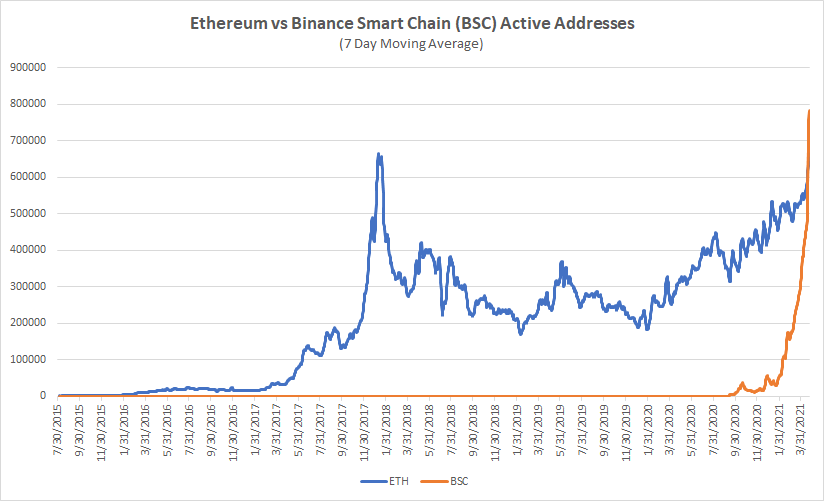

It's interesting that these ethereum network activity metrics are only just starting to surpass peak of last cycle and growth doesn't yet seem parabolic, indicating that there may still be a lot of room to grow

Meanwhile, BSC activity is on a monster parabola with no signs of stopping. It is apparent that while the pie is growing, BSC is capturing the lions share of the new retail entrants

inb4 butthurt ETH maxis

Arguments of BSC being only for scams and Ponzi tokens are reminiscent of claims that Bitcoin is only good for drugs and criminal activity

• • •

Missing some Tweet in this thread? You can try to

force a refresh