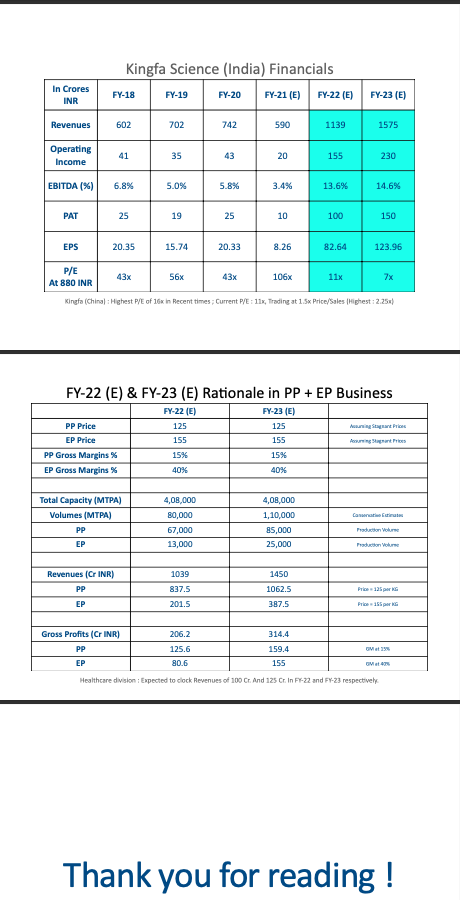

Kingfa Science & Technology (India) Limited :🧵

There is nothing more powerful than an idea whose time has come !

- Victor Hugo

Read more about the company in this thread. :)

There is nothing more powerful than an idea whose time has come !

- Victor Hugo

Read more about the company in this thread. :)

Products : (PP + EP division)

• Polypropylene

• Engineering Plastic Compounds

• Fiberglass

• Thermoplastic Elastomers

• Product Applications

• Polypropylene

• Engineering Plastic Compounds

• Fiberglass

• Thermoplastic Elastomers

• Product Applications

Manufacturing locations & Clientele :

• Chakan - Operating leverage yet to play out

• Capacity & Move towards Value Added Products

• Customers they serve

• Chakan - Operating leverage yet to play out

• Capacity & Move towards Value Added Products

• Customers they serve

Business Model + Focus Areas :

• Key Focus Areas for Kingfa (India)

• Business Model - How do they deal with OEMs

• Hidden Moat in business model.

• Key Focus Areas for Kingfa (India)

• Business Model - How do they deal with OEMs

• Hidden Moat in business model.

I hope these notes will add some value to your research while studying.

Thank you for reading. :)

Thank you for reading. :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh