Modelling the approximate "Blow Out Portfolio" of 9 blocks sold Friday.

Blue is the portfolio value if long-only (in USD mm).

Greenish is the portfolio vs a 100% NDX hedge (as of 31Dec19).

Red is 15 day realized EWMA (0.94) volatility.

Blue is the portfolio value if long-only (in USD mm).

Greenish is the portfolio vs a 100% NDX hedge (as of 31Dec19).

Red is 15 day realized EWMA (0.94) volatility.

Delta-neutral portfolio volatility (against NDX) was at the high end of its range (averaging 24+%ytd) AND the Basket performance vs NDX was super strong.

The long-only portfolio was up 62.4%ytd as of 19 Mar.

A delta-neutral (daily re-hedge vs NDX) was +61.4%ytd to 19 Mar.

The long-only portfolio was up 62.4%ytd as of 19 Mar.

A delta-neutral (daily re-hedge vs NDX) was +61.4%ytd to 19 Mar.

The question is... were there warning signs?

The answer: Being blunt, yes.

A tech-y basket hedged delta-neutral to a tech-y index was up 61.4%ytd against 24.6% vol which annualises out to an information ratio which should boggle the mind (61.4% rtn in 78d - do the math).

The answer: Being blunt, yes.

A tech-y basket hedged delta-neutral to a tech-y index was up 61.4%ytd against 24.6% vol which annualises out to an information ratio which should boggle the mind (61.4% rtn in 78d - do the math).

Since end-Sep, on a LO basis, there had only been 35 down days (out of 117) and only 18 days where the rolling 5-day P&L had been negative. Virtu? I understand. Basically long and levered while the market is undergoing volatility from rates and growth/value/mo rotation? Eh?

And all nine names down in one day? That's rare. 8 times in 2019. Twice in Jan-Feb 2020. Five times Mar2020.

Once in May, twice in June, once in early August, then not once since then.

That's unusual too.

Once in May, twice in June, once in early August, then not once since then.

That's unusual too.

As of end-Feb, EWMAvol (20d, 0.94) was nearly twice the average of 2019-2020.

That should *also* have been a warning sign.

But ride your winners, right?

Yes, but...

when your LO basket skyrockets, and intracorrelation ↑ as P&L ↑, you expect the same on the way down.

That should *also* have been a warning sign.

But ride your winners, right?

Yes, but...

when your LO basket skyrockets, and intracorrelation ↑ as P&L ↑, you expect the same on the way down.

A risk manager might question what the impact on P&L of *getting* long had been. Surely if one takes a huge hit getting OUT of $15bn of positions - many near 5% -, getting in was not done without... uh.... impact.

And if you are LEVERED long, one single Terrible, Horrible, No Good, Very Bad Day could have a bad effect.

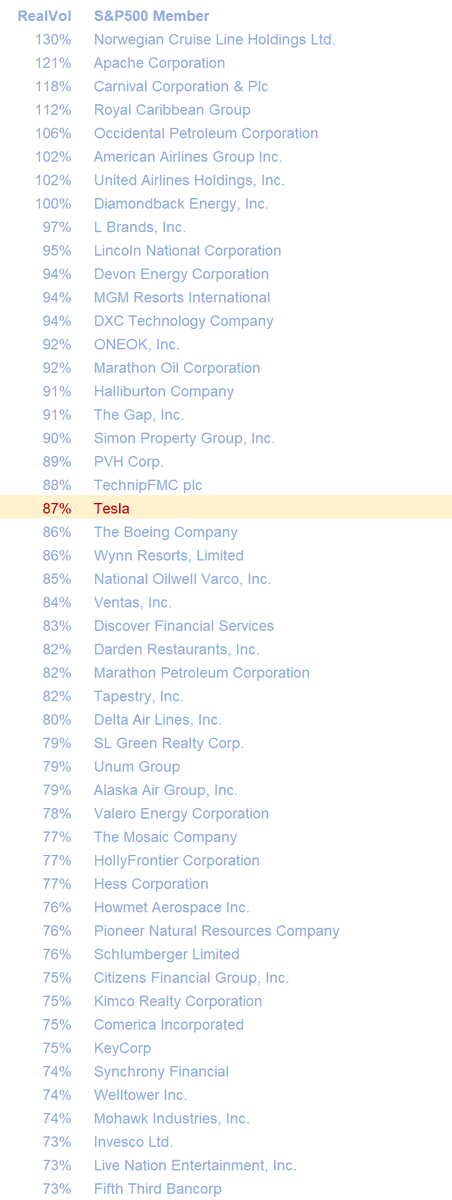

The problem is correlation, leverage, and size.

The numbers below are for a long-only portfolio which is not levered at all.

This all went bad on Wednesday.

The problem is correlation, leverage, and size.

The numbers below are for a long-only portfolio which is not levered at all.

This all went bad on Wednesday.

If the seller had been long US$1bn instead of US$15bn, even levered it would have been a cakewalk to unwind.

Levered 2:1 and that first down day on Tuesday was -7.2%.

Doable.

After all, $631mm down when you were up $2bn in the previous 10 days is fine.

Levered 2:1 and that first down day on Tuesday was -7.2%.

Doable.

After all, $631mm down when you were up $2bn in the previous 10 days is fine.

The opening print the next day was bad. And by end of day, at 2:1 leverage, their fate was effectively sealed. That would have triggered Very Large Margin Calls.

Even if they had been hedged against NDX, didn't matter.

Even if they had been hedged against NDX, didn't matter.

(I was gonna use a different gif from Goodfellas but the curse word doesn't show up).

For people with some history in Asia, there was a fund blowup around 2003-ish which took just a few days. Was similarly Very Concentrated, and Levered, and there had been considerable ‘market impact’ which *coincidentally* had produced a lot of PnL just before the blow-up.

To be clear beyond doubt, this analysis is ONLY based on the 9 listed blocks. I expect the seller had other positions (probably in other time zones) and their investment performance may have been substantially different than shown. Details REALLY matter. But It is one model.

And to further add to this, MS had blocks in some of the same names through the day. Total of $8bn (+ $10.5bn from GS). Given how much capital the FO reportedly started the year with, and the positions, they would have built up more capital and had more than that in positions

If indeed they started forcing themselves out hard on these 9 stocks on Wednesday. The fact that we haven’t seen those suggests they were pre-placed, liquidated in the general hubbub, or there are other shoes to drop.

• • •

Missing some Tweet in this thread? You can try to

force a refresh