Quick look at a few #sentiment charts:

Investor Intelligence newsletter sentiment metric continues to recover with bulls 60.8% (+6.4%), bears 16.7% (-.8%) and the correction camp at 22.5% (-5.6%)

chart via @WillieDelwiche

Investor Intelligence newsletter sentiment metric continues to recover with bulls 60.8% (+6.4%), bears 16.7% (-.8%) and the correction camp at 22.5% (-5.6%)

chart via @WillieDelwiche

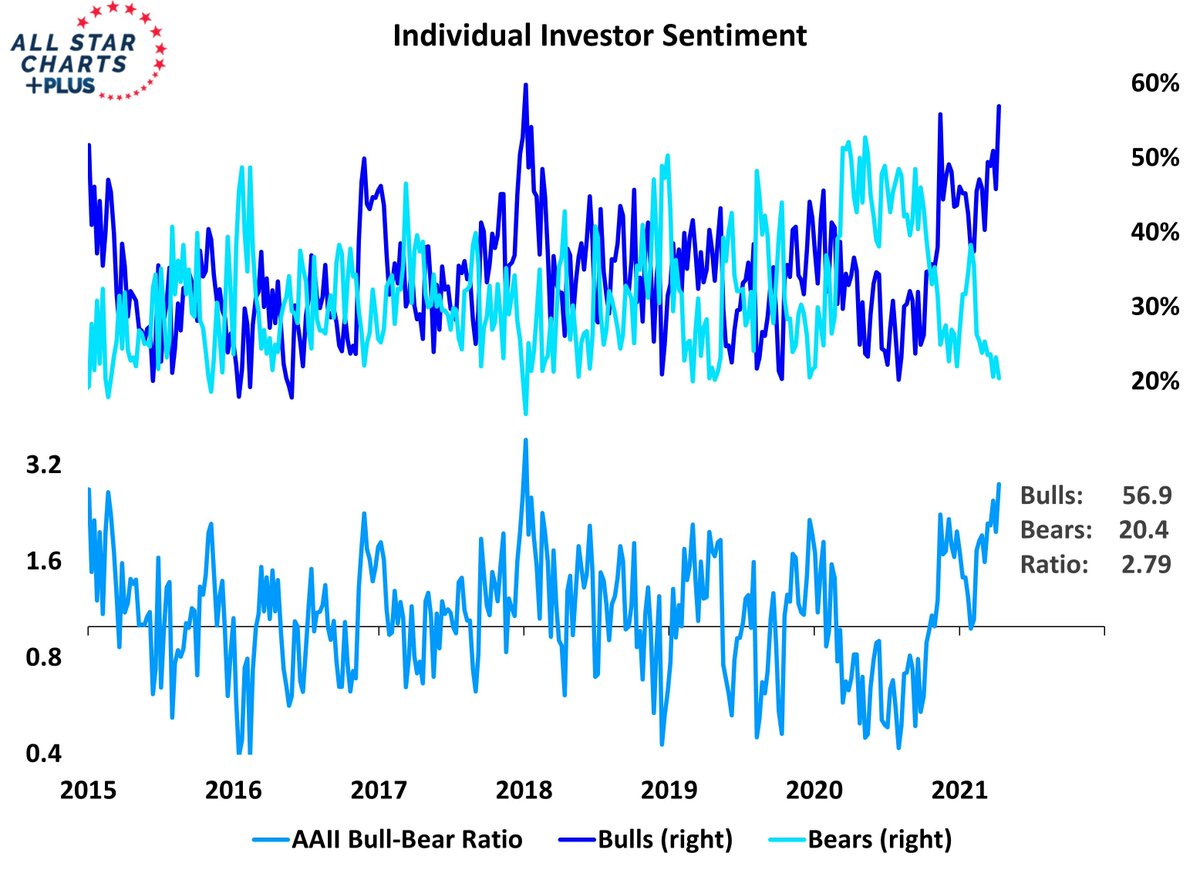

Retail investor #sentiment much more optimistic with those expecting the stock market to continue to rally at the highest levels since January 3rd 2018:

chart via @WillieDelwiche

chart via @WillieDelwiche

NAAIM Exposure Index has recovered with 90% avg and 80% median.

The net of extremes has also bounced back from the recent #contrarian pessimism I pointed out several weeks ago and is now back to more normal historical levels:

The net of extremes has also bounced back from the recent #contrarian pessimism I pointed out several weeks ago and is now back to more normal historical levels:

And for good measure, here's a bond #sentiment chart showing Consensus Bulls at historic extremes:

chart via @topdowncharts

chart via @topdowncharts

Spread between University of Michigan’s Consumer Sentiment & Conference Board’s Consumer Confidence at -24.8%, lower than 86% of monthly readings since 1970.

Attitudes of consumer's immediate personal circumstances vs general view of the overall economy.

marketwatch.com/story/why-cons…

Attitudes of consumer's immediate personal circumstances vs general view of the overall economy.

marketwatch.com/story/why-cons…

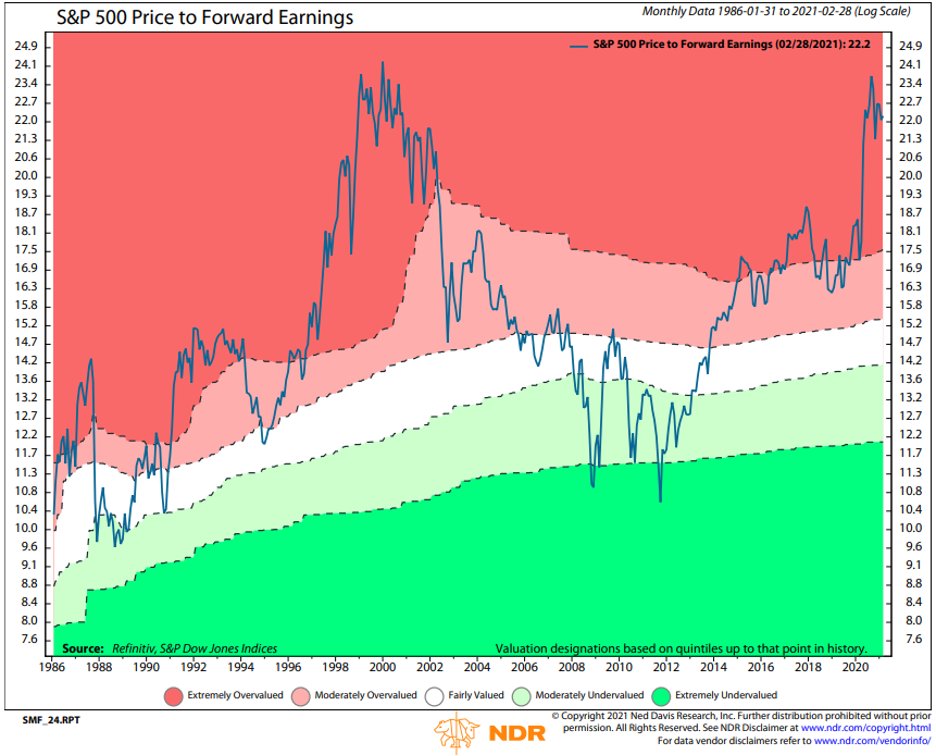

Goldman Sachs Risk Appetite Indicator reached the heights last seen in early 2018 and has since retraced ever so slightly - remaining at historic thin-air elevations:

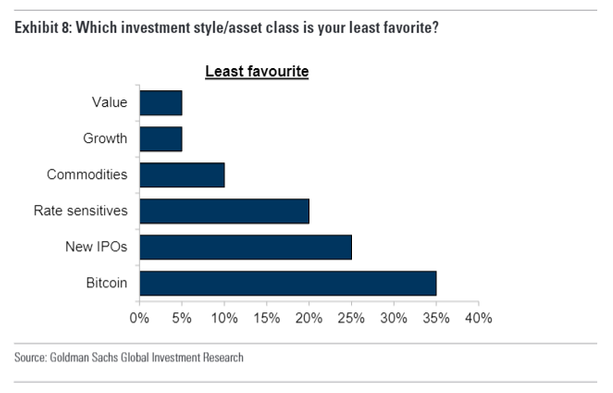

Not your typical sentiment gauge and yet... h/t @NoonSixCap

Sophos AUM $1.16B to $258M

Kynikos AUM $932M to $405M

institutionalinvestor.com/article/b1rb09…

Sophos AUM $1.16B to $258M

Kynikos AUM $932M to $405M

institutionalinvestor.com/article/b1rb09…

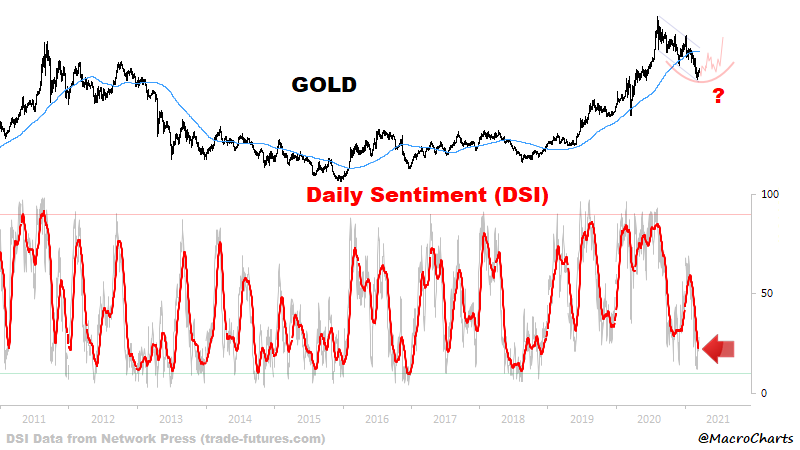

Daily Sentiment Index for...

$SPX 88% (20d MA 76.3%)

$NDX 89% (20d MA 72.6%)

SX5E 85% (20d MA 83.8%)

NIKK 85% (20d MA 74.2%)

$VIX 13% (20d MA 13.9%)

(as of yesterday)

$SPX 88% (20d MA 76.3%)

$NDX 89% (20d MA 72.6%)

SX5E 85% (20d MA 83.8%)

NIKK 85% (20d MA 74.2%)

$VIX 13% (20d MA 13.9%)

(as of yesterday)

• • •

Missing some Tweet in this thread? You can try to

force a refresh