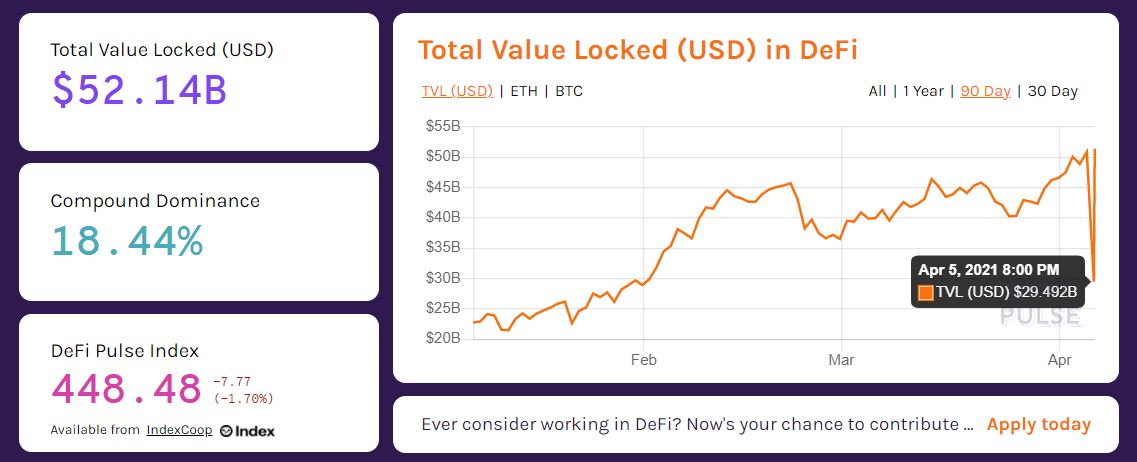

As of Tuesday (4/6), all of DeFi has $52.14B in TVL. @NexusMutual has $341.1M in TVL.

That leaves most users exposed to potential loss from compromised code. Nexus Mutual was created to solve this problem.

Members of the mutual protect cover holders from getting #rekt. (1/6)

That leaves most users exposed to potential loss from compromised code. Nexus Mutual was created to solve this problem.

Members of the mutual protect cover holders from getting #rekt. (1/6)

Nexus Mutual is a discretionary mutual, which means the mutual does not offer traditional insurance; instead, the mutual offers cover products.

A discretionary mutual model gives members the ability to purchase cover that offers discretionary risk protection to members. (2/6)

A discretionary mutual model gives members the ability to purchase cover that offers discretionary risk protection to members. (2/6)

With a traditional insurance company, your policy means you have a contractual right to have your claim paid.

With a discretionary mutual, your cover means you're guaranteed to have your claim reviewed by Claims Assessors who determine whether a claim is accepted or not. (3/6)

With a discretionary mutual, your cover means you're guaranteed to have your claim reviewed by Claims Assessors who determine whether a claim is accepted or not. (3/6)

A discretionary mutual dovetails with the decentralized ethos. Nexus Mutual is made up of members who buy cover to protect on-chain assets deposited in DeFi.

Members act as Risk Assessors & Claims Assessors under a structure driven by cooperation & aligned incentives.(4/6)

Members act as Risk Assessors & Claims Assessors under a structure driven by cooperation & aligned incentives.(4/6)

You can read more about the discretionary mutual model through this link: financialmutuals.org/wp-content/upl… (5/6)

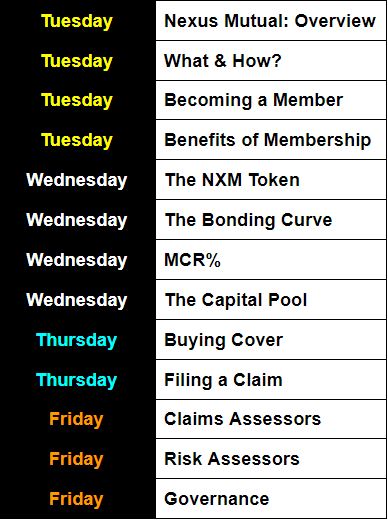

This is just an introductory thread and the first in a series. I’ll be covering the fundamentals behind Nexus Mutual throughout the week. You can find the schedule below.

Next Up: the “What & How?” of Nexus Mutual. (6/6)

Next Up: the “What & How?” of Nexus Mutual. (6/6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh