Indian Plastic Pipes and Fittings Industry: A Huge multiyear growth opportunity 📈

-Industry to grow at 12-14%. CAGR over next few years.

-Organised segment accounts for 60-65% market share.

(1/8)

-Industry to grow at 12-14%. CAGR over next few years.

-Organised segment accounts for 60-65% market share.

(1/8)

Major Growth Drivers-

-Government focus

-Increase in India's per capita plastic consumption.

-Substitution and replacement demand.

- Consolidation in pipes industry.

(2/8)

-Government focus

-Increase in India's per capita plastic consumption.

-Substitution and replacement demand.

- Consolidation in pipes industry.

(2/8)

Types of polymers and applications 👇

-Unplasticised Polyvinyl Chloride (UPVC)

- Chlorinated Polyvinyl Chloride (CPVC)

-High-density Polyethylene (HDPE)

-Polypropylene Random (PPR)

-Composite Pipe

(3/8)

-Unplasticised Polyvinyl Chloride (UPVC)

- Chlorinated Polyvinyl Chloride (CPVC)

-High-density Polyethylene (HDPE)

-Polypropylene Random (PPR)

-Composite Pipe

(3/8)

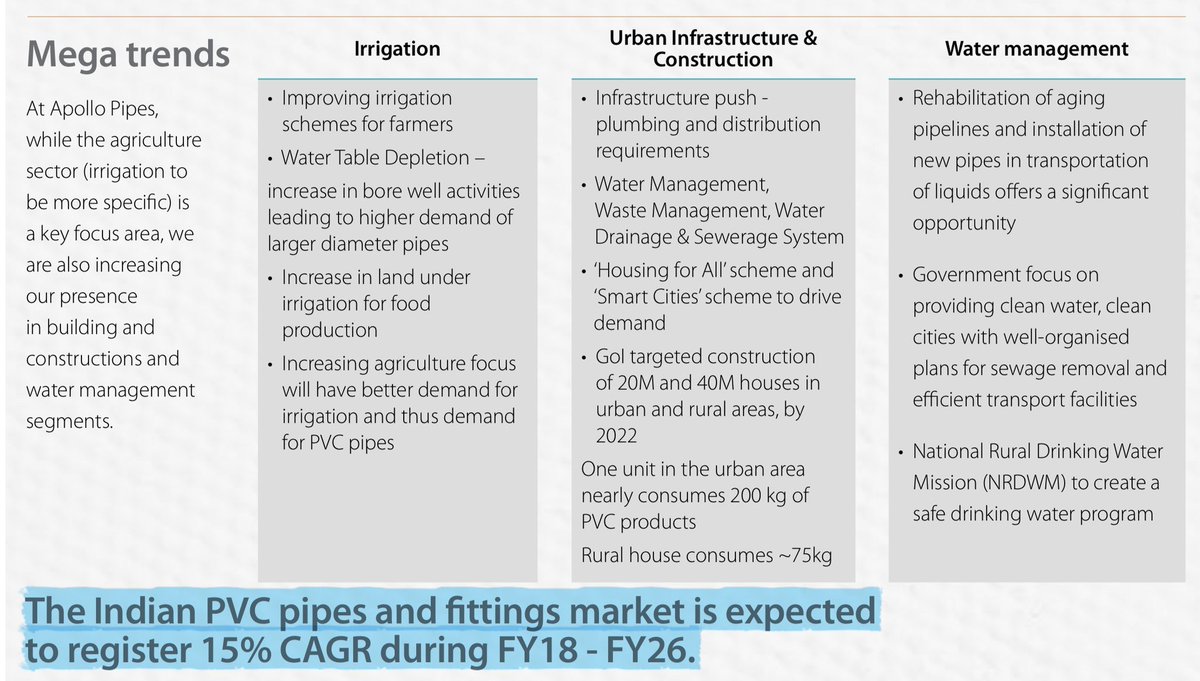

Growth drivers for the Sector: Irrigation

-Biggest end user for plastic pipes with 45-50% share.

-Huge government focus with several schemes.

-Almost 50% arable land still not irritated .

(4/8)

-Biggest end user for plastic pipes with 45-50% share.

-Huge government focus with several schemes.

-Almost 50% arable land still not irritated .

(4/8)

Growth drivers for the Sector:Water Supply and Sanitation (WSS)and Plumbing

-Second largest end user segment for pipes with 35-40% share.

(5/8)

-Second largest end user segment for pipes with 35-40% share.

(5/8)

Growth drivers for the Sector:Real Estate

Huge opportunity in

-Urbanisation

-Growth in tier2 and tier3 cities.

-Affordable Housing

-Government schemes

(6/8)

Huge opportunity in

-Urbanisation

-Growth in tier2 and tier3 cities.

-Affordable Housing

-Government schemes

(6/8)

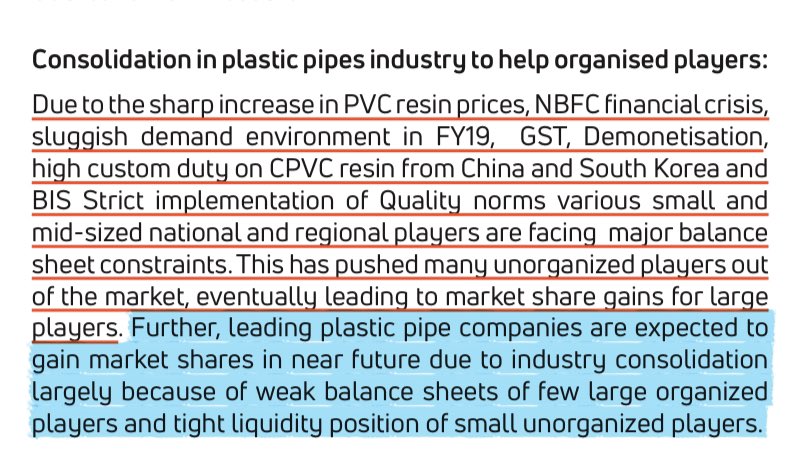

Growth drivers for the Sector:Substitutionand Replacement demand and Industry consolidation

-Organised players gaining market share at the cost of regional players with weak balance sheets.

-Replacement of old pipes and rising demand of cpvc pipes.

(7/8)

-Organised players gaining market share at the cost of regional players with weak balance sheets.

-Replacement of old pipes and rising demand of cpvc pipes.

(7/8)

• • •

Missing some Tweet in this thread? You can try to

force a refresh