2 years ago, Alameda maintained pretty strict delta neutrality most of the time, generally trying quite hard to make sure our PNL was from spreads and arbs. Today, not so much -- we got ... uh, really long in winter 2020, for instance. What changed?

A thread about super powers.

A thread about super powers.

Let's back up a little: why does Alameda trade crypto? Why don't we do something else, like equities options trading? Or sports betting? Or competitive Scrabble?

(Incidentally, these are all things various team members have done or still do :P)

(Incidentally, these are all things various team members have done or still do :P)

The basic answer: it's where the money is. We could make a bunch of sports betting models -- likely some of the world's best! -- but the money in crypto just makes it better. And sadly (for me), the money in competitive Scrabble is nothing to write home about.

But a slightly more enlightening answer: it's the thing with a lot of $ on the table where we have the biggest advantage. There's plenty of $ in equities too, of course -- but we've found that our advantages trading crypto make it the correct thing to focus on (for now!).

Let's say that, overnight, the sports betting markets 1000x'ed in size. What would we do? I can pretty confidently say we'd highly prioritize setting up the infra for data ingestion and trade placement to start doing it immediately, and work hard on models ASAP, too.

How do I know? Well, even though it's *technically* still intra-crypto, this is sorta exactly what happened when yield farming took off. Focusing a ton of time and capital on yield farming represented a *huge* strategic shift for us -- but it's one we mobilized almost overnight.

An interview candidate recently asked me what big projects we expect to do over the next year. My answer was: if you'd told me 1 year ago that 30% of our trader time would be spent trawling yield farms, I'd have asked you "what's a yield farm?"

At the end of the day, we *are* just trying to maximize EV -- we've got capital, tech, and human resources to do that, and we think crypto is what we should focus on for the time being, but we're thrilled to add more focuses as they pop up.

Why do I mention all this? Well, in Alameda's first years, we viewed arbs and spreads as our advantage. We *knew* we could make $$$ closing them, and we determined empirically we were among the only ones who could (or would, at least) for big size. It made sense to focus on this.

Superman and Wonder Woman are impressive because no one else can fly (or whatever, IDK) -- and Alameda was *really* profitable because basically no one else had our combo of capital, understanding of the markets, and exchange / bank / tech setups.

Elements of that remain true! And it remains something we do a lot of.

But over time, we found out we had other super powers -- some of them really important.

(A special lasso? X-ray vision? This really isn't my genre, I should've used a different metaphor.)

But over time, we found out we had other super powers -- some of them really important.

(A special lasso? X-ray vision? This really isn't my genre, I should've used a different metaphor.)

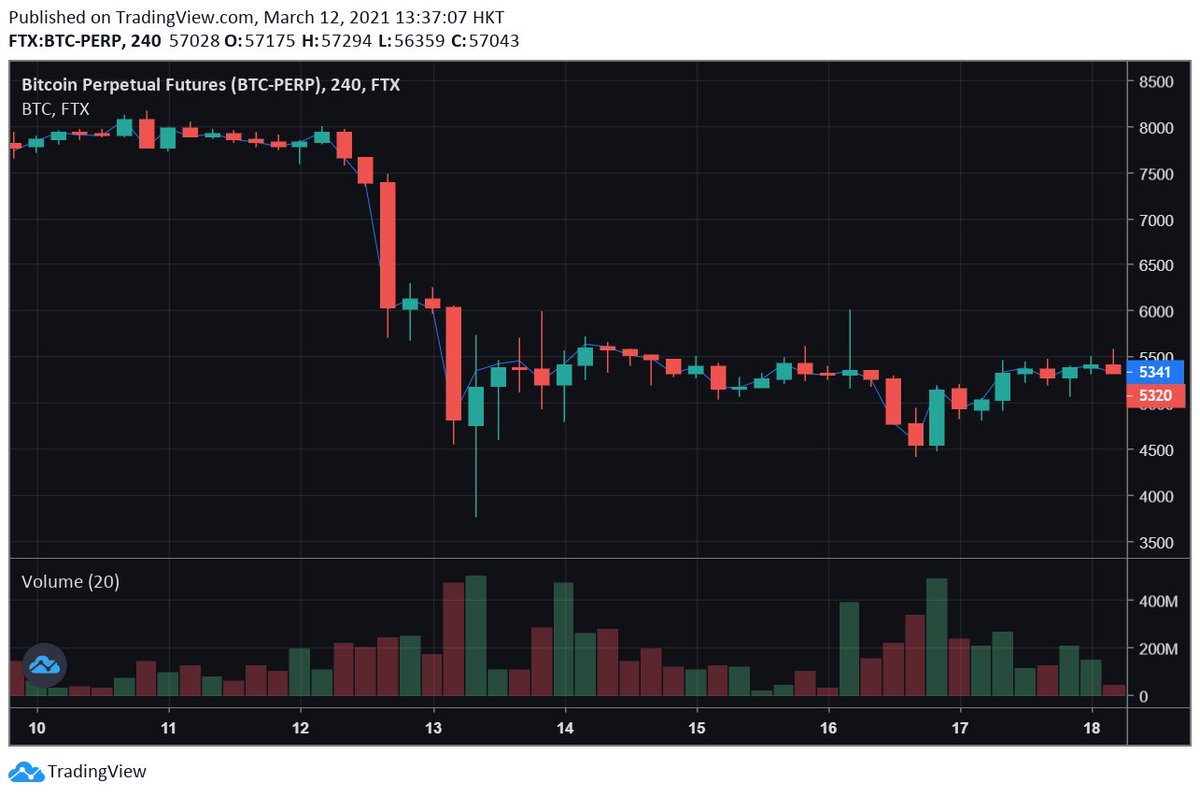

In trading all these markets, we figured a lot of stuff out that most people just weren't likely to. For instance, we were spending a lot of time staring at the BitMEX order books -- naturally we had an advantage in gaining intuition for how its liquidations affect the market.

And then we realized the set of conditions which tend to predict a ton of big liquidations -- high OI + big premia on the high-leverage platforms. Which makes it so longer-term delta bets can make sense, since maybe we're in a spot where upside potential >>> downside.

... and luckily we figured that out before Thanksgiving, because it's the fuel we needed to be confident in betting on getting really short at the top. Our understanding of margin + our big capital base represented a new super power few could replicate.

https://twitter.com/alamedatrabucco/status/1332036760939896832?lang=en

We're well-known as market makers across the whole crypto market. One thing which can make providing a lot of liquidity tough is the potential to be picked off: what if someone learns important news before you and buys/sells a ton from you before you can update?

Well, it turns out you can't exactly solve this with just your trading bots -- if you wanna have good liquidity when flow is *not* informed, you need to lose to informed flow.

The solution: be informed yourself.

The solution: be informed yourself.

So we spent a lot of time figuring out how to stay informed. We started spending more time on social media, we encouraged our whole team to urgently share big crypto news when they learn it, etc. And this did help; we started getting picked off to news less!

And we realized that our improved understanding of news would not only stop us from losing -- it could enable us to *win*.

When all the news about U.S. firms getting into crypto was coming out? We heard about it, and we knew it might be *huge*. So we bought $20k and held.

When all the news about U.S. firms getting into crypto was coming out? We heard about it, and we knew it might be *huge*. So we bought $20k and held.

(This interacted with the OI thesis, esp. w.r.t. buying specifically $20k -- with BTC at $20k, there were a TON of shorts which were gonna get liquidated since it was a new high for the market -- meaning more upside vs. downside asymmetry, and more confidence -> bigger size)

We've had smaller versions of the same thing unfold since -- we were plugged in to XRP enough to understand a) which news mattered b) how to bet on it c) when there would be momentum (basically, at recent highs/low, like for BTC at $20k).

https://twitter.com/AlamedaTrabucco/status/1349538828667678720?s=20

We made weeks-long bets about BCH before the recent BCH fork. We made weeks-long ETH bets ahead of ETH 2.0. We made big crypto-wide bets based on regulation news for BitMEX, the OKEx freeze, etc. etc.

We started doing it a LOT more when we decided that, yeah, crypto is inefficient. Delta bets always felt "icky" since they were not math-based -- using the OI stuff helped there, but ultimately we had to accept we had non-mathy edges.

https://twitter.com/AlamedaTrabucco/status/1382244132022755329?s=20

And even recently, this influenced how we bet on DOGE. We've held a long DOGE position for *months* and it's gone great -- all based on noticing how it goes up when Elon tweets:

- likely some bullish impetuses (Elon, TikTok, ETFs, etc.)

- more upside potential from liquidations

- likely some bullish impetuses (Elon, TikTok, ETFs, etc.)

- more upside potential from liquidations

Are we batting 1.000 with these? Nope, but WAY above average, and at this point it seems unlikely to be just random chance. And its our 24/7 info ingestion + market understanding + capital + willingness to bet big that let us do it and really maximize.

Are we the only ones with 24/7 coverage? Nope, but we're among the few.

Are we the only ones who understand all this? Nope, but we're among the few.

Are we the only ones with a ton of capital? Nope, but we're among the few.

Are we the only ones with all 3?

...

...

...

Maybe?

Are we the only ones who understand all this? Nope, but we're among the few.

Are we the only ones with a ton of capital? Nope, but we're among the few.

Are we the only ones with all 3?

...

...

...

Maybe?

And so we've slowly realized -- our ability to make good delta bets *is* like another super power, and it's one with a lot of $ on the table.

So we've embraced it, and we make BIG bets.

So we've embraced it, and we make BIG bets.

https://twitter.com/AlamedaTrabucco/status/1349538525218127872?s=20

With great power comes great responsibility -- and when you have a super power, you've *got* to leverage it to your advantage. It can improve outcomes by orders of magnitude -- Alameda has seen that first-hand.

• • •

Missing some Tweet in this thread? You can try to

force a refresh