1/ Balaji is a deep thinker on crypto and its implications.

Formerly the CTO of Coinbase and General Partner at Andreessen Horowitz, he’s believes crypto technologies such as bitcoin will change the world the say way Internet did.

Here's the podcast:

Formerly the CTO of Coinbase and General Partner at Andreessen Horowitz, he’s believes crypto technologies such as bitcoin will change the world the say way Internet did.

Here's the podcast:

2/ We touch on a lot of topics in the podcast.

• How to assess a strange new thing's potential

• How technologies rise and fall

• How to tell what's a fad and what's real

• How to identify nascent technology that will change the world

• How to assess a strange new thing's potential

• How technologies rise and fall

• How to tell what's a fad and what's real

• How to identify nascent technology that will change the world

3/ What got @balajis interested in crypto was the 2008 financial crisis in which banks were bailed out by the US fed.

This made him question and go deeper into the nature of money.

This made him question and go deeper into the nature of money.

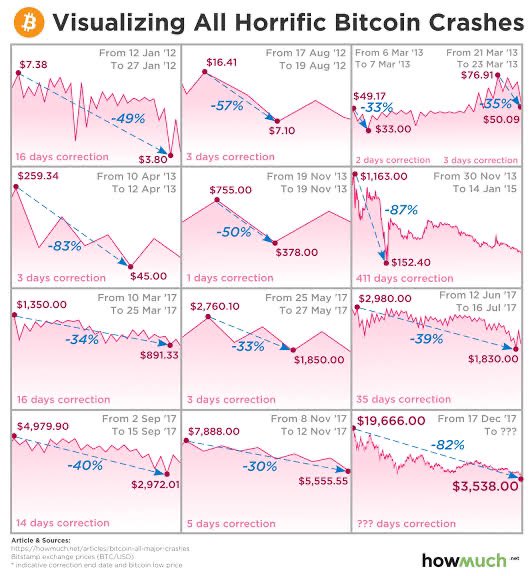

4/ Bitcoin came in 2009 but it caught his attention in 2011 when it went up to $30 per bitcoin and then down to $2 and stayed there.

When it started climbing back again from the low, @balajis got curious.

When it started climbing back again from the low, @balajis got curious.

5/ Usually emerging tech sectors go through the Gartner hype cycle where their potential is over-hyped in the short term but under-hyped in the long term.

Eventually, sectors recover and flourish, but often individual companies and startups get killed in the cycle.

Eventually, sectors recover and flourish, but often individual companies and startups get killed in the cycle.

6/ However, with bitcoin it was different.

Bitcoin survived a 90% crash and only a few companies in tech history have done that (Amazon was one of them).

So in 2011, this made @balajis pay attention and he thought there was something interesting to it.

Bitcoin survived a 90% crash and only a few companies in tech history have done that (Amazon was one of them).

So in 2011, this made @balajis pay attention and he thought there was something interesting to it.

7/ Personally, what I find interesting about @balajis approach is that most people lose interest when the price of something crashes but he started paying extra attention to bitcoin after its 2011 crash.

8/ Crypto can be seen to have been driven by different sets of people during different time periods

Earliest set of people were crypto-anarchists who, inspired by the Sovereign Individual, saw crypto technologies as a way to empower individual liberty

amazon.in/Sovereign-Indi…

Earliest set of people were crypto-anarchists who, inspired by the Sovereign Individual, saw crypto technologies as a way to empower individual liberty

amazon.in/Sovereign-Indi…

9/ Then came engineers who built companies like Coinbase that got funded by VCs.

Then came financiers such as banks and pension funds.

And now in 2021, we're seeing artists who use technologies like NFTs.

Then came financiers such as banks and pension funds.

And now in 2021, we're seeing artists who use technologies like NFTs.

10/ Crypto's main utility is to bypass abusive states like Venezuela or Nigeria where the state wields its power on citizens.

11/ Similar utility can be applied to bypass not just centralized nations but centralized companies like Facebook who can also wield their power on the users.

For example, if you have a decentralized social network, nobody can ban you from using it.

For example, if you have a decentralized social network, nobody can ban you from using it.

12/ Crypto was (and is still) a strange thing that leads to strong debates about whether it's a game-changing technology or a hyped-up toy.

But crypto is not the only thing that demands sense-making.

But crypto is not the only thing that demands sense-making.

13/ Many new trends like AI, robotics and genomics similarly are at a stage where they either can change the world or remain in history has overhyped technologies.

What is @balajis approach to making sense of these strange new developments?

What is @balajis approach to making sense of these strange new developments?

14/ He uses:

a) history - has something similar happened in the past;

b) technology - what does the new technology enable that wasn't possible before;

c) extrapolation of trends - how fast is this technology improving;

d) "nerd energy" - how passionate are the early adopters

a) history - has something similar happened in the past;

b) technology - what does the new technology enable that wasn't possible before;

c) extrapolation of trends - how fast is this technology improving;

d) "nerd energy" - how passionate are the early adopters

15/ An aspect that @balajis says it took him a long time to understand was whether people hate the existing incumbent who's only surviving due to its (historical) distribution.

He quotes Peter Theil who says: "Product is merit, distribution is connections".

I love it! 🧡

He quotes Peter Theil who says: "Product is merit, distribution is connections".

I love it! 🧡

16/ As any creator knows, you can create something amazing but if you don't have the means to distribute, your work will remain undiscovered and unappreciated.

17/ Distribution is a function of quantity and quality of people. How many people are plugged into your distribution and how much influence they wield.

Low quality, high quantity distribution = reality TV's fan base

High quality, low quantity = high energy physics mailing list

Low quality, high quantity distribution = reality TV's fan base

High quality, low quantity = high energy physics mailing list

18/ When you have an incumbent who is surviving just on legacy distribution (which itself is declining in quality of people), there's an opportunity.

E.g. purposes database is used by enterprises only for legacy purpose. All new startups use open source databases like Postgres.

E.g. purposes database is used by enterprises only for legacy purpose. All new startups use open source databases like Postgres.

19/ @balajis says it pays to pay attention to whether an incumbent has lost the loyalty of influential people as whatever they'll start paying attention to will start rising exponentially.

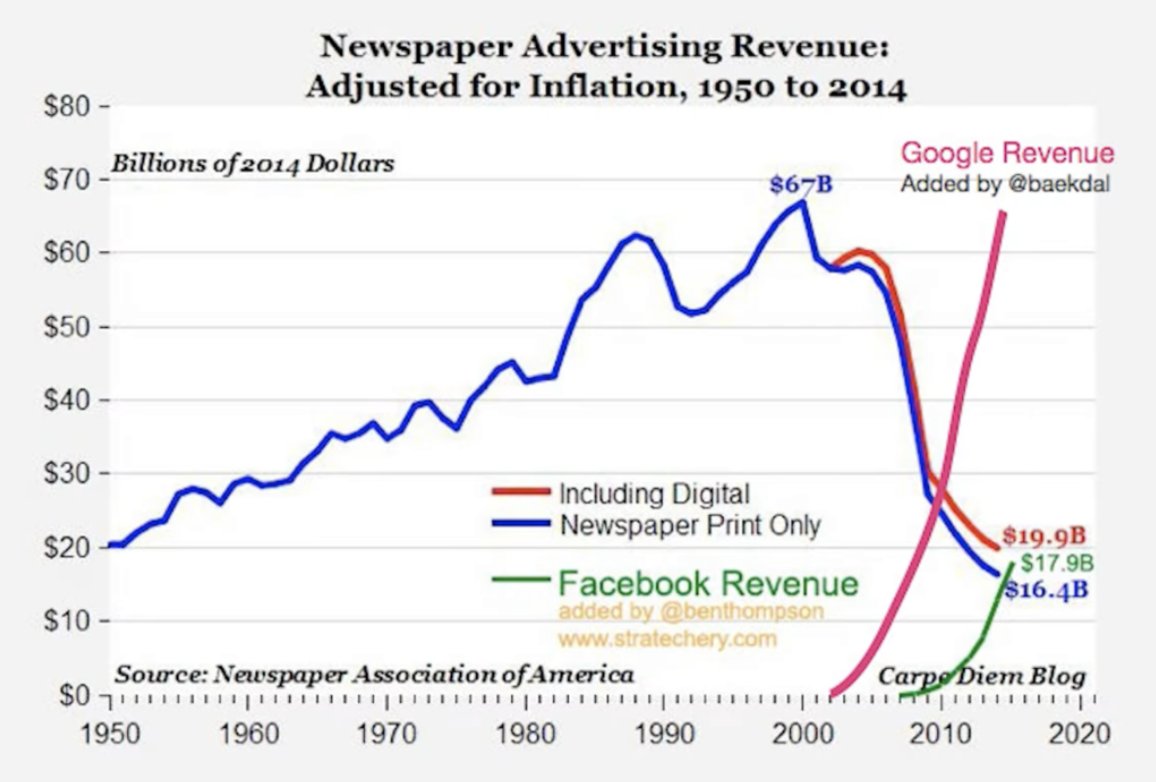

20/ Banks and traditional publications have lost the quality of distribution, even though they're surviving based on the quantity of distribution.

21/ So a really good sense-making algorithm is to see whether there's a growing frustration with the establishment that's causing people with influence root for emerging alternatives.

22/ Is this inevitable though? Does the establishment always crumble?

Amazon seems to be a counter-example as it has continued to grow without fail but @balajis attributes that to the founder Jeff Bezos.

Amazon seems to be a counter-example as it has continued to grow without fail but @balajis attributes that to the founder Jeff Bezos.

23/ The founder's role in navigating the changing world is hugely underestimated.

Facebook's bet on Instagram, Whatsapp and Oculus were totally counter-intuitive at the time when these companies were acquired (even though they look obvious in hindsight).

Facebook's bet on Instagram, Whatsapp and Oculus were totally counter-intuitive at the time when these companies were acquired (even though they look obvious in hindsight).

24/ In 2012, Zuckerberg paid a billion dollars for Instagram which was making 0 revenue.

That was 20% of Facebook's entire money at hand and it was done a few weeks before Facebook's IPO and the board wasn't consulted.

This brave decision is something only a founder can take.

That was 20% of Facebook's entire money at hand and it was done a few weeks before Facebook's IPO and the board wasn't consulted.

This brave decision is something only a founder can take.

25/ A good founder has enough conviction in the strength of the new technology and the weakness of the incumbent (which in some cases might be their own company) that they can take bold decisions.

26/ If Facebook was run by a professional CEO, chances are that Facebook would have been the crumbling establishment instead of a disruptor.

27/ Navigating technological changes isn't just about the intelligence to see the future or the past clearly, it's more about the courage to take a non-consensus position at a short-term great (monetary or reputational) cost.

28/ As @balajis said this, I was thinking this is exactly what he's doing with crypto.

Putting his reputation at stake by claiming it's the future.

Putting his reputation at stake by claiming it's the future.

29/ Driving a big change in an organization's trajectory like Zukerberg's decision to buy Instagram requires intelligence, courage, and authority.

Most people don't have the combination of these three.

Most people don't have the combination of these three.

30/ In 2008 banks were the establishment and the centralization of risk meant if home mortgages failed (which they did), everything else could fall with it (unless the Fed intervened).

This meant that the centralized banking system could take the entire economy with it.

This meant that the centralized banking system could take the entire economy with it.

31/ However, in crypto, even though individuals can make a mistake and bear risk, the entire system is decentralized enough that it's de-risked. Think of the decentralized nature of the Internet which never goes down, even though individuals can get disconnected from the network.

32/ Earlier I've raised concern about bitcoin's energy usage (say when compared to Visa that processes a much higher magnitude of transactions), but @balajis said it's a false comparison.

https://twitter.com/paraschopra/status/1359720733845319681

33/ He says bitcoin's energy usage has to be compared with the entire judiciary and enforcement capability of the US-backed dollar.

Crypto enforces property rights with math, instead of guns.

Crypto enforces property rights with math, instead of guns.

34/ The potential of crypto is talked about a lot but has crypto realized any concrete benefits for society so far?

@balajis says yes. Crypto has benefited two classes of users:

a) power users;

b) marginalized users

@balajis says yes. Crypto has benefited two classes of users:

a) power users;

b) marginalized users

35/ The power users are financiers or developers.

For example, if you have a use case where you need to send $10 to thousands of users across 100 different countries or $2million within the next 5 mins to someone in another country, existing methods aren't good enough for that.

For example, if you have a use case where you need to send $10 to thousands of users across 100 different countries or $2million within the next 5 mins to someone in another country, existing methods aren't good enough for that.

36/ Marginalized people are either unbanked or unbankable.

For example, these are the people who'll not easily get a bank account. With crypto, they don't need anyone's permission to get one.

For example, these are the people who'll not easily get a bank account. With crypto, they don't need anyone's permission to get one.

37/ When we think of payments, immediately the first thought that comes is the $5 payment at the coffee shop.

But crypto is good for payment use-cases that are extreme on some dimension (say very large, very small, very international, automated, or numerous in quantity)

But crypto is good for payment use-cases that are extreme on some dimension (say very large, very small, very international, automated, or numerous in quantity)

38/ @balajis compares bitcoin with Internet.

When the Internet came along, you could have compared it to making phone calls and the existing telephone network served quite well for that use case.

When the Internet came along, you could have compared it to making phone calls and the existing telephone network served quite well for that use case.

39/ But you could not have predicted that Internet will give rise to these tremendous use cases of search engine, shopping on so on.

Similarly, comparing bitcoin to the existing $5 payment at the coffee shop is not looking at what new use cases it'll enable.

Similarly, comparing bitcoin to the existing $5 payment at the coffee shop is not looking at what new use cases it'll enable.

40/ @balajis says bitcoin is 10x better at the following:

• 10x improvement in wire transfers in speed and internationality

• 10x improvement over gold in portability

• 10x improvement in crowdfunding in terms of quantity

• 10x improvement in wire transfers in speed and internationality

• 10x improvement over gold in portability

• 10x improvement in crowdfunding in terms of quantity

41/

• 10x improvement in the number of people in cap table (token holders)

• 10x improvement in accounting (clean record on the chain)

• 10x improvement in programmability

• 10x improvement in the number of people in cap table (token holders)

• 10x improvement in accounting (clean record on the chain)

• 10x improvement in programmability

42/ Bitcoin may be at a place where Internet was in the year 2000.

The number of Internet users was in the order of 40-50 million and most people were just using it for surfing the web (which literally meant reading stuff on the Internet).

The number of Internet users was in the order of 40-50 million and most people were just using it for surfing the web (which literally meant reading stuff on the Internet).

43/ Even though there was the hype of dotcom boom, nobody knew the full potential because truly valuable use cases were yet to be born.

Launch of iPhone in 2007 changed this and all the Internet companies (such as Google or Facebook) started going vertical while media collapsed.

Launch of iPhone in 2007 changed this and all the Internet companies (such as Google or Facebook) started going vertical while media collapsed.

44/ This was a 👏 gold quote by @balajis -> the Internet economy is much younger than it appears because the nature of exponential growth makes everything big and prominent so quickly.

But in reality, the pervasiveness of Internet economy has only happened in the last 10 years.

But in reality, the pervasiveness of Internet economy has only happened in the last 10 years.

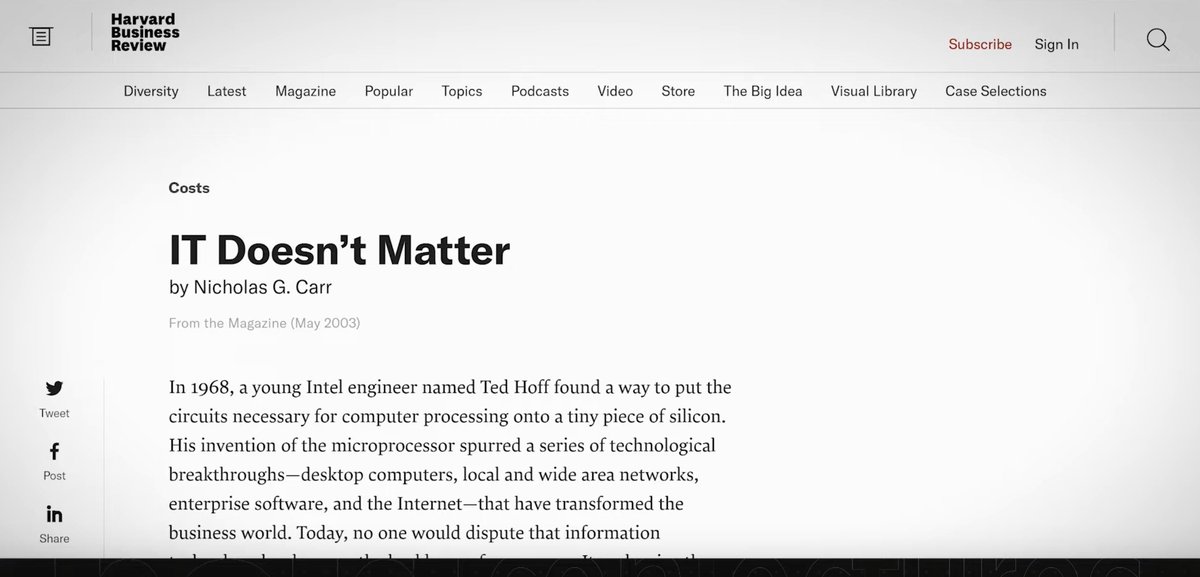

45/ @balajis says the skepticism on bitcoin is nothing unique.

Lots of experts have been skeptics about the potential of things like Internet or computer technology. Case in point the following article that appeared in 2004 in HBR.

hbr.org/2003/05/it-doe…

Lots of experts have been skeptics about the potential of things like Internet or computer technology. Case in point the following article that appeared in 2004 in HBR.

hbr.org/2003/05/it-doe…

46/ Continuing on the benefits of crypto, they go beyond 10x improvement in advanced payment use cases:

• It's accelerated advances in computer science - cryptography, formal verification, distributed systems and co-ordination problems

• It's accelerated advances in computer science - cryptography, formal verification, distributed systems and co-ordination problems

47/

• It's giving us a framework to do ethical macroeconomic experiments - people opt into different types of economic systems and we can figure out macroeconomic principles

• It's giving us a framework to do ethical macroeconomic experiments - people opt into different types of economic systems and we can figure out macroeconomic principles

48/

• It's enabled decentralization of wealth creation opportunity outside of U.S. - crypto has enabled people all over the world to bet against U.S. dollar system, which if they're right is ethical and non-violent drainage of money away from US

• It's enabled decentralization of wealth creation opportunity outside of U.S. - crypto has enabled people all over the world to bet against U.S. dollar system, which if they're right is ethical and non-violent drainage of money away from US

49/ Right now crypto is getting built at the backend level (both technologically and in human minds). But when it's fully built and scalability challenges have been solved (which is happening right now), ...

50/ ... on the front end it'll solve even more use cases that are unimaginable today (like send a cent every time you upvote a post in a social network).

51/ The massive valuations of crypto today are actually speculation on how big the digital economy will be.

52/ In the next 10 years where more people will work remotely internationally and via VR and other technologies, remain hooked onto the Internet, crypto as a native digital currency will see the corresponding growth as well.

53/ I find this interesting that the bet really is that as the digital economy grows 100x, crypto will grow 100x as well.

@balajis believes Virtual Reality may do to crypto what iPhone did to the Internet.

@balajis believes Virtual Reality may do to crypto what iPhone did to the Internet.

54/ How do we know that crypto is not a bubble?

The key thing to notice is that there have been lots of booms and crashes of crypto and it has still survived.

So it seems crypto refuses to die.

The key thing to notice is that there have been lots of booms and crashes of crypto and it has still survived.

So it seems crypto refuses to die.

55/ Plus, this time market cap of cryptocurrencies is a trillion dollars and there are many crypto companies worth many billions of dollars.

So it doesn't seem like it's going to go away.

So it doesn't seem like it's going to go away.

56/ When it comes to technology, it seems all technologies that get hyped up ultimately end up changing the world.

It's just that getting the timing right is hard as being too early and betting on something that's not ready means you'll lose.

It's just that getting the timing right is hard as being too early and betting on something that's not ready means you'll lose.

57/ But you can get scar tissues as well, which means you've seen some technology fail and decide not to invest but this time it actually works.

58/ Like the economy, every technology seems to have its boom and bust cycles of overinvestment and underinvestment, but since most technologies ultimately do end up changing the world, you have to have conviction and balance sheet of riding through the down cycle.

59/ Final part of our conversation: what are crypto states?

60/ Just like citizens of nation-states decide to issue themselves a currency and enact laws/policies, different people can come together in a social network and issue themselves cryptocurrency. This cryptocurrency-enabled social network can be thought of as a proto-nation.

61/ Just like nation-states, these users believe in common principles and the continuation of the entire group.

They have a sense of patriotism.

@balajis says the difference between Paypal and bitcoin is that people were users of Paypal but they're committed to bitcoin.

They have a sense of patriotism.

@balajis says the difference between Paypal and bitcoin is that people were users of Paypal but they're committed to bitcoin.

62/ If the story of the 2010 decade was cryptocurrency, the story of the 2020 decade is going to be crypto-states.

63/ Starting up a city is not illegal. You can take unincorporated land and start a city.

You can make laws at the local level such as making meat-eating illegal and you'll attract the people who believe in it and have an economic interest in making sure it succeeds.

You can make laws at the local level such as making meat-eating illegal and you'll attract the people who believe in it and have an economic interest in making sure it succeeds.

64/ That's it!

Hope you enjoyed the podcast and my notes.

They're also posted on my website: invertedpassion.com/crypto-is-the-…

Hope you enjoyed the podcast and my notes.

They're also posted on my website: invertedpassion.com/crypto-is-the-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh