the new exogenous money is exogenous transition shocks in the climate change debate.

fortunately, Bank of England cannot hide behind that rock because of their new climate mandate.

fortunately, Bank of England cannot hide behind that rock because of their new climate mandate.

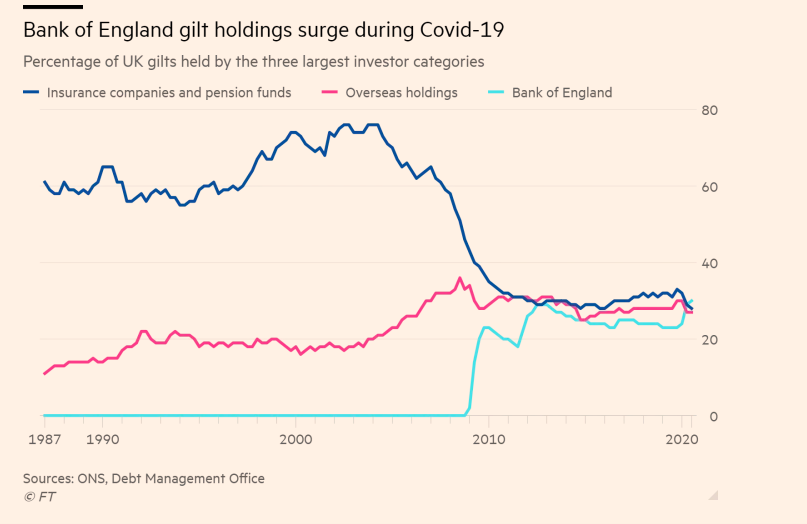

this captures well the fact that central bank action on climate = endogenous transition risks

ft.com/content/e5be56…

ft.com/content/e5be56…

remember, Mark Carney's 'tragedy of the horizons' speech identified two main risks of climate crisis:

- physical risks (climate events)

- transition risks - from green policies to accelerate transition to low-carbon

- physical risks (climate events)

- transition risks - from green policies to accelerate transition to low-carbon

now, central banks are confronted with an unpleasant conundrum that reveals the deeply political nature of their operations:

greening monetary policy (collateral, unconventional bond purchases) means endogenous transition risks

greening monetary policy (collateral, unconventional bond purchases) means endogenous transition risks

so, in a have your cake and eat it moment, there is a growing tendency in central bank communities to pretend that all transition risks come from the fiscal side (carbon pricing)

it wouldn't be surprising to find the exogenous transition shocks approach in the ECB's monetary policy strategy review, despite @Lagarde and other's recognition that central banks cannot longer hide behind the 'market neutrality' argument

but this lets central banks off the hook at a time when we are seeing an unprecedented greenwashing tsunami in financial capitalism.

Europe is not going to produce a political solution to this

ft.com/content/25177f…

Europe is not going to produce a political solution to this

ft.com/content/25177f…

• • •

Missing some Tweet in this thread? You can try to

force a refresh