BOJ's focus on inflation targeting and management of the FX market both have a context, and that context, as we have explained before, is the ongoing economic reform programme supported by both political parties and built on the sacrifice of the Jamaican people: 🧵

#BOJSpeaks

#BOJSpeaks

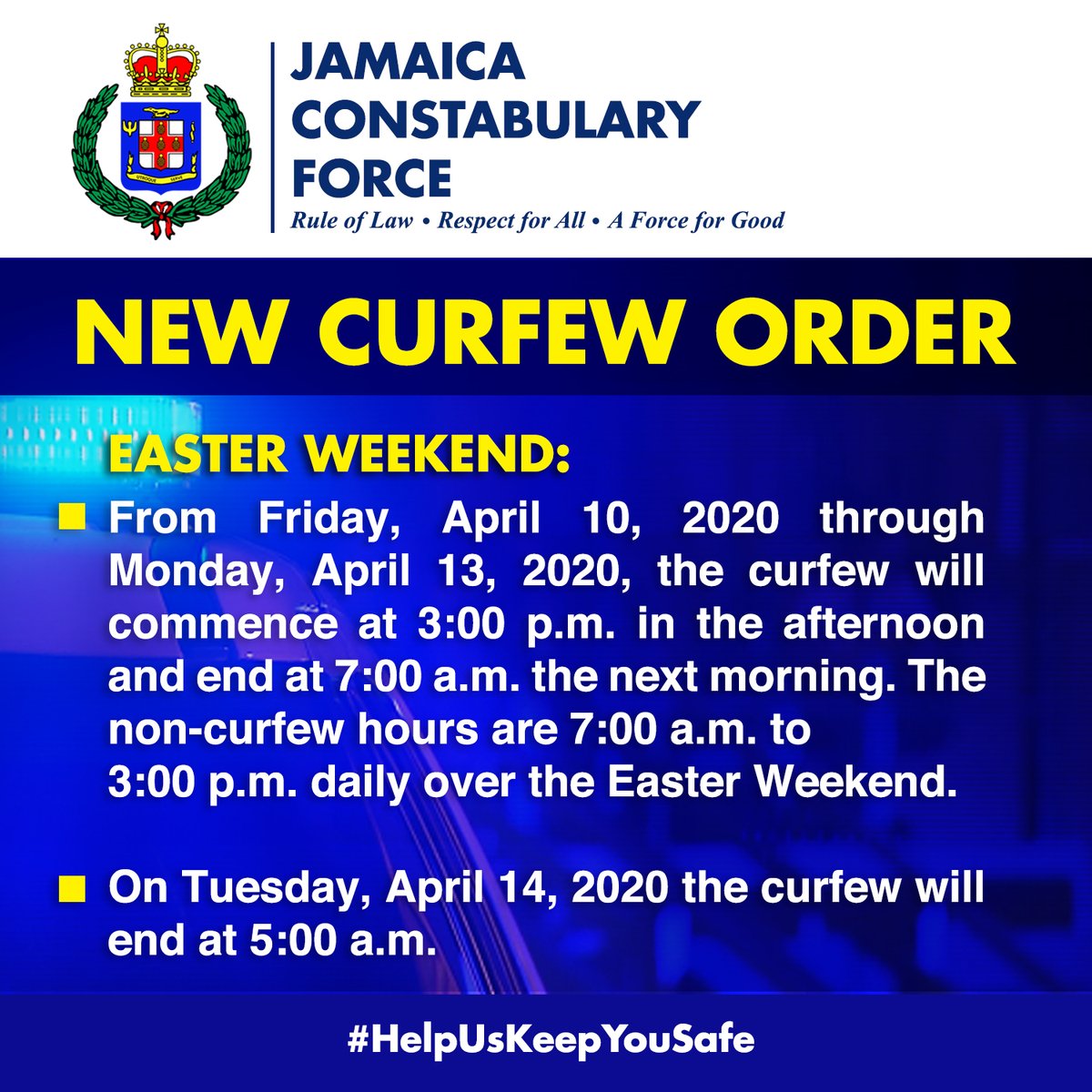

2. It is the existence of that economic reform programme - fiscal discipline, a flexible exchange rate, inflation targeting, and all - that provides the economic resilience to ensure that the pain of 1 year of COVID-19 and counting is not a hundred times worse.

#FinanceTwitterJA

#FinanceTwitterJA

3. The first and most important thing on the list was a radical shift away from debt-dependence and fiscal dominance towards fiscal responsibility and returning to a private-sector fuelled economy. Without this step first, nothing else on the list would have been possible.

4. When fiscal "crowding out" of the private sector finally became "crowding in," and BOJ then had the space to stimulate investment by slashing interest rates, the economy started earning more FX, which in turn enabled - for the first time - a real FX market and normal FX rate.

5. Yes, believe it or not, an FX rate that moves in both directions in reaction to current market conditions is exactly what happens in other market economies and is desired and very normal, just like the price movement of tomatoes or thyme in Coronation Market. #shocker

6. Obviously, the FX has to come from somewhere, and that somewhere is from PRIVATE SECTOR EARNINGS. So whenever you want to see more FX in the market, what you need to do is earn it yourself or help the private sector to earn more. It's that simple.

7. The journey continues, with much more work to do, and more focus on more private-sector earnings and implementing more reforms is what will get us further faster.

8. Getting there in the end, while navigating the challenges like COVID-19 and without finding ways to derail ourselves, is what the hard work and sacrifice to date has been all about.

• • •

Missing some Tweet in this thread? You can try to

force a refresh