Leicester City’s 2019/20 financial results covered “a season of considerable progress” when they finished 5th in the Premier League, thus qualifying for the Europa League, but their finances were significantly impacted by COVID-19. Some thoughts in the following thread #LCFC

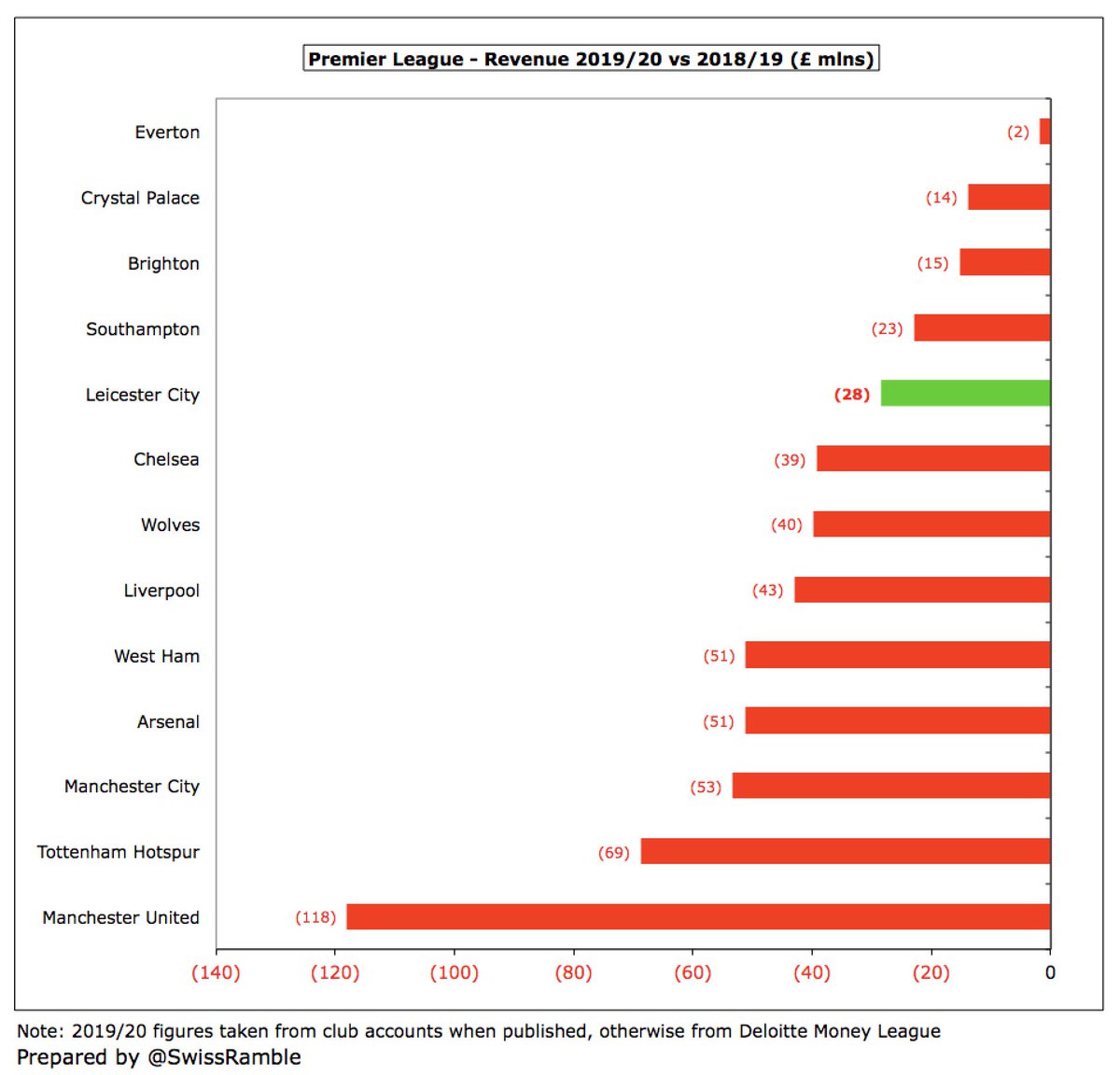

#LCFC loss before tax widened from £20m to £67m, as the pandemic led to revenue dropping £28m (16%) from £178m to £150m, though profit on player sales rose £5m to £63m. Expenses rose £23m (9%), mainly due to investment in the squad. Loss after tax was £60m.

Significantly impacted by COVID, the main driver of #LCFC revenue decrease was broadcasting income, which dropped £20m (16%) from £128m to £108m, while commercial fell £7m (18%) from £36m to £29m and match day was down £2m (11%) from £15m to £13m.

Continued investment into the squad meant #LCFC wages increased £8m (5%) to £157m and player amortisation rose £14m (22%) to £78m. Other expenses were down £5m (13%) to £32m, partly due to prior year cost of bringing in Brendan Rodgers and his staff from Celtic.

Of course, all clubs have been adversely impacted by COVID, so #LCFC £67m loss is far from unusual with no fewer than 7 clubs posting losses above £50m, the others being #EFC £140m, #SaintsFC £76m, #THFC £68m, #BHAFC £67m, #WHUFC £65m and #AFC £54m.

Without COVID, #LCFC revenue would have been £46m higher at £196m (10% more than 2019), as £33m deferred to 2020/21 (broadcasting £28m, sponsorship £5m) and £13m foregone (match day £4m, TV £9m), meaning the club would have posted £21m loss, similar to prior year.

However, #LCFC figures significantly benefited from £63m profit on player sales, up from £58m, almost entirely due to Harry Maguire’s big money move to #MUFC. This is second highest in the Premier League to date, only surpassed by #CFC £143m, but ahead of #AFC £60m and #EFC £40m.

Following promotion to the Premier League, #LCFC had delivered four years of profits, amounting to £137m, before the last two years’ losses worth £87m in total. This was obviously boosted by the amazing £92m surplus in 2017, which is actually the 3rd highest profit in PL history.

#LCFC made hardly any money from player sales up to 2016, but profits from this activity have surged to an impressive average of £50m in the past four years. Next year‘s accounts will benefit from Ben Chilwell’s £50m sale to #CFC.

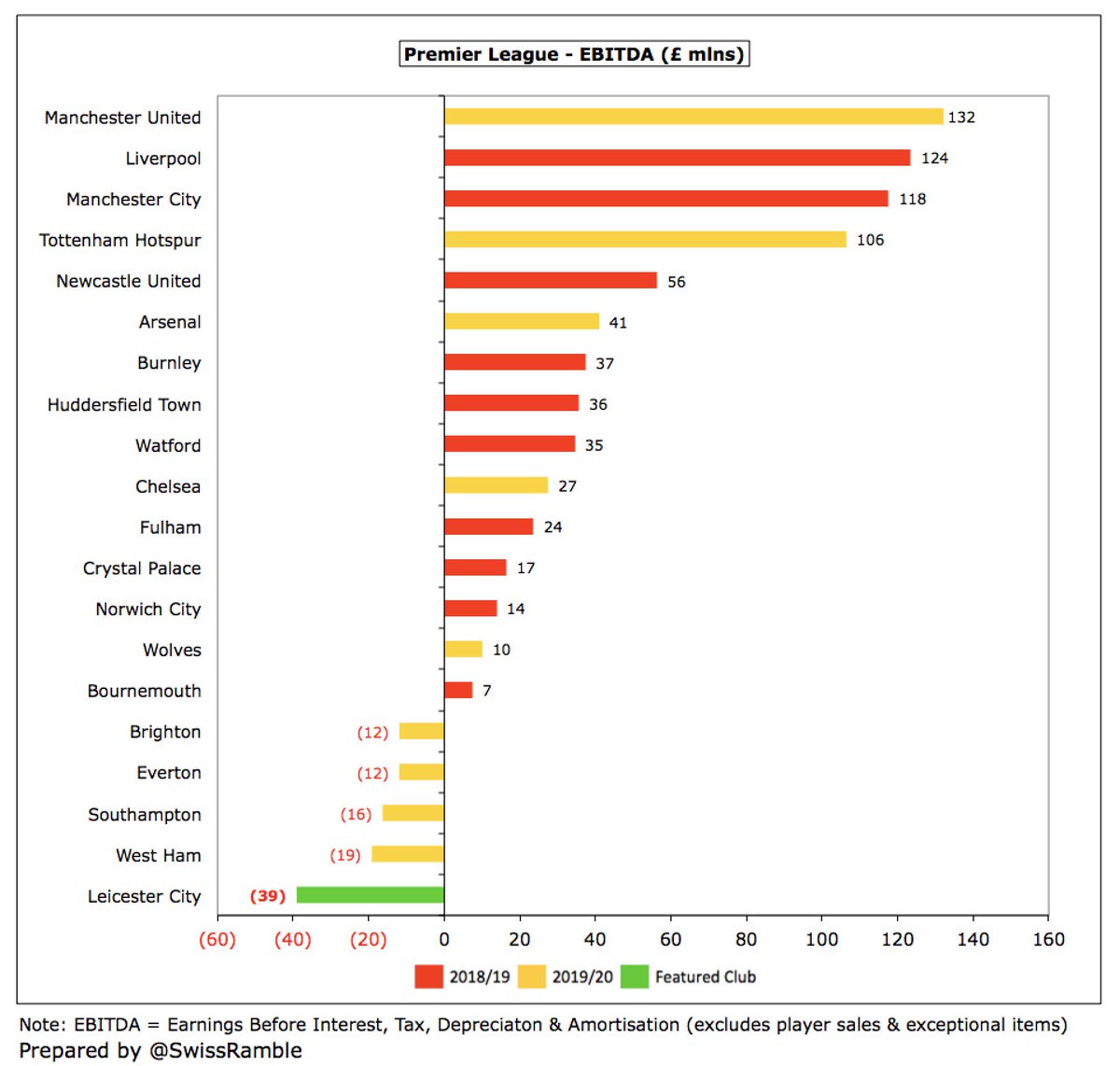

#LCFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, fell from £(6)m to £(39)m. This is actually the worst in the Premier League, though may look better when other clubs publish 2019/20 accounts.

#LCFC operating loss (i.e. excluding player sales and interest) widened from £74m to £122m, a huge deterioration from £56m profit 3 years ago. This is second worst in the Premier League, only beaten by #EFC £175m. This is the price clubs pay attempting to break into the top four.

Despite the steep decline in 2019/20, #LCFC £150m revenue is still £21m (16%) more than 2016, when they were crowned Premier League champions. However, much lower than the extraordinary £233m in 2017, which was boosted by £70m Champions League TV money.

#LCFC £150m revenue is 9th highest revenue in England (probably will be 8th after #NUFC publish 2019/20 accounts), though less than a third of #MUFC £509m. As Rodgers said, “If you analyse budgets, we should be nowhere near Manchester United. That’s the reality.”

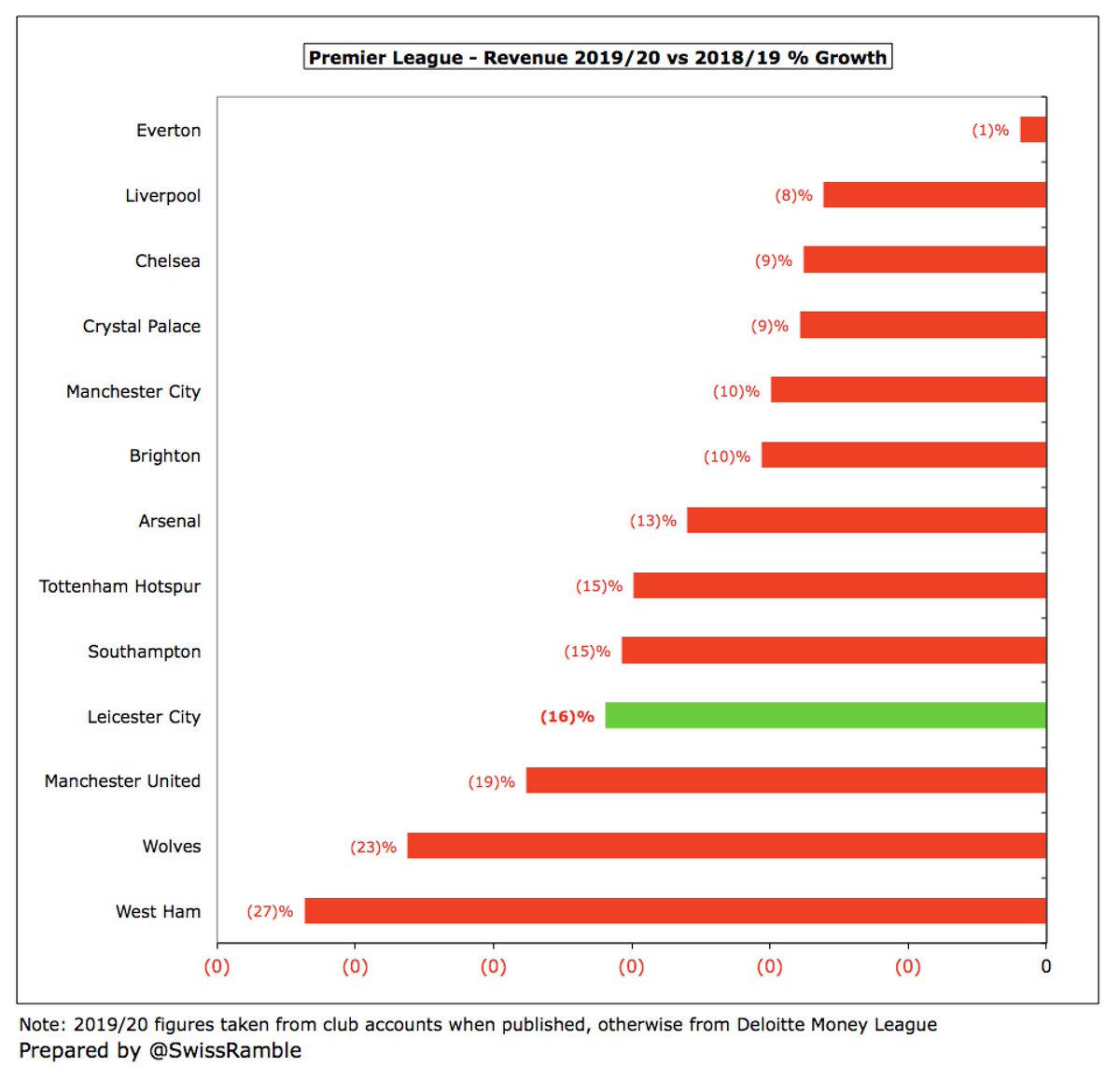

It is also worth noting that #LCFC have been more impacted by COVID-19 than many others, as their accounts close relatively early on 31st May, so more revenue has been deferred to the 2020/21 accounts than clubs whose accounts close on 30th June or 31st July.

All Premier League clubs’ revenue is down in 2019/20, due to the pandemic impact, though #LCFC 16% reduction is one of the highest in the Premier League (larger clubs more in absolute terms). #EFC small 1% decrease is due to once-off £30m for stadium naming rights option.

For the third year in a row #LCFC were 22nd in the Deloitte Money League, which ranks clubs globally by revenue. Interestingly, this is above storied clubs like Benfica, Borussia Mönchengladbach, Ajax and Milan.

#LCFC broadcasting income fell £20m (16%) from £128m to £108m, due to £28m revenue from 9 games slipping to 2020/21 accounts and £9m rebate to broadcasters, partly offset by higher merit payment for finishing 5th. Others will see similar falls when they publish 2019/20 accounts.

So #LCFC broadcasting revenue in 2020/21 will benefit from the £28m deferred from 2019/20, as the season was extended beyond the club’s 31st May accounting close. Note: overseas rights now partially split per league position (were previously distributed equally).

This season’s figures will benefit from #LCFC reaching the last 32 of the Europa League before being eliminated by Slavia Prague. As a comparison, I estimate that #AFC received £17m for getting to the same stage in 2019/20.

#LCFC will be well aware of how much money can be earned in Europe, as their solitary, albeit very lucrative, season in the Champions League means that #LCFC have the 7th highest earnings of English clubs in the last 5 years with €82m (£70m) in 2017.

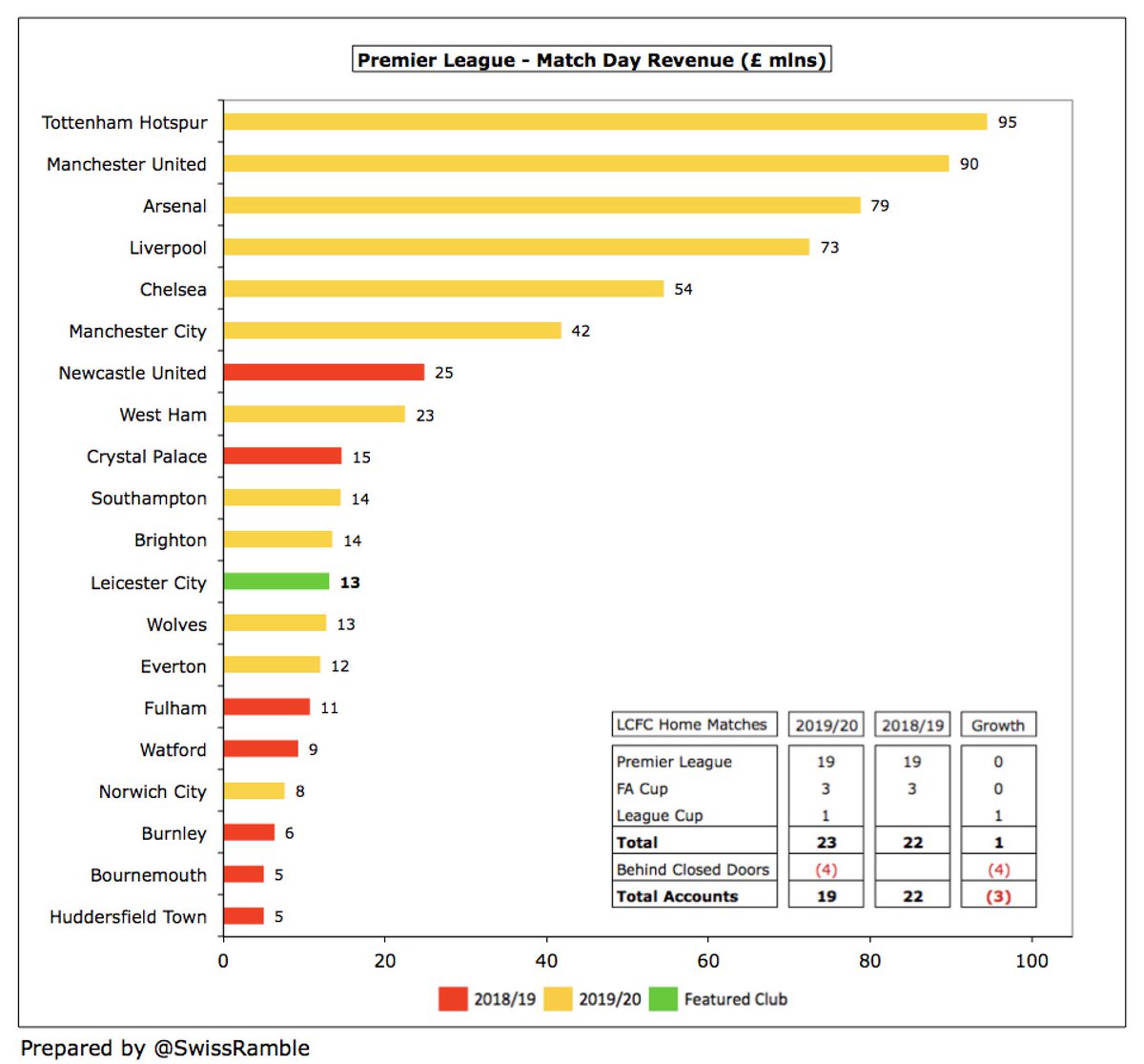

#LCFC gate receipts fell £2m (11%) from £15m to £13m, as they played 4 home games behind closed doors due to COVID. Income is firmly in the bottom half the Premier League, less than a seventh of #THFC £95m after their move to the new stadium.

#LCFC average attendance rose from 31,851 to 32,061 (for those games played with fans), which was the 11th highest in the Premier League, though a fair way below 10th placed #EFC 39,103. Ticket prices were frozen for 2019/20 for the fifth straight year.

#LCFC have plans to expand the King Power stadium, increasing the capacity to around 40,000. The club has acquired land next to the ground and spent a further £1.8m since these accounts closed on detailed design and feasibility work.

#LCFC commercial income fell £7m (18%) from £36m to £29m, mainly due to deferral of £5m sponsorship to 2020/21. Second highest ever for the club, though a long way behind the Big Six, e.g. around £113m less than #AFC £142m.

#LCFC owners King Power pay £16m sponsorship (shirt and stadium naming rights), which has driven most of the recent growth. Media reports have shirt deal as £4m. New deals in 18/19: Adidas replaced Puma as kit supplier, while Bia Saigon were the new sleeve sponsor.

#LCFC wage bill rose £8m (5%) from £149m to £157m, due to further investment in the playing squad, including contract extensions. Increase would have been even more if some bonuses had not been deferred to 2020/21. Wages virtually doubled in 4 years (£80m in 2016).

Following the growth, #LCFC £157m wage bill is 8th highest in the Premier League, just behind #EFC £165m (and only £24m below #THFC £181m). That said, it’s over £125m less than the highest-spending clubs to date in 2019/20, namely #MUFC £284m and #CFC £283m.

As a result of the revenue fall, #LCFC wages to turnover ratio increased (worsened) from 84% to 105%, the highest in Premier League to date in 2019/20 and the worst in the top flight since QPR’s 129% in 2013. Would still have been 80% without COVID revenue loss.

Remuneration for #LCFC highest paid director increased by 37% from £259k to £356k, presumably for chief executive Susan Whelan. That seems pretty good value, compared to the likes of #MUFC Ed Woodward and #THFC Daniel Levy, who both earned more than £3m.

#LCFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £14m (22%) from £64m to £78m, up from just £3m in 2014. Also booked £2m impairment. Now 7th highest in Premier League, above #THFC, but nearly £50m less than #CFC.

#LCFC other expenses cut £5m (13%) to £36m, despite including a “settlement for a legal dispute”. Not really explained, but prior year possibly included payment to Celtic to secure Brendan Rodgers. Includes £3.5m payment to King Power for management services.

#LCFC splashed out £105m on player purchases, including Youri Tielemans, Ayoze Perez, Dennis Prate and James Justin. This is the third time they have spent over £100m in last 4 seasons, and is the 7th highest in the Premier League in 2019/20 (just behind #WWFC, #EFC and #WHUFC).

#LCFC have really ramped up player investment, spending £419m in the last 4 years, compared to less than £100m in the preceding 6 years. Partly offset by sales increasing to £244m in the same period. Purchases in 2020/21 are lower, but include Wesley Fofana and Timothy Castagne.

The market value of the #LCFC playing squad has been assessed by the directors as £454m, which is around £260m more than the value in the accounts, implying significant unrealised profit. This value decreased by £28m in 2020 (massively up from £65m in 2015).

#LCFC gross debt rose £128m to £219m, mainly £154m from the owners (up £119m): £137m loans and £17m finance leases from stadium purchase. Also £64m bank loan, very largely Macquarie Bank. Debt would be even higher without 2014 conversion of £103m of shareholder loans into equity.

Since year-end #LCFC entered into two 5-year loan facilities with the club chairman for a total of £30m to finance working capital requirements and increased the facility with Macquarie by £16m. Also entered into a £35m stand-by facility with King Power.

#LCFC £219m debt is 5th largest in Premier League after investment into new training ground and playing squad. Much debt is funding for new stadiums, e.g. #THFC £831m, #BHAFC £306m and #AFC 218m, though #MUFC £526m is for Glazers’ purchase. #EFC £409m is “friendly” owner loan.

No interest payments per #LCFC cash flow statement, as interest on owner loans (6%) and finances leases (8%) is only accrued and not paid. However, it does seem a bit strange that no interest paid on Macquarie Bank loan (between 2.8% and 3.99%). Should increase going forward.

#LCFC did manage to cut transfer debt from £97m to £78m, though still more than double £32m in 2017. Partly offset by £21m transfer fees owed by other clubs, so net payable is £57m. On the low side for the Premier League, around half #AFC £154m.

Despite £122m operating loss, #LCFC had £3m operating cash flow (adding back £83m amortisation/depreciation and £42m working capital movements), but then spent £75m on infrastructure (new Seagrave training ground) and £17m net on players. Funded by new loans, mainly £111m from KP

Since King Power acquired #LCFC in August 2010, the owners have put in £301m (£106m share capital and £195m loans), while £110m has been generated from operations. Most went on player purchases and capex £317m (not split in accounts until 2018) and repaying other loans £53m.

#LCFC cash balance increased £30m from £11m to £41m, though the club has spent a further £19m since then on the industry leading new training ground, taking total investment to over £100m, despite the “uniquely challenging environment” caused by the pandemic.

#LCFC directors are confident that the club continues to comply with the Premier League and UEFA Financial Fair Play regulations, notwithstanding the large loss, as the authorities have amended the rules to “neutralise the adverse impact of the COVID-19 pandemic”.

#LCFC CEO Susan Whelan concluded, “The commitment of the club’s owners underpins our long-term ambition to be a consistent challenger domestically and a competitor in Europe each season”, as seen by their significant investment, which is especially important with COVID.

• • •

Missing some Tweet in this thread? You can try to

force a refresh