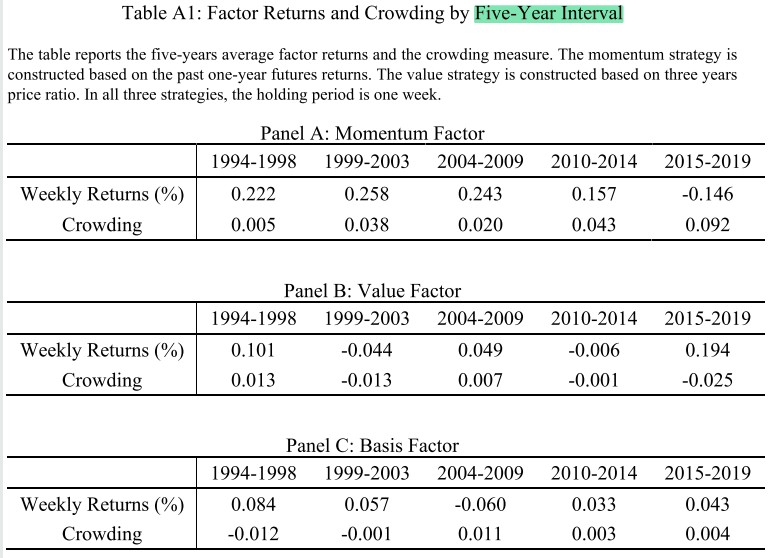

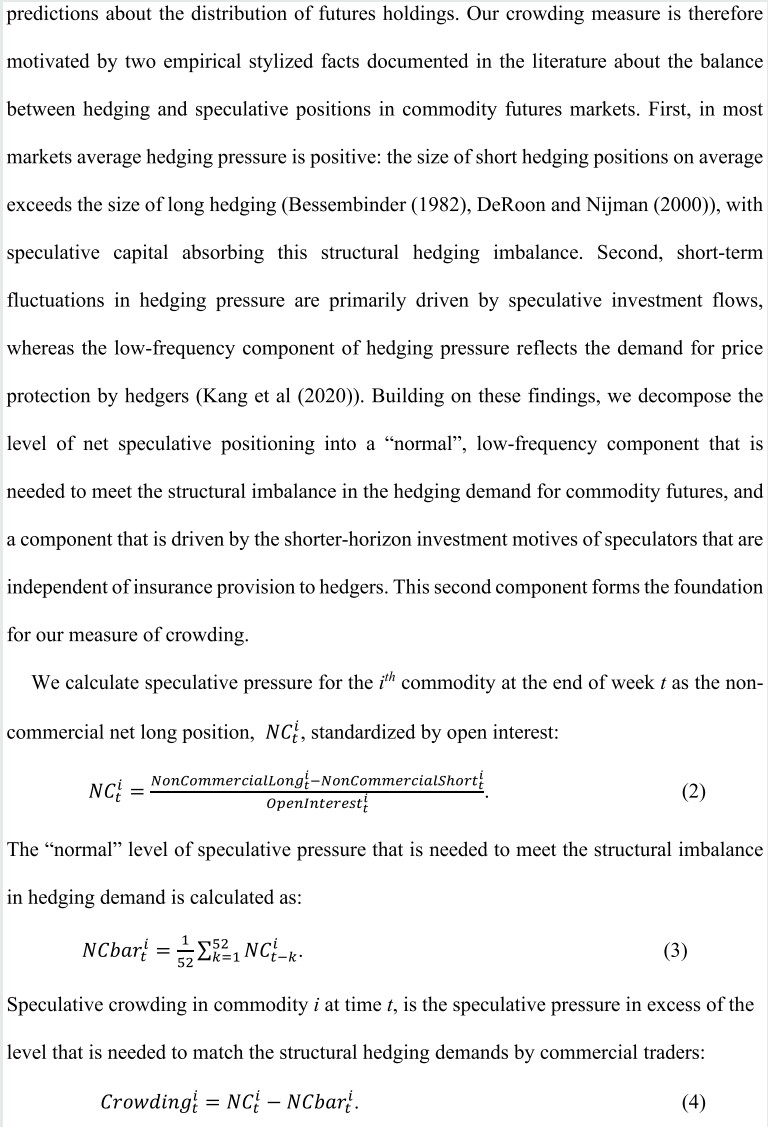

1/ Effectiveness of three versus six feet of physical distancing for controlling spread of COVID-19 among primary and secondary students and staff

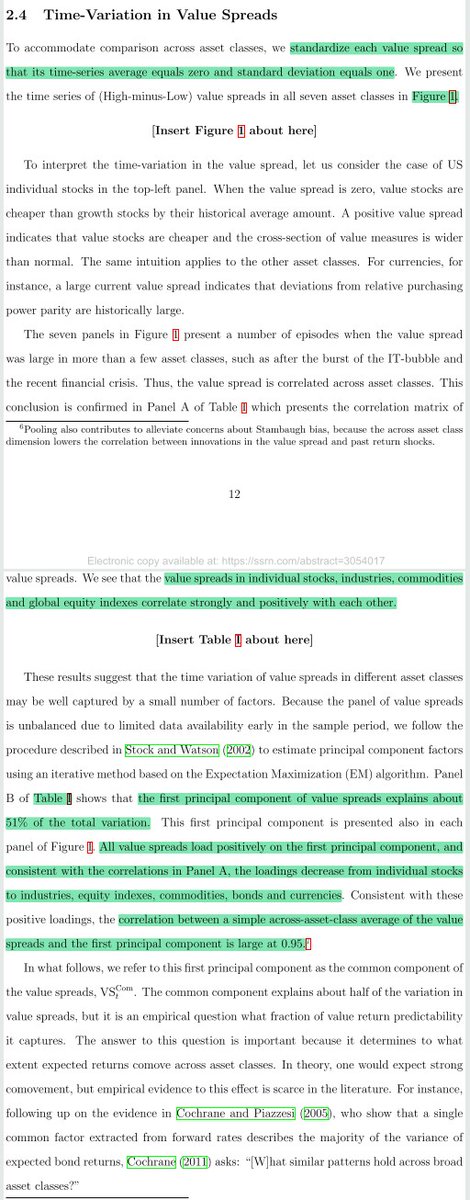

"There is no sig. difference between requiring ≥3 & ≥6 feet if other mitigation measures are implemented."

academic.oup.com/cid/advance-ar…

"There is no sig. difference between requiring ≥3 & ≥6 feet if other mitigation measures are implemented."

academic.oup.com/cid/advance-ar…

2/ "National and international guidelines differ about physical distancing for the prevention of SARS-CoV-2 transmission; studies directly comparing impact of ≥3 vs. ≥6 feet of distancing in school settings are lacking.

"The majority of districts required universal masking."

"The majority of districts required universal masking."

3/ "Current guidance from the WHO is to maintain one meter (3.3 feet) between students; the CDC recommends 6 feet.

"Data from different countries implementing different distancing guidelines seem to suggest no major difference, though they did not do a direct comparison."

"Data from different countries implementing different distancing guidelines seem to suggest no major difference, though they did not do a direct comparison."

4/ "To ensure our findings were robust, we re-estimated models after excluding districts with surveillance testing programs and re-estimated unadjusted and adjusted incident rate ratios. We also estimated models among districts that permitted less than 6 feet of distancing."

5/ Unadjusted incidence rate ratio (IRR) = 0.891 (95% CI 0.594-1.335)

"Incident cases among both students and staff were highly correlated with community rates."

"Incident cases among both students and staff were highly correlated with community rates."

6/ "In multivariable regression models controlling for community incidence, the risk of COVID-19 among students in districts with ≥3 vs ≥6 feet of distancing was similar.

"The model for staff controlling for community incidence also showed similar risk."

"The model for staff controlling for community incidence also showed similar risk."

7/ "In educational settings in England during the summer, children were advised to maintain distance 'as able,' and universal masking was not required. Reported infections and outbreaks were low.

"In Singapore, where students adopted 3-6 feet of distancing, case rates were low."

"In Singapore, where students adopted 3-6 feet of distancing, case rates were low."

8/ "Community transmission contributes to the number of infected individuals who enter the school building.

"The strong correlation does not imply increased transmission in schools when community disease prevalence is high, nor that community metrics should dictate policies."

"The strong correlation does not imply increased transmission in schools when community disease prevalence is high, nor that community metrics should dictate policies."

9/ Limitations of the study:

* Lack of complete data

* No contact tracing data

* No way to identify asymptomatic cases

* No stratification by age group

* No way to measure degree of compliance with distancing policies

* Difficulty evaluating the impact of other intervention types

* Lack of complete data

* No contact tracing data

* No way to identify asymptomatic cases

* No stratification by age group

* No way to measure degree of compliance with distancing policies

* Difficulty evaluating the impact of other intervention types

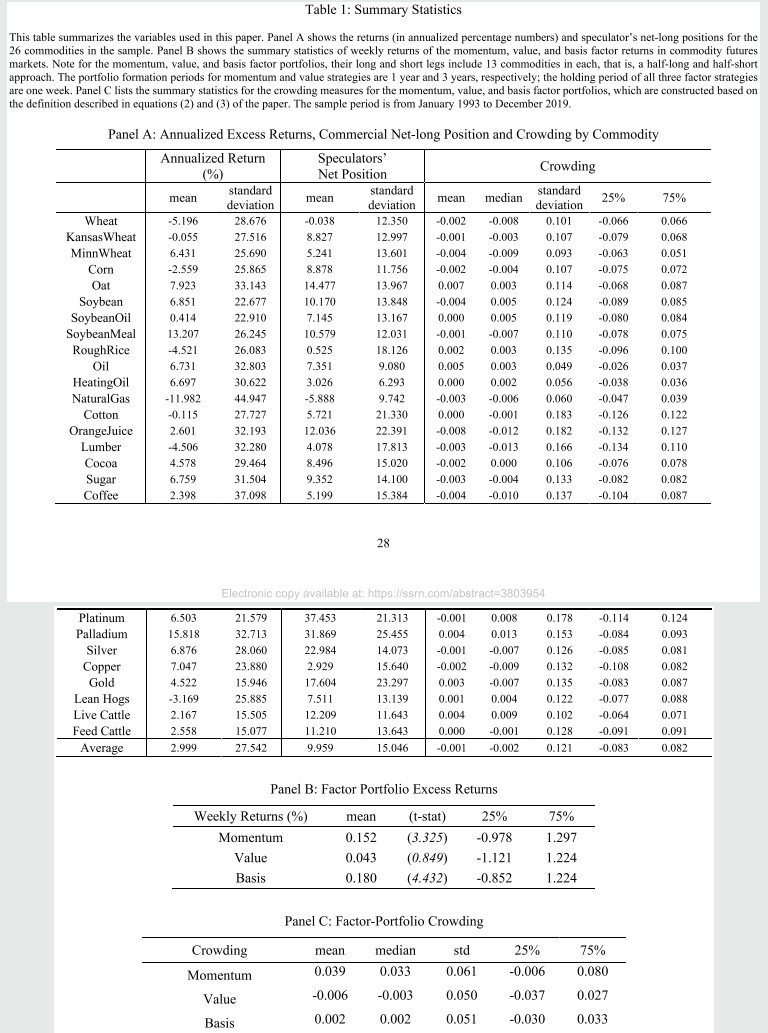

10/ Related reading:

Assessing mandatory stay‐at‐home and business closure effects on the spread of COVID‐19

Assessing mandatory stay‐at‐home and business closure effects on the spread of COVID‐19

https://twitter.com/ReformedTrader/status/1380319184110854146

• • •

Missing some Tweet in this thread? You can try to

force a refresh