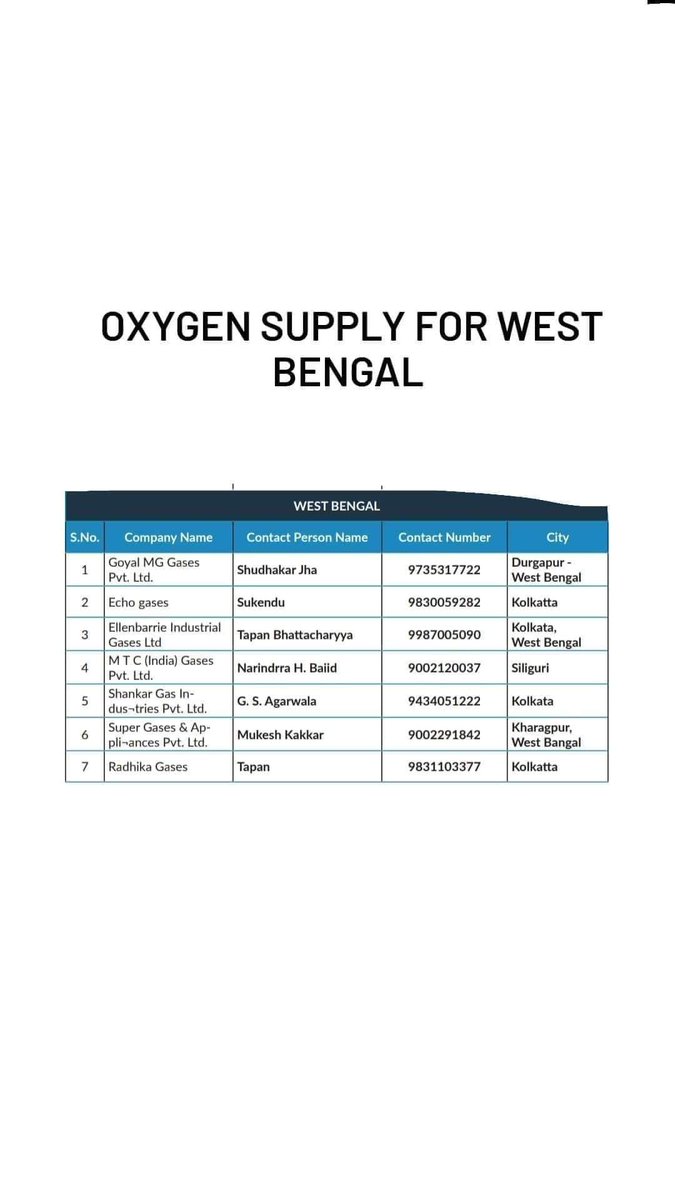

A series of lower highs and lower lows in place on BNF. Supports mainly coming in around 30900 levels ( why ? see the pic )

For any bullish/long views, BNF must close above the 32200-300 region. Until that, major trend is bearish

For any bullish/long views, BNF must close above the 32200-300 region. Until that, major trend is bearish

A close below 30900 with some more rise in COI can take BNF down to 29600 levels ( as the long COI will then be trapped). Intraday traders should watch 31300 breakdown as the first signs of trouble. Only a close > 32300 will break this bearish structure

I have pointed out earlier that none of the bullish large range days are having any followup since mid-feb. Unless this logic breaks and we have some strong bullish followup days, this bearish structure will not change

I have tried to keep the analysis simple without using any systems as such. kindly validate with your analysis before making a view. This is my view which I am following

• • •

Missing some Tweet in this thread? You can try to

force a refresh