Where do NFTs capture value?

One word - curation ✨

My first tokenized essay - $VALUE - is now live on @viamirror ⬇️

coopahtroopa.mirror.xyz/A16NP2XXi9RdHp…

One word - curation ✨

My first tokenized essay - $VALUE - is now live on @viamirror ⬇️

coopahtroopa.mirror.xyz/A16NP2XXi9RdHp…

NFTs move seamlessly between marketplaces and applications.

Here's a look at some of the key players that exist today.

Here's a look at some of the key players that exist today.

Marketplaces will introduce curation tokens - allowing collectors to signal to the most valuable creators.

Curators that attract the most sales earn the most rewards.

Curators earn tokens, commissions and delegation by playing matchmaker between creator and collector.

Curators that attract the most sales earn the most rewards.

Curators earn tokens, commissions and delegation by playing matchmaker between creator and collector.

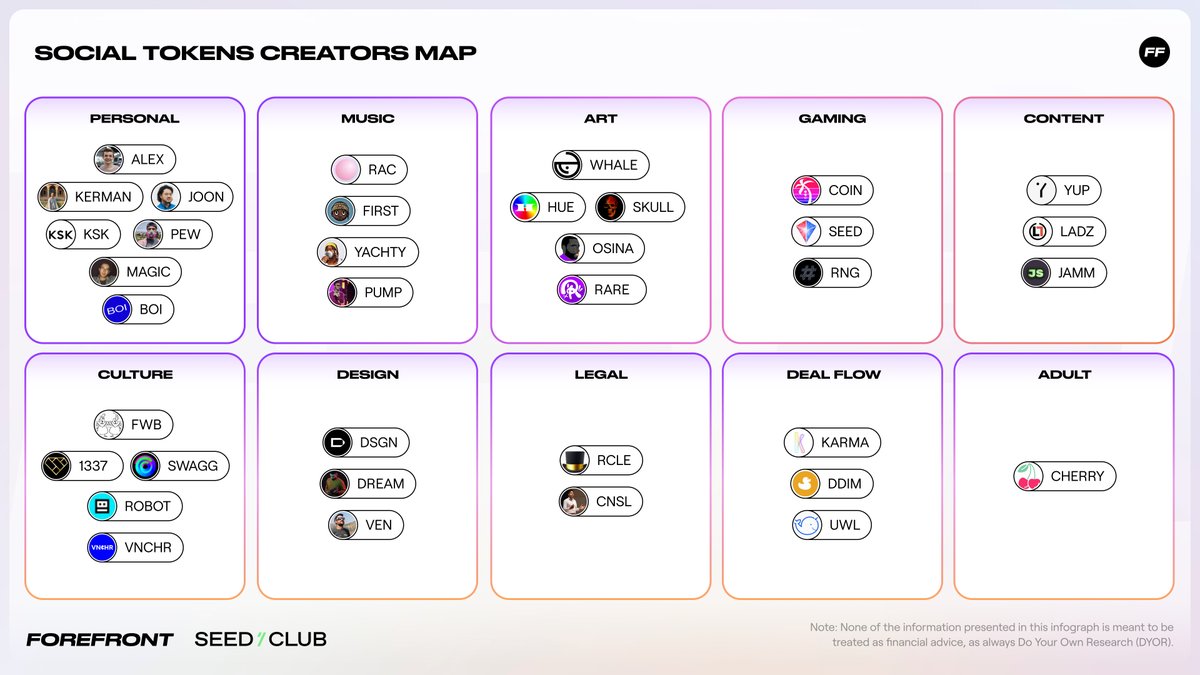

Every creator becomes their own micro-economy.

NFTs retain and increase their value by creating a diverse network of curators that share in that collection.

This is why CryptoPunks have performed so well.

NFTs retain and increase their value by creating a diverse network of curators that share in that collection.

This is why CryptoPunks have performed so well.

https://twitter.com/peruggia_v/status/1370258347341934593?s=20

Value is directly correlated to community and the longevity of specific collections.

NFTs with shared experiences - like $SOCKS - will always have a home.

To incubate this spirit - work with curators.

NFTs with shared experiences - like $SOCKS - will always have a home.

To incubate this spirit - work with curators.

https://twitter.com/lay2000lbs/status/1366167992279719938?s=20

Curators decide which NFTs have value, and which do not.

Curators signal to value and offer services like distribution and strategy to enhance that value.

Without curators - there is no market for NFTs and therefore, no value.

Curators signal to value and offer services like distribution and strategy to enhance that value.

Without curators - there is no market for NFTs and therefore, no value.

Groups like @FLAMINGODAO and Gremlins curate and collect together.

Agencies like @sixnft curate strategies, distribution, admin, and a seal of approval.

Creators bundle premium services to empower and incubate curators.

Agencies like @sixnft curate strategies, distribution, admin, and a seal of approval.

Creators bundle premium services to empower and incubate curators.

https://twitter.com/jessewldn/status/1367875874889031690?s=20

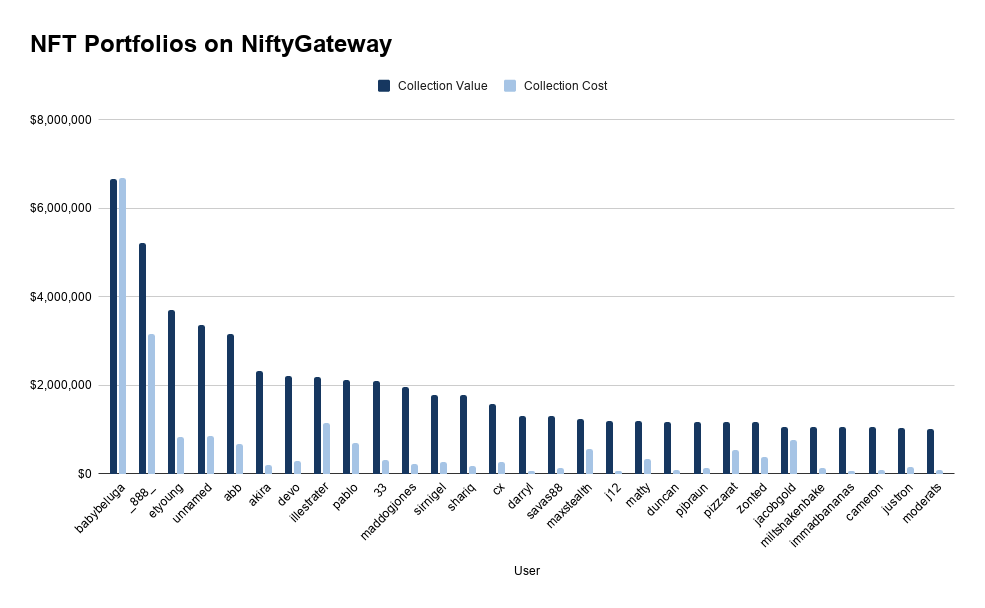

Take @WhaleShark_Pro - a curator who democratized ownership of his NFTs through a social token called $WHALE.

Governance rest in the hands of the @whale_community through a WHALE DAO - estimated to be worth ~$70M.

Governance rest in the hands of the @whale_community through a WHALE DAO - estimated to be worth ~$70M.

https://twitter.com/WhaleShark_Pro/status/1374918252086796288?s=20

When valuing a curator, look for the following:

- Which collections do they own?

- Were they early?

- Do they have influence?

- Do they have strong leadership?

- Is there democratized access?

If yes, find a way to own that basket.

- Which collections do they own?

- Were they early?

- Do they have influence?

- Do they have strong leadership?

- Is there democratized access?

If yes, find a way to own that basket.

The best curators organize around new collections using shared capital to incubate rising talent.

If you’re looking to deploy capital into NFTs, look no further than the curators.

The hardest part is going to be getting accepted.

If you’re looking to deploy capital into NFTs, look no further than the curators.

The hardest part is going to be getting accepted.

https://twitter.com/Cooopahtroopa/status/1374101538734448641?s=20

Special thanks @jessewldn @john_c_palmer @alexxzzhang and @carlosecgomes for their feedback.

The owner of this NFT will receive:

- A first look at all my future pieces

- A one hour working session

- 60 $FWB for @FWBtweets Season Two.

Happy curating!

zora.co/0xec7b4c86659F…

The owner of this NFT will receive:

- A first look at all my future pieces

- A one hour working session

- 60 $FWB for @FWBtweets Season Two.

Happy curating!

zora.co/0xec7b4c86659F…

• • •

Missing some Tweet in this thread? You can try to

force a refresh