1/ There has been a lot of accusations regarding fake activity towards Binance Smart Chain (BSC) the past few weeks, but little evidence

We actually researched BSC user & economic activity and compared to other DEXs - here's what we found

Thread 👇

We actually researched BSC user & economic activity and compared to other DEXs - here's what we found

Thread 👇

2/ The most commonly cited questionable activity we saw was that of unique addresses

The sudden uptick in unique addresses was mostly attributed to CHI tokens being minted. When BSCscan changed their algo to exclude addresses generated by the CHI contract, slope normalized

The sudden uptick in unique addresses was mostly attributed to CHI tokens being minted. When BSCscan changed their algo to exclude addresses generated by the CHI contract, slope normalized

3/ @calchulus breaks it down in this thread in more detail in this thread

https://twitter.com/calchulus/status/1368637485861937158

4/ The skepticism towards BSC is partially due to high volumes and TVL of @PancakeSwap (PCS) seemingly coming from nowhere combined w/ Asian exchanges having a reputation of wash trading

This rapid growth can however be pretty easily explained by digging into AMM dynamics

This rapid growth can however be pretty easily explained by digging into AMM dynamics

5/ First, understand that wash trading on DEXs is ALOT harder than wash trading on CEXs

Even though BSC is not censorship resistant, tx data is still open and verifiable unlike tx data on CEXs which can easily be faked

Even though BSC is not censorship resistant, tx data is still open and verifiable unlike tx data on CEXs which can easily be faked

6/ This means that in order to wash trade, Binance would need to actually pay fees instead of rebating or waiving them as some CEXs do

At $1B/day volume & 20bp fee, that's $2m - $730M annualized

At $1B/day volume & 20bp fee, that's $2m - $730M annualized

7/Let's assume that b/c Binance has deep enough pockets, that we cannot stop here

Typically, when identifying exchanges for fake volumes, we compare liquidity profiles to volumes

The exchanges w/ low liquidity relative to volumes raise alarm bells

Typically, when identifying exchanges for fake volumes, we compare liquidity profiles to volumes

The exchanges w/ low liquidity relative to volumes raise alarm bells

8/ For CEXs, there are many ways to measure liquidity, the best being to test slippage on market orders

@ArtPlaie did a great analysis on this in 2018

sylvain-ribes.medium.com/chasing-fake-v…

@ArtPlaie did a great analysis on this in 2018

sylvain-ribes.medium.com/chasing-fake-v…

9/ For AMM DEXs, it's actually a lot more straightforward.

TVL is a direct, easily quantifiable representation of liquidity

Undeniably, there is real liquidity

As expected, as TVL increased, so did volume

Liquidity begets volume which begets liquidity

TVL is a direct, easily quantifiable representation of liquidity

Undeniably, there is real liquidity

As expected, as TVL increased, so did volume

Liquidity begets volume which begets liquidity

10/ Now let's introduce a concept called DEX AMM velocity (ratio of Tx volume vs TVL) which tracks the speed of turnover of AMM capital

Higher velocity means that capital is being turned over faster (higher flow). Flow can be segmented to:

- non-arbitrage flow

- arbitrage flow

Higher velocity means that capital is being turned over faster (higher flow). Flow can be segmented to:

- non-arbitrage flow

- arbitrage flow

11/ Non-arbitrage flow is essentially trading activity from real users (but can also be from bots doing non-arb trading)

Uniswap obviously has a lot of this, being the go-to site for most traders

But a look at @DappRadar tells us that Pancakeswap has had comparable 24hr users

Uniswap obviously has a lot of this, being the go-to site for most traders

But a look at @DappRadar tells us that Pancakeswap has had comparable 24hr users

12/ In comparison, none of the other DEXs actually come close to Uni or PCS, indicating they see a relatively high amount of non-arb flow

Only PCS + Bancor see growing users

Even though Sushiswap has high TVL and volumes, this is only across a steady 2,000-3,000 daily users

Only PCS + Bancor see growing users

Even though Sushiswap has high TVL and volumes, this is only across a steady 2,000-3,000 daily users

13/ Comparing volume to users:

- Volume/User is increasing across the board reflecting higher asset prices

- Curve sees mostly large tx trades

- Sushi+Balancer have high volume/user indicating skew towards larger traders+arb flow

- Uni+PCS indicate skew towards retail

- Volume/User is increasing across the board reflecting higher asset prices

- Curve sees mostly large tx trades

- Sushi+Balancer have high volume/user indicating skew towards larger traders+arb flow

- Uni+PCS indicate skew towards retail

14/ The important nuance here is that a low volume/user ratio does not necessarily indicate low arb flow

Arb flow for UNI + CAKE is high because they have high TVLs + low gas costs

Deeper liquidity & cheaper costs both contribute to larger arb opportunities

Arb flow for UNI + CAKE is high because they have high TVLs + low gas costs

Deeper liquidity & cheaper costs both contribute to larger arb opportunities

15/ Given that a tx on Pancakeswap on BSC is 100x cheaper than a tx on Uniswap (and PCS tx fee is 20 bps vs 30bps), you would expect significantly more arbitrage opportunity as well

16/ To understand this, imagine a scenario where ETH on CEX moves up 35 bps and then down 35 bps.

Because of CEX/DEX Tx Fees + gas costs + slippage, an arb bot would not hit Uniswap b/c total cost >35bp

But arbing against PCS might cost 25 bp so trades are made on both moves

Because of CEX/DEX Tx Fees + gas costs + slippage, an arb bot would not hit Uniswap b/c total cost >35bp

But arbing against PCS might cost 25 bp so trades are made on both moves

17/ Put shortly, DEXs with lower execution fees are able to harvest volatility at higher frequencies than other DEXs

18/ To triangulate our findings, we crawled social channels (twitter, telegram, etc) of various BSC channels

This is qualitative, so no pretty charts, but the amount of engagement is very real - an actual degree of magnitude higher than ETH Projects (but also very RETAIL)

This is qualitative, so no pretty charts, but the amount of engagement is very real - an actual degree of magnitude higher than ETH Projects (but also very RETAIL)

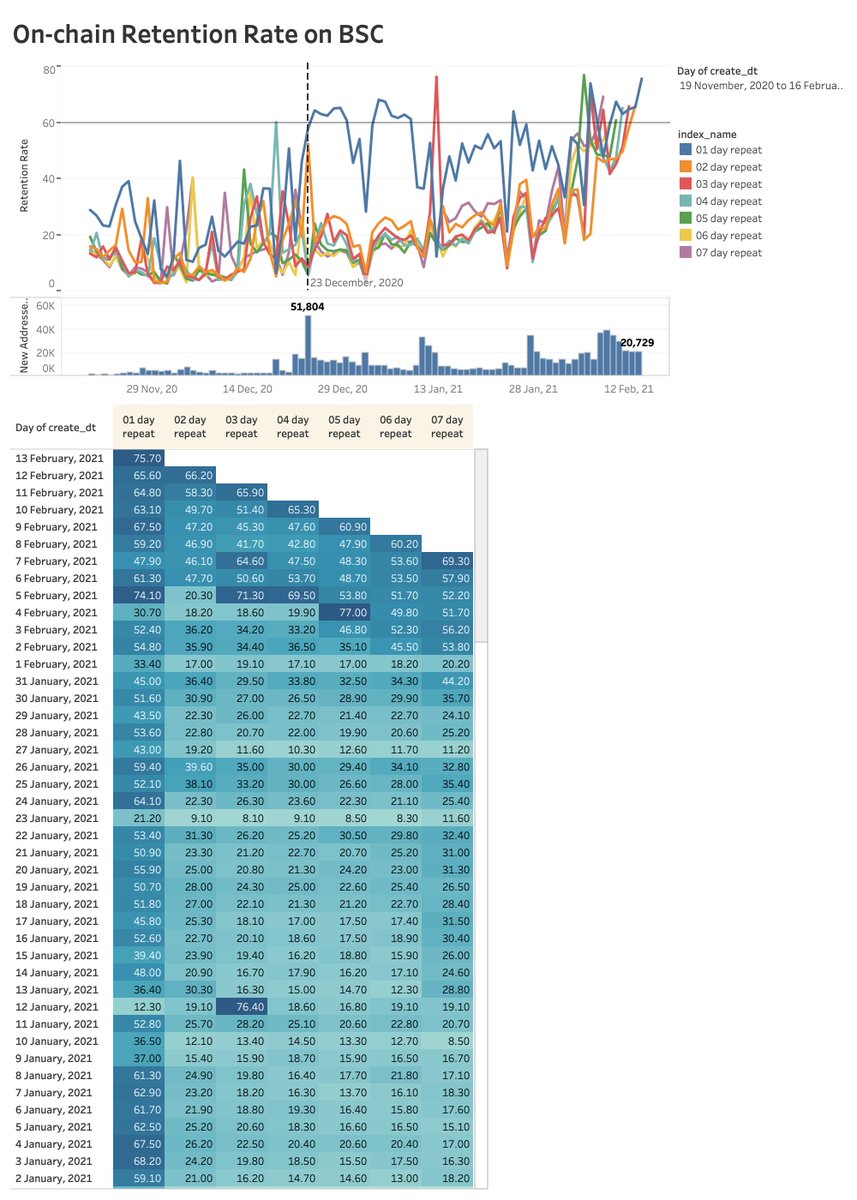

19/ This makes sense given Binance's massive userbase and their inability to afford high cost ETH DeFi environments

Data analysis on retention rates, activity at a project level, and Btoken growth doesn't show much out of the ordinary

H/T @howard_pen3

Data analysis on retention rates, activity at a project level, and Btoken growth doesn't show much out of the ordinary

H/T @howard_pen3

20/ Overall, our findings did not find much evidence to substantiate the narrative of largely fake activity + bots

Rather, it points to real fast growing activity from a largely newer less sophisticated retail audience combined with variable project quality (skews lower)

Rather, it points to real fast growing activity from a largely newer less sophisticated retail audience combined with variable project quality (skews lower)

H/T @wvaeu @Daryllautk data cuts

• • •

Missing some Tweet in this thread? You can try to

force a refresh