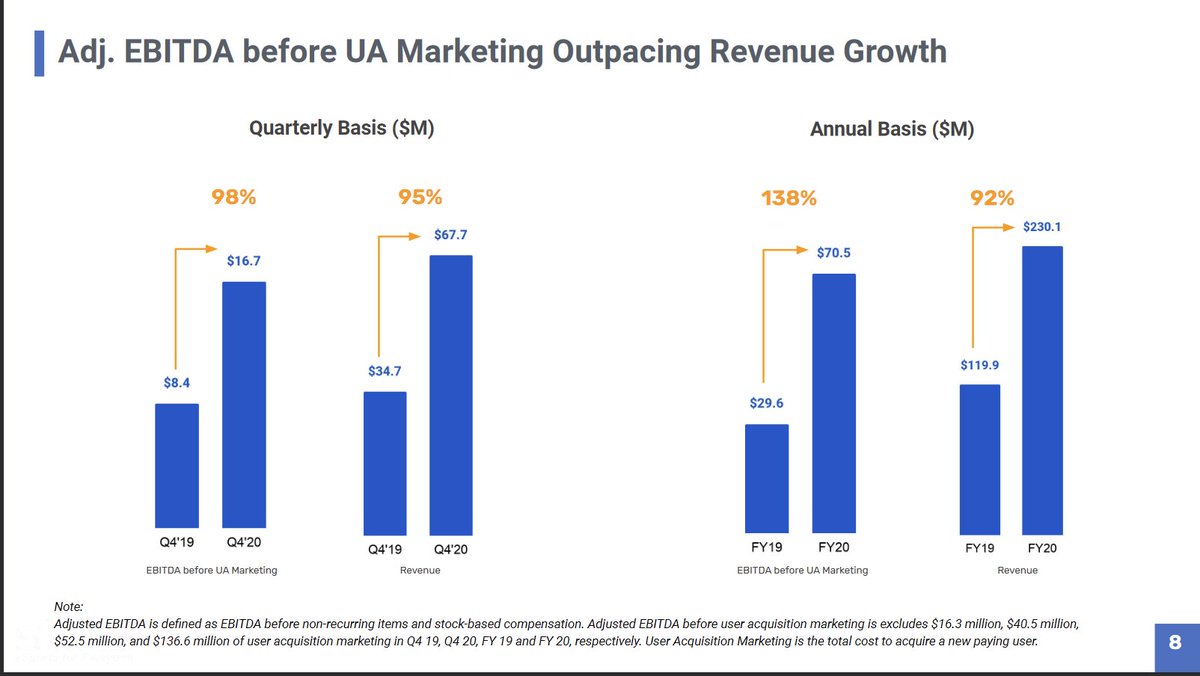

Our core profitability metric is EBITDA before user acquisition marketing. Adjusted EBITDA before UA is in line with revenue growth. We care more about Adj EBITDA rather than gross margin as GM can very by investment in infrastructure.

We rotate spending between new user acquisition cost to get new users and promos with existing users depending on where we see potential.

Our LTV/CAC is industry leading and we plan to improve over time. We have never had a cohort stop paying and they continue to grow.

Our LTV/CAC is industry leading and we plan to improve over time. We have never had a cohort stop paying and they continue to grow.

Q&A -

1st) Short report: Question about revenue concentration, can you comment on it? Are download slowing?

A) In terms of developer concentration, concentration will be there but it shifts from game to game as they grow. All titles have increased over time.

1st) Short report: Question about revenue concentration, can you comment on it? Are download slowing?

A) In terms of developer concentration, concentration will be there but it shifts from game to game as they grow. All titles have increased over time.

2nd) Question on Google Terms of Service on betting

A) Google updated ToS to permit betting which doesn't impact Skillz but begins to open their ecosystem to other forms of revenue. May continue over time. Notes Android without Google Play is growing 2x the speed of iOS.

A) Google updated ToS to permit betting which doesn't impact Skillz but begins to open their ecosystem to other forms of revenue. May continue over time. Notes Android without Google Play is growing 2x the speed of iOS.

Missed 2nd part of last q

3rd) Back to commentary on S&M - how to think about spend on it between different levers?

A) We are a leader in a big market and now is the time to capitalize on it. We built a $225M annual rev company on $130M in capital.

3rd) Back to commentary on S&M - how to think about spend on it between different levers?

A) We are a leader in a big market and now is the time to capitalize on it. We built a $225M annual rev company on $130M in capital.

We are making sure to pay attention to our paying users as they really drive revenue. Q4 16% of users were converted to payers, up from 10% in Q2.

4) Can you talk to us about IDFA - Channels for CAC that work best? Change as reopen?

A) IDFA will not expect any material effect. May be small positive as ads are less precise - lower CPMs for ad supported business models which makes Skillz more competitive.

A) IDFA will not expect any material effect. May be small positive as ads are less precise - lower CPMs for ad supported business models which makes Skillz more competitive.

We don't care about advertising to specific audiences as we can market to any audience so lower CPC makes our marketing cheaper.

5) How to scale # of players and # of tournaments as you scale users? Real time matches are fun but you need comparable skill level right?

5) How to scale # of players and # of tournaments as you scale users? Real time matches are fun but you need comparable skill level right?

Our data science investments in the company have been a fundamental feature of the company and we have methods to solve for this.

Paradise closing: Thank you. We will provide updates next time for Q1. Thanks.

Plant thoughts: Exactly as expected. This company should be strong and low stress relative to others IMO.

• • •

Missing some Tweet in this thread? You can try to

force a refresh