1/For any fiduciary, institutional or individual investor considering precious metals and wants to understand the real structural risks between owning physical metals held directly vs ETFs in a brokerage account, this research is for you.

2/As manager of a physical gold and silver fund and the owner of a large Depository, I understand the nuances between price representation vs actual ownership of precious metals.

3/Although, investors use ETFs for price exposure, they will be shocked to understand that is all they own…the price for that moment.

4/First lets go back to the Gamestop/Robinhood fiasco. That event uncovered a bonafide true systemic risk of the system. See the following video to understand what a real liquidity crisis means for anyone with a brokerage account as well as

5/the domino effect to other brokerages, banks and clearing members.

6/Another systemic risk is building infront of us; except this is to the potential downside. Unlike Robinhood not allowing new buying in shares what if institutions say no more selling and halt trading to protect the system?

7/The latest margin data released by Finra through January 2020 shows margin debt levels up 2.6% month-over-month to a record high. advisorperspectives.com/dshort/updates…

8/Trying to diversify from a systemic risk event with a traditional brokerage account is very difficult. Failures in liquidity and counterparties create a multitude of cascading events. Although extreme, just ask the dinosaurs (who had great diversity until the asteroid hit).

9/What many do not understand are the inner workings of the financial system and what that means to the average brokerage account holder.

10/What we thought we saw on our brokerage account representing true ownership was merely a mirage. The registered owner for all shares held in a brokerage account (street name) belong to Depository Trust Company (DTC).

11/To confuse matters more, Cede & Co. (a partnership within DTC) is listed as the registered owner and not you. Welcome to America! dtcc.com/settlement-and…

12/The ultimate investor is just considered a beneficial owner. investor.gov/what-registere…

13/And to understand the difference between registered and benefical owners, look no further. investor.gov/what-differenc…

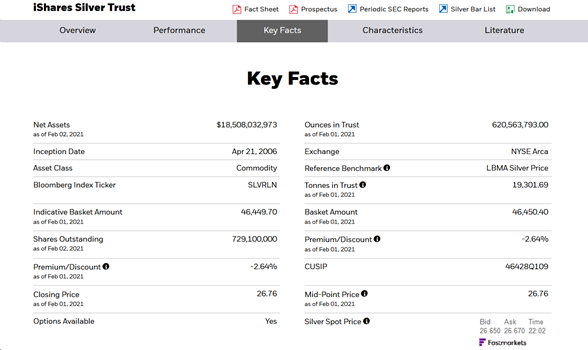

14/To explain this more clearly, lets look at a ETFS Silver Trust filing with the SEC. “The Securities will be issued as fully-registered securities registered in the name of Cede & Co.”

15/“all Securities deposited by Direct Participants with DTC are registered in the name of DTC’s partnership nominee, Cede & Co.”… “DTC has no knowledge of the actual Beneficial Owners of the Securities” sec.gov/Archives/edgar…

16/GLD prospectus pg 30, “Individual certificates will not be issued for the Shares. Instead, global certificates are deposited by the Trustee with DTC and registered in the name of Cede & Co., as nominee for DTC.

17/The global certificates evidence all of the Shares outstanding at any time.”

spdrgoldshares.com/media/GLD/file…

spdrgoldshares.com/media/GLD/file…

18/Due to structural/operational risks and potential inability to take delivery of precious metals within ETFs described in more detail here, what is the purpose of a precious metal ETF?

https://twitter.com/profitsplusid/status/1367268603137982466

19/Well just ask a boat owner… “The two happiest days in a boat owner’s life: the day you buy the boat, and the day you sell the boat.” However, if the boats sinks between between these dates that becomes your liability.

20/The ETFs are trading vehicles. In the case of precious metals, they represent nothing more than price volatility.

21/Many of these ETFs are structured as indenture trust or grantor trusts. These trusts are not an investment company registered under the investment company act of 1940.

22/Physical metals held directly either within arm’s reach or in a segregated and insured vault without any intermediary, is the best way to reduce risk. I explain this further with this interview. macrovoices.com/podcasts-colle…

23/Fiduciaries & investors must understand the benefits of physical metal as well as the simplicity of having direct control of your assets during systemic risk.

24/If the financial system takes on water, physical metal held directly has no counterparty and nowhere is Cede & Co. stamped on the bar.

25/If this does not provide clarity and you still have questions, please reach out or provide feedback. I also ask that this article be passed onto others so they understand the important distinction between 2 entirely different investment structures.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh