Middlesbrough’s 2019/20 financial results covered a season when they finished 17th in the Championship. Neil Warnock replaced Jonathan Woodgate as manager in June. Some thoughts in the following thread #Boro

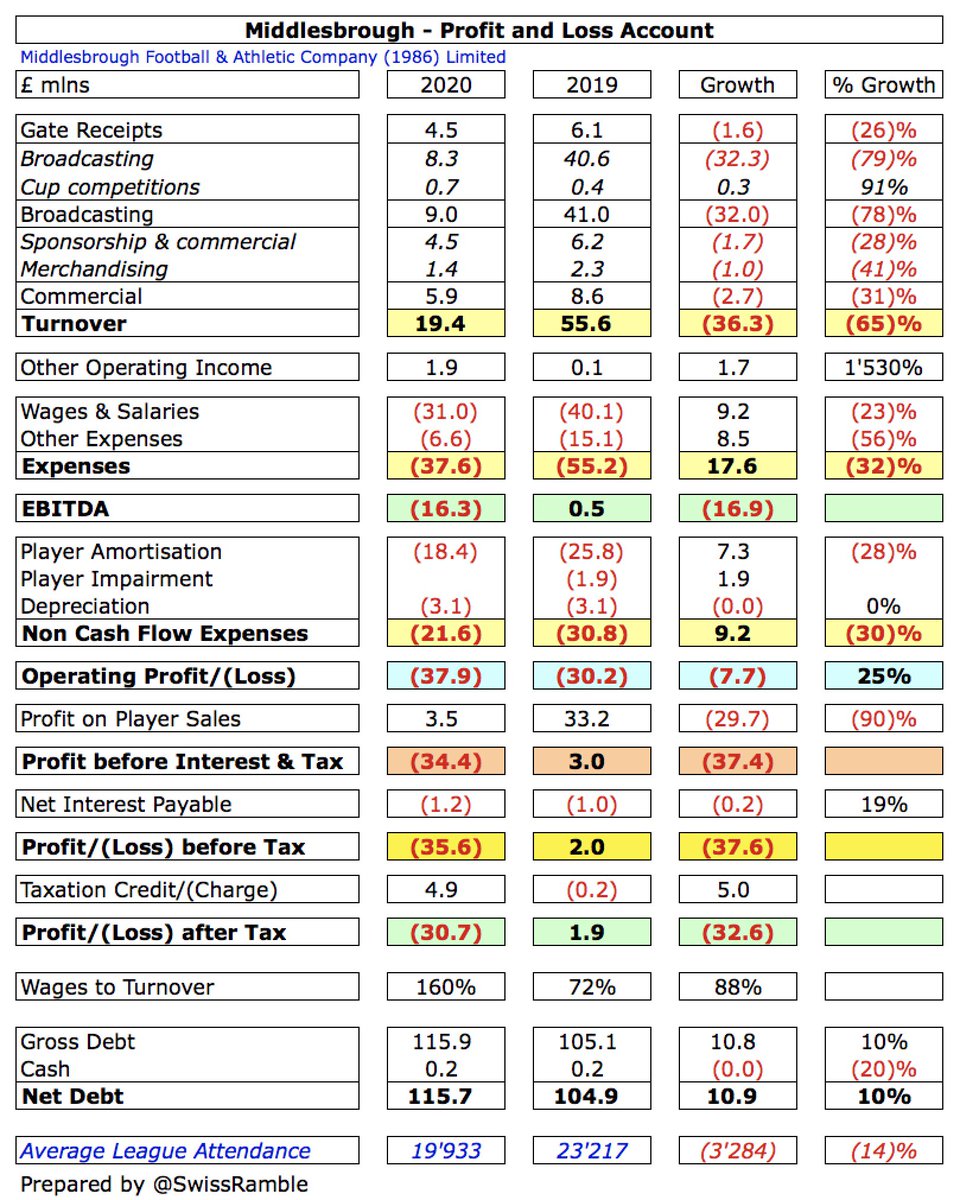

#Boro swung from £2m profit before tax to club record £36m loss, as finances hit by COVID and expiry of parachute payments. Revenue dropped £36m (65%) from £56m to £19m and profit on player sales fell £30m to £3m, partly offset by £27m (31%) cut in expenses. Loss after tax £31m.

All three #Boro revenue streams fell, especially broadcasting, which was down £32m (78%) from £41m to £9m, due to no parachute payment. Also decreases in commercial, down £2.7m (31%) from £8.6m to £5.9m, and gate receipts, down £1.6m (26%) from £6.1m to £4.5m.

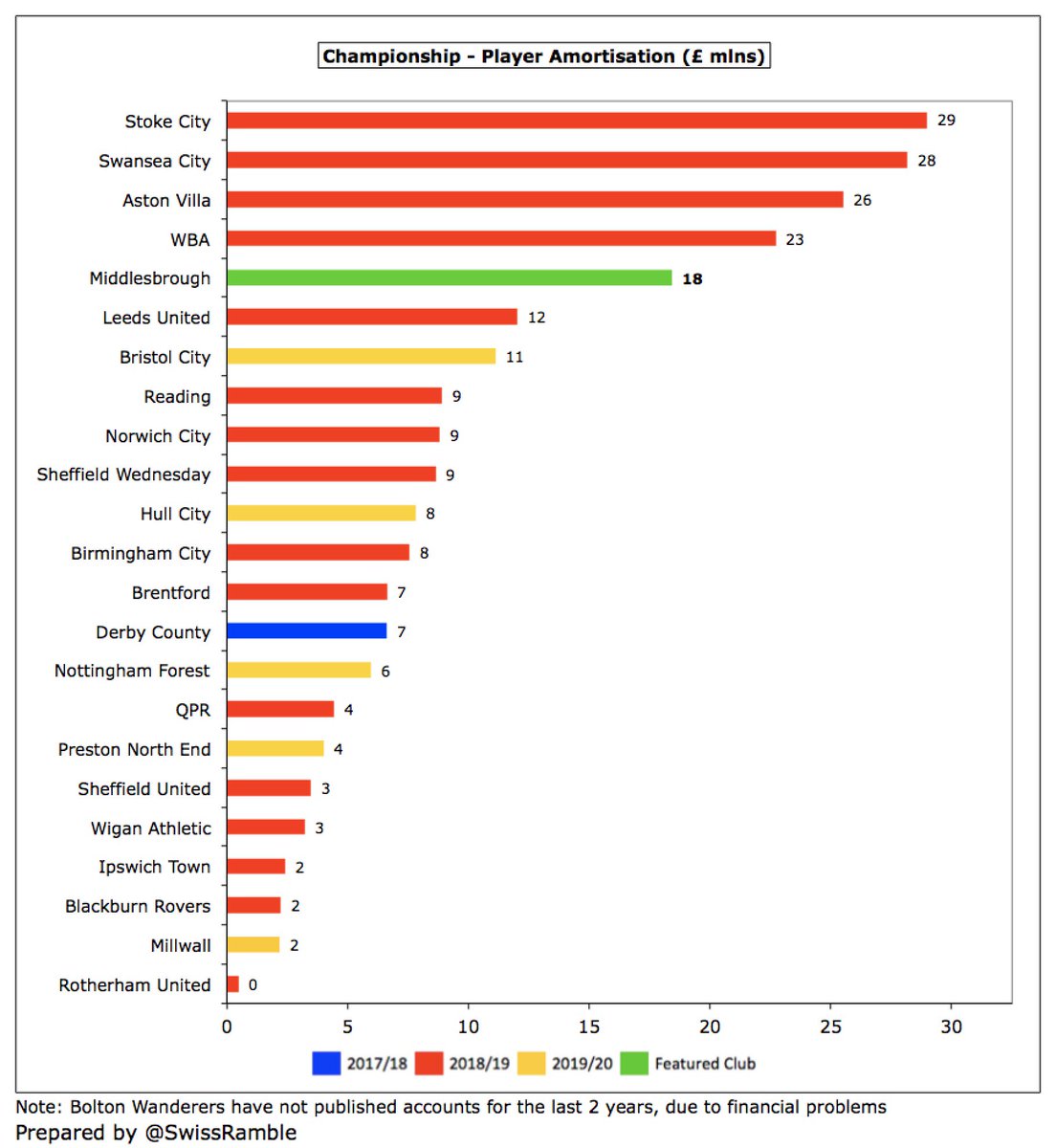

#Boro partially compensated for the revenue decline by cutting costs. Wage bill fell £9m (23%) from £40m to £31m, while player amortisation and impairment were down a third (£9m) to £18m. Other expenses were £8m (56%) lower.

#Boro other operating income rose £1.7m to £1.9m, including £1.2m from the Premier League relating to the Elite Player Performance Plan (EPPP) as a contribution towards the Category 1 Academy and £0.6m for the government furlough scheme for the pandemic.

#Boro loss of £36m is the worst reported to date in the 2019/20 Championship, though this result may well look better when other clubs publish their COVID-impacted accounts. In fact, even before the pandemic, many clubs had losses above £20m.

It is also worth noting that some clubs’ figures were boosted by once-off accounting profits from the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying figures were even worse than reported.

Excluding property sales, just 3 Championship clubs were profitable with only Hull City managing to make money so far in 2019/20. The sad reality is that almost all clubs in this division lose money, as they strive to remain competitive in pursuit of promotion to the top flight.

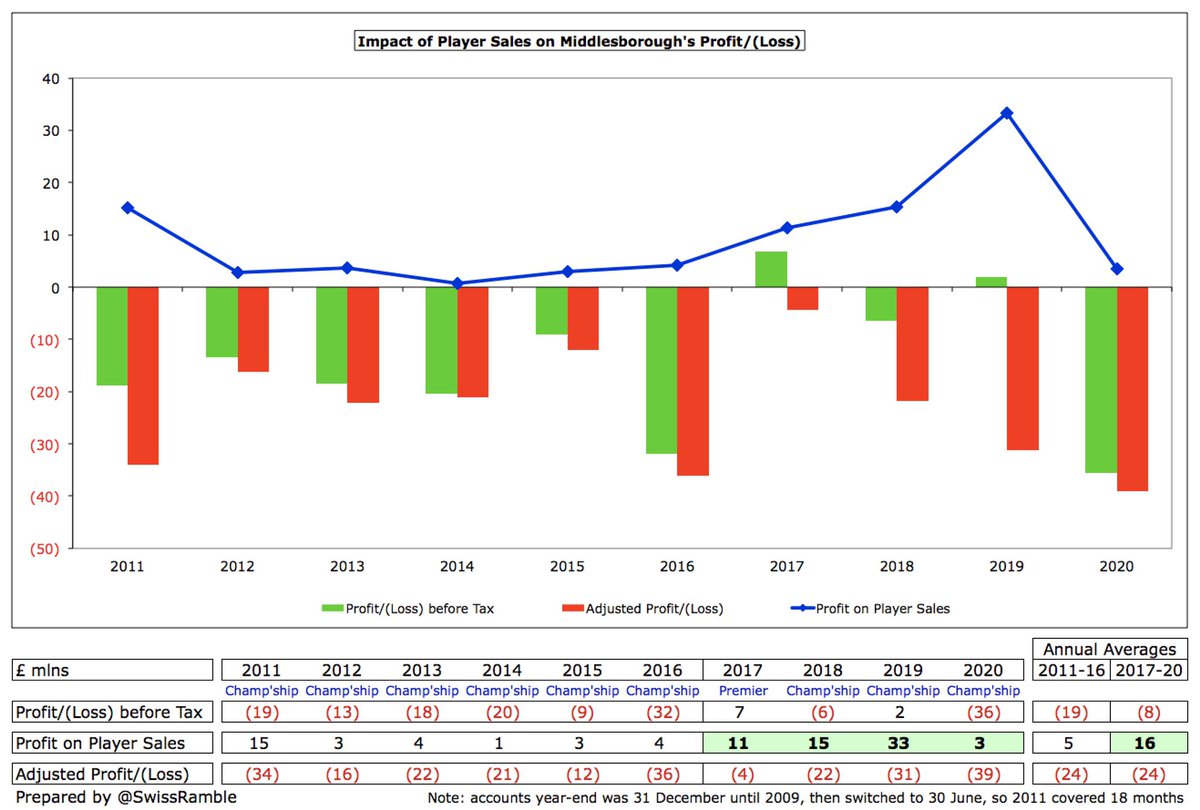

One reason for #Boro’s worse financial result is they only made £3m profit from player sales, whereas the prior year’s figures were boosted by £33m, including Traoré to #WWFC, Gibson to Burnley and Bamford to #LUFC. This was a lot less than Bristol City £26m and Hull City £23m.

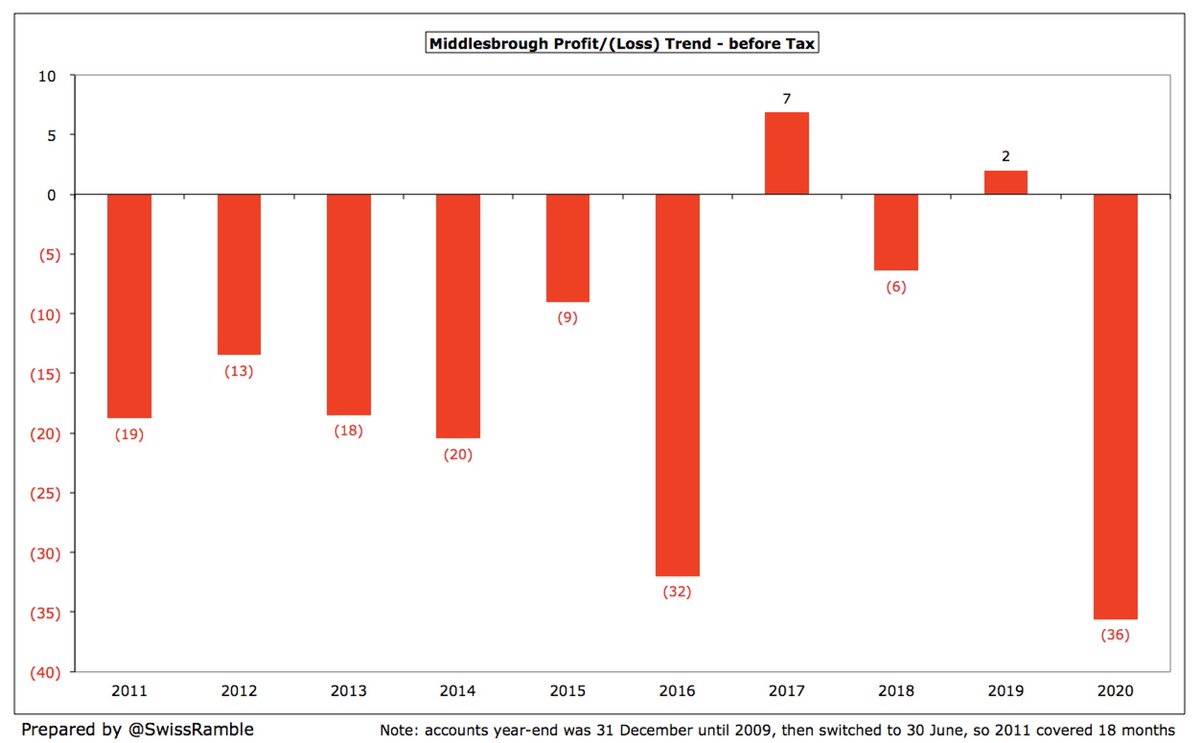

Although #Boro have generated a profit twice in the last four years, including £7m in the Premier League in 2017, they have generally posted fairly large losses. In fact, their cumulative losses over the last decade add up to £145m, averaging nearly £15m a season.

One way that #Boro have tried to become more sustainable is player trading. They have increased profit on player sales to an annual average of £16m over the past 4 years. This season included the sales of Braithwaite to Leganes, Randolph to #WHUFC and Flint to Cardiff.

#Boro operating losses (i.e. excluding player sales and interest payable) widened from £30m to £38m, having been only £4m in the Premier League in 2017. In fairness, almost all Championship clubs report substantial operating losses (nearly half of them more than £30m).

#Boro revenue has fallen by £102m (84%) from £121m to £19m since relegation from the Premier League 3 years ago, very largely due to £93m decrease in broadcasting after parachute payments ended after 2 years, though also reductions in commercial £5m and gate receipts £4m.

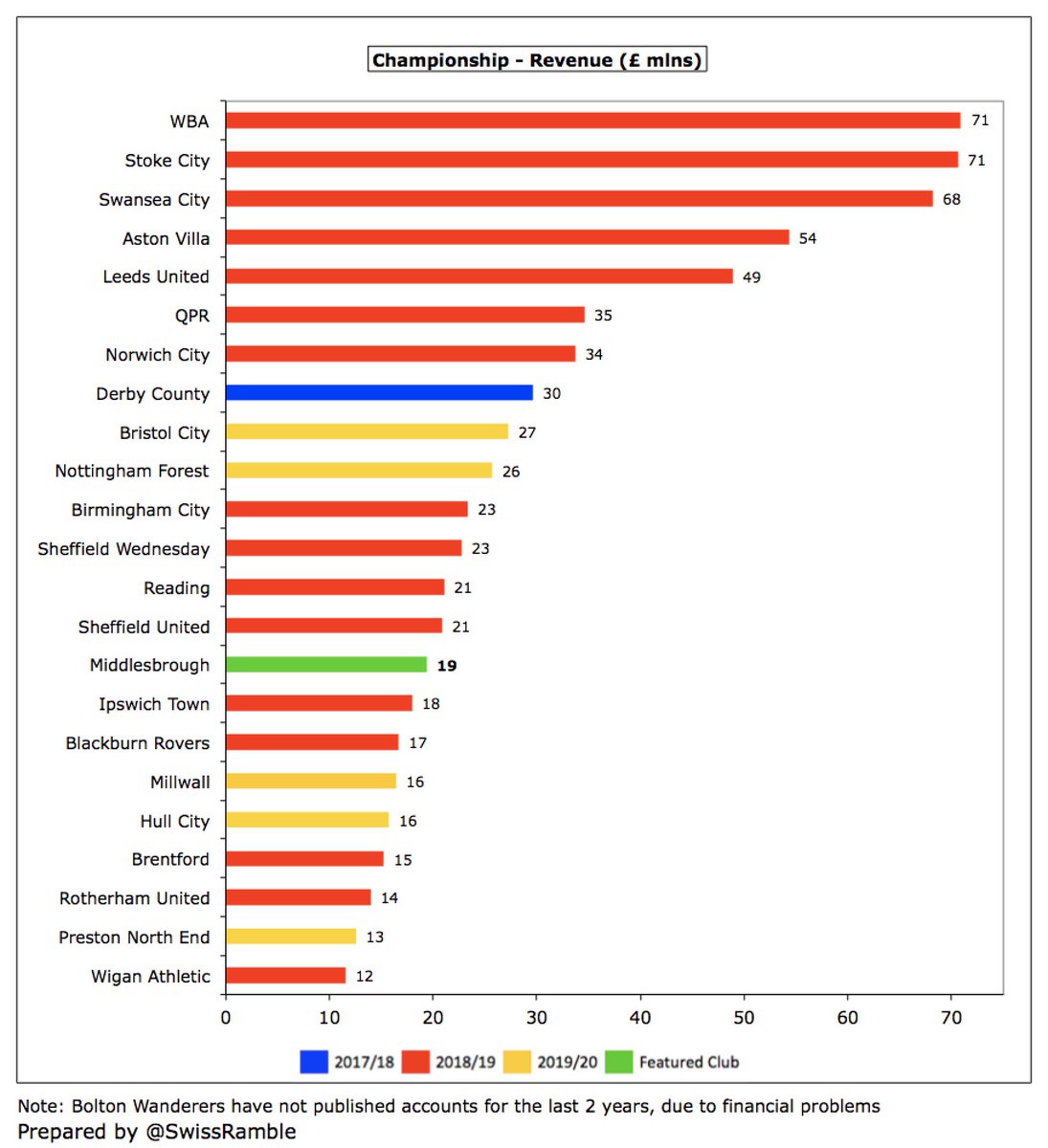

Following the decrease, #Boro £19m revenue is firmly in the bottom half of the Championship, significantly below clubs benefiting from parachute payments, e.g. in 2018/19 these included WBA £71m, Stoke City £71m and Swansea City £68m.

Championship revenue is hugely influenced by Premier League parachute payments, making it difficult for clubs like #Boro to compete. Seven clubs benefited from these in 2019/20, led by Cardiff City, #FFC £42m and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m).

If parachute payments were excluded, #Boro £19m would still be a fair way below the leading clubs. The gap to the highest placed club Leeds United (in 2018/19) would be reduced, but it would still be a chunky £30m.

#Boro broadcasting income fell £32m (78%) from £41m to £9m after parachute payments stopped, down from £102m in 2017. Most Championship clubs earn between £8m and £10m in TV money, but there is a big gap to clubs with parachute payments (over £50m for WBA, Swansea and Stoke).

#Boro match day income fell £1.6m (26%) to £4.5m, as they staged 4 fewer cup games and played 4 home games behind closed doors due to the pandemic. Has decreased 3 years in a row, so is now one of the lowest in the Championship, just ahead of Millwall.

#Boro average attendance dropped from 23,217 to 19,993 for games played with fans, down 35% from 30,449 in the top flight in 2017. This was 11th highest in the Championship, over 15,000 below #LUFC 35,322. Small ticket price increase, only second in 16 years at the Riverside.

#Boro commercial revenue fell £2.7m (31%) from £8.6m to £5.9m, comprising sponsorship & commercial, down £1.7m to £4.5m, and merchandising, down £1.0m to £1.4m. Middlesbrough’s lowest since 2014 and less than half Bristol City’s £14m in 2019/20 Championship.

In 2018/19 #Boro changed both their main sponsors. A “record-breaking three-year partnership” saw online casino 32Red become the new shirt sponsor, though long-standing Ramsdens switched to back-of-shirt, while kit supplier Adidas was replaced by a five-year deal with Hummel.

#Boro wage bill was cut 23% (£9m) from £40m to £31m, as the club “significantly reduced the size and cost of the playing squad” and made some redundancies to offset the reduction in income. Wages down 52% (£34m) from £65m peak three years ago in the Premier League.

Following the decrease, #Boro £31m wage bill is now in the bottom half of the Championship, making promotion even more difficult. Far below the likes of Aston Villa £83m, Stoke City £56m (both with parachute payments) and Norwich City £51m (promotion bonus) – all 2018/19 figures.

#Boro wages to turnover ratio shot up from 72% to 160%, the second highest to date in the Championship in 2019/20, only behind Preston 163%. This is obviously not great, but is pretty much par for the course in the Championship, where 17 of the 24 clubs are above 100%

#Boro directors remuneration was just £2k, one of the lowest in the Championship, a lot less than the likes of Reading £1.5m, WBA £953k, Birmingham City £932k and Stoke City £858k. That said, accounts note that one director was remunerated by another group company.

#Boro other expenses (i.e. excluding wages, player amortisation and depreciation) decreased by £8m (56%) from £15m to £7m without any real explanation (beyond less activity in the pandemic), though prior year was on the high side compared to other years in the Championship.

#Boro player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £8m (28%) from £26m to £18m, though up from just £4m in 2015, reflecting the investment in the squad. Still one of the highest in the Championship.

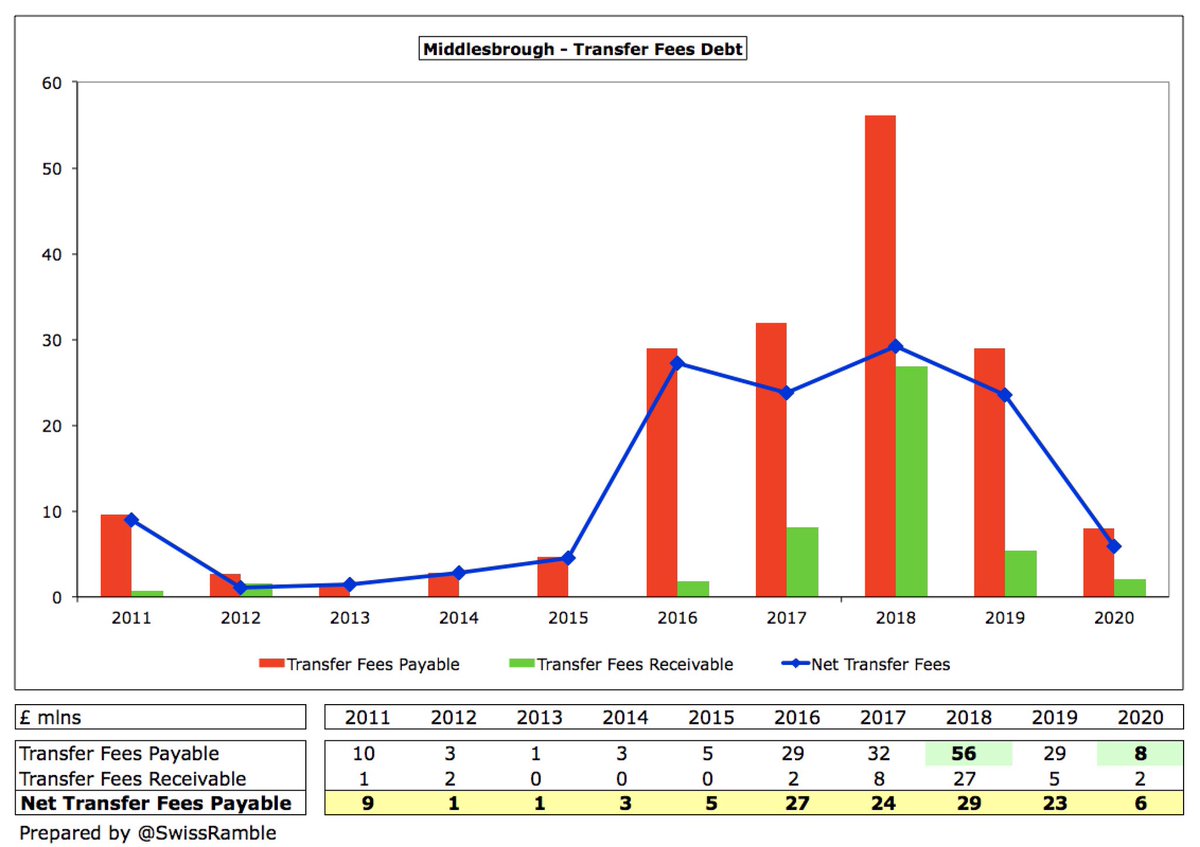

#Boro made £6m player purchases, mainly Dijksteel and Stojanovic. This was only around a tenth of the massive £66m spend of two years ago, which former manager Tony Pulis described as “the most disastrous transfer window in the club’s history”.

In the three years between 2016 and 2018 #Boro really pushed the boat out, as they averaged gross spend of £52m, compared to £6m in the preceding five years. However, in the two years since then, this has dropped to £9m with £27m sales, leading to £18m net sales.

#Boro gross debt rose £11m from £105m to £116m, all of which is owed to Steve Gibson. The debt would have been even higher if £63m had not been converted into share capital, highlighting the owner’s financial support.

#Boro £116m gross debt is the third highest in the Championship, only below #BRFC £142m & Stoke City £141m. However, like almost all debt in this division, it has been provided interest-free by the owner, so is very much of the “soft” variety.

#Boro have managed to reduce transfer debt from £29m to £8m, down from £56m in 2018. Partly offset by £2m owed to Middlesbrough by other clubs, so net £6m payable. In addition, £7m potential performance-related liabilities, based on appearances, promotion, etc.

#Boro do not include a cash flow statement in their accounts, so we do not know exactly how much interest the club actually paid, though the £1.3m shown as interest payable in the profit and loss account would place them among the highest in the Championship.

#Boro cash balance fell slightly from £210k to £167k, which is the second smallest in the Championship. In fairness, 16 clubs in this division had less than £2m cash in the bank, so this is not unusual (albeit not a great buffer in the current situation).

Despite the hefty 2019/20 loss, #Boro have no FFP issues, as their reported £40m loss over 3-year monitoring period was only £1m above the £39m limit, even before deducting allowable deductions for academy, community & infrastructure and COVID impact.

• • •

Missing some Tweet in this thread? You can try to

force a refresh