Borosil Limited : 🧵

• Sales of Larah grew by more than 4 times in 5 years !

• Trading at an EV/EBITDA of 34 times (TTM Basis)

• Expected EBITDA for FY-22 : 120+ Cr. ; lesser than 15x EV/EBITDA.

• 7-Years CAGR in Revenues : 25% while in Operating Profits : 32%.

(1/n)

• Sales of Larah grew by more than 4 times in 5 years !

• Trading at an EV/EBITDA of 34 times (TTM Basis)

• Expected EBITDA for FY-22 : 120+ Cr. ; lesser than 15x EV/EBITDA.

• 7-Years CAGR in Revenues : 25% while in Operating Profits : 32%.

(1/n)

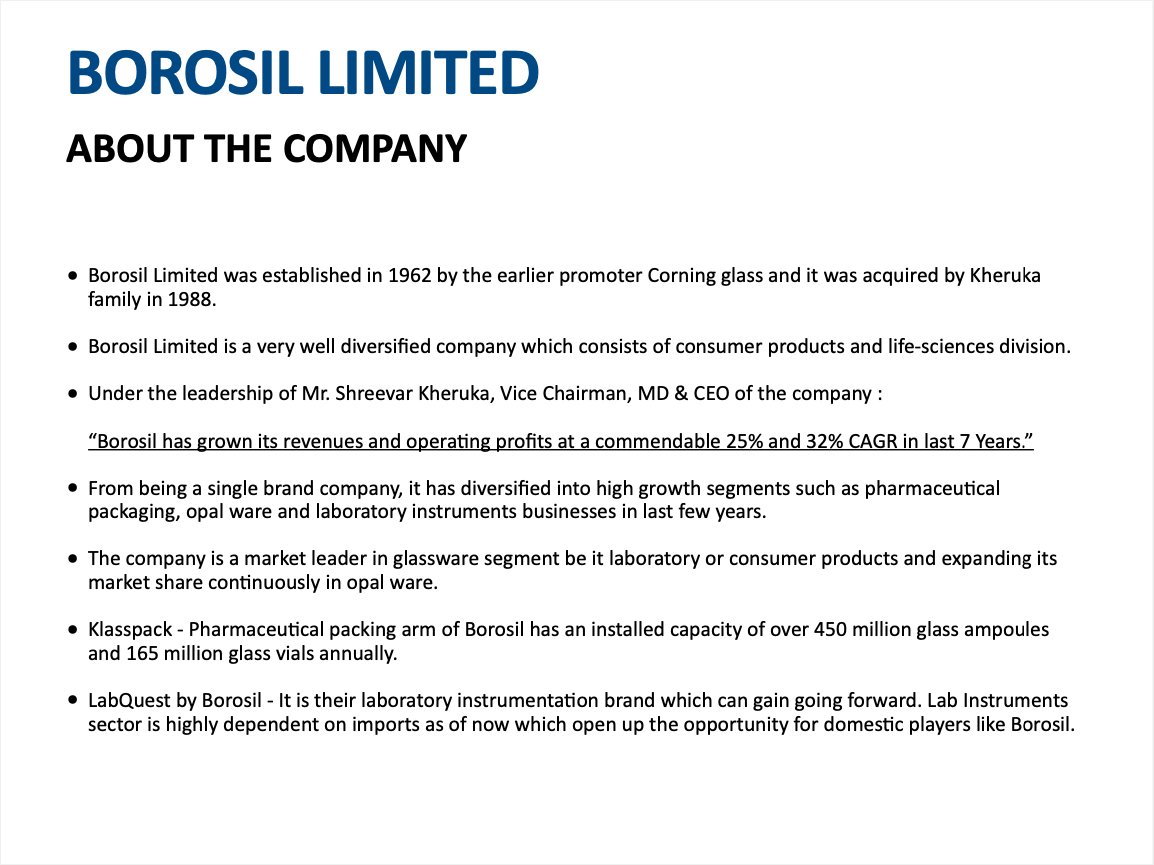

About the company :

• Borosil Limited was established in 1962 by the earlier promoter Corning glass and it was acquired by Kheruka family in 1988.

• Borosil Limited is a very well diversified company which consists of consumer products and life-sciences division.

(2/n)

• Borosil Limited was established in 1962 by the earlier promoter Corning glass and it was acquired by Kheruka family in 1988.

• Borosil Limited is a very well diversified company which consists of consumer products and life-sciences division.

(2/n)

Business Segments :

• Consumer Products Division

• Larah - Opalware brand

• Comparison of Larah & LaOpala

• Medium-term guidance on CPD business

(3/n)

• Consumer Products Division

• Larah - Opalware brand

• Comparison of Larah & LaOpala

• Medium-term guidance on CPD business

(3/n)

• Scientific & Industrial Products Division

• Klasspack - Pharma Packaging

• COVID Opportunity in Klasspack

• Medium-term guidance on SIP business

• Klasspack - Pharma Packaging

• COVID Opportunity in Klasspack

• Medium-term guidance on SIP business

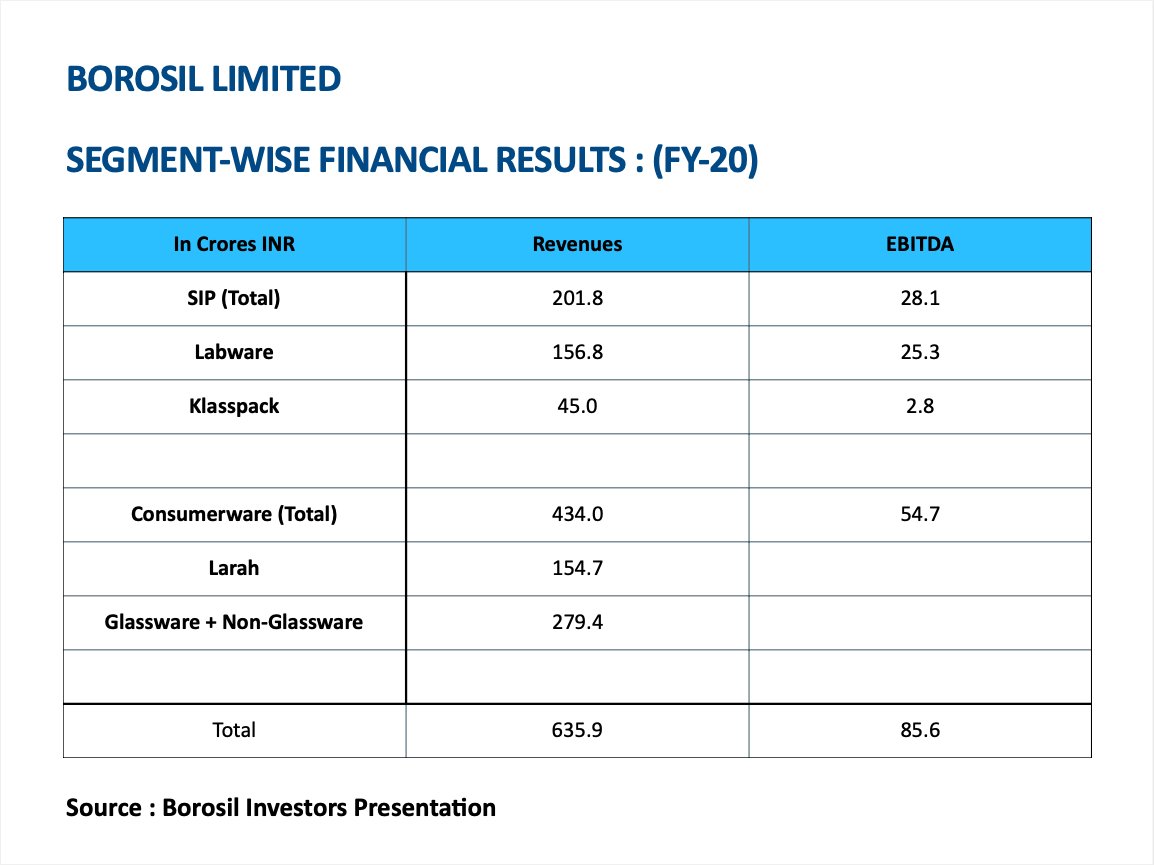

Financials :

• Growth in last 9 years

• Expected RoE and RoCE for upcoming year

• Outlook

Note : These are our expectations based on our calculations. Please don't get carried away by the numbers.

• Growth in last 9 years

• Expected RoE and RoCE for upcoming year

• Outlook

Note : These are our expectations based on our calculations. Please don't get carried away by the numbers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh