[THREAD]

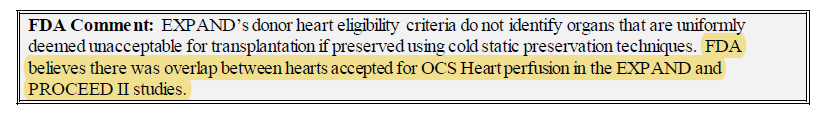

After re-listening to parts of Panel Meeting, I think it is safe to assume:

- $TMDX would only be used for extended-criteria hearts only. For ex. >=4hrs ECCT

- Existing SOC volume won't convert over to OCS (unless run back PROCEED Trial to prove OCS better than SOC)

After re-listening to parts of Panel Meeting, I think it is safe to assume:

- $TMDX would only be used for extended-criteria hearts only. For ex. >=4hrs ECCT

- Existing SOC volume won't convert over to OCS (unless run back PROCEED Trial to prove OCS better than SOC)

1/

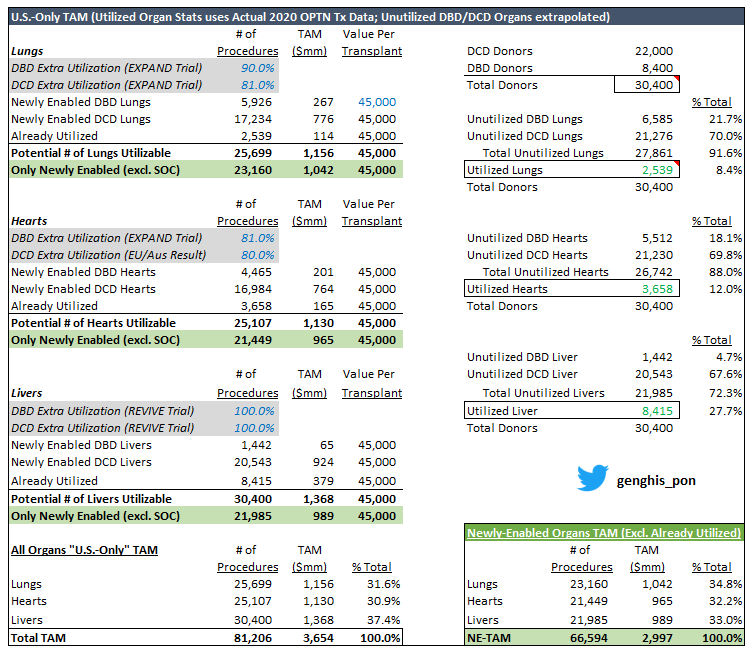

Updated U.S. TAM table above...

- Total Donors (DBD + DCD) same as previous version (30.4K) per $TMDX 10K

- "Already utilized" organs now reflect actual '20 OPTN data (instead of back-calc from 10K)

- Split in unutilized organs between DBD and DCD extrapolated from 10K

Updated U.S. TAM table above...

- Total Donors (DBD + DCD) same as previous version (30.4K) per $TMDX 10K

- "Already utilized" organs now reflect actual '20 OPTN data (instead of back-calc from 10K)

- Split in unutilized organs between DBD and DCD extrapolated from 10K

2/

- 'Newly-Enabled Organs TAM' excludes 'already utilized' organs (assuming that what can be done today w/ SOC will STILL use SOC... not $TMDX OCS)

- Newly-enabled TAM (all organs) for this reduced by 21% from Full TAM which includes 'Already Utilized' volumes

- 'Newly-Enabled Organs TAM' excludes 'already utilized' organs (assuming that what can be done today w/ SOC will STILL use SOC... not $TMDX OCS)

- Newly-enabled TAM (all organs) for this reduced by 21% from Full TAM which includes 'Already Utilized' volumes

