1/9

Last 2 weeks:

ICICI Pru 📉-15%

HDFC Life📉-7%

Max Life📉-6%

SBI Life📉-3%

What's bugging private Life Insurance companies?

Read on if you are invested (or interested) in Life Insurance:

A short thread🧵

Last 2 weeks:

ICICI Pru 📉-15%

HDFC Life📉-7%

Max Life📉-6%

SBI Life📉-3%

What's bugging private Life Insurance companies?

Read on if you are invested (or interested) in Life Insurance:

A short thread🧵

2/9

How to IPO LIC - This was a topic covered in the first Equity Capsule newsletter (read extract shared).

Historically, LIC has had lower profits & NW due to higher payouts to policyholders vs peers. But post recent amendments to LIC Act, they are in line with listed peers.

How to IPO LIC - This was a topic covered in the first Equity Capsule newsletter (read extract shared).

Historically, LIC has had lower profits & NW due to higher payouts to policyholders vs peers. But post recent amendments to LIC Act, they are in line with listed peers.

3/9

What's changed?

Earlier LIC treated payout for both policies at 95%. Now it has lowered mandated distribution of surplus from 95% to 90% for Par products (ULIPs) and 95% to 0% for Non-Par (Term Ins for Protection).

Link for Par vs Non Par products:

lifeinsurance.adityabirlacapital.com/articles/life-…

What's changed?

Earlier LIC treated payout for both policies at 95%. Now it has lowered mandated distribution of surplus from 95% to 90% for Par products (ULIPs) and 95% to 0% for Non-Par (Term Ins for Protection).

Link for Par vs Non Par products:

lifeinsurance.adityabirlacapital.com/articles/life-…

4/9

Why does this matter?

Due to higher mandated payouts, LIC was dis-incentivized from pursuing higher margin non-Par business. Thus, while LIC has 78% market share in Par products (yes!) via agents, it only has 7% share in the creamy non-par business. That's bound to change.

Why does this matter?

Due to higher mandated payouts, LIC was dis-incentivized from pursuing higher margin non-Par business. Thus, while LIC has 78% market share in Par products (yes!) via agents, it only has 7% share in the creamy non-par business. That's bound to change.

5/9

LIC's non-par products were priced 40-50% higher than peers to cover payouts. Non-par contributes 55-70% of VNB for peers and 12-20% of APEs. Meaning - high margin.

Note: LIC has similar yield on AUM, but lower ROA (9 bps vs 80-100 bps).

LIC and peer metrics (20x bigger)👇

LIC's non-par products were priced 40-50% higher than peers to cover payouts. Non-par contributes 55-70% of VNB for peers and 12-20% of APEs. Meaning - high margin.

Note: LIC has similar yield on AUM, but lower ROA (9 bps vs 80-100 bps).

LIC and peer metrics (20x bigger)👇

6/9

Why is LIC focusing on non-par now?

ULIP growth is coming off recently and unlikely to revive.

Why?

Traditionally, Insurance has been sold for tax savings & investment (mis-selling). Budget 2020 capped tax exemption on ULIPs. And YOLO generation doesn't "invest" in ULIPS.

Why is LIC focusing on non-par now?

ULIP growth is coming off recently and unlikely to revive.

Why?

Traditionally, Insurance has been sold for tax savings & investment (mis-selling). Budget 2020 capped tax exemption on ULIPs. And YOLO generation doesn't "invest" in ULIPS.

7/9

So what about listed Insurance players?

Credit Suisse estimates that rising reinsurance costs and LIC's aggressive foray into non-Par will shrink Value of New Business (VNB) margins for peers by 1-3% and impact growth outlook 👇

So what about listed Insurance players?

Credit Suisse estimates that rising reinsurance costs and LIC's aggressive foray into non-Par will shrink Value of New Business (VNB) margins for peers by 1-3% and impact growth outlook 👇

8/9

This brings the "high" valuation of Life Insurance players in question. Historically strong VNB CAGR (19-26%) over FY17-20 has enabled Indian insurers sustain high multiples 2.5-3x Embedded Value (EV) multiples. Here is what CS had to say on LI valuations.

This brings the "high" valuation of Life Insurance players in question. Historically strong VNB CAGR (19-26%) over FY17-20 has enabled Indian insurers sustain high multiples 2.5-3x Embedded Value (EV) multiples. Here is what CS had to say on LI valuations.

9/9

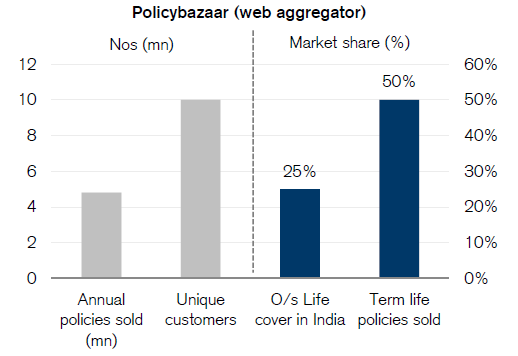

So where is the opportunity?

Wait for Policybazaar (IPO in 2021).

Why?

1. Insurance sales via Digital channels is increasing, esp for non-Par (TL)

2. Aggregators are growing rapidly as they bring ease & transparency

3. PB processes in 1 in every 2 TL policy in India!!

/end

So where is the opportunity?

Wait for Policybazaar (IPO in 2021).

Why?

1. Insurance sales via Digital channels is increasing, esp for non-Par (TL)

2. Aggregators are growing rapidly as they bring ease & transparency

3. PB processes in 1 in every 2 TL policy in India!!

/end

Important: Rajya Sabha passes bill to hike FDI in insurance sector to 74% from current 49%.

Some timing.

Some timing.

Update 1: Since this thread has garnered some interest, pointing out some counter-views by CLSA (summary in image).

Their view is that while LIC is changing path, it will be difficult to gain market share in non-par products due to LICs weaker cost structure and inefficiencies.

Their view is that while LIC is changing path, it will be difficult to gain market share in non-par products due to LICs weaker cost structure and inefficiencies.

Few DMs asking for primer/ overview on Life Insurance. I don't want to recreate the wheel, given many have done a good job at it. Here is a good primer on LI in layman's language (brokerage notes are technical). Credits to author CA Prudvi Raj Saya.

drive.google.com/file/d/1W4QIG7…

drive.google.com/file/d/1W4QIG7…

• • •

Missing some Tweet in this thread? You can try to

force a refresh