Fed Policy Forecast🧵

This is a timeline and thread open to criticism (constructive please, not 'orange man bad'). I hope others will throw some rocks at this and we all are better for it.

*Fed doesn't raise before Q1 2023 earliest and AFTER QE tapers off.

This is a timeline and thread open to criticism (constructive please, not 'orange man bad'). I hope others will throw some rocks at this and we all are better for it.

*Fed doesn't raise before Q1 2023 earliest and AFTER QE tapers off.

2/J. Powell is focused on full employment that according to the Fed we DID NOT achieve post GFC. The new AIT regime allows inflation to run🔥so it averages 2% over some period. He is consistently dovish in this regard IMO.

3/The highest BLS employment is Feb20 - 152,523,000 so we need to achieve at least that before J.Powell begins tightening and included in that discussion is QE currently $120B+/month.

4/My forecast I am inviting criticism is based on these assumptions:

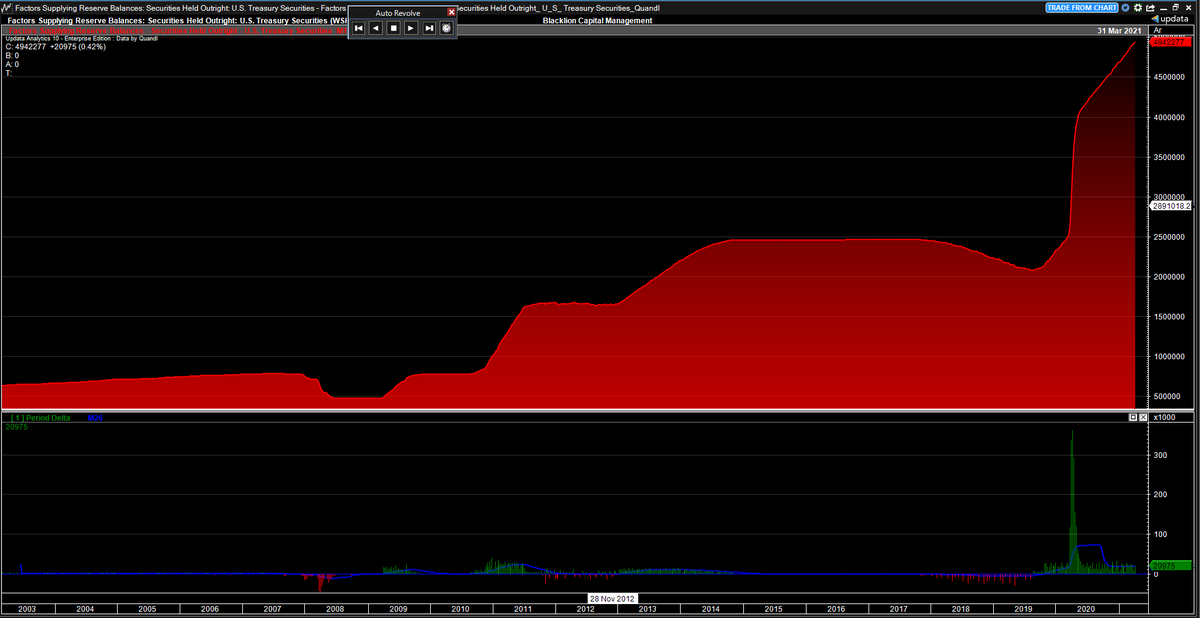

•The Fed will achieve >= prior employment levels BEFORE tapering QE

•FOMC will taper QE BEFORE raising FF. They will taper ~$10B/Month and take ~1 year to wind down QE

•Equity ⬇️20% stops tightening

•The Fed will achieve >= prior employment levels BEFORE tapering QE

•FOMC will taper QE BEFORE raising FF. They will taper ~$10B/Month and take ~1 year to wind down QE

•Equity ⬇️20% stops tightening

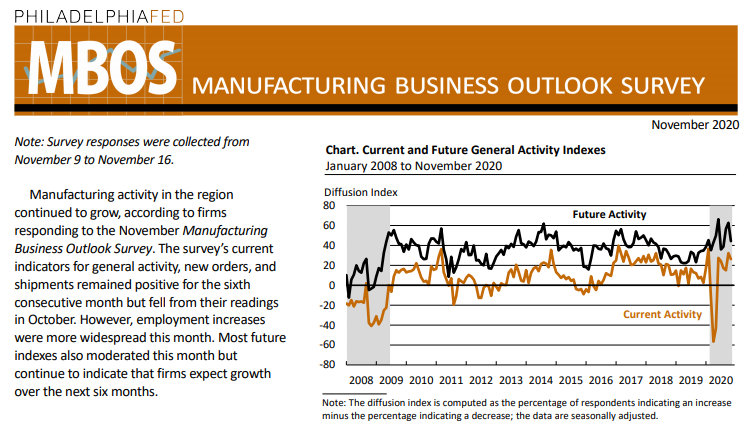

5/Current BLS Employment is 144,120,000. 8,403,000 < Feb 2020 level. If we add jobs at the same rate as this week's report we need 9 more months to hit pre-COVID levels that is Jan 2022.

•Too optimistic or pessimistic?

•QE tapering will begin March2022

•Too optimistic or pessimistic?

•QE tapering will begin March2022

6/QE Tapering will take a year ASSUMING no equity drawdown approaching 20% at which point FOMC folds and stops tapering, all bets off, potential currency crisis.

If all goes well QE ends Feb 2023

If all goes well QE ends Feb 2023

7/First Fed Funds increase is late Q1 2023. Some measures forecast sooner. I think 'the market' doesn't trust Powell and thinks FOMC will tighten (taper QE then raise FF) in anticipation of 2%+ inflation and full employment. I read him differently.

8/So what say you #fintwit? I've a host of reasons this may play out faster or more slowly, but I am mostly here to learn. School me in the art of monetary policy prognostication.

Good follow up poll from Kai @MacroTechnicals

https://twitter.com/MacroTechnicals/status/1379119001222152192?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh