An optimistic Coronavirus thread, & not only about the corona you know!

There are 4 others widespread human coronaviruses (& 2 rare ones) and most of the time, they only give you a common cold.

Why is it important, if SARS-CoV-2 is different?

Meet OC43.

There are 4 others widespread human coronaviruses (& 2 rare ones) and most of the time, they only give you a common cold.

Why is it important, if SARS-CoV-2 is different?

Meet OC43.

As I said, OC43 will only give you a cold. Sometimes it gives a bad respiratory infection, but it's rare, and no one really cares about OC43. But it hasn't always been like that!

Recent research (dr.dk/nyheder/viden/…) suggests OC43 was responsible for the "Russian flu" of 1890

Recent research (dr.dk/nyheder/viden/…) suggests OC43 was responsible for the "Russian flu" of 1890

In many ways, that pandemic was eerily similar to the Covid one - e.g. see this great story (sorry, in French). It killed more than 1 million people and spread like a wildfire.

vidal.fr/actualites/262…

vidal.fr/actualites/262…

A London pneumologist tells the story of coming one morning to his practice to find... 1000 new patients !

zora.uzh.ch/id/eprint/5735…

zora.uzh.ch/id/eprint/5735…

So how did we go from that deadly disease to a common cold? Immunity, of course. And this is the good news.

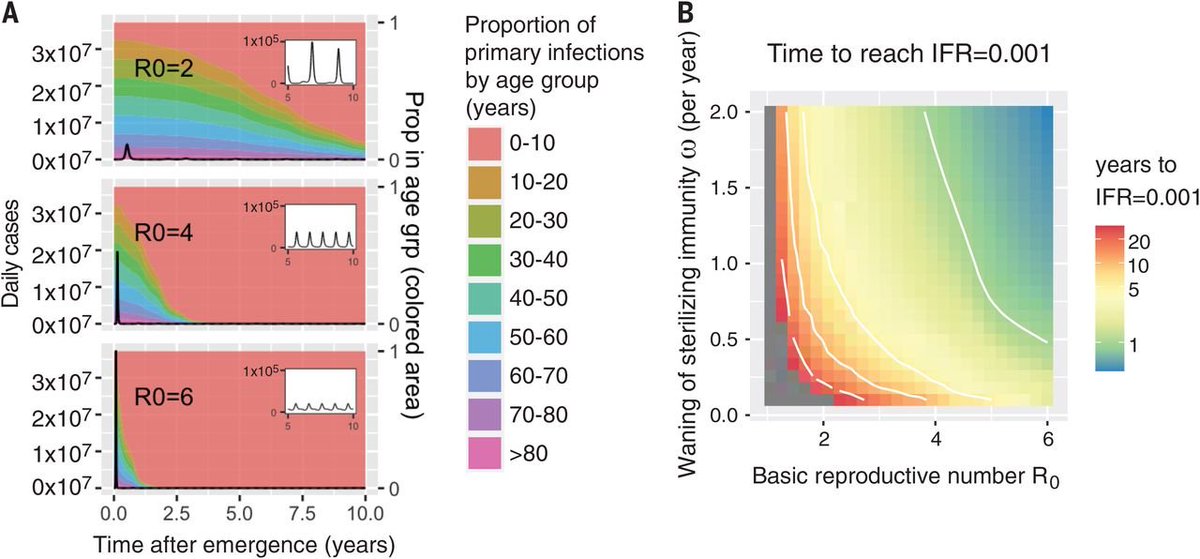

By looking at the way the 4 coronaviruses mutate and the immune system develops, Lavine & al. built a model to estimate the time needed to build the 3 immunities

By looking at the way the 4 coronaviruses mutate and the immune system develops, Lavine & al. built a model to estimate the time needed to build the 3 immunities

(Infection, symptoms, transmission). They conclude that ( without any vaccine - the problem disapears in a few years (can be longer if variants develop)

BUT with a vaccine, this drops to less than a year.

There is hope.

Interestingly, a key assumption to the model is that young children do not develop a serious version of the disease. That would totally change the conclusions...

science.sciencemag.org/content/371/65…

There is hope.

Interestingly, a key assumption to the model is that young children do not develop a serious version of the disease. That would totally change the conclusions...

science.sciencemag.org/content/371/65…

So one day, your grandchildren will probably treat Sars-CoV-2 as a cold... and it will be weird !

• • •

Missing some Tweet in this thread? You can try to

force a refresh