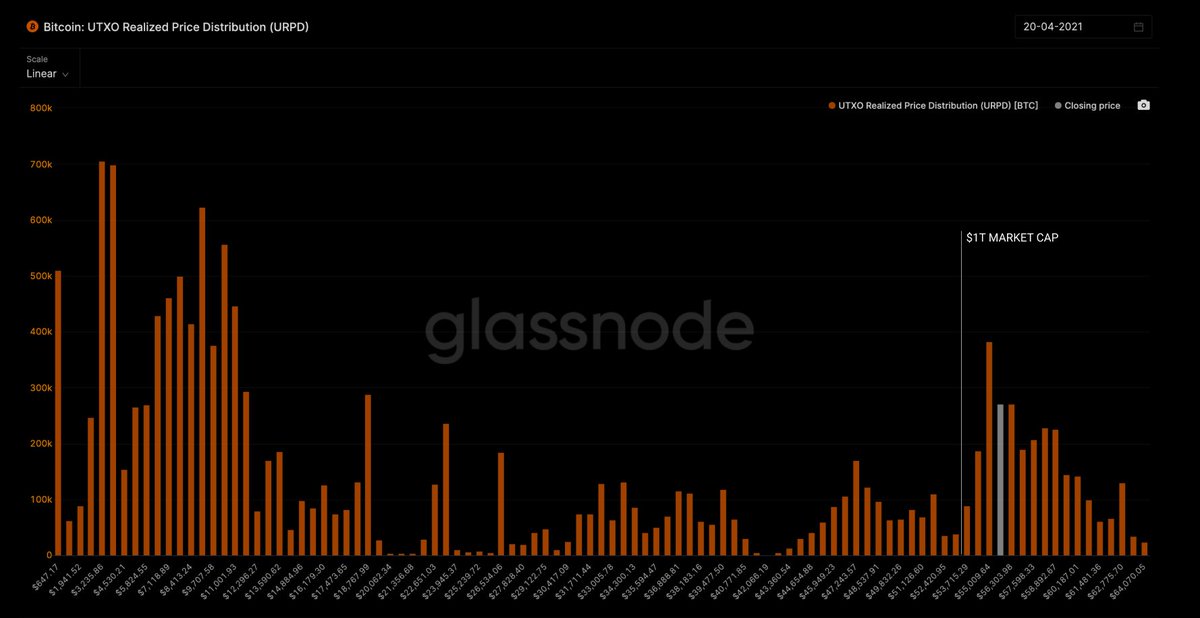

This revisit of lower price has created incredibly strong price validation for Bitcoin about $1T cap. 14% of the supply last moved above $1T cap.

This is a key line in the sand imprinted into BTC's price discovery, an area of immense support.

This is a key line in the sand imprinted into BTC's price discovery, an area of immense support.

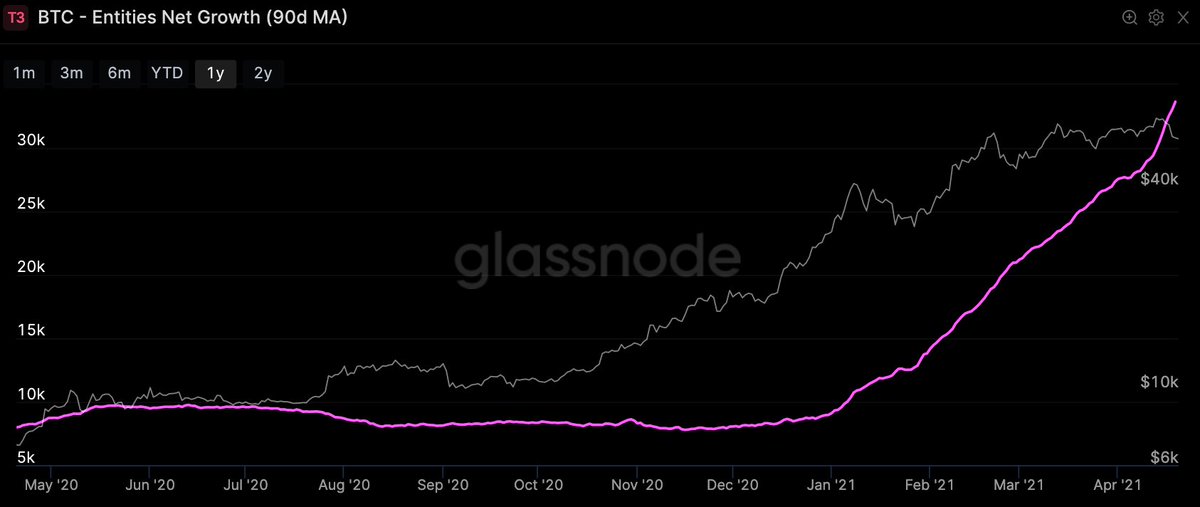

Anyone thinking we are going into a prolong price correction needs to know about the rate of new users coming into the network per day. We're in the middle of a bull market with a hockey stick of new adoption, especially in the last 2 weeks.

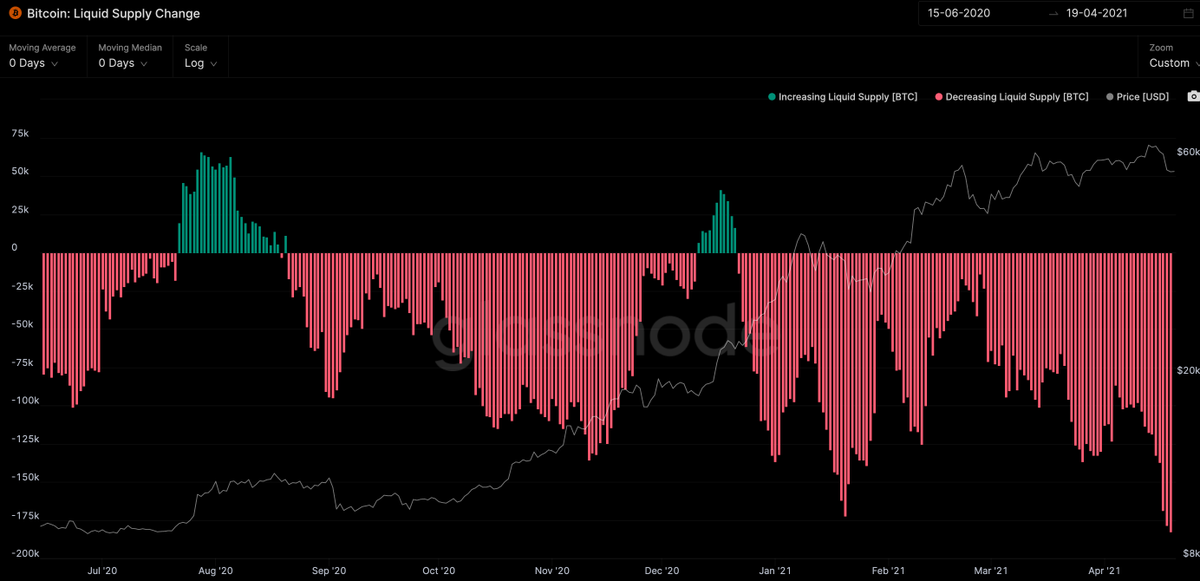

Coins continue to move to very strong holders (the Rick Astleys of this world). And moving at all-time-high rates.

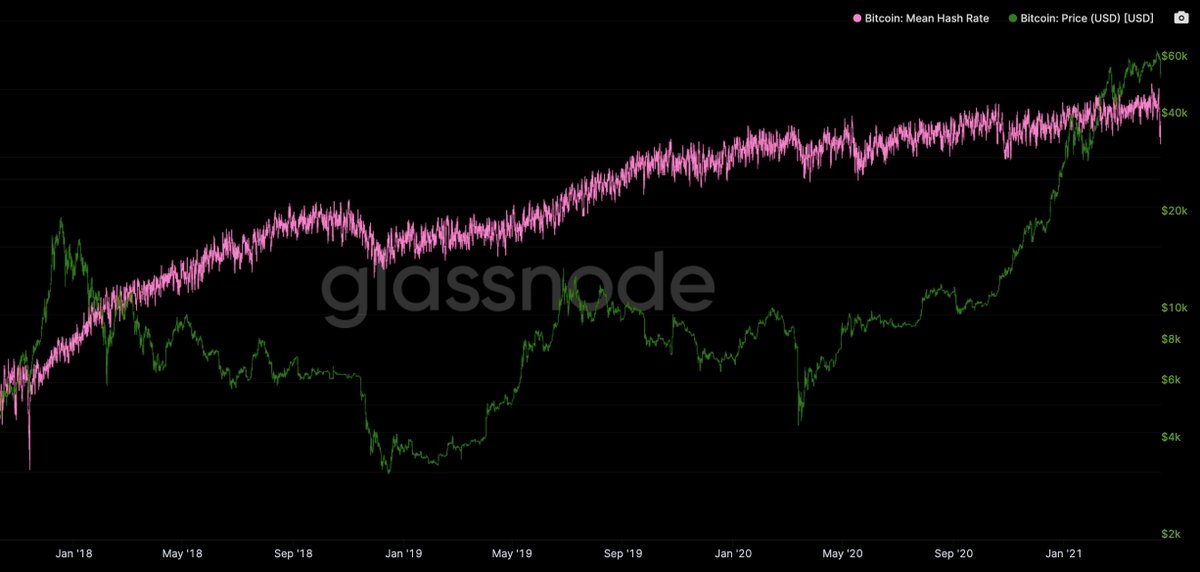

Lots of bearishness from technical traders the last few days. Meanwhile fundamentals are stellar, we're very close to the bottom, if it hasn't already been put in.

Data: @glassnode

Data: @glassnode

• • •

Missing some Tweet in this thread? You can try to

force a refresh