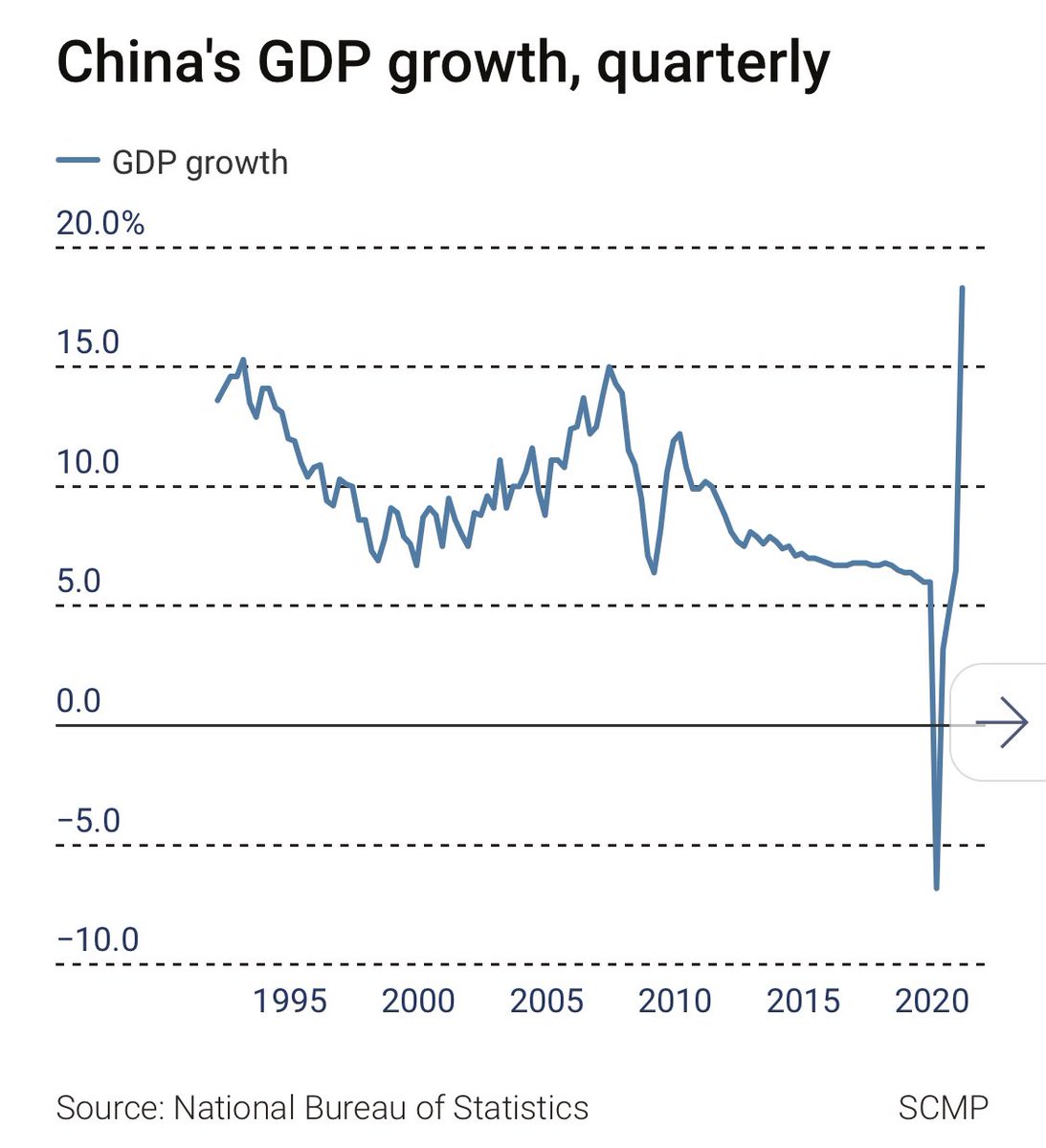

Big headline annual surge in China’s GDP in 1st qtr, but largely due to almost 10% reported quarterly fall this time last year. On a quarterly basis, last quarter was actually a damp squib riding just 0.6%, aka 2.4% annualised. /1

This follows a 2.5% quarterly rise in Q4 2020. At this rate, officially reported growth will be tumbling rapidly before year end towards 4%. Jan/Feb were esp disappointing partly related to a COVID scare, but the structure of the GDP growth - more details tomorrow - was too. /2

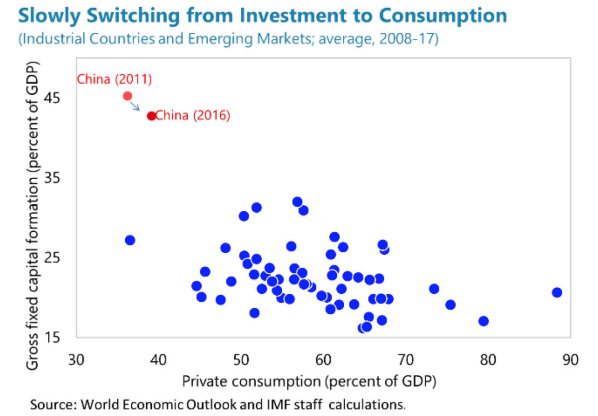

Most of the increase was thanks to industry and construction. Plus exports. Consumer spending is showing good y/y comparisons of course, but isn’t carrying the load as one might have hoped. /3

Not yet at least. Perhaps better in Q2. But can’t endure because foundational support for the HH sector just isn’t there. So if other restraints over real estate, local govt spending etc persist, there might be a govt rethink on infrastructure, credit etc later this yr /3

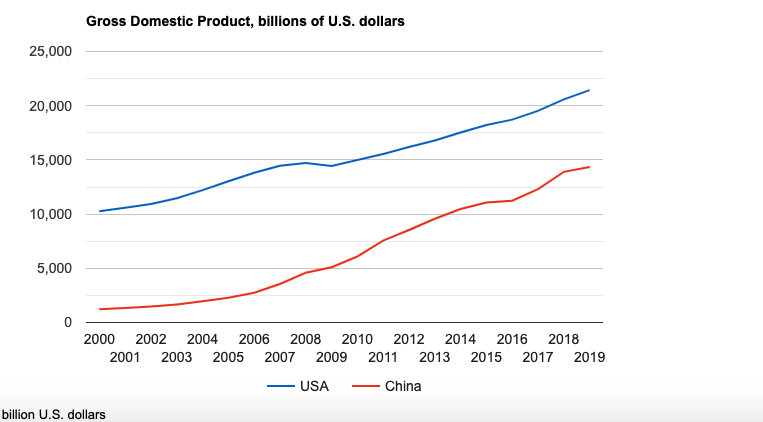

Just to contextualise, we are still in pandemic pandemonium as far as official econ stats are concerned. Was always case that economy would return to lower growth as it ran back into structural headwinds. But Q1 sends warning this point might’ve arrived sooner than expected. Ends

• • •

Missing some Tweet in this thread? You can try to

force a refresh