$ETSY - The ultimate brand of personalization.

Why $ETSY could be $100B company by 2025 and a valuable lesson for New Investors.

Here is a Thread 🧵 //

Why $ETSY could be $100B company by 2025 and a valuable lesson for New Investors.

Here is a Thread 🧵 //

2/ $ETSY Product:

Etsy operates a marketplace offering a largest selection of locally made gifts. Everything from jewelry, clothing, pottery, bath, body, now home furnishing and 10-more areas!

They operate a two-sided marketplace between buyers (82M) & sellers (4.4M) as at 2020

Etsy operates a marketplace offering a largest selection of locally made gifts. Everything from jewelry, clothing, pottery, bath, body, now home furnishing and 10-more areas!

They operate a two-sided marketplace between buyers (82M) & sellers (4.4M) as at 2020

The Moat:

3/ Brand Recognition:

• Over 80%+ of purchases on $ETSY are made by organic buyers compared to 20% paid by marketing

• This level of word of mouth helps to lower CAC and drives scale.

• $ETSY has become a household name and this is likely to stick post-pandemic.

3/ Brand Recognition:

• Over 80%+ of purchases on $ETSY are made by organic buyers compared to 20% paid by marketing

• This level of word of mouth helps to lower CAC and drives scale.

• $ETSY has become a household name and this is likely to stick post-pandemic.

4/ On Brand - Consumers love $ETSY:

• $ETSY is differentiated by their unique product offering; >80% of their product can't be found anywhere

•Habitual buyers' growing over 157% including repeat buyers growing 97% YoY.

• Active buyers also grew 77%

People keep coming back!

• $ETSY is differentiated by their unique product offering; >80% of their product can't be found anywhere

•Habitual buyers' growing over 157% including repeat buyers growing 97% YoY.

• Active buyers also grew 77%

People keep coming back!

5/ Network effects of the marketplace:

The increased repeat buyers growing over 100% has led to increased sellers on the platform growing over -> 64% YoY and sellers are making 22% more money!

It's a powerful flywheel - The more buyers come on Etsy, the better for sellers.

The increased repeat buyers growing over 100% has led to increased sellers on the platform growing over -> 64% YoY and sellers are making 22% more money!

It's a powerful flywheel - The more buyers come on Etsy, the better for sellers.

6/ The Passion economy is booming!

• $ETSY has improved take-rate from negative 2% to around 5%.

• Due to the pandemic, the seller and creator economy is growing massively. Over 50% of $ETSY sellers do this full-time.

And we all know about how fast this market is growing!

• $ETSY has improved take-rate from negative 2% to around 5%.

• Due to the pandemic, the seller and creator economy is growing massively. Over 50% of $ETSY sellers do this full-time.

And we all know about how fast this market is growing!

7/ $ETSY TAM:

• Estimated at over $1.7 Trillion Market Opportunity.

• But if we took a TAM of over $250B and $ETSY with its 5% MarketShare while being the 4th largest e-Commerce in the US- What does the future represent?

•Also, $ETSY is growing 2.5x, fast as the industry!

• Estimated at over $1.7 Trillion Market Opportunity.

• But if we took a TAM of over $250B and $ETSY with its 5% MarketShare while being the 4th largest e-Commerce in the US- What does the future represent?

•Also, $ETSY is growing 2.5x, fast as the industry!

8/ eCommerce is still in its early Innings:

• Mckinsey's recent research report in February 2021 suggests eCommerce is are still less penetrated at 20% in the US. Therefore suggesting more opportunity.

• This is the Global Marketshare of eCommerce today.

We're just starting

• Mckinsey's recent research report in February 2021 suggests eCommerce is are still less penetrated at 20% in the US. Therefore suggesting more opportunity.

• This is the Global Marketshare of eCommerce today.

We're just starting

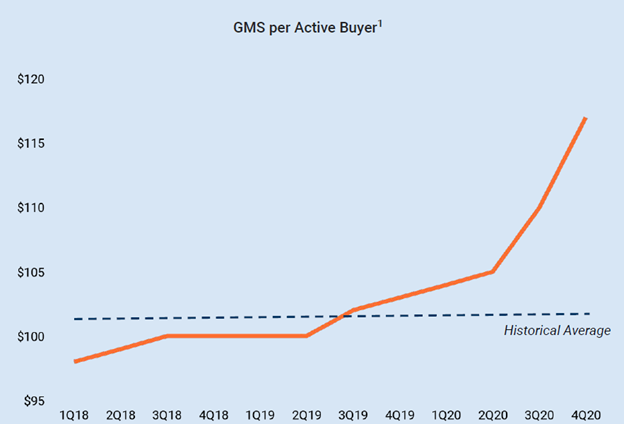

9/ On the Financial aspect;

• Revenue: $1.7B (111% YoY)

• 76% Gross Margins from 50% a few years ago!

• 31% EBITDA margins

• Massive signs of significant operating leverage.

$ETSY is growing both top-line and bottom-line by triple digits!

• Revenue: $1.7B (111% YoY)

• 76% Gross Margins from 50% a few years ago!

• 31% EBITDA margins

• Massive signs of significant operating leverage.

$ETSY is growing both top-line and bottom-line by triple digits!

10/ Another measure of the bottom-line.

This is the Return of Equity (ROE) [The profitability of a business in relation to the equity]

These days, Revenue growth is easy, but bottom-line metrics are hard.

Only the best of businesses can show such improvement below in ROE:

This is the Return of Equity (ROE) [The profitability of a business in relation to the equity]

These days, Revenue growth is easy, but bottom-line metrics are hard.

Only the best of businesses can show such improvement below in ROE:

11/ Future Growth Opportunities by 2025:

$ETSY offers much more...

• Home improvement is the fastest growing segment benefiting from the housing boom (Growth 118%+)

• I believe $ETSY will make a big acquisition in 2021 (soon)

• International expansion in the UK and Europe.

$ETSY offers much more...

• Home improvement is the fastest growing segment benefiting from the housing boom (Growth 118%+)

• I believe $ETSY will make a big acquisition in 2021 (soon)

• International expansion in the UK and Europe.

12/ The biggest risks to my thesis:

A potential decrease in market share within eCommerce as Competition heats up from Amazon or physical retail interactions post-Covid.

However, I will say that $ETSY has shown massive execution and $ETSY is growing 2.5x the eCommerce market.

A potential decrease in market share within eCommerce as Competition heats up from Amazon or physical retail interactions post-Covid.

However, I will say that $ETSY has shown massive execution and $ETSY is growing 2.5x the eCommerce market.

13i/ If you want to go deeper on $ETSY:

Best Resources:

a) @borrowed_ideas released a great write-up analysis on the business model, unit economics and everything about Etsy. Kudos!

borrowedideas.substack.com/p/deep-dive-on…

Best Resources:

a) @borrowed_ideas released a great write-up analysis on the business model, unit economics and everything about Etsy. Kudos!

borrowedideas.substack.com/p/deep-dive-on…

13ii/

b) @InvestmentTalkk has a great story on the Founding of $etsy. Kudos!

The execution from the current CEO, Josh Silverman has been phenomenal since 2017! He was the past CEO of Skype.

I'll let you read more:

investmenttalk.substack.com/p/a-history-of…

b) @InvestmentTalkk has a great story on the Founding of $etsy. Kudos!

The execution from the current CEO, Josh Silverman has been phenomenal since 2017! He was the past CEO of Skype.

I'll let you read more:

investmenttalk.substack.com/p/a-history-of…

14/ FY 2020 - Financial Highlights & Latest Updates:

I also put together an Indepth thread on 2020 Earnings and key takeaways last two months.

Etsy still remains one of my largest position.

They report earnings on May 5, 2021 I plan to share updates:

I also put together an Indepth thread on 2020 Earnings and key takeaways last two months.

Etsy still remains one of my largest position.

They report earnings on May 5, 2021 I plan to share updates:

https://twitter.com/InvestiAnalyst/status/1365096556689432578

*Bonus* - $ETSY offers a key lesson for Investors in context of 2021

Period: 2015 - 2017. $Etsy declined over 75%! meanwhile, Revenue-Gross profit were growing over 30%!!

Why?

1) Amazon launched their marketplace ($TDOC?)

Later,

2) Trump's election led to a rotation to value

Period: 2015 - 2017. $Etsy declined over 75%! meanwhile, Revenue-Gross profit were growing over 30%!!

Why?

1) Amazon launched their marketplace ($TDOC?)

Later,

2) Trump's election led to a rotation to value

16/ What happened next?

$ETSY grew >3000%!! in less than 5-years! i.e $10K Invested would be worth $300K+

Lesson: If you had the ability to look out over a long-term horizon (just 5-years), focus on the big picture and only fundamentals(!!)- you'll have caught a multi-bagger!

$ETSY grew >3000%!! in less than 5-years! i.e $10K Invested would be worth $300K+

Lesson: If you had the ability to look out over a long-term horizon (just 5-years), focus on the big picture and only fundamentals(!!)- you'll have caught a multi-bagger!

17/ Bottom-line on $ETSY:

$ETSY offers:

✅Superior Brand Recognition

✅High Network effects

✅ High ROE

✅Operating leverage

✅e-Commerce is still early

✅$ETSY's story feel young

✅Practice patience, perspective + focus on fundamentals.

Thanks for reading.

$ETSY offers:

✅Superior Brand Recognition

✅High Network effects

✅ High ROE

✅Operating leverage

✅e-Commerce is still early

✅$ETSY's story feel young

✅Practice patience, perspective + focus on fundamentals.

Thanks for reading.

Thanks Max for inviting me @MaxTheComrade @WOLF_Financial

It was great to listen to you folks! @AnthonyOhayon @borrowed_ideas @EugeneNg_VCap @plantmath1 @clueless_1337 @StockMarketNerd @7investing

Kindly share if this was helpful. Cheers again and have a good day.

It was great to listen to you folks! @AnthonyOhayon @borrowed_ideas @EugeneNg_VCap @plantmath1 @clueless_1337 @StockMarketNerd @7investing

Kindly share if this was helpful. Cheers again and have a good day.

• • •

Missing some Tweet in this thread? You can try to

force a refresh