3/

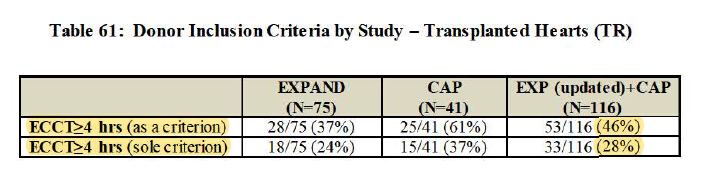

- Math uses 81% Extra Utilization in DBD Heart per EXPAND trial but can actually flex to 84% per EXPAND + CAP... either way still around $2.9Bn (Main star in the show is DCD)

- Again these numbers don't include international (rest of Key Markets) or potential Kidney biz

- Math uses 81% Extra Utilization in DBD Heart per EXPAND trial but can actually flex to 84% per EXPAND + CAP... either way still around $2.9Bn (Main star in the show is DCD)

- Again these numbers don't include international (rest of Key Markets) or potential Kidney biz

4/

- Must apply haircut to TAM b/c a chunk of ppl die @ home (can't get to them till too late), but National Program logistics mapping to partially offset this (would snowball w/ more regions)

- A lot remains to be seen re: how surgeons use OCS if approved (indications etc.)

- Must apply haircut to TAM b/c a chunk of ppl die @ home (can't get to them till too late), but National Program logistics mapping to partially offset this (would snowball w/ more regions)

- A lot remains to be seen re: how surgeons use OCS if approved (indications etc.)

5/ Our view is that demand can be explosive.

Say for hearts, 6.5mm ppl in U.S. have heart failure w/ 5-10% of patients in advanced/end-stage.

That equals 487.5K potential recipients (at midpoint).

Judging from this alone, the supply should be filled if approved.

Say for hearts, 6.5mm ppl in U.S. have heart failure w/ 5-10% of patients in advanced/end-stage.

That equals 487.5K potential recipients (at midpoint).

Judging from this alone, the supply should be filled if approved.

6/ In 2020, 12,588 donors died and donated >=1 organ, while there were only 3,722 Heart Transplants.

In response to Al Stammers on FDA Panel the other day, CEO Waleed confirmed that w/ just DBD alone (using EXPAND+CAP extra utilization)...

Transplant volumes can double.

In response to Al Stammers on FDA Panel the other day, CEO Waleed confirmed that w/ just DBD alone (using EXPAND+CAP extra utilization)...

Transplant volumes can double.

7/ Our math gets to 4,454 extra hearts or 2.2x today's volume.

If can achieve, that's $200mm in sales for that alone ($45K/Tx).

DCD will then open pool to potential 16,943 hearts. If achieve, that's another $762mm.

(All of this while disregarding already utilized hearts)

If can achieve, that's $200mm in sales for that alone ($45K/Tx).

DCD will then open pool to potential 16,943 hearts. If achieve, that's another $762mm.

(All of this while disregarding already utilized hearts)

8/ DCD Heart will have readout of top line data

- May / may not have Panel meeting (has breakthrough designation, so potential streamline process)

- Expect to file PMA in Q3'21

- Approval probably 9-12mo post-file (so '22)

By that time, National Program likely very strong.

- May / may not have Panel meeting (has breakthrough designation, so potential streamline process)

- Expect to file PMA in Q3'21

- Approval probably 9-12mo post-file (so '22)

By that time, National Program likely very strong.

9/ Moreover, all the math drive off 30.4K assumption of donors per $TMDX 10K.

IMO 30.4K sounds low given 2.8mm deaths a year in U.S. + 165mm signed up to be organ donors.

Filtering down w/ CDC by age, place of death, etc... 30.4K still looks small.

IMO 30.4K sounds low given 2.8mm deaths a year in U.S. + 165mm signed up to be organ donors.

Filtering down w/ CDC by age, place of death, etc... 30.4K still looks small.

https://twitter.com/genghis_pon/status/1376536397503365126?s=21

10/ DBD + DCD newly enabled hearts give sales opp of $962mm total.

If you apply haircut of 50% assuming death @ home, families refusing to sign off, logistics issues...

It's still $480mm for just U.S. hearts.

Haircut gets smaller as National Program gets efficient.

If you apply haircut of 50% assuming death @ home, families refusing to sign off, logistics issues...

It's still $480mm for just U.S. hearts.

Haircut gets smaller as National Program gets efficient.

11/ National Program can help $TMDX strong-arm competitors so I have fewer concerns about other players gaining lots of U.S. share.

At $33.50/share, I have EV of $884.7mm using FDSO.

10.2x EV/'22 Sales

5.9x EV/'23 Sales

Execution matters & have to keep retesting. That said...

At $33.50/share, I have EV of $884.7mm using FDSO.

10.2x EV/'22 Sales

5.9x EV/'23 Sales

Execution matters & have to keep retesting. That said...

12/ Don't think $TMDX is expensive but my time-frame is long. My views only.

I think 22K DCD deaths of which 16.9K hearts can potentially be used by OCS is a huge number / sales opp that will be a landslide when approved.

DCD donor hearts possible only b/c of $TMDX.

I think 22K DCD deaths of which 16.9K hearts can potentially be used by OCS is a huge number / sales opp that will be a landslide when approved.

DCD donor hearts possible only b/c of $TMDX.

13/ That alone gives $762mm total sales opp.

In addition, surgeons would embrace DCD hearts.

It won't be on the fence.

There's no competition.

I reckon the ramp up will be much FASTER than we expect for DCD b/c there's no other choice and can provide immediate benefit.

In addition, surgeons would embrace DCD hearts.

It won't be on the fence.

There's no competition.

I reckon the ramp up will be much FASTER than we expect for DCD b/c there's no other choice and can provide immediate benefit.

14/ OPTN has multiple data pulls which spit out similar numbers but are actually different.

This table below now exactly ties the # of utilized hearts to $TMDX's sponsor presentation.

DBD Opp $201mm

DCD Opp $764mm

Newly-Enabled Organ U.S. TAM $3.0Bn vs. $2.9Bn in 1st slide.

This table below now exactly ties the # of utilized hearts to $TMDX's sponsor presentation.

DBD Opp $201mm

DCD Opp $764mm

Newly-Enabled Organ U.S. TAM $3.0Bn vs. $2.9Bn in 1st slide.

Please look at last tweet in thread for a revised table with 3,658 hearts and the corresponding outputs.

OPTN has a lot of data and I linked a different row to populate first table up top. Would recommend looking at last table in thread instead for 100% clarity.

OPTN has a lot of data and I linked a different row to populate first table up top. Would recommend looking at last table in thread instead for 100% clarity.

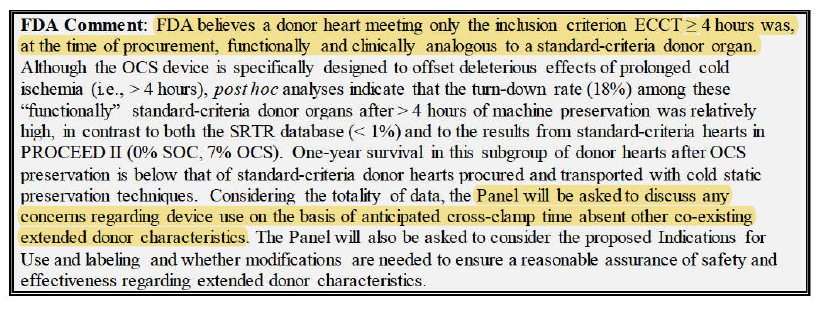

This 50% haircut can presumably include scenarios where Tx surgeon choose to wait longer to use SOC donor heart nearby instead of OCS extended-criteria heart.

As noted on Panel, there will be cases where Tx surgeons prefer to harvest hearts locally w/ SOC to get 95% survival.

As noted on Panel, there will be cases where Tx surgeons prefer to harvest hearts locally w/ SOC to get 95% survival.

• • •

Missing some Tweet in this thread? You can try to

force a refresh