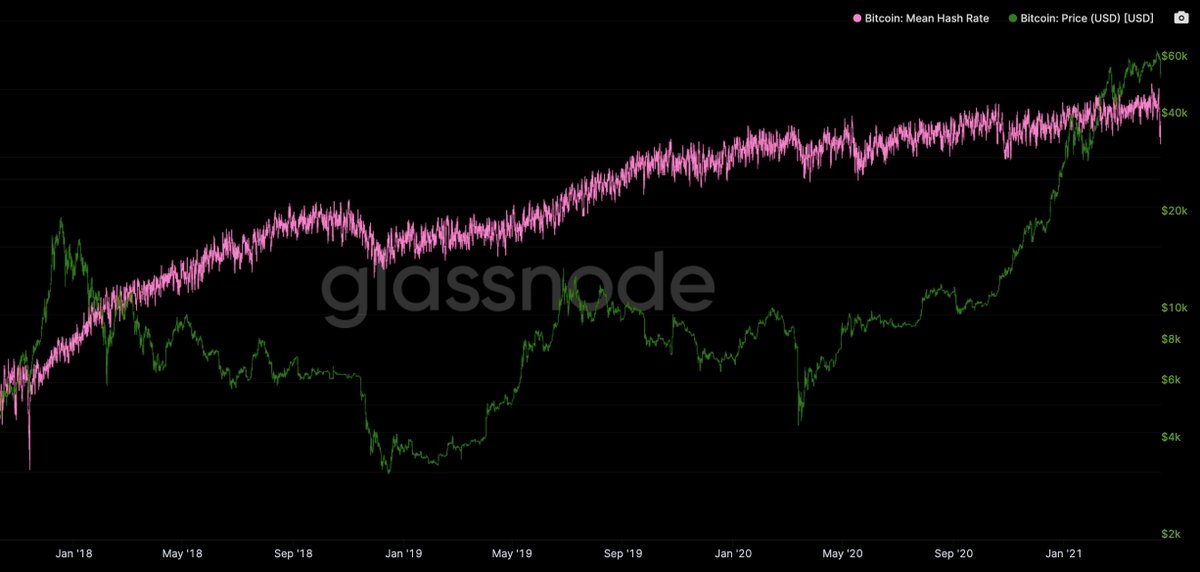

Chinese miners went offline 3hrs into the difficulty adjustment.

The difficulty adjusts every 2 weeks to match the natural increase in hash rate from miners. This keeps block times to a steady 10 mins. If you're going to slow the network down, this is the best window to do so.

The difficulty adjusts every 2 weeks to match the natural increase in hash rate from miners. This keeps block times to a steady 10 mins. If you're going to slow the network down, this is the best window to do so.

9.5hrs into the difficulty adjustment, 9000 BTC was deposited into Binance, this provided enough selling pressure to drop the Bitcoin price below $59k support, forcing the $4.9b of liquidations.

It's an interesting timing of events.

We have 11 more days before the next difficulty adjustment corrects for any loss in miner hash rate. Note the hash rate is already returning to the network.

This is an addendum to my price crash post mortem thread:

We have 11 more days before the next difficulty adjustment corrects for any loss in miner hash rate. Note the hash rate is already returning to the network.

This is an addendum to my price crash post mortem thread:

https://twitter.com/woonomic/status/1383841368829677568?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh