A short thread on Venture Capital.

1/ VCs are a portfolio of uncorrelated, risky bets that entrepreneurs take.

2/ Essentially VCs underwrite business risk - they let entrepreneurs take the risk that has a small chance exceptional returns.

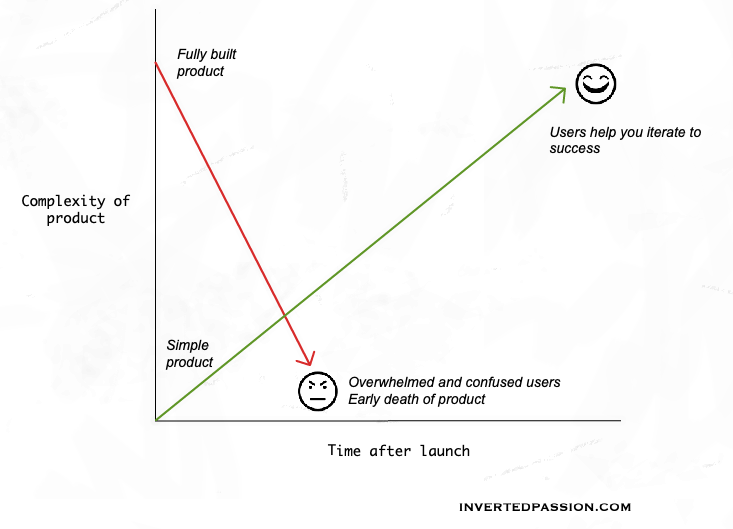

3/ VCs don’t judge whether a startup would fail - they expect failure by default.

Rather, they judge whether a startup could become big.

Rather, they judge whether a startup could become big.

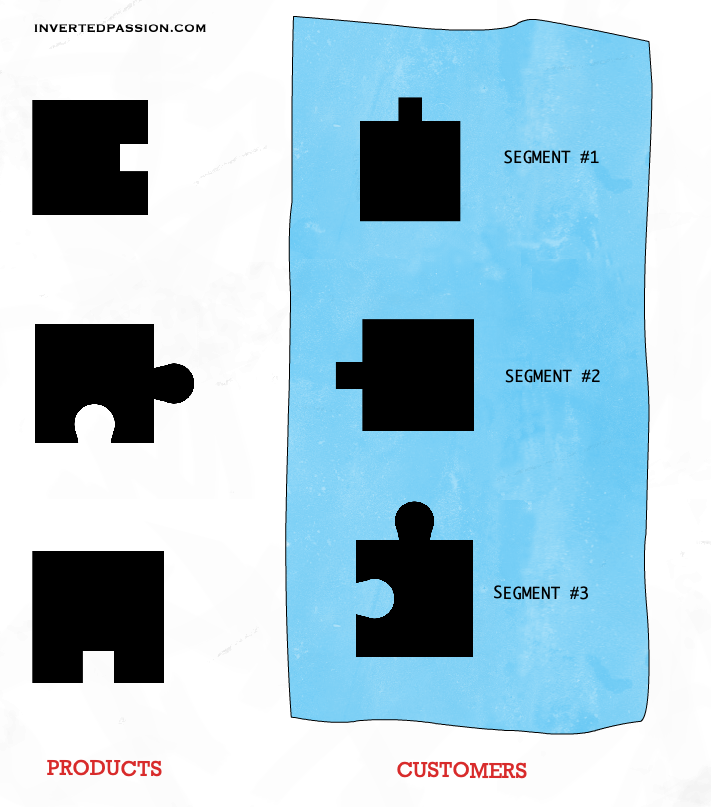

4/ Because bets should be uncorrelated, good VCs are fairly wide in types of startups they fund.

Best VCs would fund consumer, SaaS, deep-tech or any other type of company.

Best VCs would fund consumer, SaaS, deep-tech or any other type of company.

5/ Many VCs seem to be focused on tech not because they love tech but because tech companies grow really big.

Remember: VCs are all about giving a return on portfolio via a few companies working out while most failing.

Remember: VCs are all about giving a return on portfolio via a few companies working out while most failing.

6/ Entrepreneurs who diss on VCs because they wouldn’t fund their company don’t understand that VCs are given money by investors to produce high-risk, high-return rewards.

For low-risk, low-reward returns, investors have bonds.

For low-risk, low-reward returns, investors have bonds.

7/ It’s a bit unfair that an entrepreneur is expected to focus 100% of her effort on a company that will most likely fail while VCs hedge their risk via a portfolio.

But then what entrepreneurs get is the joy of doing one thing and building something.

You can’t have it all.

But then what entrepreneurs get is the joy of doing one thing and building something.

You can’t have it all.

8/ That’s it.

The key thing to remember is that VCs are an instrument for investors to get high-risk, high-reward return.

And it’s a great way for society to fund innovations that wouldn’t exist otherwise.

The key thing to remember is that VCs are an instrument for investors to get high-risk, high-reward return.

And it’s a great way for society to fund innovations that wouldn’t exist otherwise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh