#marketupdate, breaking it down, post mortem.

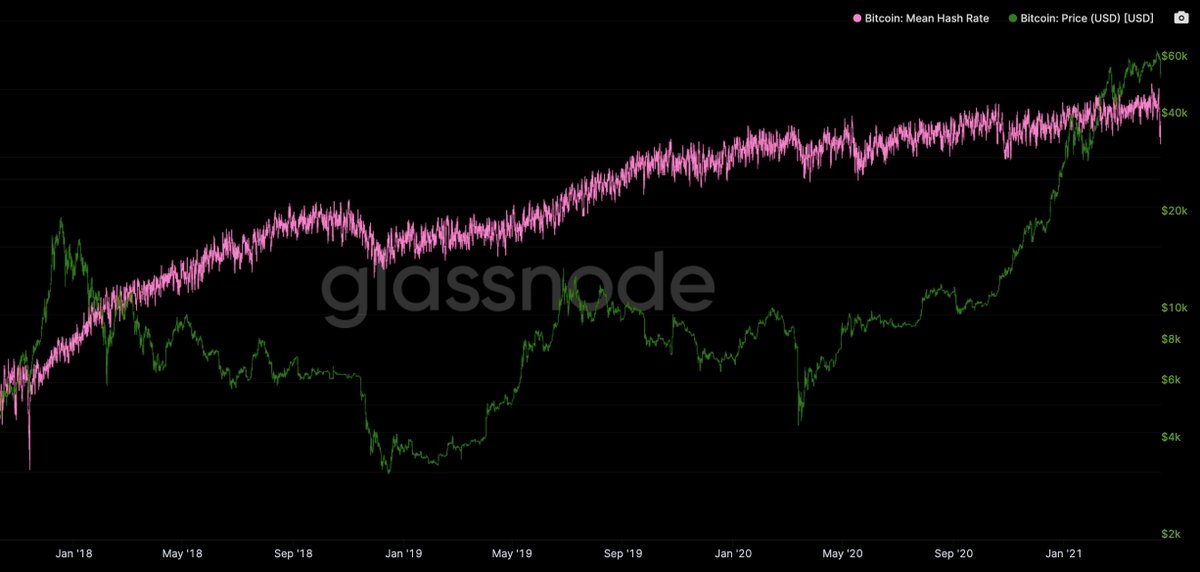

We just saw the single largest 1-day drop in mining hash rate since Nov 2017. The hash rate on the network essentially halved, causing mayhem in BTC price as it crashed.

We just saw the single largest 1-day drop in mining hash rate since Nov 2017. The hash rate on the network essentially halved, causing mayhem in BTC price as it crashed.

The power outage in Xinjiang (which powers a significant amount of the BTC mining network) was known before the BTC price crash. Here's local news on 15th April.

translate.google.com/translate?sl=a…

translate.google.com/translate?sl=a…

16 April.

9000 BTC was sent into Binance, read that as a sell off of those coins.

I'd note that Binance serves volume from Asia more than the West. It's likely this was sent in from a whale with closer knowledge to happenings in China.

9000 BTC was sent into Binance, read that as a sell off of those coins.

I'd note that Binance serves volume from Asia more than the West. It's likely this was sent in from a whale with closer knowledge to happenings in China.

This sell down was compounded by sell off of quarterly futures (used by more sophisticated traders) on derivative markets which was already underway as early as 13th April.

The two combined sell pressures was sufficient to tip the price below liquidation levels ($59k).

This triggered a cascade of automatic sell-offs in a chain reaction.

$4.9b contracts were liquidated, $9.3b including alt-coin markets.

1m trader accounts liquidated in total.

This triggered a cascade of automatic sell-offs in a chain reaction.

$4.9b contracts were liquidated, $9.3b including alt-coin markets.

1m trader accounts liquidated in total.

This dip happened while unprecedented numbers of new users are arriving onto the network per day. There's been a retail influx in the last 2-3 weeks.

Supply profile (price when the supply last moved), now forming the largest cluster of price discovery since BTC was below $10k. Validation of BTC as a trillion dollar asset is immensely strong.

13.5% of the entire BTC supply last moved above $1T cap.

13.5% of the entire BTC supply last moved above $1T cap.

The on-chain SOPR metric near a full reset. A classic buy the dip signal.

In simple terms, profit taking by longer term investors is completing, very little sell power left unless investors want to sell at a loss from their entry price. Unlikely in a bull market.

In simple terms, profit taking by longer term investors is completing, very little sell power left unless investors want to sell at a loss from their entry price. Unlikely in a bull market.

Summary:

- Initial sell off due to anticipation of miners going offline in China.

- Sell pressure was sufficient to trigger liquidation of short term speculator positions forcing price violently down.

- Longer term fundamentals is very strong.

Data: @glassnode @bybt_com

- Initial sell off due to anticipation of miners going offline in China.

- Sell pressure was sufficient to trigger liquidation of short term speculator positions forcing price violently down.

- Longer term fundamentals is very strong.

Data: @glassnode @bybt_com

• • •

Missing some Tweet in this thread? You can try to

force a refresh