Financial History: Sunday Reads

• Suez Canal IPO

• Sinking The Florida Land Bubble

• Suez Crisis & Currency Markets

• Medieval Shipping Contracts & ETFs

• 19th Century VC: Whaling

investoramnesia.com/2021/03/28/a-h…

• Suez Canal IPO

• Sinking The Florida Land Bubble

• Suez Crisis & Currency Markets

• Medieval Shipping Contracts & ETFs

• 19th Century VC: Whaling

investoramnesia.com/2021/03/28/a-h…

While the events of this week at the Suez Canal have been extremely costly, this is certainly not the first time the Suez Canal has stoked international controversy.

Let's take a quick look at the history.

Let's take a quick look at the history.

Here’s a fun fact for you...

Did you know that the Suez Canal was a publicly traded company?

This excellent chart from @GlobalFinData shows the stock returns from IPO in 1862 through the 1930s.

Did you know that the Suez Canal was a publicly traded company?

This excellent chart from @GlobalFinData shows the stock returns from IPO in 1862 through the 1930s.

The Suez Canal Company was formed in 1858 with a market capitalization of $40 Million.

Egyptian government owned 44% of shares, and the remaining 56% was comprised of French and Egyptian investors.

Egyptian government owned 44% of shares, and the remaining 56% was comprised of French and Egyptian investors.

Construction finished at the end of the 1860s, but in 1873 the Egyptian government ran into trouble.

Their leader, Ismail, had borrowed more than 2x the cost of the Suez Canal to fund other infrastructure, and the Egyptian treasury was in serious debt by 1875.

Their leader, Ismail, had borrowed more than 2x the cost of the Suez Canal to fund other infrastructure, and the Egyptian treasury was in serious debt by 1875.

Ismail needed funding, and fast.

The solution? Selling Egypt's stake in the Suez Canal Co.

British PM Benjamin Disraeli secured a loan from Lionel de Rothschild to buy Ismail's shares.

Britain now owned 46% of the Suez Canal Co.

The solution? Selling Egypt's stake in the Suez Canal Co.

British PM Benjamin Disraeli secured a loan from Lionel de Rothschild to buy Ismail's shares.

Britain now owned 46% of the Suez Canal Co.

Following anti-European riots in 1882, Britain invaded and took over Egypt, putting it under "protectorate" status.

In 1888 the Convention of Constantinople declared the Suez canal a neutral zone under British protection.

In 1888 the Convention of Constantinople declared the Suez canal a neutral zone under British protection.

All that changed in 1956.

In this year, Egyptian President Nasser nationalized the canal at the expense of Anglo-French powers.

This provocative action led to the infamous Suez Crisis in 1956, where Israeli / British / French forces tried and failed to wrestle back control.

In this year, Egyptian President Nasser nationalized the canal at the expense of Anglo-French powers.

This provocative action led to the infamous Suez Crisis in 1956, where Israeli / British / French forces tried and failed to wrestle back control.

44%*

Dammit

Dammit

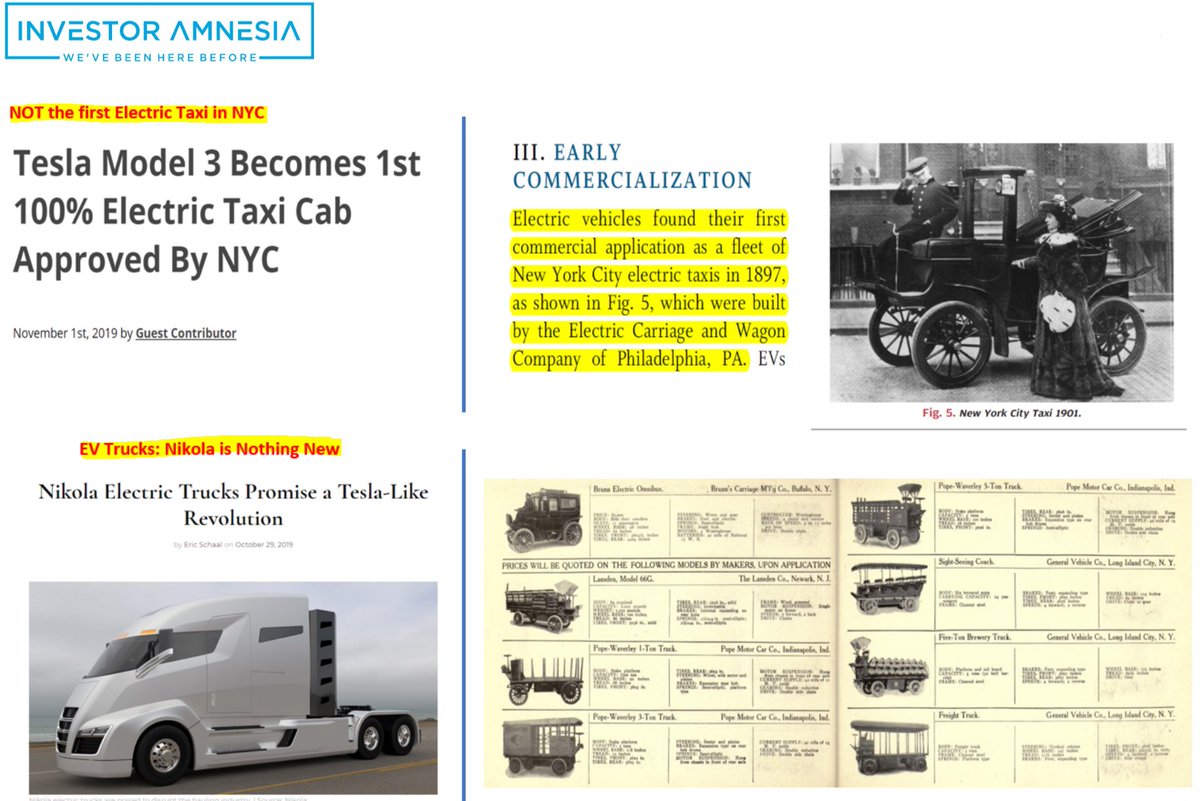

This cartoon is from 1876 and titled “Lion’s Share”.

Shows a British Lion securing the safety of the 'key to India' by acquiring Egypt's shares in the Suez Canal. In the background, British PM Benjamin Disraeli hands a purse of money to Ismail Pasha, Khedive of Egypt.

Shows a British Lion securing the safety of the 'key to India' by acquiring Egypt's shares in the Suez Canal. In the background, British PM Benjamin Disraeli hands a purse of money to Ismail Pasha, Khedive of Egypt.

• • •

Missing some Tweet in this thread? You can try to

force a refresh