$UPST FULL Thread on Upstart Holdings - Up 47%!😯

Why I've been bullish on this leader in AI disrupting the Trillion-dollar Consumer Lending Market!

✅What is so special?

✅What are the Competitive advantages?

✅ $LMND of Lending?

Let's explore in this deep thread👇👇

Why I've been bullish on this leader in AI disrupting the Trillion-dollar Consumer Lending Market!

✅What is so special?

✅What are the Competitive advantages?

✅ $LMND of Lending?

Let's explore in this deep thread👇👇

1/ Thread Overview:

2- Company Overview

4-Competitive advantages & Emerging Moats

5 -Financials & Customer Growth

7 - Market Opportunity

8 - Management Team

9- The bear thesis & Risks

2- Company Overview

4-Competitive advantages & Emerging Moats

5 -Financials & Customer Growth

7 - Market Opportunity

8 - Management Team

9- The bear thesis & Risks

2/ $UPST Overview:

A lending platform that applies AI & machine learning to improve the consumer lending and underwriting process for making effective credit assessments.

They help their bank partners by referring loans, creating a seamless and simple consumer facing app.

A lending platform that applies AI & machine learning to improve the consumer lending and underwriting process for making effective credit assessments.

They help their bank partners by referring loans, creating a seamless and simple consumer facing app.

3/ $UPST Cont'd

🛑OLD: Most F.I use FICO scores, around 30 indicators to determine credit.

✅FUTURE: Holistic method now, $UPST applies AI to get 1600+ indicators based over 10.5milion trained variables (Ye!) about a persons background to determine data-driven credit decisions.

🛑OLD: Most F.I use FICO scores, around 30 indicators to determine credit.

✅FUTURE: Holistic method now, $UPST applies AI to get 1600+ indicators based over 10.5milion trained variables (Ye!) about a persons background to determine data-driven credit decisions.

4/$UPST Competitive Advantages [Emerging Moat]

Build vs Lease: To rebuild a modelling system to recreate credit decisions is expensive but its easier to partner with $UPST, creating a win-win for banks as they save massive costs as well as an easy process for consumers.

Cont'd

Build vs Lease: To rebuild a modelling system to recreate credit decisions is expensive but its easier to partner with $UPST, creating a win-win for banks as they save massive costs as well as an easy process for consumers.

Cont'd

4i/ $UPST Advanced AI Effectiveness:

Their system is more advanced, more efficient and superior

a) 75% reduction in loss rates

b) Over 70% of loans are performed without documents

c) Higher approvals for banks

d) Higher automaton, reducing human error & cost

As seen below

Their system is more advanced, more efficient and superior

a) 75% reduction in loss rates

b) Over 70% of loans are performed without documents

c) Higher approvals for banks

d) Higher automaton, reducing human error & cost

As seen below

4ii/ $UPST Compelling value prop..

The value to banks is $UPST's advanced machine learning increases more effective loans --> lower loss rates --> More loans approved -> more money for the financial institutions --> more money for UPST.

Leads to high switching costs for banks.

The value to banks is $UPST's advanced machine learning increases more effective loans --> lower loss rates --> More loans approved -> more money for the financial institutions --> more money for UPST.

Leads to high switching costs for banks.

4iii/ $UPST Comps.. Flexible

The Ease of Customizability & Integration capabilities for bank partners such that banks can integrate their existing system allowing the bank to input their variables and to define their own credit policies.

Con'td

The Ease of Customizability & Integration capabilities for bank partners such that banks can integrate their existing system allowing the bank to input their variables and to define their own credit policies.

Con'td

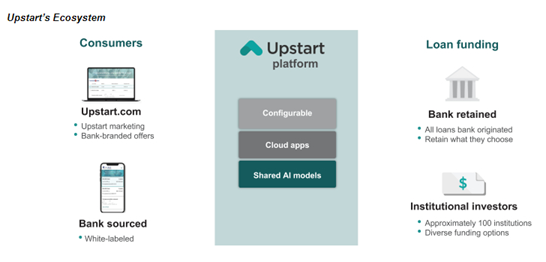

4iv/ $UPST Comps... The model

A Two-sided business model and network effects as $UPST acts as the middle man between aggregating consumer demand --> which helps the Revenue growth of bank partners as well as helps upstart too

Multi-channel revenue model from the Ecosystem below

A Two-sided business model and network effects as $UPST acts as the middle man between aggregating consumer demand --> which helps the Revenue growth of bank partners as well as helps upstart too

Multi-channel revenue model from the Ecosystem below

5/ $UPST 2017 - 2021 Financial Growth:💰

Beautiful Revenue growth has consistently accelerated

Bump in growth for 2021 due to:

i) high ROI on their models,

ii) the reopening

iii) Liquidity (excluding acquisitions)

*Remarkable despite the negative effects of the pandemic

Beautiful Revenue growth has consistently accelerated

Bump in growth for 2021 due to:

i) high ROI on their models,

ii) the reopening

iii) Liquidity (excluding acquisitions)

*Remarkable despite the negative effects of the pandemic

5ii/ $UPST Financials (2) - FY 2020: 💰

They have become incredibly efficient while growing top-line! (Beauty :) )

- Contribution Profit ($105M), Up 115% YoY.

- Income from Ops ($11.8M), Up 357% YoY

- Adj. EBITDA: $32M, Up 463% YoY

They have become incredibly efficient while growing top-line! (Beauty :) )

- Contribution Profit ($105M), Up 115% YoY.

- Income from Ops ($11.8M), Up 357% YoY

- Adj. EBITDA: $32M, Up 463% YoY

6/ $UPST Customers & Total Transaction Volume Growth: 💵

They now have over 13-15 Bank Partners.

Observe the acceleration in loans transacted on their platform

- Over 750,000K Transactions since they were founded.

This translates to more data for their AI models :)

They now have over 13-15 Bank Partners.

Observe the acceleration in loans transacted on their platform

- Over 750,000K Transactions since they were founded.

This translates to more data for their AI models :)

7/ $UPST Market Opportunity & Prize: 🌎

• The consumer lending market: $4.2 Trillion, $UPST 5% market share

• The BIGGEST markets are Auto Loans, Mortgages, student loans, business loans and credit cards. (Worth Trillions)

• There are over 3500-5000 FI's that could use $UPST

• The consumer lending market: $4.2 Trillion, $UPST 5% market share

• The BIGGEST markets are Auto Loans, Mortgages, student loans, business loans and credit cards. (Worth Trillions)

• There are over 3500-5000 FI's that could use $UPST

7i/ $UPST TAM Expansion: 🌐

They just expanded their TAM into Auto's with this acquisition -- This is why the stock is UP BIG because this is massive!

Auto is among the Top-3 largest lending market beyond mortgages in the US.

They just expanded their TAM into Auto's with this acquisition -- This is why the stock is UP BIG because this is massive!

Auto is among the Top-3 largest lending market beyond mortgages in the US.

8/ $UPST Mgmt Teams (My favourite!)

One of the most competent teams I know!!

Founded in 2012 by 3-Co-founders! (30% ownership stake]

David Girouard CEO (formerly w. Google and Apple) – called father" of Google Enterprise building it from scratch.

✅ Top Glassdoor ratings!

One of the most competent teams I know!!

Founded in 2012 by 3-Co-founders! (30% ownership stake]

David Girouard CEO (formerly w. Google and Apple) – called father" of Google Enterprise building it from scratch.

✅ Top Glassdoor ratings!

8i/ Mgmt Cont'd:

- 2nd Founder: Anna Couselman (Fmr. Google and ran Gmail)

- Paul Gu (29yrs) but incredibly smart. He was recognized as one of Peter Thiel's 20 under 20 Fellows <Top 1% of society's gifted> Also Forbes 30 under 30

- Company has awarded for a great culture

- 2nd Founder: Anna Couselman (Fmr. Google and ran Gmail)

- Paul Gu (29yrs) but incredibly smart. He was recognized as one of Peter Thiel's 20 under 20 Fellows <Top 1% of society's gifted> Also Forbes 30 under 30

- Company has awarded for a great culture

9/ $UPST Risks:

• The story is early

• Customer Concentration and Crossriver bank risks

• Issue with Credit Karma & need for referrals

• Longer sales cycles

• The big banks may to build their models from scratch

• Competitors like $NCNO $LC? [No credible ones so far]

• The story is early

• Customer Concentration and Crossriver bank risks

• Issue with Credit Karma & need for referrals

• Longer sales cycles

• The big banks may to build their models from scratch

• Competitors like $NCNO $LC? [No credible ones so far]

10/ $UPST - Other Notable Achievements:

• Upstart is #12 on the Forbes top 50 most promising artificial intelligence companies of 2019.

• Inc Magazine's Best Workplace for 2020

• Higher NPS and superior product reviews and customers love the product.

• Upstart is #12 on the Forbes top 50 most promising artificial intelligence companies of 2019.

• Inc Magazine's Best Workplace for 2020

• Higher NPS and superior product reviews and customers love the product.

11/ Want to read more indepth:

Visit: @JonahLupton: jonahlupton.substack.com/p/upst-upstart

Visit: @GetBenchmarkCo: getbenchmark.substack.com/p/upstart-ai-d…

Personally, I'll write about the conference call, takeaways, 2020 highlights and What Investors can expect in '2021:

investianalystnewsletter.substack.com

Visit: @JonahLupton: jonahlupton.substack.com/p/upst-upstart

Visit: @GetBenchmarkCo: getbenchmark.substack.com/p/upstart-ai-d…

Personally, I'll write about the conference call, takeaways, 2020 highlights and What Investors can expect in '2021:

investianalystnewsletter.substack.com

10/ $UPST Summary:

✅Financials: Profitable & rapidly growing

✅3-Superior Founder Led Team & Culture

✅Great product with superior reviews & NPS

✅Leading advanced technology product

✅Compelling Value proposition and competitive advantages

✅ Trillion-dollar industry TAM.

✅Financials: Profitable & rapidly growing

✅3-Superior Founder Led Team & Culture

✅Great product with superior reviews & NPS

✅Leading advanced technology product

✅Compelling Value proposition and competitive advantages

✅ Trillion-dollar industry TAM.

11/11- $UPST Final words:

Personally, I've worked within AI on a complex project for determining credit decisions for my FI.

Hence, I wanted to share with my followers why I've been bullish.

Thanks for reading and If you enjoyed, kindly share.

What are your thoughts? :)

Personally, I've worked within AI on a complex project for determining credit decisions for my FI.

Hence, I wanted to share with my followers why I've been bullish.

Thanks for reading and If you enjoyed, kindly share.

What are your thoughts? :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh