1/9 Thread: The agony and ecstasy of concentrated portfolio

JPM recently updated their famous paper on the concentrated portfolios. Just like the earlier two, it is a very humbling read.

Given the pick up in volatility, perhaps the danger of concentration is more intuitive now.

JPM recently updated their famous paper on the concentrated portfolios. Just like the earlier two, it is a very humbling read.

Given the pick up in volatility, perhaps the danger of concentration is more intuitive now.

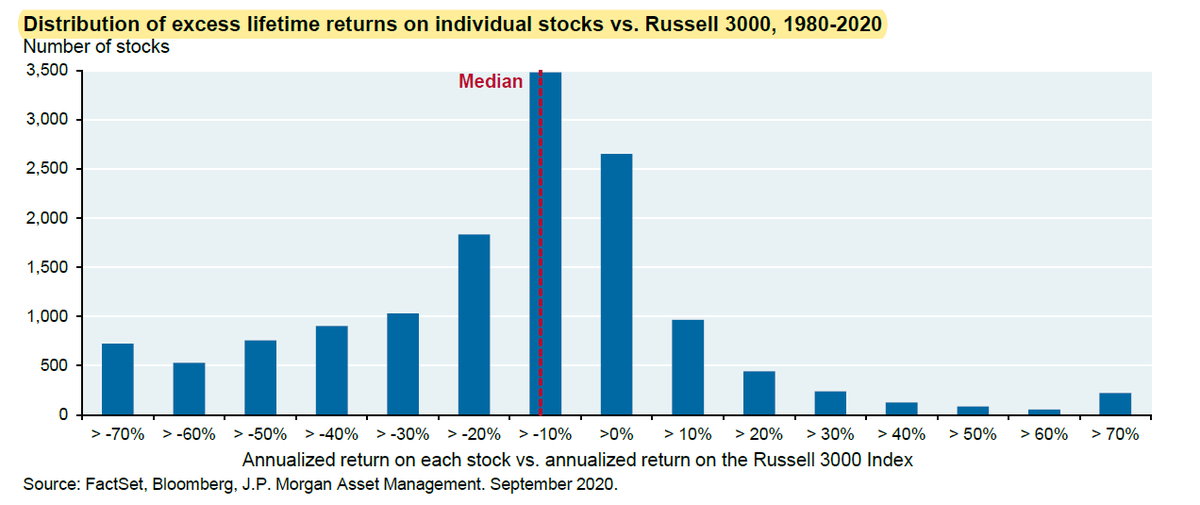

2/9 "more than 40% of all companies that were ever in the Russell 3000 Index experienced a “catastrophic stock price loss”, which we define as a 70% decline in price from peak levels which is not recovered."

3/9 Take a minute to read this. If you have been told "stocks always go up", I have news for you.

It's a very hard endeavor we all still choose to do, for better or worse.

It's a very hard endeavor we all still choose to do, for better or worse.

4/9 The returns, of course, do not follow normal distribution. This is why I don't want to waste my time studying companies which are just average.

Easier said than done though; great companies eventually become mediocre or even die all the time. It's a treacherous game.

Easier said than done though; great companies eventually become mediocre or even die all the time. It's a treacherous game.

5/9 Why do companies fail?

"we found that most instances of business failures were largely outside management’s control"

If you find yourself in a difficult industry, you may appear a lot worse than you actually are, and vice versa.

"we found that most instances of business failures were largely outside management’s control"

If you find yourself in a difficult industry, you may appear a lot worse than you actually are, and vice versa.

6/9 "At the same time, a measure of market depth has been falling. This latter measure suggests that prices could evaporate should selling pressure suddenly increase for a given stock or sector."

Hmm, kinda rings a bell.

Hmm, kinda rings a bell.

7/9 "the risk is NOT whether the Fed would raise rates to much higher levels; the risk might be whether the Fed would raise them at all. A yield of 3.0%-3.5% on the 10 year Treasury, which would still be low relative to inflation, could create substantial equity market losses."

8/9 While growth investors certainly benefited from low rates in the last few years, let's not forget the broader picture: many "value" stocks did see deep erosion of fundamentals.

9/9 Some more examples of failure/sufferings of old economy stocks here.

Link to the full report: theirrelevantinvestor.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

Link to the full report: theirrelevantinvestor.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh