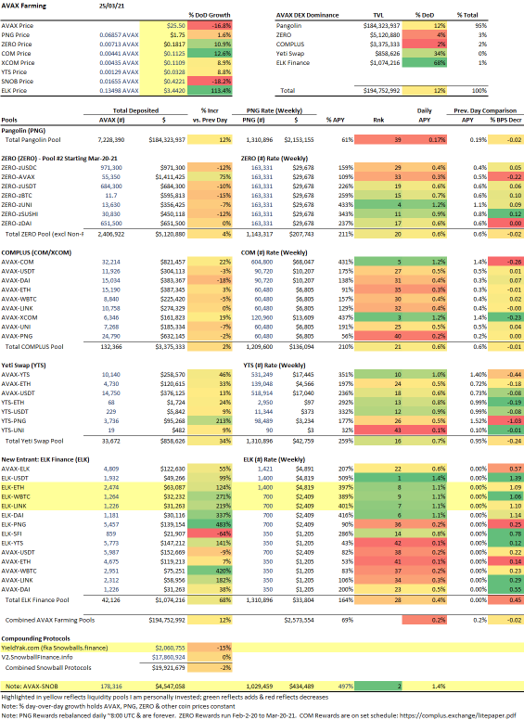

Daily Update (Thu Mar 24) on @avalancheavax Farming Yields for @pangolindex, @OfficialZeroDEX, @complusnetwork, @YetiSwap, @elk_finance + @yieldyak_ auto-compounder

Hi All - since the last update a couple of days, I feel like I've aged 5 yrs...

1/12

Hi All - since the last update a couple of days, I feel like I've aged 5 yrs...

1/12

1) Price Action: yesterday, we had some uplift with @Tesla's news that they would accept #bitcoin, but that was short-lived with crypto taking a dive & BTC struggling to stay above $50k & #Ethereum hovering ~$1.6k. $AVAX is -17% to $25.50. UGH!!!

2/12

2/12

2) Yield Farming. In times of macro weakness, the investor tendency is towards risk aversion, and yield farming is viewed as risk-on. So I've been monitoring the farms closely, and it's good to see that, in spite of price weakness, there has been stability at the lows

3/12

3/12

TVL is +12% (holding prices constant - it would be down otherwise), with strong growth from new entrant @elk_finance (+68%) to >$1m TVL & @YetiSwap (+23%) to >$850k. $ELK token price is up >100% which is no doubt driving up TVL. There's a bit of hype with

4/12

4/12

a future NFT marketplace as well - definitely one to keep an eye out.

It's no surprise that $ELK then is leading on APY with 5 of the top 10 pools, though despite a large $1m overall TVL is relatively shallow vs. mainstays $PNG, $ZERO & $COM

5/12

It's no surprise that $ELK then is leading on APY with 5 of the top 10 pools, though despite a large $1m overall TVL is relatively shallow vs. mainstays $PNG, $ZERO & $COM

5/12

Snooping around, I also found quite a cool #Dapp tracker tool called @iomarkr which has a very slick interface for yield farming pools. It seems like their Twitter feed provides timely updates as well. This seems like a quality app for any serious $AVAX farmer!

6/12

6/12

3) Auto-Compounder Spotlight. Seems like there's been some activity here:

- Snowballs.finance rebranding to @yieldyak_ to remove the confusion with its competitor which has no doubt hurt TVL, but it continues to be a primary compounder across all the $AVAX DEXes

7/12

- Snowballs.finance rebranding to @yieldyak_ to remove the confusion with its competitor which has no doubt hurt TVL, but it continues to be a primary compounder across all the $AVAX DEXes

7/12

- @throwsnowballs migrating to a much nicer UI v2. It's worth repeating $SNOB-$AVAX continues to be the KING of yields with a simple APY 500% and a compounded APY (at YieldYak.com) >10,000%. I believe $SNOB will continue to hold up due to the compounder trend

8/12

8/12

4) Portfolio Strategy. I greatly reduced my farmed pools the last few days as I wanted to see stability in the market. Now that I'm seeing it, I'm going to re-build/add to my positions, factoring high yield & deeper liquidity:

9/12

9/12

- $SNOB/AVAX: 500% APY

- $COM/AVAX: 430% APY

- ELK pools: $ELK/ETH, ELK/WBTC, ELK/LINK

For the ELK pools, I'm conscious that part of the reason for high yield is price run-up (sustainable?) & shallow pools. So I can't take on too much exposure with my PA size

10/12

- $COM/AVAX: 430% APY

- ELK pools: $ELK/ETH, ELK/WBTC, ELK/LINK

For the ELK pools, I'm conscious that part of the reason for high yield is price run-up (sustainable?) & shallow pools. So I can't take on too much exposure with my PA size

10/12

5) Finally, it's worth mentioning an exciting new project @AvalaunchApp, which will provide a gateway for IDOs to the $AVAX community

11/12

https://twitter.com/AvalaunchApp/status/1374739654675726339

11/12

As you know, I've incorporated an IDO strategy into my overall investment strategy, where you can make multi-baggers to juice overall returns. Of course this is closer to venture investing on the risk curve, so be careful & stay safe! & only in a positive macro market!

12/12

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh