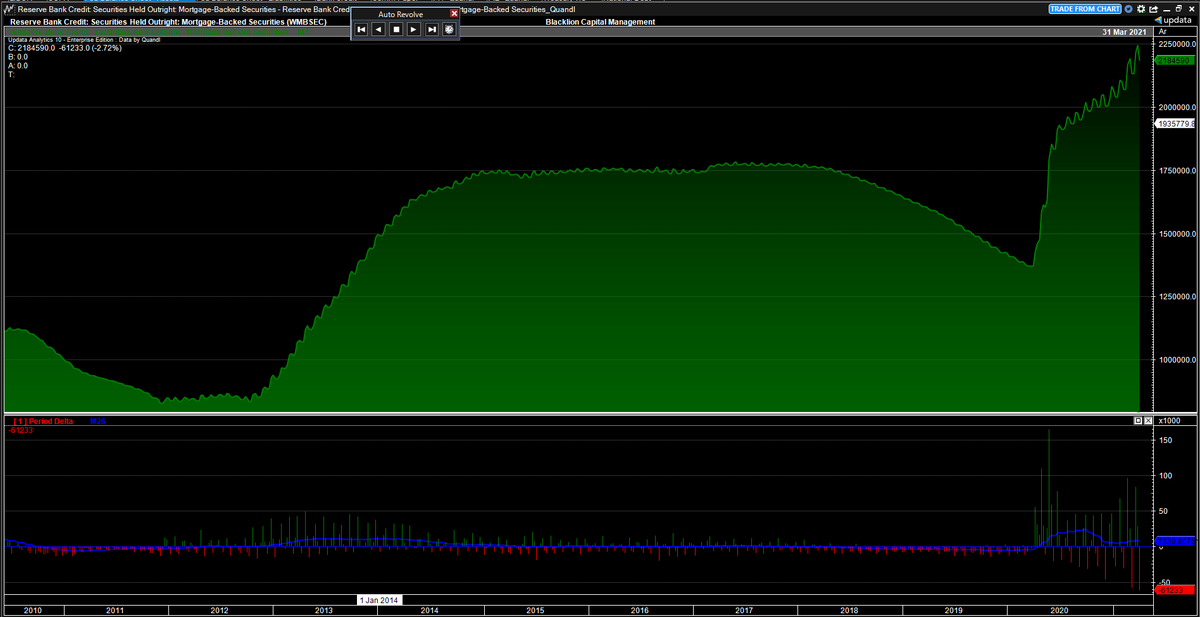

Mortgage Backed Securities continue their increasing maturity volatility (on sheet) as the portfolio expands. Down $62.2B this week.

Fed Balance Sheet Summary Easter Weekend 2021

Sheet Assets⬇️

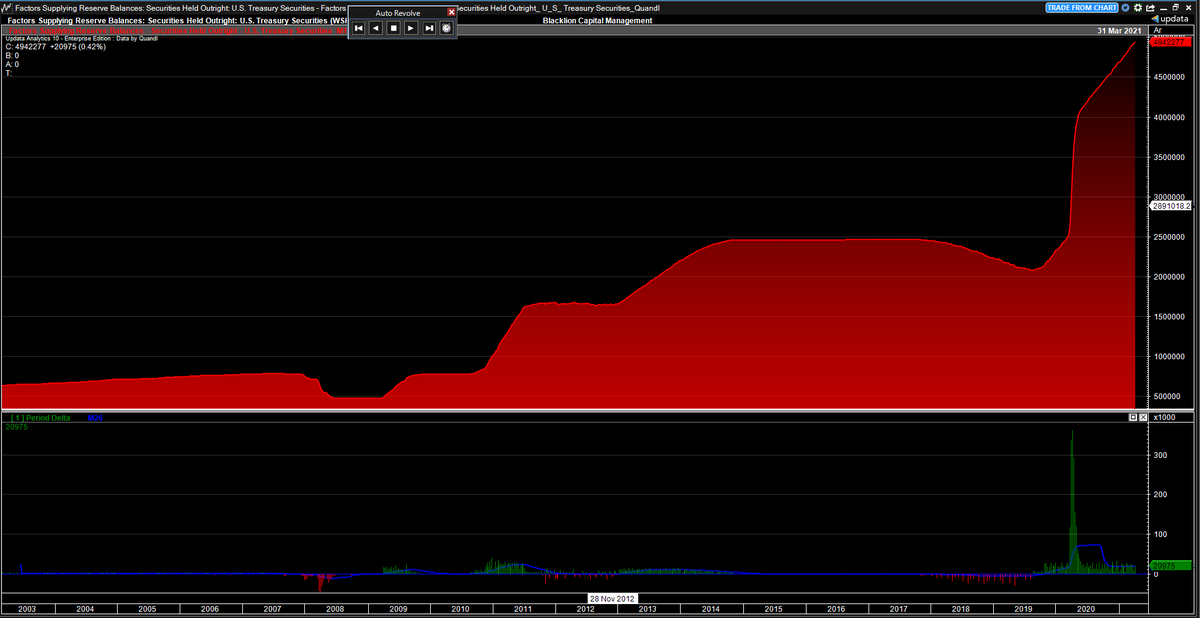

Treasuries⬆️🎉

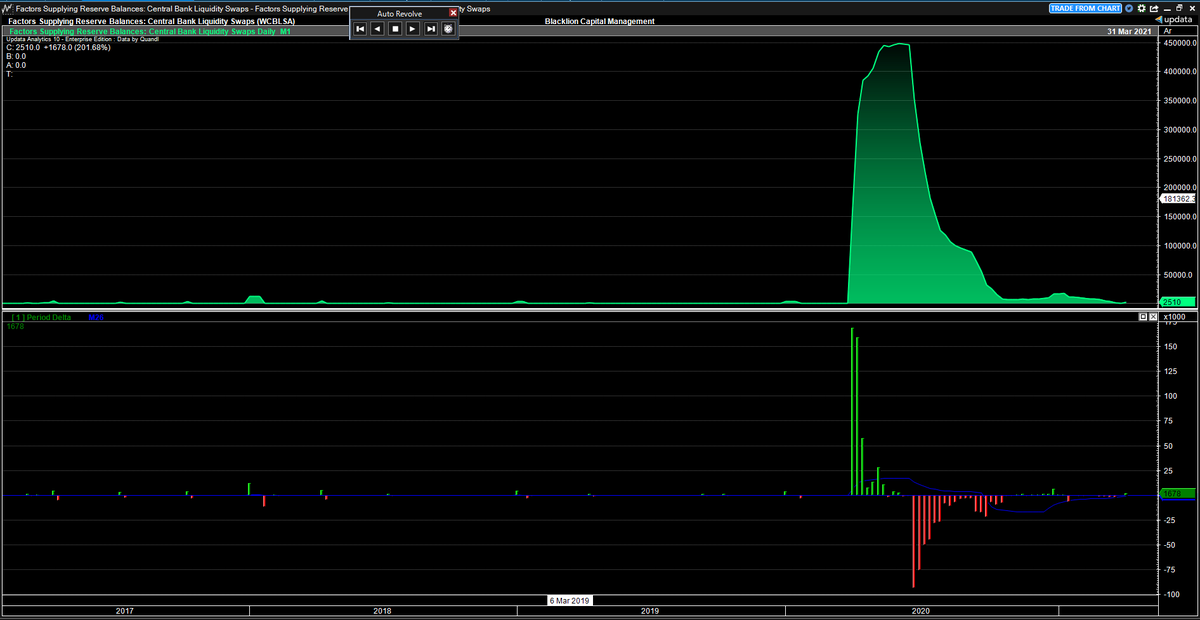

Liquidity Swaps⬆️🧐

MBS⬇️

REPO🥱

Sheet Liabilities⬇️

Other Deposits⬇️

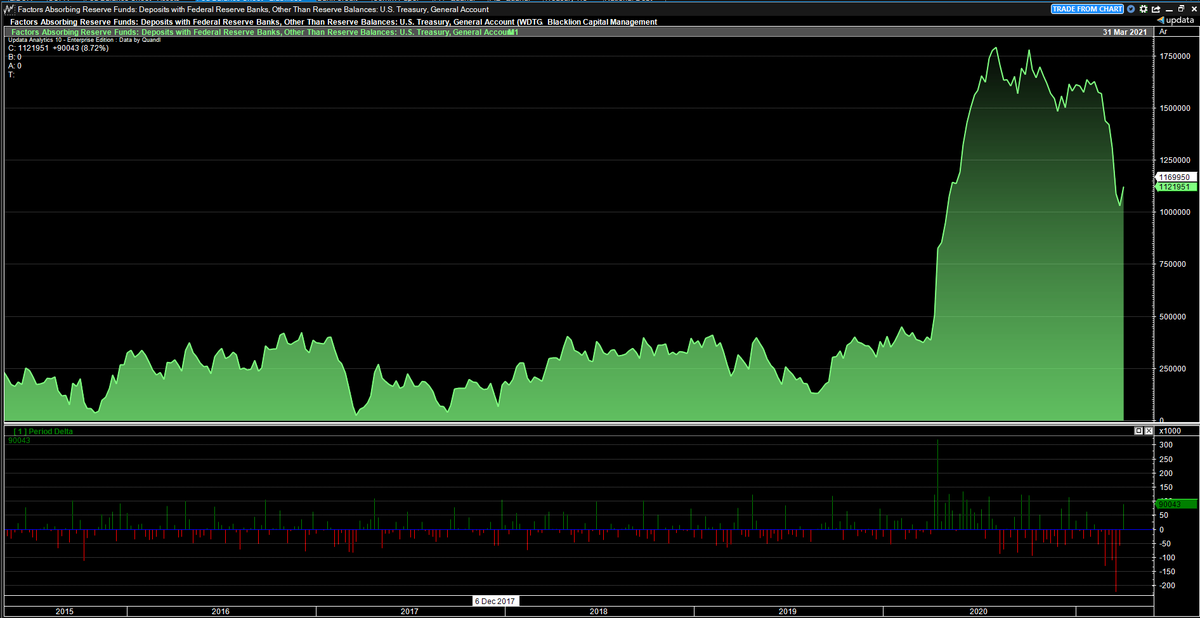

TGA⬆️

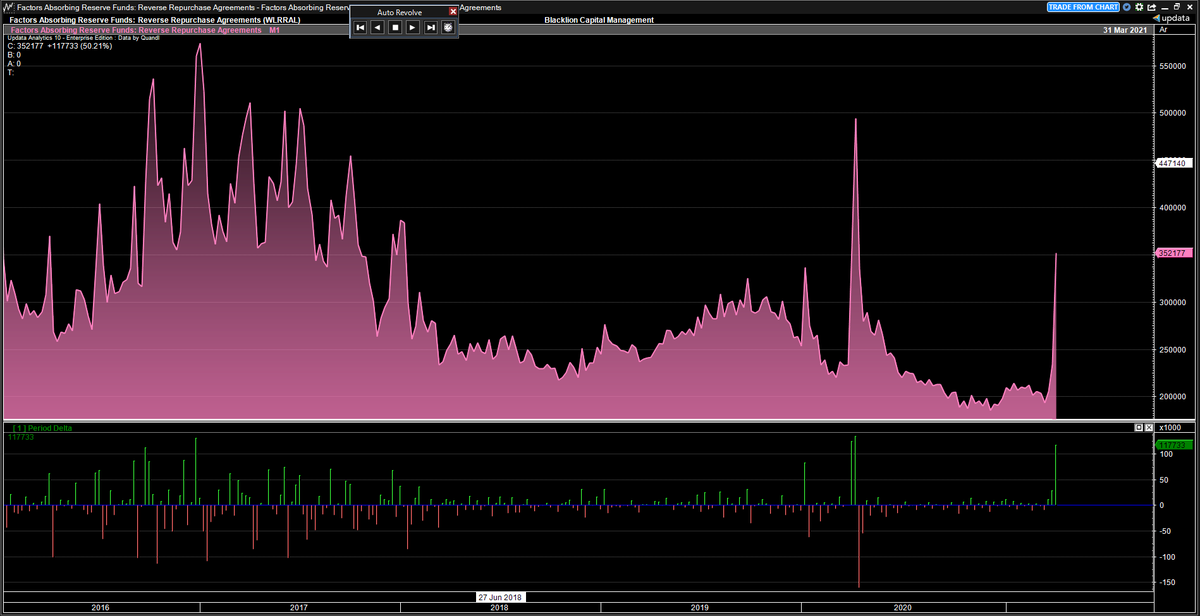

Reverse REPO⬆️🚀

Sheet Assets⬇️

Treasuries⬆️🎉

Liquidity Swaps⬆️🧐

MBS⬇️

REPO🥱

Sheet Liabilities⬇️

Other Deposits⬇️

TGA⬆️

Reverse REPO⬆️🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh