#Bitcoin update

1/14

On a morning like this it feels good to almost have no emotion and be reminded that buying and just HODLing #Bitcoin and analyzing the short-term charts rather out of curiosity and risk management - but not trading it - is a good place 2 b. ;-)

1/14

On a morning like this it feels good to almost have no emotion and be reminded that buying and just HODLing #Bitcoin and analyzing the short-term charts rather out of curiosity and risk management - but not trading it - is a good place 2 b. ;-)

https://twitter.com/2210ft/status/1383136330062966784

2/14

I have reattached my previous tweet above as I still think you can read from it what drives this cycle and makes it very robust and it answers the questions to many metrics that we currently regularly see, like decreasing liquid supply/ balance on exchanges etc.

I have reattached my previous tweet above as I still think you can read from it what drives this cycle and makes it very robust and it answers the questions to many metrics that we currently regularly see, like decreasing liquid supply/ balance on exchanges etc.

3/14

This is my fundamental view for this cycle and it does not change. In the shorter term, we have now broken the most recent up-trend and the break-out of the declining momentum trend (S2N Ratio, lower chart), which I was so excited about, got reversed.

This is my fundamental view for this cycle and it does not change. In the shorter term, we have now broken the most recent up-trend and the break-out of the declining momentum trend (S2N Ratio, lower chart), which I was so excited about, got reversed.

4/14

I think there are two scenarios here. The first one is a reasonable further consolidation to around 50k, which means a 100d S2N ratio of 0. The second scenario is a prolonged correction over weeks or months before we enter the next phase of the bull market.

I think there are two scenarios here. The first one is a reasonable further consolidation to around 50k, which means a 100d S2N ratio of 0. The second scenario is a prolonged correction over weeks or months before we enter the next phase of the bull market.

5/14

The first scenario is supported by the dynamics of the 2017 cycle which has seen healthy resets of the S2N ratio to 0 and slightly below, i.e. price has been touching the 100d MA trend or going slightly below.

The first scenario is supported by the dynamics of the 2017 cycle which has seen healthy resets of the S2N ratio to 0 and slightly below, i.e. price has been touching the 100d MA trend or going slightly below.

6/14

As you can see in the chart, this has happened regularly before new moves up (red circles). Look how elevated we are currently still (green circle). Far away from a reset! We have only been this elevated during corrections in the final hot phase of the previous bull run.

As you can see in the chart, this has happened regularly before new moves up (red circles). Look how elevated we are currently still (green circle). Far away from a reset! We have only been this elevated during corrections in the final hot phase of the previous bull run.

7/14

And that latter observation also leads me to this potential second scenario of a prolonged correction, just by the fact that we have gone really very far very early in this cycle.

And that latter observation also leads me to this potential second scenario of a prolonged correction, just by the fact that we have gone really very far very early in this cycle.

8/14

In 2017, after the same time since the halving we were at around 1.5x the previous cycle peak. At over $60k recently we were already at > 3x! In 2020 we have seen prices around $5k, this is up more than 12x! And #Bitcoin is no small asset anymore.

In 2017, after the same time since the halving we were at around 1.5x the previous cycle peak. At over $60k recently we were already at > 3x! In 2020 we have seen prices around $5k, this is up more than 12x! And #Bitcoin is no small asset anymore.

9/14

My point is that even after this correction we are still very far in this cycle. Without any further external shocks and FUD I think scenario 1 is more likely and we just enter a bit more consolidation as I expect a lot of investors still wanting in.

My point is that even after this correction we are still very far in this cycle. Without any further external shocks and FUD I think scenario 1 is more likely and we just enter a bit more consolidation as I expect a lot of investors still wanting in.

10/14

If we see more external shocks/FUD or general risk-off event in markets, I think this could let institutions pause their buying and also trigger more selling for profit taking and this would lead to scenario 2.

If we see more external shocks/FUD or general risk-off event in markets, I think this could let institutions pause their buying and also trigger more selling for profit taking and this would lead to scenario 2.

11/14

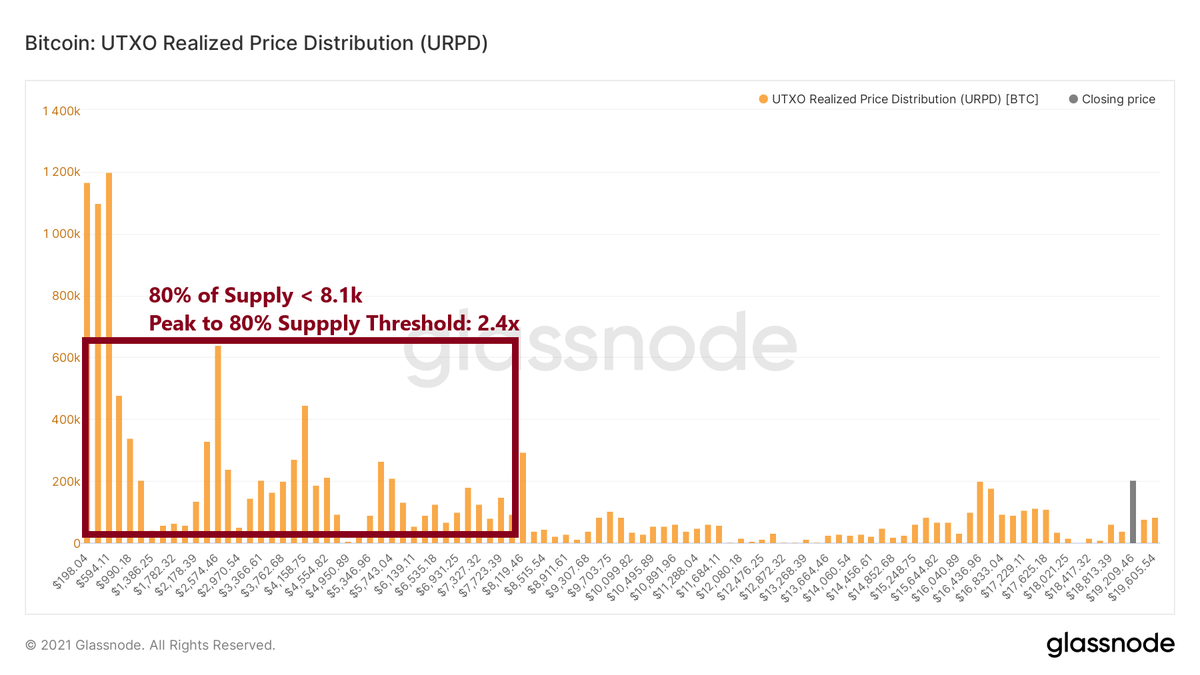

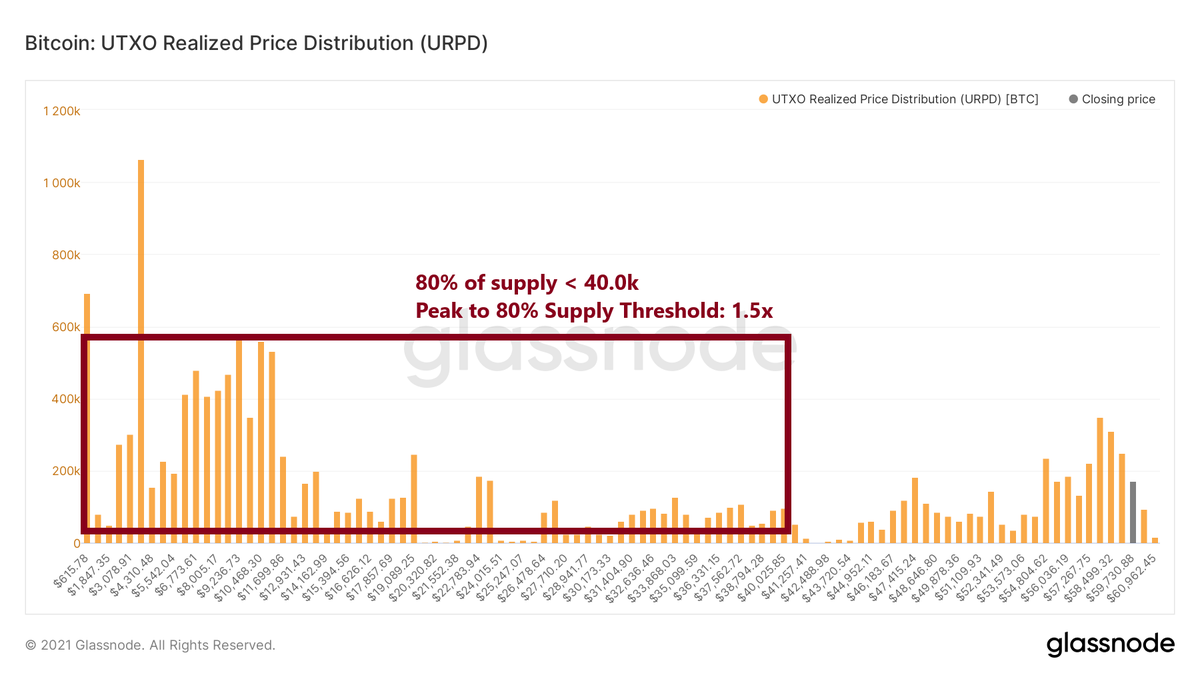

Actually, a longer cooling off (in either of the 2 scenarios) and consolidation would be very healthy as it would allow to build a stronger base, which is more sustainable. The mechanics behind this scenario are illustrated here

Actually, a longer cooling off (in either of the 2 scenarios) and consolidation would be very healthy as it would allow to build a stronger base, which is more sustainable. The mechanics behind this scenario are illustrated here

https://twitter.com/2210ft/status/1381312595743944704?s=20

12/14

The longer it takes, the further we can go, so overall, although I like to see rising prices daily like everyone else, I also know that patience will be rewarded and if the overheating happens too quickly, the top of this cycle will be lower.

The longer it takes, the further we can go, so overall, although I like to see rising prices daily like everyone else, I also know that patience will be rewarded and if the overheating happens too quickly, the top of this cycle will be lower.

13/14

The role that time plays until we see a top is illustrated in my pinned tweet on the S2N-Ratio so I will not explain it again and I still think that the price scenarios shown there could materialize. It all comes down to how quick we end up overheating.

The role that time plays until we see a top is illustrated in my pinned tweet on the S2N-Ratio so I will not explain it again and I still think that the price scenarios shown there could materialize. It all comes down to how quick we end up overheating.

14/14

More time until top = more sustainable prices = higher final top.

As always retweet if you like.

More time until top = more sustainable prices = higher final top.

As always retweet if you like.

• • •

Missing some Tweet in this thread? You can try to

force a refresh