Finally @Pandaswapex is LIVE! Been waiting for this one all week. Farming/rewards of $BAMBOO will start at block 800,000 (~1-2 days). Come back for full review of APYs when launched!

https://twitter.com/Pandaswapex/status/1375834160951140363

@Pandaswapex yield farming is LIVE (as of ~9:45 UTC)!!!

Will try to post live updates on my strategy - GET IT HERE 1ST

But trying to press buttons as fast as possible to make free monies

Will try to post live updates on my strategy - GET IT HERE 1ST

But trying to press buttons as fast as possible to make free monies

#AVAXyieldfarming, *EXTREME* #ALPHAleak

Here's my @Pandaswapex playbook (which can be repeated for future new farms):

1) They told us farming rewards started block 800,000 -> go to avascan.info/blockchain/c/t… to see what block we are at

1/12

Here's my @Pandaswapex playbook (which can be repeated for future new farms):

1) They told us farming rewards started block 800,000 -> go to avascan.info/blockchain/c/t… to see what block we are at

1/12

2) a) Pre-fund the "Liquidity Kings" on $PNG or your favourite @avalancheavax DEX

b) Then LP them on @Pandaswapex

c) Then STAKE them once staking is available - in this case, they were available around 9:30 UTC

Remember that NO $BAMBOO existed at start!

2/12

b) Then LP them on @Pandaswapex

c) Then STAKE them once staking is available - in this case, they were available around 9:30 UTC

Remember that NO $BAMBOO existed at start!

2/12

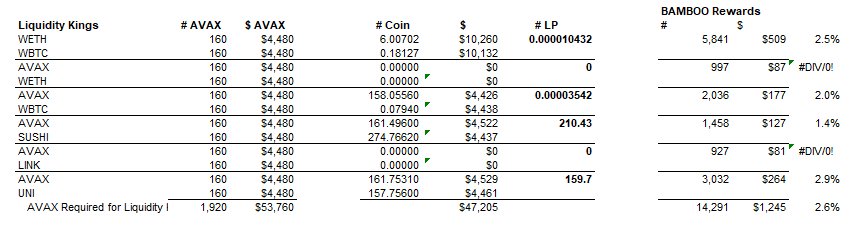

3) Once farming starts, put together a simple XLS to track your rewards. Extreme price discovery & not much info, so this is the only way to see quickly which farms have the best yield. Here's the rough-and-ready analysis I put together

3/12

3/12

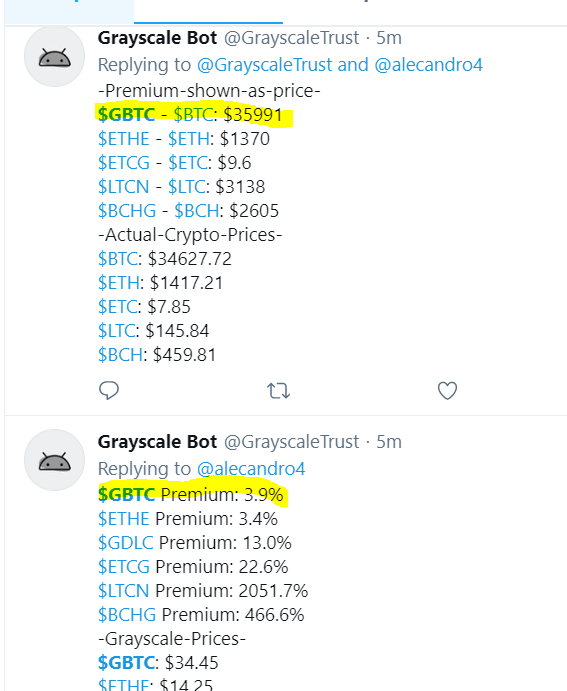

4) Once $BAMBOO is generated, go to @yieldyak_ Price Comparison to track price of $BAMBOO, which

a) helps you track price discovery & stability of project

b) helps you track your reward yield

yieldyak.com/compare

4/12

a) helps you track price discovery & stability of project

b) helps you track your reward yield

yieldyak.com/compare

4/12

5) Once you generate enough $BAMBOO from your "Liquidity Kings" LPs, LP this BAMBOO with Pool 2 LPs, i.e. those that are paired with BAMBOO, like BAMBOO-AVAX, BAMBOO-SUSHI.

In this case we know BAMBOO-AVAX has the highest emissions so start with that

5/12

In this case we know BAMBOO-AVAX has the highest emissions so start with that

5/12

6) As you can see, $BAMBOO-$AVAX LP has proved to be quite lucrative (>50% yield in an hour)...

So I'm tracking all the pools, harvesting the rewards & aggressively re-investing them into our KING money maker BAMBOO-AVAX

Meanwhile...

6/12

So I'm tracking all the pools, harvesting the rewards & aggressively re-investing them into our KING money maker BAMBOO-AVAX

Meanwhile...

6/12

7) Next, in the case of @Pandaswapex, there are a LOT of pools, so that means even with apes, there will be opps to take advantage. Everyone knows $BAMBOO-$AVAX gets the most rewards so everyone attacked that like us

7/12

7/12

So what I did was prefunded my account with all the Pool 2 coins: $ETH, $BTC, $LINK, $SUSHI, $ETH. Also I made sure to have LOTs of $AVAX as in the 1st few hrs, we want to be able to reinvest with impunity

As $BAMBOO rewards coming in, I'm starting new Pool 2 LPs

8/12

As $BAMBOO rewards coming in, I'm starting new Pool 2 LPs

8/12

in this case, I started adding to $BAMBOO-$YFI & $BAMBOO-$SNOB, as they are least interesting or most esoteric so might not be attracting capital

At this stage, its all a guesstimate/strategery, & when we get more info (later), we can be more analytical. Now though we APE

9/12

At this stage, its all a guesstimate/strategery, & when we get more info (later), we can be more analytical. Now though we APE

9/12

All the while, we are evaluating all the APYs and reallocating (adding/removing) funds to maximise. For example, $ETH-$BTC was yielding 5.0%, while $AVAX-ETH was yielding 1.5%, so I un-LPed that and added to ETH-BTC

10/12

10/12

We should be monitoring $BAMBOO price to ensure the stability of the project - yield farming is a confidence game, & things can collapse quickly

In this case, BAMBOO was fluctuating wildly, then settled at ~$0.09, & now price is actually now increasing to ~$0.18

11/12

In this case, BAMBOO was fluctuating wildly, then settled at ~$0.09, & now price is actually now increasing to ~$0.18

11/12

Everything is going to plan. Apologies for the rough & ready analysis, but thought it would be super instructive to you guys. Ping me with any questions

Be careful & be safe - this is just my actions & NOT investment advice!

Current snapshot below:

12/12

Be careful & be safe - this is just my actions & NOT investment advice!

Current snapshot below:

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh