Here's why I'm super bullish on $FARM 👇

1/

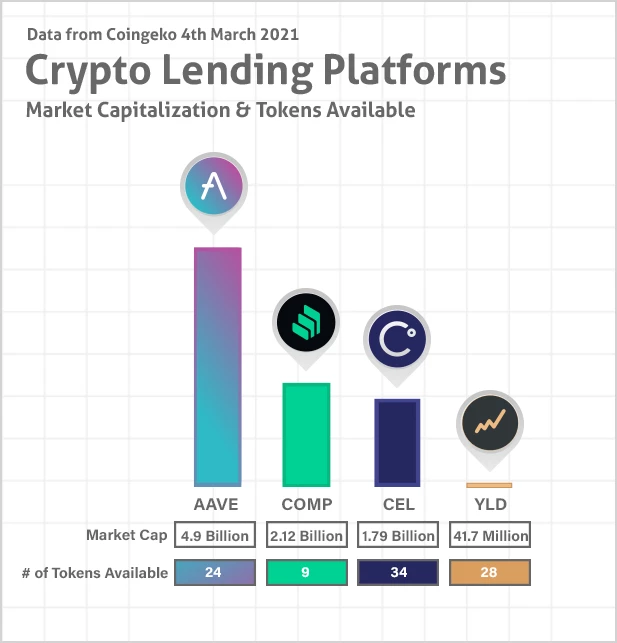

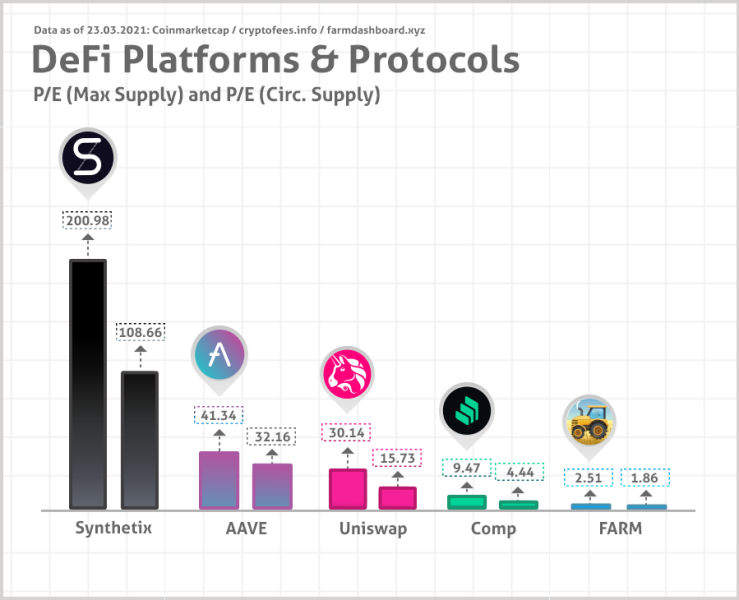

$FARM brings $200k daily @ $125M Mcap (yup, Million)

$SNX brings $50k daily @ $2B Mcap (yes, 2 Billion)

$AAVE brings $360K daily @ $4B Mcap (again Billion mcap)

And sure, they operate in different sectors, but let that sink in.

1/

$FARM brings $200k daily @ $125M Mcap (yup, Million)

$SNX brings $50k daily @ $2B Mcap (yes, 2 Billion)

$AAVE brings $360K daily @ $4B Mcap (again Billion mcap)

And sure, they operate in different sectors, but let that sink in.

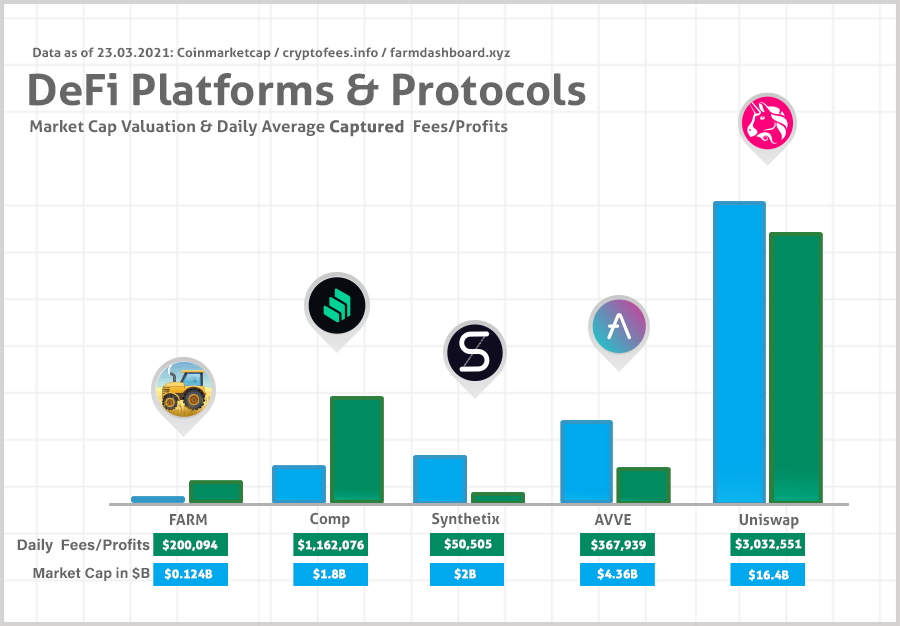

2/ P/E ratio shows that $FARM is insanely undervalued.

On the other side, $SNX, while being a great product, is off the charts because of capturing *only* $50K daily at a $2B valuation.

On the other side, $SNX, while being a great product, is off the charts because of capturing *only* $50K daily at a $2B valuation.

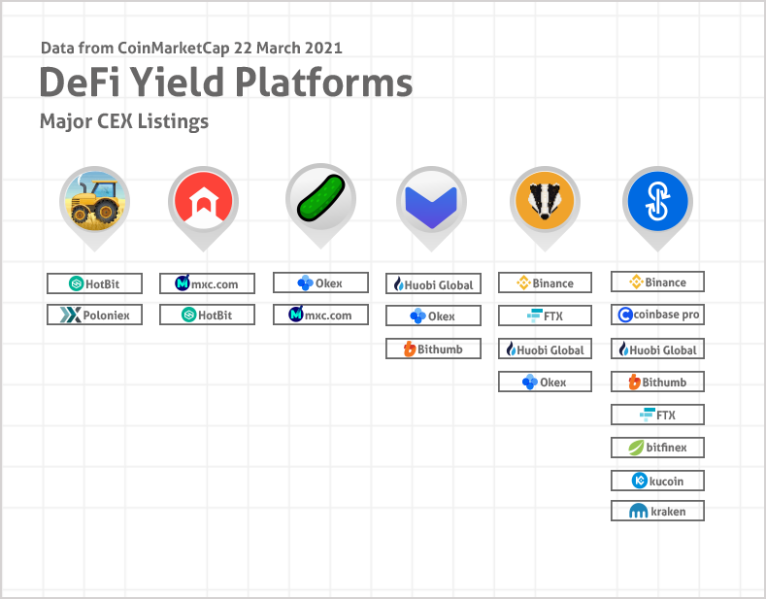

3/ On top of that, $FARM hasn't been listed yet by any top #CEX as compared to most of the other yield accruing protocols.

$BOND $PICKLE $VALUE $BADGER $YFI

$BOND $PICKLE $VALUE $BADGER $YFI

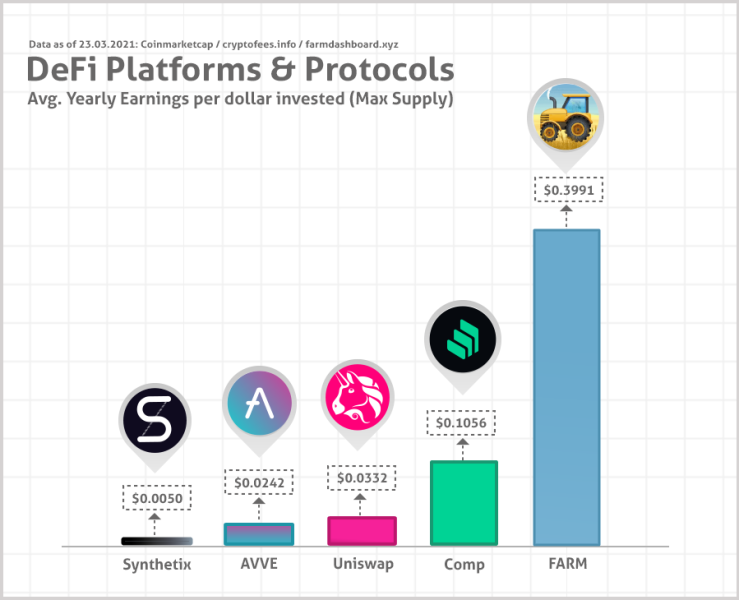

4/ Bonus: IF, I repeat, if all the protocols were to pay out dividends based on the amount of $ they capture for their stakeholders on the same basis:

Shown as per dollar invested.

$SNX $AAVE $UNI $COMP $FARM

Shown as per dollar invested.

$SNX $AAVE $UNI $COMP $FARM

5/ On a side note, it's still really hard to calculate or even get the right $ numbers in #DeFi. Some projects don't disclose them or their dashboard/dune analytics show everything from user growth/platform usage but not $$$ :/ If you spot a miscalculation, let me know!

7/ Almost forgot; @harvest_finance is about to expand to #BSC in no time

You better fasten your seatbelts

You better fasten your seatbelts

https://twitter.com/harvest_finance/status/1375204548092985346

• • •

Missing some Tweet in this thread? You can try to

force a refresh